TRANSFORMING SOLENT MARINE & MARITIME SUPPLEMENT Rear Admiral Rob Stevens, CB

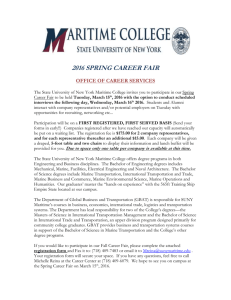

advertisement