HW3_Inventory.docx

advertisement

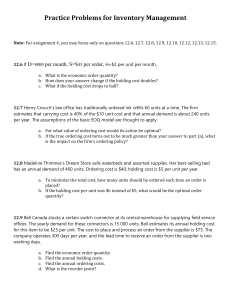

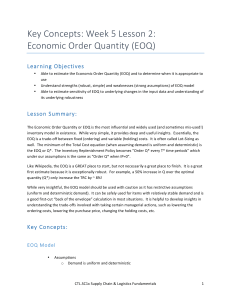

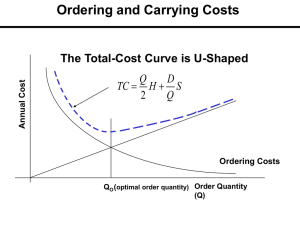

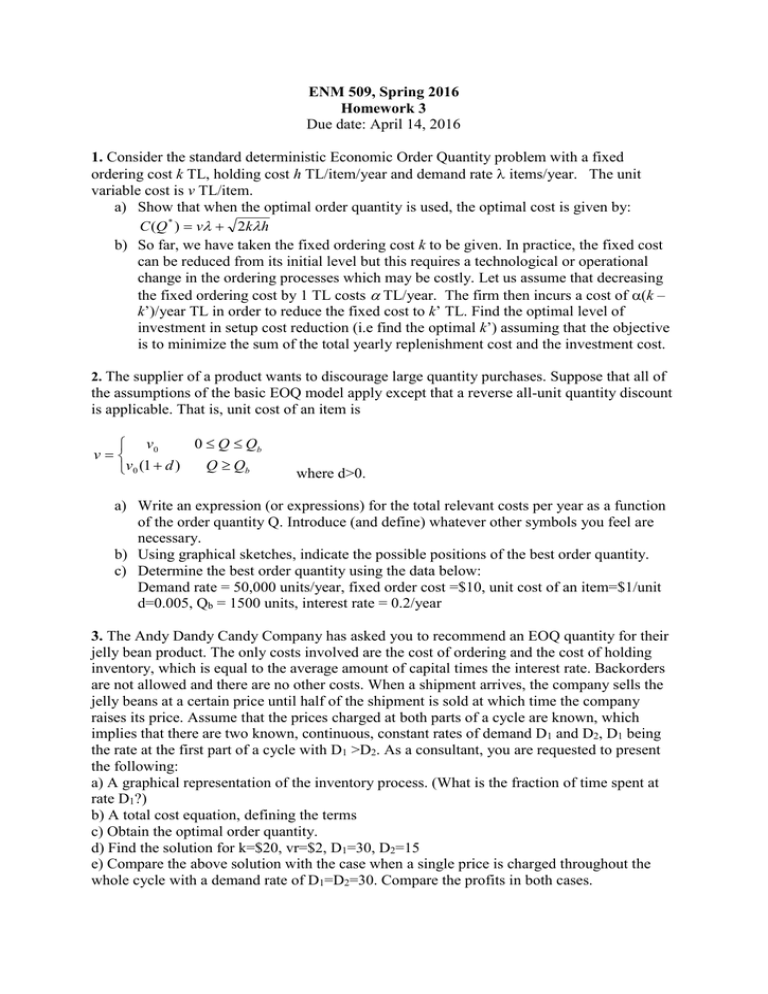

ENM 509, Spring 2016 Homework 3 Due date: April 14, 2016 1. Consider the standard deterministic Economic Order Quantity problem with a fixed ordering cost k TL, holding cost h TL/item/year and demand rate items/year. The unit variable cost is v TL/item. a) Show that when the optimal order quantity is used, the optimal cost is given by: C (Q * ) v 2kh b) So far, we have taken the fixed ordering cost k to be given. In practice, the fixed cost can be reduced from its initial level but this requires a technological or operational change in the ordering processes which may be costly. Let us assume that decreasing the fixed ordering cost by 1 TL costs TL/year. The firm then incurs a cost of (k – k’)/year TL in order to reduce the fixed cost to k’ TL. Find the optimal level of investment in setup cost reduction (i.e find the optimal k’) assuming that the objective is to minimize the sum of the total yearly replenishment cost and the investment cost. 2. The supplier of a product wants to discourage large quantity purchases. Suppose that all of the assumptions of the basic EOQ model apply except that a reverse all-unit quantity discount is applicable. That is, unit cost of an item is 0 Q Qb v0 v Q Qb v0 (1 d ) where d>0. a) Write an expression (or expressions) for the total relevant costs per year as a function of the order quantity Q. Introduce (and define) whatever other symbols you feel are necessary. b) Using graphical sketches, indicate the possible positions of the best order quantity. c) Determine the best order quantity using the data below: Demand rate = 50,000 units/year, fixed order cost =$10, unit cost of an item=$1/unit d=0.005, Qb = 1500 units, interest rate = 0.2/year 3. The Andy Dandy Candy Company has asked you to recommend an EOQ quantity for their jelly bean product. The only costs involved are the cost of ordering and the cost of holding inventory, which is equal to the average amount of capital times the interest rate. Backorders are not allowed and there are no other costs. When a shipment arrives, the company sells the jelly beans at a certain price until half of the shipment is sold at which time the company raises its price. Assume that the prices charged at both parts of a cycle are known, which implies that there are two known, continuous, constant rates of demand D1 and D2, D1 being the rate at the first part of a cycle with D1 >D2. As a consultant, you are requested to present the following: a) A graphical representation of the inventory process. (What is the fraction of time spent at rate D1?) b) A total cost equation, defining the terms c) Obtain the optimal order quantity. d) Find the solution for k=$20, vr=$2, D1=30, D2=15 e) Compare the above solution with the case when a single price is charged throughout the whole cycle with a demand rate of D1=D2=30. Compare the profits in both cases. 4. Consider the following stochastic version of the EOQ problem. When you order Q units, the received quantity in each cycle is Q(1+x) (rather than Q) where x is a quantity that models the delivery errors. Assume that x is a continuous random variable distributed uniformly in the interval (-α, α) (where 0< α < 1). a. Find the optimal order quantity minimizing the expected costs per unit time and compare it to the regular EOQ quantity. b. Find the optimal expected length of a cycle. c. Explain the effect of α on the optimal ordering quantity.