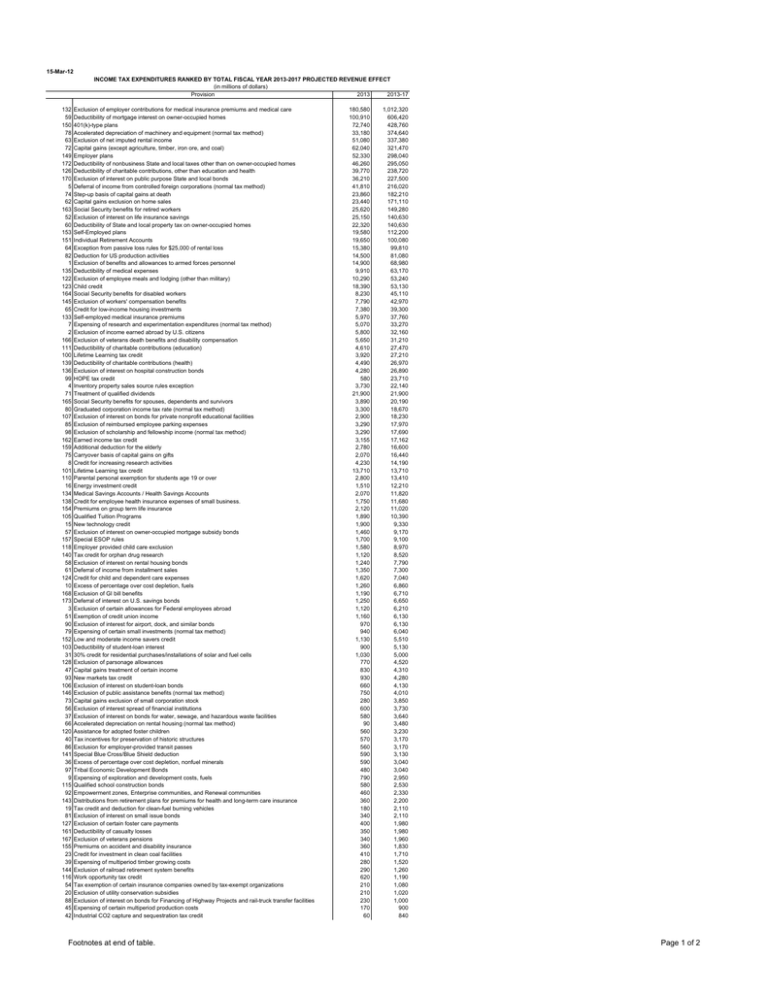

Provision 2013 2013-17 132 Exclusion of employer contributions for medical insurance premiums and...

advertisement

15-Mar-12 INCOME TAX EXPENDITURES RANKED BY TOTAL FISCAL YEAR 2013-2017 PROJECTED REVENUE EFFECT (in millions of dollars) Provision 2013 2013-17 132 59 150 78 63 72 149 172 126 170 5 74 62 163 52 60 153 151 64 82 1 135 122 123 164 145 65 133 7 2 166 111 100 139 136 99 4 71 165 80 107 85 98 162 159 75 8 101 110 16 134 138 154 105 15 57 157 118 140 58 61 124 10 168 173 3 51 90 79 152 103 31 128 47 93 106 146 73 56 37 66 120 40 86 141 36 97 9 115 92 143 19 81 127 161 167 155 23 39 144 116 54 20 88 45 42 Exclusion of employer contributions for medical insurance premiums and medical care Deductibility of mortgage interest on owner-occupied homes 401(k)-type plans Accelerated depreciation of machinery and equipment (normal tax method) Exclusion of net imputed rental income Capital gains (except agriculture, timber, iron ore, and coal) Employer plans Deductibility of nonbusiness State and local taxes other than on owner-occupied homes Deductibility of charitable contributions, other than education and health Exclusion of interest on public purpose State and local bonds Deferral of income from controlled foreign corporations (normal tax method) Step-up basis of capital gains at death Capital gains exclusion on home sales Social Security benefits for retired workers Exclusion of interest on life insurance savings Deductibility of State and local property tax on owner-occupied homes Self-Employed plans Individual Retirement Accounts Exception from passive loss rules for $25,000 of rental loss Deduction for US production activities Exclusion of benefits and allowances to armed forces personnel Deductibility of medical expenses Exclusion of employee meals and lodging (other than military) Child credit Social Security benefits for disabled workers Exclusion of workers' compensation benefits Credit for low-income housing investments Self-employed medical insurance premiums Expensing of research and experimentation expenditures (normal tax method) Exclusion of income earned abroad by U.S. citizens Exclusion of veterans death benefits and disability compensation Deductibility of charitable contributions (education) Lifetime Learning tax credit Deductibility of charitable contributions (health) Exclusion of interest on hospital construction bonds HOPE tax credit Inventory property sales source rules exception Treatment of qualified dividends Social Security benefits for spouses, dependents and survivors Graduated corporation income tax rate (normal tax method) Exclusion of interest on bonds for private nonprofit educational facilities Exclusion of reimbursed employee parking expenses Exclusion of scholarship and fellowship income (normal tax method) Earned income tax credit Additional deduction for the elderly Carryover basis of capital gains on gifts Credit for increasing research activities Lifetime Learning tax credit Parental personal exemption for students age 19 or over Energy investment credit Medical Savings Accounts / Health Savings Accounts Credit for employee health insurance expenses of small business. Premiums on group term life insurance Qualified Tuition Programs New technology credit Exclusion of interest on owner-occupied mortgage subsidy bonds Special ESOP rules Employer provided child care exclusion Tax credit for orphan drug research Exclusion of interest on rental housing bonds Deferral of income from installment sales Credit for child and dependent care expenses Excess of percentage over cost depletion, fuels Exclusion of GI bill benefits Deferral of interest on U.S. savings bonds Exclusion of certain allowances for Federal employees abroad Exemption of credit union income Exclusion of interest for airport, dock, and similar bonds Expensing of certain small investments (normal tax method) Low and moderate income savers credit Deductibility of student-loan interest 30% credit for residential purchases/installations of solar and fuel cells Exclusion of parsonage allowances Capital gains treatment of certain income New markets tax credit Exclusion of interest on student-loan bonds Exclusion of public assistance benefits (normal tax method) Capital gains exclusion of small corporation stock Exclusion of interest spread of financial institutions Exclusion of interest on bonds for water, sewage, and hazardous waste facilities Accelerated depreciation on rental housing (normal tax method) Assistance for adopted foster children Tax incentives for preservation of historic structures Exclusion for employer-provided transit passes Special Blue Cross/Blue Shield deduction Excess of percentage over cost depletion, nonfuel minerals Tribal Economic Development Bonds Expensing of exploration and development costs, fuels Qualified school construction bonds Empowerment zones, Enterprise communities, and Renewal communities Distributions from retirement plans for premiums for health and long-term care insurance Tax credit and deduction for clean-fuel burning vehicles Exclusion of interest on small issue bonds Exclusion of certain foster care payments Deductibility of casualty losses Exclusion of veterans pensions Premiums on accident and disability insurance Credit for investment in clean coal facilities Expensing of multiperiod timber growing costs Exclusion of railroad retirement system benefits Work opportunity tax credit Tax exemption of certain insurance companies owned by tax-exempt organizations Exclusion of utility conservation subsidies Exclusion of interest on bonds for Financing of Highway Projects and rail-truck transfer facilities Expensing of certain multiperiod production costs Industrial CO2 capture and sequestration tax credit Footnotes at end of table. 180,580 100,910 72,740 33,180 51,080 62,040 52,330 46,260 39,770 36,210 41,810 23,860 23,440 25,620 25,150 22,320 19,580 19,650 15,380 14,500 14,900 9,910 10,290 18,390 8,230 7,790 7,380 5,970 5,070 5,800 5,650 4,610 3,920 4,490 4,280 580 3,730 21,900 3,890 3,300 2,900 3,290 3,290 3,155 2,780 2,070 4,230 13,710 2,800 1,510 2,070 1,750 2,120 1,890 1,900 1,460 1,700 1,580 1,120 1,240 1,350 1,620 1,260 1,190 1,250 1,120 1,160 970 940 1,130 900 1,030 770 830 930 660 750 280 600 580 90 560 570 560 590 590 480 790 580 460 360 180 340 400 350 340 360 410 280 290 620 210 210 230 170 60 1,012,320 606,420 428,760 374,640 337,380 321,470 298,040 295,050 238,720 227,500 216,020 182,210 171,110 149,280 140,630 140,630 112,200 100,080 99,810 81,080 68,980 63,170 53,240 53,130 45,110 42,970 39,300 37,760 33,270 32,160 31,210 27,470 27,210 26,970 26,890 23,710 22,140 21,900 20,190 18,670 18,230 17,970 17,690 17,162 16,600 16,440 14,190 13,710 13,410 12,210 11,820 11,680 11,020 10,390 9,330 9,170 9,100 8,970 8,520 7,790 7,300 7,040 6,860 6,710 6,650 6,210 6,130 6,130 6,040 5,510 5,130 5,000 4,520 4,310 4,280 4,130 4,010 3,850 3,730 3,640 3,480 3,230 3,170 3,170 3,130 3,040 3,040 2,950 2,530 2,330 2,200 2,110 2,110 1,980 1,980 1,960 1,830 1,710 1,520 1,260 1,190 1,080 1,020 1,000 900 840 Page 1 of 2 INCOME TAX EXPENDITURES RANKED BY TOTAL FISCAL YEAR 2013-2017 PROJECTED REVENUE EFFECT (in millions of dollars) Provision 2013 2013-17 121 33 108 44 148 91 26 48 102 30 25 13 38 50 35 21 76 156 67 70 95 158 17 27 14 53 147 83 87 32 55 169 12 109 43 46 49 84 89 114 125 34 28 41 112 160 11 142 6 18 29 96 104 113 117 119 129 130 131 171 94 22 69 24 67 137 77 Adoption credit and exclusion Advanced Energy Property Credit Credit for holders of zone academy bonds Expensing of certain capital outlays Exclusion of military disability pensions Exemption of certain mutuals' and cooperatives' income Amortize all geological and geophysical expenditures over 2 years Income averaging for farmers Education Individual Retirement Accounts Credit for energy efficient appliances Natural gas distribution pipelines treated as 15-year property Capital gains treatment of royalties on coal Capital gains treatment of certain timber income Expensing of reforestation expenditures Expensing of exploration and development costs, nonfuel minerals Credit for holding clean renewable energy bonds Ordinary income treatment of loss from small business corporation stock sale Income of trusts to finance supplementary unemployment benefits Discharge of mortgage indebtedness Exceptions from imputed interest rules Credit to holders of Gulf Tax Credit Bonds. Additional deduction for the blind Alcohol fuel credits Allowance of deduction for certain energy efficient commercial building property Exclusion of interest on energy facility bonds Special alternative tax on small property and casualty insurance companies Exclusion of special benefits for disabled coal miners Special rules for certain film and TV production Tax credit for certain expenditures for maintaining railroad tracks Qualified energy conservation bonds Small life insurance company deduction Exclusion of interest on veterans housing bonds Exception from passive loss limitation for working interests in oil and gas properties Exclusion of interest on savings bonds redeemed to finance educational expenses Deduction for endangered species recovery expenditures Treatment of loans forgiven for solvent farmers Deferral of gain on sale of farm refiners Deferral of tax on shipping companies Investment credit for rehabilitation of structures (other than historic) Discharge of student loan indebtedness Credit for disabled access expenditures Advanced nuclear power production credit Credit for construction of new energy efficient homes Exclusion of gain or loss on sale or exchange of certain brownfield sites Exclusion of employer-provided educational assistance Tax credit for the elderly and disabled Alternative fuel production credit Tax credit for health insurance purchased by certain displaced and retired individuals Deferred taxes for financial firms on certain income earned overseas Bio-Diesel and small agri-biodiesel producer tax credits Credit for energy efficiency improvements to existing homes Recovery Zone Bonds Deduction for higher education expenses Special deduction for teacher expenses Welfare-to-work tax credit Employer-provided child care credit Employee retention credit for employers affected by Hurricane Katrina, Rita, and Wilma Exclusion for benefits provided to volunteer EMS and firefighters Making work pay tax credit Build America Bonds Expensing of environmental remediation costs Deferral of gain from dispositions of transmission property to implement FERC restructuring policy Cancellation of indebtedness Temporary 50% expensing for equipment used in the refining of liquid fuels Credit for homebuyer Refundable Premium Assistance Tax Credit Accelerated depreciation of buildings other than rental housing (normal tax method) 380 380 180 110 130 120 160 90 80 140 90 80 80 80 70 70 60 40 250 50 50 40 110 100 30 40 40 80 80 30 30 20 30 20 20 20 20 20 20 20 20 0 20 30 40 10 10 10 0 0 0 0 0 0 0 0 0 0 0 0 -170 -180 -20 530 -1,150 0 -7,370 730 700 700 660 660 620 480 480 480 460 440 430 430 430 420 350 300 300 250 250 240 240 210 210 200 200 200 160 160 150 150 140 130 130 120 100 100 100 100 100 100 80 70 40 40 40 10 10 0 0 0 0 0 0 0 0 0 0 0 0 -730 -820 -1,100 -3,020 -3,140 -10,510 -35,790 Source: Office of Management and Budget, Budget of the United States Government Fiscal Year 2012, Analytical Perspectives, Table 17-3. Available at http://www.whitehouse.gov/sites/default/files/omb/budget/fy2013/assets/teb2013.xls Page 2 of 2