Schroder Dana Andalan II Fund Factsheet About Schroders

advertisement

Fund Factsheet

Schroder Dana Andalan II

All data expressed as of 31 May 2016

Fund Category: Fixed Income

About Schroders

Effective Date

29 October 2008

PT. Schroder Investment Management Indonesia (''PT. SIMI'') is a 99% owned subsidiary of Schroders Plc. headquartered in the

United Kingdom. Schroders started its investment management business in 1926 and managed funds appoximately USD 466.9

billion (as of March 2016) for its clients worldwide. PT. SIMI manages funds aggregating IDR 73.11 trillion (as of May 2016) for

its retail and institutional clients in Indonesia including pension funds, insurance companies and social foundations.

Effective Statement

S-7704/BL/2008

Launch Date

3 November 2008

Currency

Rupiah

Investment Objective

Unit Price (NAV per Unit)

IDR 1,059.25

The investment objective of Schroder Dana Andalan II is to provide an attractive investment return with emphasis on capital

stability.

Fund Size

IDR 1.17 trillion

Asset Allocation

Minimum Initial Investment

IDR 100,000 *

Top Holdings

Debt Securities

Cash

Number of Offered Units

2 Billion Units

Valuation Period

Daily

Subscription Fee

Max. 0.50%

80% - 100%

0% - 20%

Investment in fixed income securities with less than 1

year of maturity and cash, will not exceed 90%.

Portfolio Breakdown

SR006 (Sukuk)

Standard Chartered (TD)

Debt Securities

Cash

Redemption Fee

Max. 1.00%

Switching Fee

Max. 1.00%

(In Alphabetical Order)

Deutsche Bank (TD)

FR0028 (Bond)

FR0060 (Bond)

74.28%

25.72%

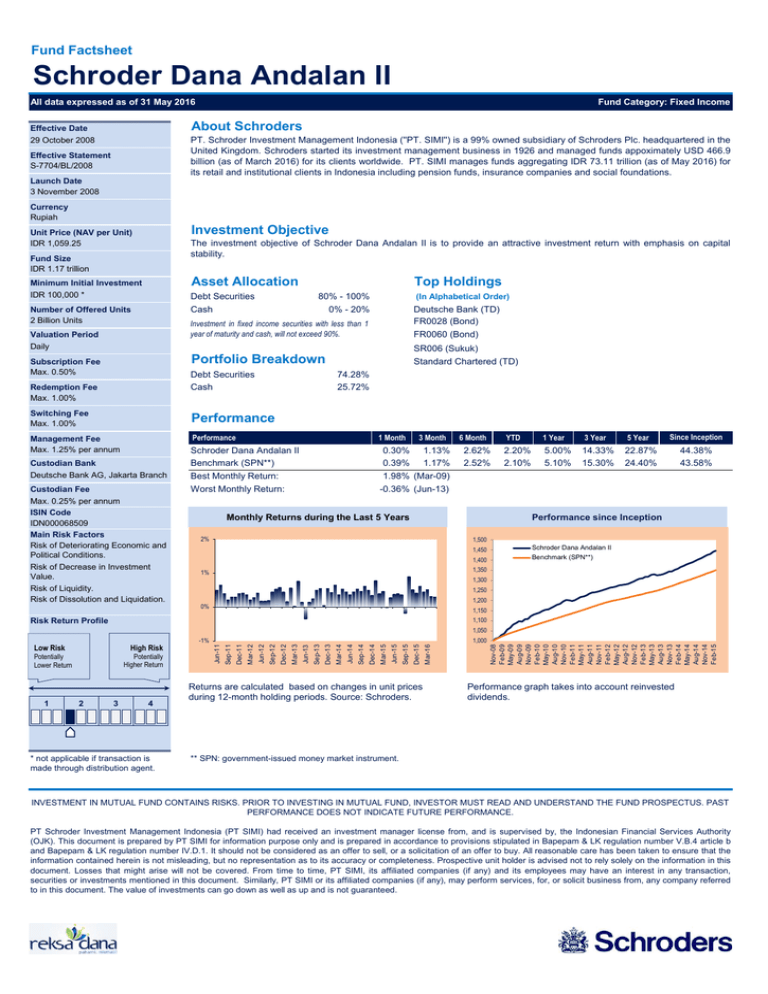

Performance

Management Fee

Max. 1.25% per annum

Custodian Bank

Deutsche Bank AG, Jakarta Branch

Custodian Fee

Max. 0.25% per annum

ISIN Code

IDN000068509

Main Risk Factors

Risk of Deteriorating Economic and

Political Conditions.

Risk of Decrease in Investment

Value.

Risk of Liquidity.

Risk of Dissolution and Liquidation.

Performance

1 Month

Schroder Dana Andalan II

Benchmark (SPN**)

Best Monthly Return:

Worst Monthly Return:

0.30% 1.13%

0.39% 1.17%

1.98% (Mar-09)

-0.36% (Jun-13)

3 Month

6 Month

2.62%

2.52%

Monthly Returns during the Last 5 Years

YTD

1 Year

3 Year

5 Year

2.20%

2.10%

5.00%

5.10%

14.33%

15.30%

22.87%

24.40%

Since Inception

44.38%

43.58%

Performance since Inception

2%

1,500

1,450

Schroder Dana Andalan II

1,400

Benchmark (SPN**)

1,350

1%

1,300

1,250

1,200

0%

1,150

1,100

Risk Return Profile

1,050

1

2

3

4

* not applicable if transaction is

made through distribution agent.

Mar-16

Dec-15

Jun-15

Sep-15

Mar-15

Dec-14

Jun-14

Sep-14

Mar-14

Dec-13

Jun-13

Sep-13

Mar-13

Dec-12

Jun-12

Sep-12

Mar-12

Dec-11

Returns are calculated based on changes in unit prices

during 12-month holding periods. Source: Schroders.

Nov-08

Feb-09

May-09

Aug-09

Nov-09

Feb-10

May-10

Aug-10

Nov-10

Feb-11

May-11

Aug-11

Nov-11

Feb-12

May-12

Aug-12

Nov-12

Feb-13

May-13

Aug-13

Nov-13

Feb-14

May-14

Aug-14

Nov-14

Feb-15

1,000

Jun-11

Potentially

Higher Return

Potentially

Lower Return

Sep-11

High Risk

Low Risk

-1%

Performance graph takes into account reinvested

dividends.

** SPN: government-issued money market instrument.

INVESTMENT IN MUTUAL FUND CONTAINS RISKS. PRIOR TO INVESTING IN MUTUAL FUND, INVESTOR MUST READ AND UNDERSTAND THE FUND PROSPECTUS. PAST

PERFORMANCE DOES NOT INDICATE FUTURE PERFORMANCE.

PT Schroder Investment Management Indonesia (PT SIMI) had received an investment manager license from, and is supervised by, the Indonesian Financial Services Authority

(OJK). This document is prepared by PT SIMI for information purpose only and is prepared in accordance to provisions stipulated in Bapepam & LK regulation number V.B.4 article b

and Bapepam & LK regulation number IV.D.1. It should not be considered as an offer to sell, or a solicitation of an offer to buy. All reasonable care has been taken to ensure that the

information contained herein is not misleading, but no representation as to its accuracy or completeness. Prospective unit holder is advised not to rely solely on the information in this

document. Losses that might arise will not be covered. From time to time, PT SIMI, its affiliated companies (if any) and its employees may have an interest in any transaction,

securities or investments mentioned in this document. Similarly, PT SIMI or its affiliated companies (if any), may perform services, for, or solicit business from, any company referred

to in this document. The value of investments can go down as well as up and is not guaranteed.