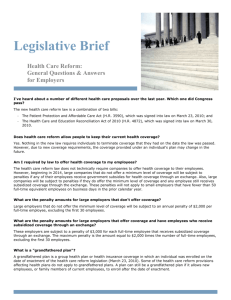

Reflections E UCLID MANAGERS Health Reform FAQ

advertisement

EServing UCLID MANAGERS the independent agent since 1976 ® A Legislative Review Service by Euclid Managers October 2010 EUCLID MANAGERS® has served the independent agent since 1976, offering a portfolio of group health, professional liability, individual life, health, annuity and long-term care products. We proudly represent many fine carriers including Group Products: UnitedHealthcare of Illinois Delta Dental of Illinois MetLife Individual Products: American General Life Companies AXA/Equitable Banner Life Genworth Financial Insurance Co. Guarantee Trust Life HumanaOne John Hancock Life Lincoln National Life MetLife Prudential Financial RBC Insurance Transamerica West Coast Life …and many more! Contact Information Reflections Health Reform FAQ Health reform has become a “constant companion" – always there or on the mind. But, like many companions, it still remains a mystery for many. To some extent, this is due to the fact that so many questions need to be answered by regulation. But, perhaps the biggest culprit is that so much is changing in a short period of time. This issue of Legislative Review provides answers to some of health reforms “Frequently Asked Questions" (FAQ). Is it likely that health reform will be repealed? It is expected that an effort to repeal health reform will occur. However, even should the make-up of Congress change significantly after the November elections, President Obama will retain the veto pen. continued on page 2 A letter from Karen Knippen I have never been more impressed of our industry than I have these past months. In the face of uncertainty, brokers have spent hours and hours learning about what health reform means – and then undertaken the task of working with their clients to help them understand it. This has meant many long days – and nights – reading the law, newly issued rules, analyses and articles. Euclid Managers is your partner in deciphering the changes and disseminating knowledge. We will continue to research your questions and concerns as reform is implemented. Sincerely yours, 234 Spring Lake Drive Itasca, Illinois 60143 Phone: (630) 238-1900 Outside Chicagoland: (800) 345-7868 Fax: (630) 773-8790 Visit us at: www.euclidmanagers.com Karen Knippen, RHU, REBC, CLTC EUCLID MANAGERS® has been serving the independent agent since 1976 with a portfolio of group health, professional liability and individual life and health, annuity and long-term care products. We proudly represent UnitedHealthcare, Delta Dental of Illinois, MetLife and HumanaOne. We encourage your feedback and suggestions. Please call your EUCLID MANAGERS® Marketing Representative or Marcy Graefen at (630) 238-2915 for more information. Outside Chicagoland, call (800) 345-7868. Website: www.euclidmanagers.com Congress may deny funding for some of the provisions of reform. But, how this would affect the provisions of reform regarding insurance is unclear. It is expected that the court challenges to reform will not bear immediate fruit. Cases in the courts are notoriously slow. Some experts believe that the challenge regarding the constitutionality of the individual mandate has merit. In any event, further tinkering with health reform – while great to dream about – may just prolong the paralysis in the market that the uncertainty of reform has spawned. Many employers and individuals are holding off on decisions until they understand “what the rules are." What is "Grandfathered status"? Grandfathered status is meant to fulfill the administration’s promise that “if you like your plan, you can keep it." A grandfathered plan is able to delay or avoid certain provisions of health reform. In order to be grandfathered, a plan must have been in effect on March 23, 2010. What are the benefits of grandfathered status? A grandfathered plan does not have to comply with the following provisions: • First dollar coverage for preventive care • Revised appeals process • Limits on employee out-of-pocket expenses • Nondiscrimination requirements. There are other provisions that are delayed or avoided. Among these is that while employers will have to cover dependents until age 26, grandfathered plans can exclude those dependents who have coverage available elsewhere. What changes to a plan can cause a loss of grandfathered status? The list of changes that cause a loss of grandfathered status are many, including: • Significant cut or reduction of benefits including cuts to a specific type of coverage such as that for mental health, diabetes and the like • Increase in co-insurance charges • Significant increase in co-payments. Increases in excess of $5 or a percentage equal to medical inflation plus 15 percentage points result in a loss of status • Significant increase in deductibles. To maintain grandfathered status, deductibles can be raised only by a percentage equal to medical inflation -2- Reflections plus 15 percentage points. For example, a family deductible of $1000 may increase by $190 or $200 between 2010 and 2011. It could increase by an additional $50 for 2011 to 2012. • Significant decrease in employer contributions. Employers cannot decrease the percent of premiums paid by the employer by more than 5 percentage points. • Tighten or add an annual limit on what the insurer pays. Plans cannot add an annual dollar limit without losing grandfathered status unless they are replacing a lifetime dollar limit with an annual dollar limit that is “at least as high as the lifetime limit." • Change insurance companies. Coverage from the new insurer will not be considered a grandfathered plan. Can you still have a grandfathered plan if you’ve changed insurers? What about if there has only been a change in drug formularies? The rules regarding grandfathered status issued in June are interim final rules. As such, they may still be changed. But, as they currently stand, they state unequivocally that changing insurers (called issuers) will cause the loss of grandfathered status. A change in formulary is unlikely to cause a loss of this status. However, federal regulators have indicated that eliminating a range of drugs, such as those that treat depression, could cause a loss of grandfathered status. I thought only self-funded health plans had to test their plans for discrimination. I heard this is changing for health plans that are not grandfathered. Is this true? All insured plans will be subject to testing for discrimination. As such, carve out plans will likely fail nondiscrimination testing. What is unclear at this point is whether the $100 per day per participant penalty will be enforced on small employers or if any other penalties will be assessed small employers. Some insurers and analysts are of the opinion that small employers (50 or fewer employees) will be required to comply but will not face any penalties for discriminatory plans. Given this uncertainty and lack of guidance, employers are well-advised to consider whether their current plans can pass the nondiscrimination tests. They can then consider how to meet the tests and plan for any necessary changes. Can an employer still cover only management or only salaried employees? If the plan is grandfathered it can clearly do so. However, a non-grandfathered plan cannot – except in rare cases – restrict eligibility to such a class of employees and pass the nondiscrimination tests. The critical issue to be clarified is whether there will be penalties for maintaining such plans. One of the provisions of health reform makes Simple Cafeteria Plans available to small employers. The requirements for these plans state that an employer offering one of these plans will be deemed to have met all nondiscrimination rules. One has to wonder why this provision is in the law if small employers can continue to offer discriminatory plans. I’ve heard that many of the provisions of health reform were effective September 23, 2010. Is this true? What are they? It’s important to remember that the provisions will apply to plans at the beginning of a new plan year occuring on or after September 23, 2010. Plans will be prohibited from imposing any preexisting condition exclusions on enrollees under age 19. In most cases, this will mean changes for dependents. However, employers should be aware that this provision applies equally to any employees who meet the age requirement. The ban includes both benefit limitations and outright coverage denials. Also of importance is that any persons meeting this age limit and already under the plan and subject to a preexisting condition waiting period will be affected. A plan with a six month waiting period that comes under the provision will have to shorten the period for these individuals. What are some of the preventive services that must be covered at 100%? The list of “preventive" services is extensive. For adults services include: • Screening for men for an abdominal aortic aneurysm • Depression screening • Diet counseling for adults at higher risk of chronic disease • Obesity screening and counseling • Tobacco use screening and cessation interventions • Various maternity related services. The list of “preventive services" for children includes: • Alcohol and drug use assessments for adolescents • Autism screening for children at 18 and 24 months • Iron supplements for children ages 6 to 12 months at risk for anemia • Obesity screening and counseling • Oral health risk assessments • Vision screening. What other provisions of health reform are effective in the coming months? Effective January 1, 2011, flexible spending accounts, health savings accounts and other similar plans will no longer be able to provide reimbursement for over the counter drugs unless a person has a doctor’s prescription. Employers will have to include the costs for health insurance on W-2 statements issued for the year 2011. Won’t employers just cancel their plans and let employees take care of health insurance on their own? Dependents must be covered to age 26. Coverage does not have to be extended to spouses or children of these “adult children." This is a valid concern and some employers may, indeed do so. However, employers offer health plans now and there is no requirement to do so. This fact does not change with the implementation of reform. Lifetime limits on “essential health benefits" will also be prohibited. Annual dollar limits may be implemented in lieu of lifetime limits. Can the small business tax credit that starts this year be used for dental and vision plans? Annual dollar limits are subject to new restrictions, leading to a phase out of dollar limits over the next three years until 2014 when the Affordable Care Act bans them for most plans. Plans will be allowed to set annual limits no lower than $750,000. Preventive benefits must be provided without any deductibles or copayments when provided by a network provider. Yes, provided each plan meets the requirements for the credit. IRS Notice 2010-41 provides details and includes plans: limited scope dental or vision; long-term care, nursing home care, home health care, community-based care, or any combination thereof; coverage only for a specified disease or illness; hospital indemnity or other fixed indemnity insurance; and Medicare supplemental health insurance; certain other supplemental coverage, and similar supplemental coverage provided to coverage under a group health plan. Reflections -3- EServing UCLID MANAGERS the independent agent since 1976 ® A Legislative Review Service by Euclid Managers October 2010 Reflections A service publication for brokers from Euclid Managers®, proudly representing UnitedHealthcare of Illinois, Delta Dental of Illinois, MetLife and HumanaOne. EUCLID MANAGERS ® Serving the independent agent since 1976 Visit us online www.euclidmanagers.com. Editor: Pamela D. Mitroff Legislative Review is published by Euclid Managers®, 234 Spring Lake Drive., Itasca, IL 60143. For more information, contact your Marketing Representative or Marcy Graefen at (630) 238-2915 or fax your request to (630) 773-8790. Outside Chicagoland: (800) 345-7868, Fax (877) 444-2250. © Permission to quote with credit to source. Health Reform FAQ Inside: 234 Spring Lake Drive, Itasca, Illinois 60143 Presorted First-Class Mail U.S. Postage PAID Addison, IL 60101 Permit No. 210 EServing UCLID MANAGERS the independent agent since 1976 ®