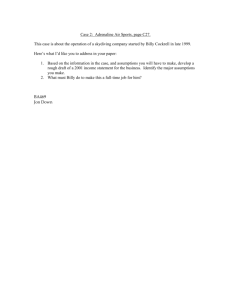

Straight talking from a hedge fund manager

Straight talking from a hedge fund manager

Funds International. London: Mar 2005. pg. 8 http://proquest.umi.com/pqdweb?did=810135141&sid=6&Fmt=3&clientId=68814&RQT=

309&VName=PQD

Abstract (Document Summary)

The debate over the regulation of hedge funds rages on, as does criticism regarding the opaqueness of reporting standards and the use of backfilled performance data in indices

(see page 7). FI asked Michael D Billy, managing director of managed funds at Floridabased fund-of-hedge fund managers American Diversified Funds (ADF), for his comments on the state of the industry.

In this respect, he points specifically to the collapse of the Long Term Capital

Management (LTCM) hedge fund in 1998. He adds: "Absent that guide, it would be safe to assume that ethics and integrity are also ignored. With the enormous inflows of funds into hedge-type products, the opportunity for deceit exists."

Full Text (424 words)

Copyright Lafferty Ltd. Mar 2005

The debate over the regulation of hedge funds rages on, as does criticism regarding the opaqueness of reporting standards and the use of backfilled performance data in indices

(see page 7). FI asked Michael D Billy, managing director of managed funds at Floridabased fund-of-hedge fund managers American Diversified Funds (ADF), for his comments on the state of the industry.

ADF is a strong advocate of regulation. Its hedge funds, which now house total assets of

$7 billion, have been voluntarily subjected to external auditing by two independent firms on a monthly, quarterly and yearly basis for many years.

On the issue of backfilled performance data, Billy comments: "The posting of a lofty track record is an enticement for anyone seeking a return on investment that props up underperforming asset classes. Through the meteoric expansion of hedge funds, and other hybrid operations, I have no doubt that in some circles greed and chicanery are replacing sound management tenets."

But this, he believes, is a situation that will not go on forever. "If an investment operation is predicated on backfilling, its existence will be short-lived as the comparables between strategy and reality will demand exposure. Currently, and going forward, performance is becoming more scrutinised, versus being readily accepted, in all areas of assets under management."

What may not be obvious to fund managers who are "smudging the figures," says Billy, is that "in the long run markets are definitive when it comes to exposing fact from fantasy. With the advent of more regulatory oversight, those only interested in serving themselves will be exposed, in time, as corrupt."

Rapid growth in the number of new hedge fund managers scrambling to get in on the act is also of concern to Billy. "I have no doubt there are current 'run and gun' operators whose operational mode involves no lesson learned from history."

In this respect, he points specifically to the collapse of the Long Term Capital

Management (LTCM) hedge fund in 1998. He adds: "Absent that guide, it would be safe to assume that ethics and integrity are also ignored. With the enormous inflows of funds into hedge-type products, the opportunity for deceit exists."

Regarding the possibility that another LTCM may be lurking in the background, Billy quips: "My crystal ball is actually a bowling ball, but I'd be willing to place a dollar bet on my bowling ball's ability to foresee." And what it "foresees" is none too pleasant. "I will predict that another LTCM debacle is waiting to surface."