CS – EXECUTIVE TAX LAWS & PRACTICE (Only Direct Taxation)

advertisement

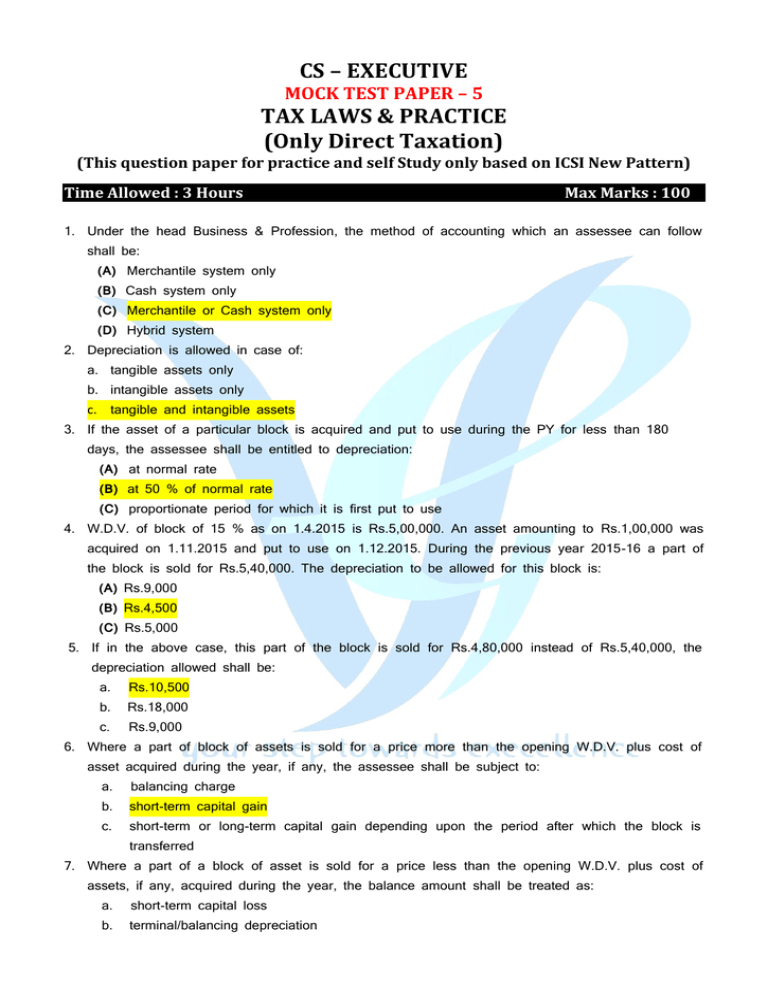

CS – EXECUTIVE MOCK TEST PAPER – 5 TAX LAWS & PRACTICE (Only Direct Taxation) (This question paper for practice and self Study only based on ICSI New Pattern) Time Allowed : 3 Hours Max Marks : 100 1. Under the head Business & Profession, the method of accounting which an assessee can follow shall be: (A) Merchantile system only (B) Cash system only (C) Merchantile or Cash system only (D) Hybrid system 2. Depreciation is allowed in case of: a. tangible assets only b. intangible assets only c. tangible and intangible assets 3. If the asset of a particular block is acquired and put to use during the PY for less than 180 days, the assessee shall be entitled to depreciation: (A) at normal rate (B) at 50 % of normal rate (C) proportionate period for which it is first put to use 4. W.D.V. of block of 15 % as on 1.4.2015 is Rs.5,00,000. An asset amounting to Rs.1,00,000 was acquired on 1.11.2015 and put to use on 1.12.2015. During the previous year 2015-16 a part of the block is sold for Rs.5,40,000. The depreciation to be allowed for this block is: (A) Rs.9,000 (B) Rs.4,500 (C) Rs.5,000 5. If in the above case, this part of the block is sold for Rs.4,80,000 instead of Rs.5,40,000, the depreciation allowed shall be: a. Rs.10,500 b. Rs.18,000 c. Rs.9,000 6. Where a part of block of assets is sold for a price more than the opening W.D.V. plus cost of asset acquired during the year, if any, the assessee shall be subject to: a. balancing charge b. short-term capital gain c. short-term or long-term capital gain depending upon the period after which the block is transferred 7. Where a part of a block of asset is sold for a price less than the opening W.D.V. plus cost of assets, if any, acquired during the year, the balance amount shall be treated as: a. short-term capital loss b. terminal/balancing depreciation c. written down value for purpose of charging current year depreciation 8. Where an electricity company charging depreciation on straight line method on each asset separately, sells any asset for a price less than the opening W.D.V. the balance amount shall be treated as: a. short-term capital loss b. terminal depreciation c. written down value 9. An asset which was acquired for Rs.5,00,000 was earlier used for scientific research. After the research was completed the machinery was brought into the business of the assessee. The actual cost of the asset for the purpose of inclusion in the block of asset shall be: (A) Rs.5,00,000 (B) Rs. NIL (C) Market value of the asset on the date it was brought into business 10. Unabsorbed depreciation brought forward from an earlier year of a particular business can be set off from: a. the same business b. any head of income c. any business income d. any head of income but first from business income 11. If an assessee carries on any scientific research related to his business, he shall be allowed deduction u/s 35 on account of: a. revenue expenditure b. capital expenditure c. both revenue and capital expenditure d. both revenue and capital expenditure excepting expenditure incurred on acquisition of land 12. Brought forward unabsorbed capital expenditure on scientific research can be carried forward: a. for any number of years b. for 8 years c. for 10 years 13. R Ltd., paid Rs.1,10,00,000 during the previous year 2014-15 for acquiring the telecommunication rights which were effective for 11 years. It commenced the business of operating the telecommunication service with effect from PY 2015-16. R Ltd., shall be entitled to a deduction of: a. Rs.11 lakhs w.e.f. PY 2014-15 b. Rs.11 lakhs w.e.f. PY 2015-16 c. none of these two 14. Short-term capital gain is a gain arising from the transfer of an asset which is held by the assessee for not more than: a. 36 months from the date of its acquisition b. 12 months from the date of its acquisition c. 12 months from the date of its acquisition in case of listed securities, units of equity MF and unit of UTI and zero coupon bond and for not more than 36 months in the case of other assets 15. Distribution of assets at the time of partial or complete partition of HUF shall: a. be regarded as a transfer in the hands of HUF for capital gain purposes b. be regarded as a transfer in the hands of coparceners c. not be regarded as transfer in the hands of HUF d. neither be regarded as transfer in the hands of HUF nor in the hands of coparceners 16. Conversion of personal effect into stock in trade shall: a. be subject to capital gain b. not be subject to capital gain c. shall be subject to tax under business head 17. In the case of compulsory acquisition, the indexation of cost of acquisition or improvement shall be done till the: a. previous year of compulsory acquisition b. in which the full compensation is received c. in which part or full compensation is received 18. In case of compulsory acquisition, if enhanced compensation is received, then for purpose of computation of capital gain the cost of acquisition and cost of improvement in that case shall be taken as: a. nil b. cost of acquisition or cost of improvement which was in excess of initial compensation earlier received c. none of these 19. If goodwill of a profession which is self-generated is transferred, there will: a. be capital gain b. not be any capital gain c. be a short-term capital gain 20. The surcharge applicable in the case of an individual is a) 2% of tax payable b) 10% of tax payable c) 12% of tax payable if total income exceeds ` 100 lakh d) Nil 21. The surcharge applicable to a domestic company for A.Y. 2016-17 is a) 2% always irrespective of level of income b) 10% if total income exceeds ` 1 crore. c) 5% if total income exceeds ` 1 crore d) 7% if the total income exceeds ` 1 crore but upto` 10 crore. 22. A non-resident individual having taxable income in India of ` 3,00,000 shall be allowed rebate of how much under section 87A a) 2,000 b) 3,000 c) 5,000 d) Nil 23. A newly set up business coming into existence, the first previous year will commence from a) Date of set up of business b) 1st April of previous year c) Any date after set up of business d) one day before date of set up of business 24. Exemption limit of ` 3,00,000 or ` 5,00,000 is applicable for a) Resident assessee b) Non-resident assessee c) Both resident and non-resident assessee d) none of them 25. A non-resident individual who is 85 years of age shall be allowed exemption of ........ from taxable income a) ` 5,00,000 b) ` 2,00,000 26. Income tax is charged on the basis of rate prescribed by c) ` 2,50,000 a) Income tax Act b) Finance Act c) Central Board of Direct Taxes d) Ministry of Law d) Nil 27. Charging section of income tax is a) Section 4 b) Section 9 c) Section 15 d) Section 28 28. Rebate under section 87A is allowed to a) Resident individual b) any individual (resident or non-resident) c) Resident individual and HUF d) all assessee 29. Rebate under section 87A shall be allowed to the maximum extent of a) ` 3,000 b) ` 2,000 c) ` 5,000 30. Total income is based on / total income varies according to: a) residential status of assessee b) citizenship of assessee c) both A and B d) none of the above d) tax payable 31. In computing the period of stay in India it is …………………. that stay should be for a …….. a) not necessary, continuous period b) necessary, continuous period c) d) None of the above Either a) and b) 32. Which of the following statement is false? a) Presence in territorial waters of India (TWI) would also be regarded as present in India b) Place and purpose of stay is immaterial c) After introduction exceptions, Condition 2 has not been deleted d) In computing period stay in India, day of entry & leaving India are not considered as stay in India 33. HUF will become Non-resident if: a) control & management is wholly situated outside India b) control & management is partly in India and partly outside India c) control & management is wholly situated India d) None of the above 34. Indian company is said to be resident in India if: a) Control wholly or partly in India b) Always resident c) c) Control wholly outside India Control wholly in India 35. If control of the foreign company is POEM in India, then it is: a) Non-resident in India b) Resident in India c) d) None of the above RNOR in India 36. If the POEM of an Indian company is wholly outside India, then company will become: a) Resident in India b) Non-resident in India c) d) None of the above RNOR in India 37. “X” was born on 5th May, 1992 in India & later on took the citizenship of U.S.A. Neither his parents nor his grandparents were born in divided/ undivided India. “X” in this case shall be: a) Citizen of India b) Person of Indian origin c) d) None of the above A foreign national 38. “X”, a foreign national visited India during the previous year 2015-16 for 180 days. He had never visited India prior to this visit. “X” in this case shall be: a) Resident in India b) Non-resident in India c) d) None of the above RNOR 39. Mr. C, a Japanese citizen left India after a stay of 10 years on 01.06.2013. During financial year 2014-15, he came to India for 46 days. Later, he returned to India for 1 year on 10.10.2015. Determine his residential status for the A.Y. 2016-17. a) Resident & ROR in India b) RNOR c) Non-resident in India d) None of the above 40. Every year, the residential status of an assessee: a) may change b) will certainly change c) will not change d) None of the above 41. Compute the GAV of the house whose Municipal Value is ` 75,000, Fair Rent is ` 80,000, standard rent is ` 78,000 and Actual rent received/ receivable is ` 72,000. a) ` 72,000 b) ` 78,000 c) ` 75,000 d) ` 80,000 42. Municipality has levied taxes of `45,000 but the assessee has paid ` 55,000 which includes ` 5,000 for the earlier year and ` 5,000 for the subsequent year. What amount of deduction shall be allowed to the assessee? a. `45,000 b) ` 55,000 c) ` 50,000 d) ` 60,000 43. If municipal taxes paid are more than the amount of Gross Annual Value, there ……………. a. cannot be negative Net Annual Value b) can be negative Net Annual Value c) d) None of the above any of the above 44. An assessee has borrowed money for purchase of a house & Interest is payable outside India. Such interest shall a) be allowed as deduction b) not to be allowed on deduction c) be allowed as deduction if the tax is deducted at source d) such interest shall not be considered 45. What is the maximum amount of deduction allowed in respect of income from house property in respect of self-occupied property for which loan is taken for the repair of the property? a) ` 30,000 b) ` 1,50,000 c) ` 2,00,000 d) Nil 46. Rashi is entitled to get a pension of ` 600 per month from a private company. She gets 3/5 th of the pension commuted and received ` 36,000. She did not receive gratuity. The taxable value of commuted value of pension is a) ` 16,000 b) ` 6,000 c) ` 18,000 d) ` 10,000 47. Swati is an employee of private company. In the previous year she received salary of ` 1,80,000 and entertainment allowance of ` 12,000. She spent ` 6,000 on entertainment. Under section 16(ii), she is entitled to deduction of: a) ` 12,000 b) ` 6,000 c) ` 5,000 d) Nil 48. An assessee received ` 200 per month for 3 children as children education allowance. What shall be the amount exempt in his hands for such allowance? a) ` 7,200 b) ` 3,600 c) ` 2,400 49. Transport Allowance received by assessee is exempt upto d) Nil a) amount received b) ` 1600 p.m. or ` 3200 p.m. for blind/handicapped employee c) Lower of a) and b) d) None of the above 50. An assessee, transport employee received allowance allowed to them of ` 20,000. The amount spent by him is ` 12,000. What amount would be exempt on account of allowance? a) ` 12,000 b) ` 10,000 c) ` 14,000 51. Mr. Arvind has the following receipts from his employer: d) Nil Particulars ` (1) Basic pay 3,000 p.m. (2) Dearness allowance (D.A.) 600 p.m. (3) Commission 6,000 p.a. (4) Motor car for personal use (expenditure met by the employer) 500 p.m. (5) House rent allowance 900 p.m. Find out the amount of HRA eligible for exemption to him assuming that he paid a rent of ` 1,000 p.m. for his accommodation at Kanpur. DA forms part of salary for retirement benefits. a) ` 7,680 b) ` 10,800 c) ` 17,280 d) Nil 52. For an employee other than Government employee, when RFA given to employee is not owned by employer, what amount shall be taxable in the hands of employee? a) Actual Rent or 20 % of Salary, whichever is less b) Actual Rent or 15 % of Salary, whichever is less c) Actual Rent or 10 % of Salary, whichever is less d) None of the above 53. Ram, Finance Manager in ABC Ltd. The company has provided him rent-free unfurnished accommodation in Mumbai. He gives you the following particulars: Particulars ` Basic salary ` 6,000 p.m. Advance salary for April 2015 ` 5,000 Dearness Allowance ` 2,000 p.m. (30% for retirement benefits) Bonus ` 1,500 p.m. Even though the company allotted house to him on 01.04.2015, he occupied the same only from 01.11.2015. Calculate the taxable value of perquisite for A.Y. 2016-17. a) ` 6,075 b) ` 6,000 c) ` 4,500 d) Nil 54. An employer provided his employee a sofa set whose actual cost is ` 70,000. Employee pays ` 2,000 to his employee towards this sofa set. What amount shall be taxable in the hands of the employee? a) ` 7,000 b) ` 2,000 c) ` 5,000 d) ` 10,000 55. Ravi retired on 01.10.2015 receiving ` 5,000 p.m. as pension. On 01.02.2016, he commuted 60% of his pension and received ` 3,00,000 as commuted pension and receiving gratuity of ` 5,00,000 at the time of retirement. What amount of uncommuted and commuted pension is taxable if he is a non-government employee? a) ` 24,000, ` 50,000 c) Nil, ` 1,33,333 b) ` 24,000, ` 1,33,333 d) Nil, ` 50,000 56. Ramesh who is non-government employee and covered by the Payment of Gratuity Act 1972 retired on 15.06.2015 after completion of 26 years 8 months of service and received gratuity of ` 6,00,000. At the time of retirement his salary was: Basic Salary : ` 5,000 p.m. Dearness Allowance : ` 3,000 p.m. (60% of which is for retirement benefits) Commission : 1% of turnover (turnover in the last 12 months was ` 12,00,000) Bonus : ` 12,000 p.a. What amount of gratuity shall be taxable? a) ` 4,75,385 b) ` 4,98,600 c) Nil d) ` 6,00,000 57. Rohit who is not a government employee retired on 01.12.2014 after 20 years 10 months of service, receiving leave salary of ` 5,00,000. Other details of his salary income are: Basic Salary : ` 5,000 p.m. (` 1,000 was increased w.e.f. 01.04.2014) Dearness Allowance : ` 3,000 p.m. (60% of which is for retirement benefits) Commission : ` 500 p.m. Bonus : ` 1,000 p.m. Leave availed during service : 480 days He was entitled to 30 days leave every year. How much amount of leave salary shall be taxable? a) Nil b) ` 4,73,600 c) ` 5,00,000 d) None of the above 58. An assessee received family pension of ` 90,000, what amount is taxable u/h Other Sources? a) ` 60,000 b) ` 75,000 c) ` 45,000 d) None of the above 59. The interest on Post Office Savings Bank account would be exempt from tax only upto for an individual account a) ` 3,500 b) ` 5,500 c) ` 7,000 d) without limit 60. Karan has received gift of ` 1,50,000 in cash from his mother’s sister. The amount shall be taxable in the hands of a) Karan b) his mother’s sister c) exempt from tax d) Any of the above 61. An assessee purchased an immovable property having stamp duty value of ` 10,50,000 for ` 5,00,000. What amount shall be taxable under head Other Sources? a) ` 10,50,000 b) ` 5,50,000 c) ` 10,00,000 d) Nil 62. Casual income is taxable @ ……………. under the provision of section ………………….. a) 30%, 115BC b) 30%, 115BB c) 20%,115BB d) Nil, 115BC 63. If medical insurance is for the life of senior citizen of an age of 60 years or more, deduction allowed shall be limited to the extent of a) 15,000 b) 10,000 c) 30,000 d) no limit 64. Mr. A paid medical insurance premium of ` 27,000 during year to insure health of his father, aged 63 years, who is not dependent on him. He incurred ` 4,000 by cheque on preventive health check-up of his father. Compute deduction allowable u/s80D for A.Y. 2015-16. a) 21,000 b) 30,000 c) 15,000 d) Nil 65. Deduction under section 80DD for a person with disability shall be a) ` 75,000 b) ` 1,00,000 c) ` 1,75,000 d) No limit 66. Deduction u/s 80GGB and 80GGC shall be allowed only if sum is contributed by way a) in cash b) electronically c) by any mode other than cash d) None of the above 67. X has income under head salary ` 90,000, Income from long term capital gains ` 90,000 and casual income ` 55,000, in this case maximum amount of deductions allowed shall be a) ` 90,000 b) ` 1,00,000 c) ` 1,80,000 d) ` 70,000 68. Deduction available in respect of royalty income of authors under section 80QQB shall not exceed ……………. in a previous year a) ` 2,00,000 b) ` 3,50,000 c) ` 3,00,000 d) None of the above 69. Daily allowance received by Member of legislative assembly (MLA) is a) exempt b) taxable c) d) None of the above included in the income only for finding rate of tax 70. Mrs. R receives salary of ` 1,00,000 from PQ Ltd., Mr. R receives salary of ` 1,50,000 f?rom PQ Ltd. Both of them have substantial interest in company. Other Income of Mr. A and Mrs. A excluding such remuneration is ` 10,00,000 and ` 12,00,000 respectively. Taxable income of Mr. A and Mrs. A shall be a) ` 11,50,000, ` 13,50,000 b) ` 11,00,000, ` 13,50,000 c) d) ` 10,00,000, ` 14,50,000 ` 12,50,000, ` 12,00,000 71. When marriage of parents subsist, Income of minor child shall be included in the income of a) Father b) Mother c) Parent, whose income (excluding such income) is higher d) Parent, whose income (including such income) is higher 72. ` 1,00,000 earned by minor child from manual activity is invested in FDR. He earns ` 10,000 as interest from FDR during the previous year. ` 1,00,000 and ` 10,000 shall be assessed in the hands of a) Minor, Minor b) Minor, Parents c) Parents, Parents d) Parents, Minor 73. G has 4 minor children: 2 daughters and 2 sons. Annual income of 2 daughters was `7,500 and ` 5,000 and of sons was ` 5,500 and ` 1,250 respectively. The daughter having income of ` 5,000 is suffering from a disability specified under section 80U. Work out the amount of income earned by minor children to be clubbed in the hands of G. a. ` 13,250 b) ` 10,000 c) ` 13,500 d) `9,750 74. Roshan earns ` 2,50,000 as interest from a firm where he has made a total investment of ` 5,00,000 as on first day of previous year. Out of the total investment of ` 5,00,000, ` 3,00,000 is the amount which was gifted to him by his wife, Teena. What is amount that shall be clubbed in the income of Teena a) ` 2,50,000 b) ` 1,50,000 c) ` 1,00,000 d) Nil 75. A TP report has to be filed by ABC Ltd. in this case, return of income shall be filed by: a) 30th September of assessment year c) 30th September of previous year b) 30th November of assessment year d) 30th November previous year 76. For PY 2012-13, H incurred a loss of ` 40,000 u/h PGBP and filed return of loss within due date. He again incurred loss of ` 50,000 during PY 2013-14. But for this year he did not file return. In PY 2014-15 he earned income of ` 5,00,000. How much loss can Mr. H carry forward and set off in this year? a) 90,000 b) 50,000 c) 40,000 d) Nil 77. A partnership firm has turnover of ` 75,00,000 and income under head Business/Profession ` 5,00,000 for PY 2014-15. In this case, the last date of filing of return of income shall be ……… a) 31st July 2015 b) 31st July 2014 c) 30th September 2015 d) No need to file return 78. For PY 2014-15, X, an assessee shall be allowed to file belated return of income latest upto..… a) 31.03.2016 b) 31.03.2017 c) 30.09.2016 d) 31.03.2018 79. For the previous year 2014-15, Mr. X has filed original return of income on 01.11.2015 whose due date of filing of return was 31st July 2015, he can file revised return of income latest upto a) 31st March 2016 b) 31st March 2017 c) d) Return cannot be revised 30th September 2016 80. Revised return can be filed a) within 1 year from end of relevant AY b) before completion of assessment c) earlier of a) and b) d) belated return is not allowed to be filed 81. ABC Ltd. has loss under the head Business/Profession ` 3,00,000 for previous year 2014-15. In this case, the company has to file the return latest by …………. a) 31st July 2016 b) 31st July 2015 30th September 2015 c) d) 30th September 2016 82. Notice u/s 143(2) shall be served within ……. from the end of the financial year in which ROI is filed. a) 6 months b) 6 years c) 12 months 83. A assessee, being company has to pay how much advance tax upto 15 th d) 30 days December of Financial Year a) 100 % b) 45 % 84. The last date of payment of advance tax is a) 15th March of financial year c) 15th September of financial year c) 75 % d) 60 % b) 15th December of financial year d) 15th March of assessment year 85. During the PY ending 31st March, 2015, a charitable trust earned an income of ` 4,00,000. Amount applied by trust is ` 2,00,000. How much amount shall be taxable? a) ` 3,40,000 b) ` 4,00,000 c) ` 1,40,000 d) Nil 86. Total donation received by assessee is ` 60,00,000. Out of which anonymous donation is of `20,00,000. What amount of anonymous donation shall be chargeable to tax a) ` 20,00,000 b) ` 19,00,000 c) ` 17,00,000 d) Nil 87. If the assesse is engaged in the business of growing and manufacturing rubber, the agricultural income in that case shall be: a) 40 % of the income from such business b) 60 % of the income from such business c) d) 100 % of the income from such business 65 % of the income from such business 88. What will be the tax liability in case of an individual whose agricultural income is 1,00,000, expenses relating to agriculture is 20,000 and income from business is 3,00,000. a) 10,300 b) 5,000 c) 3,090 (after rebate) d) 8,240 89. If amount payable as per normal provision of Income tax act is 52,000 and AMT is 47,000. The AMT credit available with assessee is 15,000. What is the amount payable and the AMT credit that shall be carried forward? a) 52,000, 10,000 b) 47,000, 10,000 c) 52,000, 15,000 d) 37,000, Nil 90. AMT is applicable on a) Individual whose Adjusted Total Income is ` 25 lakhs b) Individual whose Adjusted Total Income does not exceed ` 20 lakhs c) HUF whose Adjusted Total Income does not exceed ` 20 lakhs d) None of the above 91. MAT credit can be carried forward for a) 10 previous years b) 10 assessment years d) indefinite d) no carry forward 92. When an order is passed by Commissioner of Income Tax, it shall be appealed in front of a) Income tax appellate authority b) Commissioner of Income Tax (Appeal) c) High Court d) Supreme Court 93. Which is the first appellate authority? a) Income tax appellate authority b) Commissioner of Income Tax (Appeal) c) High Court d) Supreme Court 94. What is the limit for the amount payable during the entire previous year mentioned under section 194C upto which TDS shall not be deducted? a) ` 90,000 b) ` 75,000 c) ` 30,000 d) Nil 95. What shall be the rate at which TDS on payment to contractor/sub-contractor be deducted under section 194C when the payment is made to Individual or HUF? a) 1 % b) 2 % c) 10 % d) Nil 96. What is total amount during the previous year upto which TDS on rent under section 194I shall not be deducted? a) ` 30,000 b) ` 75,000 c) ` 2,00,000 d) ` 1,80,000 97. What shall be rate of TDS on fees for professional or technical service under section 194J? a) 20 % b) 10 % c) 30 % d) 15 % 98. What is total amount during the previous year upto which TDS on fees for professional or technical service shall not be deducted? a) ` 20,000 b) ` 75,000 c) ` 30,000 d) Nil 99. In case of winnings from horse races, payments exceeding …………… are subject to tax deduction at source at the rate of ……………..%? a) 5000, 30% b) 10,000, 30% c) 5,000, 10% d) 1,000, 10% 100. No deduction of tax at source will be made by a banking company under section 194A with respect to aggregate amount of interest paid or payable on time deposits during the financial year 2013-14, if it does not exceed ……………….? a) 10,000 b) 5,000 c) 20,000 d) None of the above