Buying and Existing Business

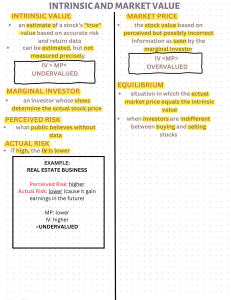

advertisement

Buying an Existing Business There is nothing so easy to learn as experience and nothing so hard to apply…Josh Billings Advantages May continue to be successful Best location Employees and suppliers established Equipment installed Inventory in place Hit the ground running Use previous experience Easier financing Disadvantages A loser Created ill will Employees not suitable Equipment obsolete or inefficient Change and innovation difficult Inventory outdated or obsolete Accounts receivable worth less Overpriced Steps in Acquiring a Business Analyze your skills, abilities, and interests Prepare a list of potential candidates Investigate and evaluate Explore financing options Ensure smooth transition Due Diligence Process The process of investigating the details of a company that is for sale to determine the strengths, weaknesses, opportunities, and threats facing it 5 Critical Questions Why does the owner want to sell? What is the physical condition? What is the potential? What legal aspects should be considered? Is the business financially sound? Physical Conditions Building Inventory Accounts receivable Lease arrangements Business records Intangible assets Location and appearance Potential of Products Customer characteristics and composition-who, why, how often, loyalty, new customers, well-defined, growing? Competitor analysis-number and intensity, saturation point reached, reason for survival, sales comparison, uniqueness? Legal Aspects Liens Bulk Transfers Contract assignments Covenants not to compete Ongoing legal liabilities Financial Soundness Income statements and balance sheets (3-5 years) Income tax returns (3-5 years) Owner’s compensation (and relatives) Cash flow Methods for Determining the Value of a Business Balance Sheet technique Adjusted Balance Sheet technique Excess Earnings Method Capitalized Earnings Approach Discounted Future Earnings approach Market approach Understanding the Seller’s Side Picking the right buyer Structuring the deal Exit strategies Negotiating the deal Exit Strategies Straight business sale Sale with agreement from the founder to stay on Form a limited partnership Sell a controlling interest Restructure the company Sell to an international buyer Use a 2-step sale Establish an ESOP Factors Affecting Negotiations How strong is the desire to sell? Is the seller willing to finance part of the purchase price? What terms does the buyer suggest? Which ones re most important to him/her? Is it urgent that the seller close the deal quickly? What deal structure best suits your needs? What are the tax consequences? Will the seller sign a restrictive covenant? Is he willing to stay on? What general economic conditions exist? Negotiations Prepare Remember the difference between a position and an interest Develop the right mindset Always leave yourself an escape hatch Keep your emotions in check Sometimes it’s best to remain silent