Document 15103532

advertisement

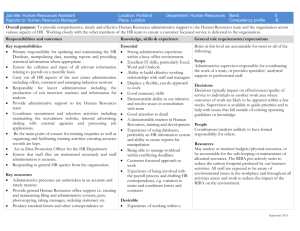

“O, God increase my knowledge” ISLAMIC BANKING TRAINER MANUAL RIBA MODULE ISLAMIC BANKING • ECONOMIC PHILOSOPHY OF ISLAM – no concept of Riba because it encourages • concentration of wealth in few hands • creation of monopolies • greed and selfishness leading to injustice and oppression ISLAMIC BANKING • ISLAMIC MODEL OF DISTRIBUTION OF WEALTH • Based on two underlying principles – Importance of economic goals – Real nature of wealth and property ISLAMIC BANKING • ISLAMIC MODEL OF DISTRIBUTION OF WEALTH • economic activities of man are lawful, meritorious and at times obligatory and necessary • however economic activity is not the basic problem and therefore economic progress is not the be-all and end-all of human existence ISLAMIC BANKING • IMPORTANCE OF ECONOMIC GOALS • according to materialistic economics – Livelihood is the fundamental problem of man and economic development is the ultimate goal of human life • according to Islamic economics – Livelihood may be necessary and indispensable but cannot be the true purpose of human life ISLAMIC BANKING • REAL NATURE OF WEALTH AND PROPERTY • wealth in all its possible forms is created by Allah • therefore wealth is the property of Allah • the right of property which accrues to man is delegated to him by Allah • therefore Allah has the right to demand that man subordinate his use of wealth to the commandments of Allah ISLAMIC BANKING • REAL NATURE OF WEALTH AND PROPERTY • whatever wealth man possesses has been received from Allah • it should be used in such a way that it ensures success in the world hereafter • since wealth has been received from Allah it’s use by Man should also be subject to the commandment of Allah ISLAMIC BANKING • REAL NATURE OF WEALTH AND PROPERTY • Allah may command man to give a specified part of his wealth to another man. • Allah may forbid use of wealth in a particular way Hud 87 OBJECTIVES OF DISTRIBUTION OF WEALTH 1. Establishment of a practicable Economic system Islam accepts the following thing within a certain limits: a. laws of demand and supply b. motive of personal profit c. market forces d. natural relation of employer and employee 2. Enabling every one to get what is rightfully due to him:A: Elementary level of deserving wealth: Factors of production B: Secondary level of deserving wealth: poor In the second verse: 3 Eradicating the Concentration of Wealth through: Prohibition of hoarding, interest, gambling, speculation, Uqood Fasidah, and Gharar Holy Quran Says in Al Hashr 7: The Factor of Production in Conventional System • Capitalism has four factors of production 1. Capital - the produced means of production" Compensation: Interest 2. Land -'natural resources'' (that is to say, those things which are being used as means of production without having previously undergone any process of human production). Compensation:: Rentals 3. Labour -that is to say, any exertion on the part of man. Compensation: Wages 4. Entrepreneur, or Organization - the fourth factor which brings together the other three factors, exploits them and bears the risk of profit and loss in production. Compensation:Profit The Factors of Production In Islam • 1. Capital —That is, those means of production which cannot be used in the process of production until and unless during this process they are either wholly consumed or completely altered in form, and which, therefore, cannot be let or leased (for example, liquid money or food stuffs etc.) • Compensation: Profit • 2. Land —that is, those means of production which are so used in the process of production that their original and external form remains unaltered, and which can hence be let or leased (for example, lands, houses, machines etc.). • Compensation: Rentals • 3. Labour -that is, human exertion, whether of the bodily organs or of the mind or of the heart. This exertion thus includes organization and planning too. • Compensation: Wages ISLAMIC BANKING • DIFFERENCE BETWEEN CAPITALISM, SOCIALISM AND ISLAM • CAPATILISM affirms an absolute and unconditional right to private property • SOCIALISM totally denies the right to private property • ISLAM admits the right to private property but does not consider it to be an absolute and unconditional right which can be used to cause disorder on earth ISLAMIC BANKING • RIBA – Riba means excess, increase or addition – Riba in banking implies any excess compensation without due consideration First Revelation about Riba – “That which you give as interest to increase the peoples' wealth increases not with God; but that which you give in charity, seeking the goodwill of God, multiplies manifold.” (Surah Rome, Verse 39) Second Revelation – “And for their taking interest even though it was forbidden for them, and their wrongful appropriation of other peoples' property. We have prepared for those among them who reject faith a grievous punishment ” (Surah al-Nisa', verse 161) Third Revelation – “Believers! Do not swallow riba, doubled and redoubled, and be mindful of Allah so that you may attain true success” ( Al Imran, Ayat 130) Fourth Revelation Surah Al Baqarah Verses 274-281 Those who spend their wealth night and day, secretly and openly, they have their reward with their Lord, and there is no fear for them, nor shall they grieve. Those who take riba (usury or interest) will not stand but as stands the one whom the demon has driven crazy by his touch. That is because they have said: Trading is but like riba. So, whoever receives an advice from his Lord and stops, he is allowed what has passed, and his matter is upto Allah. And the ones who revert back, those are the people of Fire. There they remain forever. Allah destroys riba and nourishes charities. And Allah does not like any sinful disbeliever. Surely, those who believe and do good deeds, establish Salah and Zakah have their reward with their Lord, and there is no fear for them,nor shall they grieve. O those who believe, fear Allah and give up what still remains of the riba if you are believers. But if you don not, then listen to the declaration of war from Allah and His Messenger. And if you repent, yours is your principal. Neither you wrong, nor be wronged. And if there be one in misery, then deferment till ease. And that you leave it as alms is far better for you, if you really know. And be fearful of a day when you shall be returned to Allah, then everybody shall be paid, in full, what he has earned. And they shall not be wronged. (Verses of Surah Al Baqarah: 274281) Prohibition of Riba in Hadith The prohibition of Interest is not limited to Islam, but it is shared by Judaism and Christianity. Some of the old testaments have rendered riba as haram (See Exodus 22:25, Leviticus 25:35-36, Deutronomy 23:20, Psalms 15:5, Proverbs 28:8, Nehemiah 5:7 and Ezakhiel 18:8,13,17 & 22:12). Agibi Bank was established circa 700 B.C. in Babylonian and functioned exclusively on equity basis. ISLAMIC BANKING • CLASSIFICATION OF RIBA – Riba-un-Nasiyah or Riba-al-Jahiliya – Riba-al-Fadl or Riba-al-Bai ISLAMIC BANKING • CLASSIFICATION OF RIBA – Riba-un-Nasiyah or Riba-al-Jahiliya • “that kind of loan where specified repayment period and an amount in excess of capital is predetermined”( Imam Abu Bakr Hassas Razi) ISLAMIC BANKING • CLASSIFICATION OF RIBA – Riba-un-Nasiyah or Riba-al-Jahiliya • “all loans that draw interest is riba”(Hadith quoted by Ali ibn Talib) • “the loan that draws profit is one of the forms of riba”(definition from Sahabi Fazala Bin Obaid) ISLAMIC BANKING • CLASSIFICATION OF RIBA – Riba-un-Nasiyah or Riba-al-Jahiliya • real and primary form of riba • premium paid to the lender in return for his waiting • giving or taking of every excess amount in exchange of a loan at an agreed rate irrespective of whether it is low or high ISLAMIC BANKING • CLASSIFICATION OF RIBA – Riba-al-Fadl • excess taken in exchange of specific commodities which are homogeneous • legal definition defers in every fiqh ISLAMIC BANKING • CLASSIFICATION OF RIBA – Hadith prohibiting Riba-al-Fadl • ‘sell gold in exchange of equivalent gold • sell silver in exchange of equivalent silver • sell dates in exchange of equivalent dates • sell wheat in exchange of equivalent wheat • sell salt in exchange of equivalent salt • sell barley in exchange of equivalent barley ISLAMIC BANKING • CLASSIFICATION OF RIBA – Hadith prohibiting Riba-al-Fadl • sell barley in exchange of equivalent barley but if a person transacts in excess, it will be riba. • However sell gold for silver anyway you please on the condition it is hand-to-hand(spot sales) and sell barley for date anyway you please on the condition it is hand-to-hand(spot sales) ISLAMIC BANKING • CLASSIFICATION OF RIBA – Imam Abu Hanifa on Riba-al-Fadl • commodities must have two common characteristics – Weight – Volume • includes all commodities having weight or volume and are being exchanged ISLAMIC BANKING • CLASSIFICATION OF RIBA – Imam Shafi on Riba-al-Fadl • commodities must have two common characteristics – be a medium of exchange – be edible • includes all commodities that are edible or can be used as a medium of exchange(currency) ISLAMIC BANKING • CLASSIFICATION OF RIBA – Imam Maalik on Riba-al-Fadl • commodities must have two common characteristics – can be preserved – be edible • includes all commodities that are edible and can be preserved ISLAMIC BANKING • CLASSIFICATION OF RIBA – Imam Ahmad Bin Hanbal on Riba-al-Fadl • first citation conforms to the opinion of Imam Abu Hanifa • second citation conforms to the opinion of Imam Shafi • third citation includes three characteristics at the same time i.e. edible, weight and volume ISLAMIC BANKING • CLASSIFICATION OF RIBA – Present day Islamic scholars on Riba-al-Fadl • if two characteristics i.e. weight and use as medium of exchange is present then the following transactions are not allowed – a deferred sale of goods having weight and homogeneous nature – a sale of unequal goods having weight and homogeneous nature ISLAMIC BANKING • THE LAWS OF RIBA AL FADL – First law • Exchange of any of the six commodities with itself but differing in quality, is allowed only under certain conditions ISLAMIC BANKING • THE LAWS OF RIBA AL FADL – First Law • CONDITIONS OF EXCHANGE • Any difference in value/quality should be ignored • The commodities should be exchanged in equal amounts (equal weight and volume). • No of direct exchange of commodities of the same kind • A person should sell his commodity against cash at the market value and buy someone else’s commodity in exchange of cash proceeds at the market value. ISLAMIC BANKING • THE LAWS OF RIBA AL FADL – Second law • Exchange of a product with its raw material is allowed under certain conditions ISLAMIC BANKING • THE LAWS OF RIBA AL FADL – Second law • Exchange of a product with its raw material is allowed under certain conditions ISLAMIC BANKING • THE LAWS OF RIBA AL FADL – Second Law • CONDITIONS OF EXCHANGE • If the characteristics of the product has been totally changed by the industry, then different amounts can be exchanged. • If little difference has been made – either the exchange should be in equal weights – or one of the commodities should be sold in the market and the cash proceeds used to buy the then one. ISLAMIC BANKING • THE LAWS OF RIBA AL FADL – Third Law • Exchange of any of the six commodities with one another is allowed in unequal amounts but the payment should not be deferred – Provided that the general conditions of a sale contract are fulfilled ISLAMIC BANKING • TYPES OF RIBA – Riba al Nasiah is classified in two types: • Sood-e-Mufrad( Simple Interest) – interest calculated only on the initial investment • Sood-e-Murakkab(Compound Interest) – reinvestment of each interest payment on money invested to earn more interest ISLAMIC BANKING • TYPES OF RIBA – Quranic verses on absolute prohibition of Riba: • “O believers fear God and give up the interest that remains outstanding (i.e. whether it is simple interest or multiplied interest) if you are believers” (Surah Al-Baqrah, verse 278) ISLAMIC BANKING • TYPES OF RIBA – Quranic verses on absolute prohibition of Riba: • “If you do not do so then be sure of being at war with God and His Messenger. But if you repent, you can have your principal( only not any kind of interest or premium). Neither should you commit injustice nor should you be subjected to it” Al-Baqrah, verse 278) (Surah ISLAMIC BANKING • TYPES OF RIBA – Tijarti Sood(Commercial interest) • interest paid on loan taken for productive and profitable purpose – Sarfi Sood (Usury) • interest paid on loan taken for personal need and expenses Arguments given to Justify Commercial Interest a: Commercial Interest is charged from wealthy persons whereas usury is charged from the poor. It does not exploit the poor while consumption interest or usury exploit the poor. Ans. Validity of a transaction is not based on the financial status of a party, like sale, leasing etc. Law does not differentiate between poor and wealthy in crimes like bribery, theft etc. Further, Commercial Interest also exploit the poor. b: It was not in the prevalent modern shape in those days. Ans. When some thing is prohibited, it is not directed to a particular form of it but it covers every form which comes in its general sense, e.g. gambling and pork, liquor and adultery are as Haram now as they were in Jahiliyyah c: The Commercial interest was not in vogue in Arab Ans. History shows that it was in vogue. d: Doctrine of necessity and wisdom requires to allow it Ans. (i) It does not, it is not at all a necessity in Shariah. Even from economic point of view, the modern interest has brought more harm to the humanity than the premature forms of usury. (ii) The Principles of Shariah are binding, even though their wisdom is not visible in a particular transaction. They are based on Illat. ISLAMIC BANKING An Nur 33 Yaseen 71 Az Zukhruf 32 Al Ma’arij 24-25 Al An’aam 141 Al Hashr 7