1A Syllabus TTh 11-1 Spring 2012

advertisement

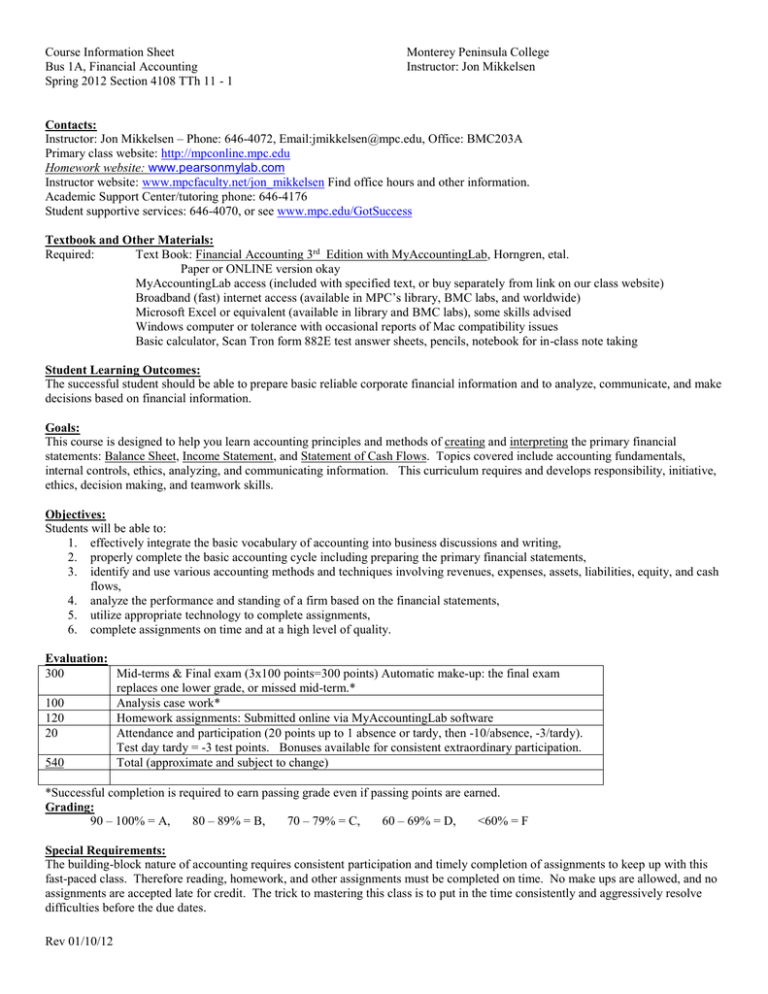

Course Information Sheet Bus 1A, Financial Accounting Spring 2012 Section 4108 TTh 11 - 1 Monterey Peninsula College Instructor: Jon Mikkelsen Contacts: Instructor: Jon Mikkelsen – Phone: 646-4072, Email:jmikkelsen@mpc.edu, Office: BMC203A Primary class website: http://mpconline.mpc.edu Homework website: www.pearsonmylab.com Instructor website: www.mpcfaculty.net/jon_mikkelsen Find office hours and other information. Academic Support Center/tutoring phone: 646-4176 Student supportive services: 646-4070, or see www.mpc.edu/GotSuccess Textbook and Other Materials: Required: Text Book: Financial Accounting 3rd Edition with MyAccountingLab, Horngren, etal. Paper or ONLINE version okay MyAccountingLab access (included with specified text, or buy separately from link on our class website) Broadband (fast) internet access (available in MPC’s library, BMC labs, and worldwide) Microsoft Excel or equivalent (available in library and BMC labs), some skills advised Windows computer or tolerance with occasional reports of Mac compatibility issues Basic calculator, Scan Tron form 882E test answer sheets, pencils, notebook for in-class note taking Student Learning Outcomes: The successful student should be able to prepare basic reliable corporate financial information and to analyze, communicate, and make decisions based on financial information. Goals: This course is designed to help you learn accounting principles and methods of creating and interpreting the primary financial statements: Balance Sheet, Income Statement, and Statement of Cash Flows. Topics covered include accounting fundamentals, internal controls, ethics, analyzing, and communicating information. This curriculum requires and develops responsibility, initiative, ethics, decision making, and teamwork skills. Objectives: Students will be able to: 1. effectively integrate the basic vocabulary of accounting into business discussions and writing, 2. properly complete the basic accounting cycle including preparing the primary financial statements, 3. identify and use various accounting methods and techniques involving revenues, expenses, assets, liabilities, equity, and cash flows, 4. analyze the performance and standing of a firm based on the financial statements, 5. utilize appropriate technology to complete assignments, 6. complete assignments on time and at a high level of quality. Evaluation: 300 Mid-terms & Final exam (3x100 points=300 points) Automatic make-up: the final exam replaces one lower grade, or missed mid-term.* 100 Analysis case work* 120 Homework assignments: Submitted online via MyAccountingLab software 20 Attendance and participation (20 points up to 1 absence or tardy, then -10/absence, -3/tardy). Test day tardy = -3 test points. Bonuses available for consistent extraordinary participation. 540 Total (approximate and subject to change) *Successful completion is required to earn passing grade even if passing points are earned. Grading: 90 – 100% = A, 80 – 89% = B, 70 – 79% = C, 60 – 69% = D, <60% = F Special Requirements: The building-block nature of accounting requires consistent participation and timely completion of assignments to keep up with this fast-paced class. Therefore reading, homework, and other assignments must be completed on time. No make ups are allowed, and no assignments are accepted late for credit. The trick to mastering this class is to put in the time consistently and aggressively resolve difficulties before the due dates. Rev 01/10/12 Course Information Sheet Bus 1A, Financial Accounting Spring 2012 Section 4108 TTh 11 - 1 Monterey Peninsula College Instructor: Jon Mikkelsen Homework Assignments: Each chapter’s homework assignment is completed using online software accessible from links on the class web page. The textbook homework assignments listed on the course schedule share the same content as the assignments online. The homework software changes the numbers for each student requiring different answers on line than in the paper text. You are encouraged to work together to help each other master the homework, but each student needs to do their own work. Large scale sharing of answers becomes plagiarism and is not acceptable. Chapters 2 through 4 require a practice set to enable you work through a full accounting cycle. Use this tool to help you connect all of the separate learning points of those chapters into one cohesive experience. You are done with your homework only when you can complete it error free without using any references to help you get through it. Tests: Two mid-term exams and one final examination are administered for this class. There are no makeup exams. The final exam will replace any lower of the two mid-term examinations only if the final exam score is higher. If you miss a mid-term exam, then the final exam score will count both for the final exam score and again for the missed mid-term exam score. If the final exam is lower, then the mid-term scores stand. These exams will be given in-class in-person on paper. Tests are to be completed individually, without assistance. Extra Credit: There is no scheduled extra credit for this class. There is an abundance of study material available, and your time and effort will most effectively improve your score by studying and practicing before exams. Policies Dropping: Students who do not attend the first day of class on time may be dropped from the class by the instructor. Other students may be added to the class at that time, so the spot may no longer be available. Students may be dropped from the class roster during the semester due to insufficient class activity as determined by the instructor. The final responsibility to drop is the responsibility of the student. If you feel lost or hopeless, please contact me so I can try to help look for ways to help you make the right decision. Plagiarism and Cheating: The accounting profession cannot tolerate fraud so integrity must start here. Any student found to have plagiarized or otherwise cheated will automatically receive a zero grade on the entire series of related assignments, and could be subject to further action. Teamwork is encouraged on homework assignments and other projects. However, teamwork does not include copying from or giving multiple answers to others. Tests are to be performed without assistance. You are responsible for shielding your answers from plain view of other students. Cheating in this class destroys the foundation of future learning. Please ask for help at the first sign of trouble, and get the legitimate assistance you need to really succeed. Etiquette: Maintain integrity. Be polite. Be decent. Welcome alternative points of view. Start your work early, especially when in need of help or when others rely on your input. This class is a profanity and hostility free environment. Have patience and work towards positive outcomes. Grading: Credit/No-Credit grading is facilitated through the Admissions and Records Office. Please contact the Admissions and Records Office for appropriate deadlines and other information. Letter grades are calculated based on points accumulated. Intermediate points tracking is the student responsibility. The instructor reports individual assignment grades to the student, then compiles and reports final grades once at the end of the semester according to the guidelines set forth in the evaluation section above. Student Supportive Services: Students with special needs are encouraged to contact Student Supportive Services for accommodations and a variety of available resources. Learn more about this here: http://www.mpc.edu/GotSuccess Individual responsibility: It is solely the student’s individual responsibility to meet all deadlines and requirements for this course. It is the student’s responsibility and right to ask for help and to proactively overcome any obstacles to successfully complete this course. Your initiative Rev 01/10/12 Course Information Sheet Bus 1A, Financial Accounting Spring 2012 Section 4108 TTh 11 - 1 Monterey Peninsula College Instructor: Jon Mikkelsen may be the most important factor in making this a successful class for you. Make sure we give you your money’s worth and tell us if we need to do something different to help you. Date Jan 31 Feb 2 Mar Rev 01/10/12 Topic Assignment content in lecture. Submit homework online Introduction Income Statement fundamentals and interpretation Chapter 1, Accounting S1-1, S1-7, E1-14, E1-16, Environment & Fundamentals E1-17, E1-19, E1-21, Balance sheet fundamentals and interpretation. The accounting Equation & double entry accounting In Class Activities D: Discussion Case Groups: CalCPA Groups: Sox Easy quiz #2 7 Chapter 1 finish P1-35A, Practice Set: Page 57 9 Chapter 2 Recording Transactions S2-1, S2-6, S2-8, 14 Chapter 2 finish E2-17, S2-11, Practice Set: Page 127 16 Chapter 3 Adjusting entries S3-2, S3-3, E3-19 & E3-20, E3-22 21 Chapter 3 finish E3-17, P3-33A, Practice Set: Page 193 23 Chapter 4 Closing S4-1, S4-4, S4-5, S4-11 28 Chapter 4 finish P4-24A, Practice Set: Page 250 1 In-Class Monopoly Exam Review Entire Practice Set due before the beginning of class. On time/early attendance is especially important today. 6 8 Test #1 (ch’s 1-4, the accounting cycle) Chapter 5 Merchandising 13 15 Chapter 5 finish Chapter 6 Inventory S5-12, P5-33A 20 Chapter 6 finish E6-27, E6-28 22 Chapter 7 Internal Controls & Cash P7-25A, E7-18, E7-21, E722 27 29 Spring Recess Spring Recess D: profitability and strength D: www.sec.gov, revenue recognition D:sec.gov, adjustments D: debt analysis E5-14, P5-28A, E5-20 D: gross profit E6-15, E6-16, E6-24, E6-25 D: inventory analysis Course Information Sheet Bus 1A, Financial Accounting Spring 2012 Section 4108 TTh 11 - 1 Date Apr May Rev 01/10/12 Monterey Peninsula College Instructor: Jon Mikkelsen Topic Assignment content in lecture. Submit homework online In Class Activities (Preview expected) 3 Chapter 7 finish P7-32A 5 Chapter 8 Receivables E8-13, E8-14, E8-22 10 12 Chapter 8 finish Chapter 9 Plant Assets & Intangibles S8-4, E8-15, P8-30A E9-13, E9-14, E9-15, P928A D: A/R management 17 19 Chapter 9 finish Exam #2 (ch’s 5-9) E9-20, E9-23, P9-31A D: Asset turnover 24 26 Chapter 10 Current Liabilities Chapter 10 finish Chapter 11 Begin Long Term Liabilities E10-9, E10-10, E10-12 E10-14, P10-15A 1 Chapter 11 finish E11-16, E11-17, P11-24A 3 Chapter 12 Paid-In Capital S12-7, E12-15, E12-21, E12-23 8 Chapter 12 finish E12-24, E12-25, P12-27A 10 Chapter 13 begin Retained Earnings & Income Statement E13-12, E13-14, E13-15, E13-16 15 Chapter 13 finish P13-24A, E13-21, P13-28A 17 Chapter 14 Cash Flows E14-13, S14-4, E14-17, E14-19 22 Chapter 14 finish P14-26A 24 Final Exam Review Bring your prioritized topic review list to class. 29 Final Exam Final exam Tuesday May 29th ***10:30am-12:30pm*** in our regular class room. NOTE that is ½ hour earlier than normal. E11-13, E11-14, S11-5 D: Sanbanes Oxley D: compensation investigation D: bond risk & return D: price to earnings ratio D: DuPont method return on equity analysis D: Cash flow analysis