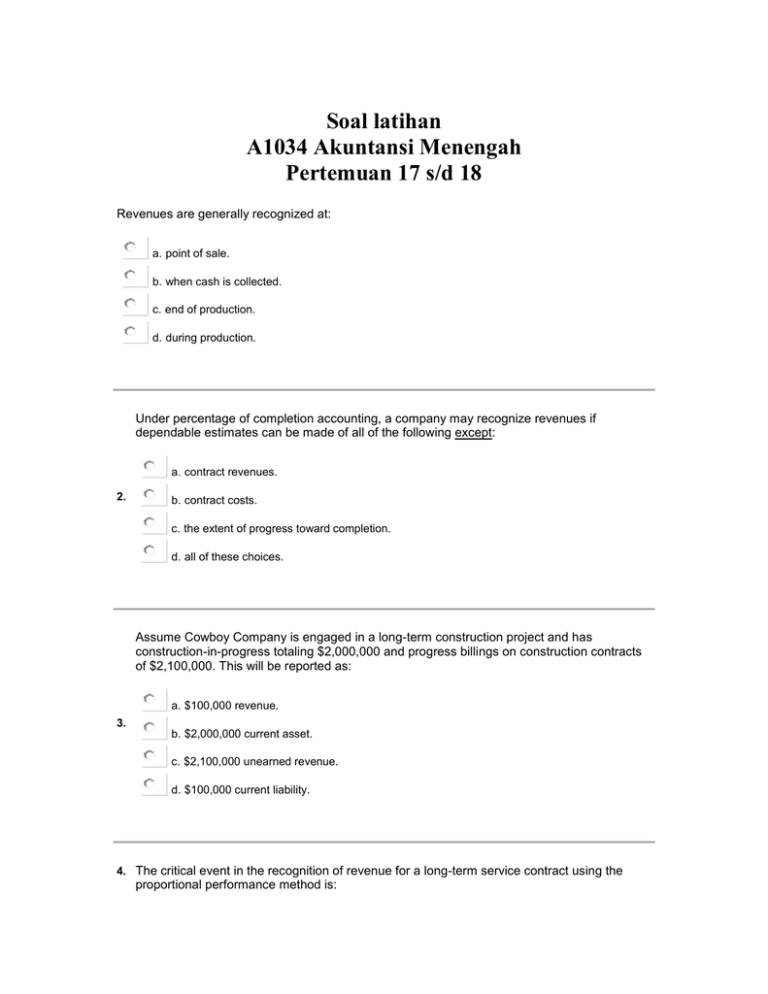

Soal latihan A1034 Akuntansi Menengah Pertemuan 17 s/d 18

advertisement

Soal latihan A1034 Akuntansi Menengah Pertemuan 17 s/d 18 Revenues are generally recognized at: a. point of sale. b. when cash is collected. c. end of production. d. during production. Under percentage of completion accounting, a company may recognize revenues if dependable estimates can be made of all of the following except: a. contract revenues. 2. b. contract costs. c. the extent of progress toward completion. d. all of these choices. Assume Cowboy Company is engaged in a long-term construction project and has construction-in-progress totaling $2,000,000 and progress billings on construction contracts of $2,100,000. This will be reported as: a. $100,000 revenue. 3. b. $2,000,000 current asset. c. $2,100,000 unearned revenue. d. $100,000 current liability. 4. The critical event in the recognition of revenue for a long-term service contract using the proportional performance method is: a. point of sale. b. collection of cash. c. final act of service. d. none of these choices. There are at least three different approaches to revenue recognition that depend on the receipt of cash, the three approaches are: a. installment sales, cost recovery, and the allowance method. 5. b. installment sales, allowance method, and the cash. c. cost recovery, cash, and the allowance method. d. cost recovery, cash, and the installment sales. Under the cost recovery method, income is recognized when: a. the revenue is earned. 6. b. the cost of the item sold is recovered through cash receipts. c. as cash is received. d. all cash has been received. Under the installment sales method, when the sale has been made: a. accounts receivable is credited. 7. b. deferred gross is debited. c. cash is debited. d. installment sales is credited. What method of accounting was developed for use when property is exchanged without transfer of title and without a sales contract being completed? a. completed contract method 8. b. proportional performance c. consignment d. deposit method The cash method: a. is consistent with accrual accounting. 9. b. recognizes revenue when cash is collected. c. matches expenses to revenues earned. d. recognizes revenues when earned. Under the full accrual method, revenue is typically recognized at: a. point of sale. 10. b. during the collection of cash. c. during the collection of cash, only after all costs are recovered. d. during production.