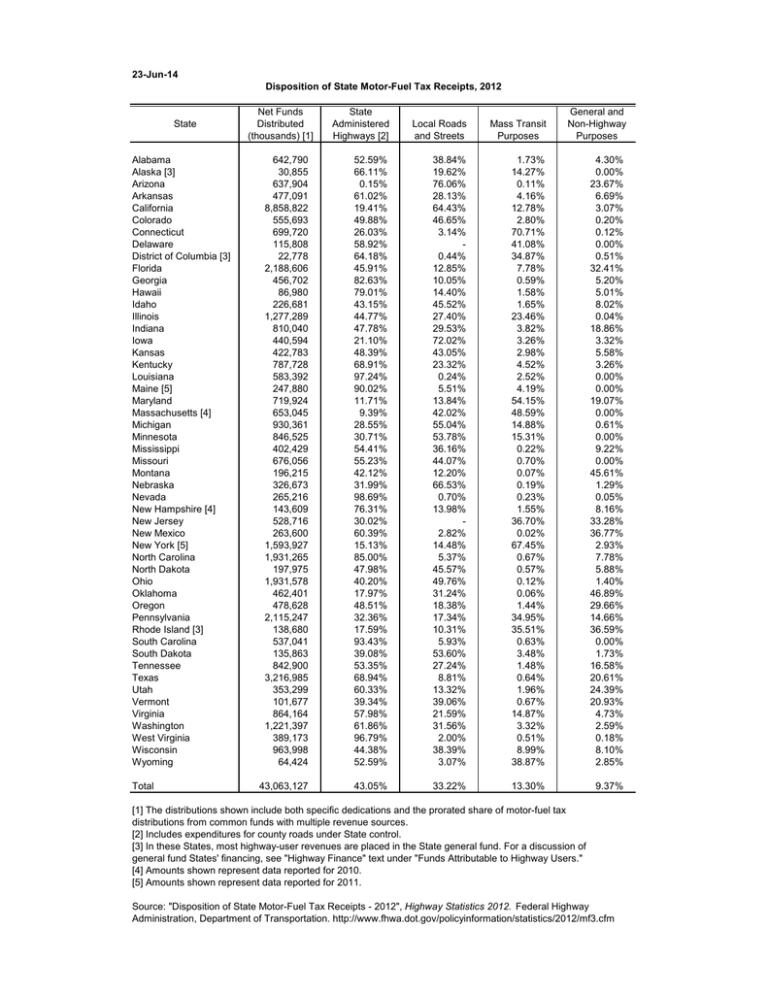

23-Jun-14 Disposition of State Motor-Fuel Tax Receipts, 2012 Net Funds State

advertisement

23-Jun-14 Disposition of State Motor-Fuel Tax Receipts, 2012 State Alabama Alaska [3] Arizona Arkansas California Colorado Connecticut Delaware District of Columbia [3] Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine [5] Maryland Massachusetts [4] Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire [4] New Jersey New Mexico New York [5] North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island [3] South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming Total Net Funds Distributed (thousands) [1] State Administered Highways [2] Local Roads and Streets Mass Transit Purposes General and Non-Highway Purposes 642,790 30,855 637,904 477,091 8,858,822 555,693 699,720 115,808 22,778 2,188,606 456,702 86,980 226,681 1,277,289 810,040 440,594 422,783 787,728 583,392 247,880 719,924 653,045 930,361 846,525 402,429 676,056 196,215 326,673 265,216 143,609 528,716 263,600 1,593,927 1,931,265 197,975 1,931,578 462,401 478,628 2,115,247 138,680 537,041 135,863 842,900 3,216,985 353,299 101,677 864,164 1,221,397 389,173 963,998 64,424 52.59% 66.11% 0.15% 61.02% 19.41% 49.88% 26.03% 58.92% 64.18% 45.91% 82.63% 79.01% 43.15% 44.77% 47.78% 21.10% 48.39% 68.91% 97.24% 90.02% 11.71% 9.39% 28.55% 30.71% 54.41% 55.23% 42.12% 31.99% 98.69% 76.31% 30.02% 60.39% 15.13% 85.00% 47.98% 40.20% 17.97% 48.51% 32.36% 17.59% 93.43% 39.08% 53.35% 68.94% 60.33% 39.34% 57.98% 61.86% 96.79% 44.38% 52.59% 38.84% 19.62% 76.06% 28.13% 64.43% 46.65% 3.14% 0.44% 12.85% 10.05% 14.40% 45.52% 27.40% 29.53% 72.02% 43.05% 23.32% 0.24% 5.51% 13.84% 42.02% 55.04% 53.78% 36.16% 44.07% 12.20% 66.53% 0.70% 13.98% 2.82% 14.48% 5.37% 45.57% 49.76% 31.24% 18.38% 17.34% 10.31% 5.93% 53.60% 27.24% 8.81% 13.32% 39.06% 21.59% 31.56% 2.00% 38.39% 3.07% 1.73% 14.27% 0.11% 4.16% 12.78% 2.80% 70.71% 41.08% 34.87% 7.78% 0.59% 1.58% 1.65% 23.46% 3.82% 3.26% 2.98% 4.52% 2.52% 4.19% 54.15% 48.59% 14.88% 15.31% 0.22% 0.70% 0.07% 0.19% 0.23% 1.55% 36.70% 0.02% 67.45% 0.67% 0.57% 0.12% 0.06% 1.44% 34.95% 35.51% 0.63% 3.48% 1.48% 0.64% 1.96% 0.67% 14.87% 3.32% 0.51% 8.99% 38.87% 4.30% 0.00% 23.67% 6.69% 3.07% 0.20% 0.12% 0.00% 0.51% 32.41% 5.20% 5.01% 8.02% 0.04% 18.86% 3.32% 5.58% 3.26% 0.00% 0.00% 19.07% 0.00% 0.61% 0.00% 9.22% 0.00% 45.61% 1.29% 0.05% 8.16% 33.28% 36.77% 2.93% 7.78% 5.88% 1.40% 46.89% 29.66% 14.66% 36.59% 0.00% 1.73% 16.58% 20.61% 24.39% 20.93% 4.73% 2.59% 0.18% 8.10% 2.85% 43,063,127 43.05% 33.22% 13.30% 9.37% [1] The distributions shown include both specific dedications and the prorated share of motor-fuel tax distributions from common funds with multiple revenue sources. [2] Includes expenditures for county roads under State control. [3] In these States, most highway-user revenues are placed in the State general fund. For a discussion of general fund States' financing, see "Highway Finance" text under "Funds Attributable to Highway Users." [4] Amounts shown represent data reported for 2010. [5] Amounts shown represent data reported for 2011. Source: "Disposition of State Motor-Fuel Tax Receipts - 2012", Highway Statistics 2012. Federal Highway Administration, Department of Transportation. http://www.fhwa.dot.gov/policyinformation/statistics/2012/mf3.cfm 29-Mar-13 Disposition of State Motor-Fuel Tax Receipts, 2011 State Alabama Alaska [3] Arizona Arkansas California Colorado Connecticut Delaware District of Columbia [3] Florida Georgia Hawaii Idaho Illinois [4] Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts [4] Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire [4] New Jersey [3] New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island [3] South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming Total Net Funds Distributed (thousands) [1] State Administered Highways [2] Local Roads and Streets Mass Transit Purposes General and Non-Highway Purposes 649,891 30,066 637,069 436,927 8,726,258 555,578 629,256 116,476 29,938 2,180,564 474,386 89,349 223,293 1,231,452 838,013 437,229 424,587 730,317 615,238 247,880 738,177 653,045 942,175 845,626 400,205 684,849 191,901 335,966 264,699 143,609 556,169 274,543 1,593,927 1,707,846 166,990 1,756,857 440,493 424,651 3,402,538 138,295 515,273 125,983 845,215 3,098,059 352,918 97,800 875,110 1,256,713 399,744 968,339 66,654 37.90% 91.87% 9.91% 68.92% 18.29% 28.85% 30.63% 59.65% 6.92% 39.77% 91.91% 77.79% 42.56% 39.06% 57.96% 17.42% 32.38% 67.83% 92.28% 90.02% 11.90% 9.39% 29.70% 1.46% 53.59% 50.42% 37.13% 8.40% 97.94% 76.31% 31.26% 50.85% 15.13% 84.67% 45.87% 41.14% 8.00% 47.43% 57.22% 1.03% 92.27% 32.73% 51.21% 74.48% 61.83% 51.52% 61.56% 51.31% 96.16% 35.80% 53.62% 53.23% 8.10% 75.36% 22.70% 65.80% 61.79% 3.41% 0.00% 2.03% 14.12% 0.23% 14.32% 49.42% 29.51% 35.70% 76.16% 27.16% 22.23% 5.83% 5.51% 14.34% 42.02% 54.75% 38.83% 34.83% 44.93% 12.89% 87.54% 1.13% 13.98% 11.60% 13.29% 14.48% 5.68% 44.11% 56.10% 45.36% 20.73% 10.91% 0.54% 5.21% 50.77% 27.08% 9.88% 35.67% 26.26% 21.13% 39.29% 1.85% 44.95% 3.15% 2.85% 0.03% 3.31% 0.41% 12.98% 8.70% 65.16% 40.35% 90.62% 12.44% 1.98% 1.40% 0.48% 26.17% 6.35% 3.92% 0.70% 6.13% 1.89% 4.19% 50.56% 48.59% 13.96% 59.42% 2.89% 4.65% 3.59% 1.63% 0.87% 1.55% 36.94% 1.05% 67.45% 1.11% 4.00% 1.23% 3.69% 25.56% 20.70% 63.26% 2.52% 12.54% 5.12% 0.84% 1.30% 4.01% 12.48% 5.03% 1.36% 7.41% 38.15% 3.04% 0.00% 11.42% 7.96% 2.63% 0.19% 0.80% 0.00% 0.43% 32.74% 4.51% 6.48% 5.92% 0.04% 0.00% 2.19% 39.75% 3.81% 0.00% 0.00% 22.24% 0.00% 0.69% 0.00% 8.69% 0.00% 46.02% 2.42% 0.06% 8.16% 20.20% 34.82% 2.93% 6.92% 6.02% 1.52% 42.95% 5.87% 10.75% 35.17% 0.00% 1.83% 15.24% 13.78% 1.20% 18.20% 4.01% 3.76% 0.17% 11.71% 2.52% 43,568,136 42.52% 34.09% 14.84% 7.93% [1] The distributions shown include both specific dedications and the prorated share of motor-fuel tax distributions from common funds with multiple revenue sources. [2] Includes expenditures for county roads under State control. [3] In these States, most highway-user revenues are placed in the State general fund. For a discussion of general fund States' financing, see "Highway Finance" text under "Funds Attributable to Highway Users." [4] Amounts shown represent data reported for Illinois for 2009 and the others are 2010. Source: "Disposition of State Motor-Fuel Tax Receipts - 2011", Highway Statistics 2011. Federal Highway Administration, Department of Transportation. http://www.fhwa.dot.gov/policyinformation/statistics/2011/mf3.cfm 29-Mar-13 Disposition of State Motor-Fuel Tax Receipts, 2010 State Alabama Alaska [3] Arizona Arkansas California Colorado Connecticut Delaware District of Columbia [3] Florida Georgia Hawaii Idaho Illinois [4] Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey [3] New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island [3] South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming Total Net Funds Distributed (thousands) [1] State Administered Highways [2] Local Roads and Streets Mass Transit Purposes General and Non-Highway Purposes 648,071 25,232 629,134 482,192 4,958,913 556,542 624,291 114,579 20,568 2,155,752 467,037 81,027 227,159 1,231,452 817,024 429,227 435,559 653,527 595,764 251,414 707,632 653,045 945,741 827,341 377,618 683,461 186,304 316,991 266,251 143,609 555,502 270,445 1,632,193 1,619,848 147,088 1,728,628 431,177 351,126 2,035,620 138,746 517,768 134,007 825,448 3,036,731 343,705 95,970 860,153 1,292,824 391,570 951,750 66,892 48.34% 106.34% 1.13% 64.14% 31.30% 30.84% 47.42% 88.05% 3.43% 46.79% 61.30% 81.84% 35.20% 39.06% 64.87% 12.26% 68.77% 63.55% 97.40% 91.01% 37.72% 9.39% 34.20% 5.96% 46.84% 61.23% 42.32% 22.01% 96.42% 76.31% 50.03% 57.03% 53.75% 80.42% 37.32% 39.03% 20.29% 58.56% 97.69% 21.20% 92.77% 42.45% 58.41% 44.05% 61.55% 49.60% 60.56% 46.05% 94.28% 31.53% 46.95% 47.50% 25.65% 83.03% 24.48% 60.36% 48.96% 3.23% 0.12% 10.36% 14.60% 8.31% 9.41% 56.44% 29.51% 29.19% 80.92% 23.72% 22.78% 0.37% 5.51% 9.52% 42.02% 49.11% 58.87% 43.02% 38.28% 14.42% 74.95% 0.00% 13.98% 9.96% 0.87% 24.01% 5.84% 54.57% 58.03% 9.84% 23.77% 0.03% 2.90% 6.39% 41.57% 26.39% 5.71% 35.34% 23.24% 21.68% 47.74% 1.64% 44.37% 3.45% 1.08% -31.99% 4.74% 2.50% 7.12% 19.72% 49.24% 11.83% 85.80% 8.04% 19.03% 1.88% 0.42% 26.17% 5.95% 5.20% 0.70% 9.14% 2.23% 3.20% 33.16% 48.59% 15.30% 34.92% 3.44% 0.49% 4.22% 0.72% 2.22% 1.55% 26.94% 3.02% 19.48% 1.64% 1.13% 1.23% 3.38% 4.98% 0.04% 42.05% 0.85% 12.22% 6.73% 1.58% 1.33% 9.03% 13.25% 1.08% 3.76% 8.24% 45.20% 0.00% 0.00% 11.10% 5.20% 1.21% 0.00% 0.10% 0.00% 0.40% 30.56% 10.04% 6.86% 6.32% 0.04% 0.00% 1.32% 6.81% 4.53% 0.00% 0.00% 18.32% 0.00% 0.58% 0.00% 6.70% 0.00% 39.05% 2.33% 1.10% 8.16% 13.08% 39.09% 2.77% 10.38% 6.98% 1.72% 66.49% 9.99% 0.00% 33.85% 0.00% 1.73% 7.14% 48.66% 1.05% 18.13% 3.67% 4.43% 0.18% 15.72% 2.01% 37,939,648 49.30% 30.49% 9.51% 10.02% [1] The distributions shown include both specific dedications and the prorated share of motor-fuel tax distributions from common funds with multiple revenue sources. [2] Includes expenditures for county roads under State control. [3] In these States, most highway-user revenues are placed in the State general fund. For a discussion of general fund States' financing, see "Highway Finance" text under "Funds Attributable to Highway Users." [4] Amounts shown represent data reported for 2009. Source: "Disposition of State Motor-Fuel Tax Receipts - 2010", Highway Statistics 2010. Federal Highway Administration, Department of Transportation. http://www.fhwa.dot.gov/policyinformation/statistics/2010/mf3.cfm 29-Mar-13 Disposition of State Motor-Fuel Tax Receipts, 2009 State Alabama Alaska [3] Arizona Arkansas California Colorado Connecticut Delaware District of Columbia [3] Florida Georgia Hawaii Idaho Illinois Indiana [4] Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey [3] New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island [3] South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming Total Net Funds Distributed (thousands) [1] State Administered Highways [2] Local Roads and Streets Mass Transit Purposes General and Non-Highway Purposes 715,697 7,332 633,480 446,419 5,266,143 541,562 613,719 118,885 23,830 2,127,222 1,203,478 86,151 215,614 1,231,452 855,848 427,867 413,840 619,897 600,837 232,339 849,990 648,570 947,877 750,964 414,991 679,775 176,976 314,976 450,083 147,501 559,039 321,044 1,628,419 1,559,503 142,845 1,656,909 438,177 341,535 2,030,599 133,807 520,038 127,600 818,626 2,969,876 337,529 79,072 862,868 1,251,671 386,646 949,064 58,904 39.68% 95.91% 0.01% 61.33% 16.57% 64.03% 37.88% 55.45% 0.00% 55.54% 61.85% 70.41% 34.63% 39.06% 70.23% 21.78% 27.93% 60.90% 98.86% 90.98% 40.33% 83.86% 28.19% 14.75% 43.24% 61.41% 41.17% 29.23% 96.08% 75.93% 40.09% 32.06% 43.03% 82.29% 50.85% 39.07% 4.08% 51.86% 46.00% 33.88% 89.64% 52.63% 60.83% 31.65% 83.91% 40.33% 51.56% 49.45% 96.87% 42.68% 51.44% 57.71% 4.08% 72.49% 26.59% 82.94% 21.06% 3.47% 0.00% 98.13% 16.65% 7.67% 20.38% 56.52% 29.51% 22.53% 74.39% 52.20% 25.37% 0.39% 8.60% 26.12% 6.86% 56.62% 56.34% 45.59% 38.23% 11.30% 67.92% 0.82% 13.19% 10.28% 22.74% 30.94% 6.51% 40.57% 57.52% 11.49% 26.14% 15.87% 1.99% 6.77% 30.95% 25.07% 5.84% 13.64% 26.71% 21.54% 43.48% 1.69% 38.57% 3.59% 0.06% 0.01% 2.67% 3.75% 0.00% 14.06% 56.82% 44.55% 1.18% 13.56% 10.33% 2.21% 2.12% 26.17% 5.94% 3.03% 0.64% 7.75% 0.75% 0.12% 20.68% 8.97% 13.74% 28.71% 1.91% 0.37% 2.62% 2.33% 0.01% 1.75% 35.96% 4.14% 21.95% 1.17% 1.18% 1.34% 2.09% 4.56% 38.13% 27.19% 1.94% 12.70% 4.48% 1.21% 1.10% 10.83% 18.43% 2.64% 0.73% 8.78% 41.66% 0.00% 0.00% 24.83% 4.62% 0.00% 0.08% 1.84% 0.00% 0.69% 13.12% 2.45% 6.99% 4.99% 0.04% 1.30% 0.49% 19.23% 5.98% 0.00% 0.00% 11.94% 0.31% 0.67% 0.00% 7.28% 0.00% 44.50% 0.53% 0.00% 9.12% 13.67% 33.22% 4.09% 8.30% 7.40% 1.79% 82.34% 15.00% 0.00% 35.46% 0.00% 1.66% 8.23% 60.27% 1.35% 22.14% 3.68% 3.73% 0.19% 9.83% 0.68% 39,637,086 44.29% 33.16% 9.69% 9.62% [1] The distributions shown include both specific dedications and the prorated share of motor-fuel tax distributions from common funds with multiple revenue sources. [2] Includes expenditures for county roads under State control. [3] In these States, most highway-user revenues are placed in the State general fund. For a discussion of general fund States' financing, see "Highway Finance" text under "Funds Attributable to Highway Users." [4] Amounts shown represent data reported for 2008. Source: "Disposition of State Motor-Fuel Tax Receipts - 2009", Highway Statistics 2009. Federal Highway Administration, Department of Transportation. http://www.fhwa.dot.gov/policyinformation/statistics/2009/mf3.cfm 3-Mar-11 Disposition of State Motor-Fuel Tax Receipts, 2008 State Alabama Alaska [3] Arizona Arkansas California Colorado Connecticut Delaware District of Columbia [3] Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey [3] New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island [3] South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming Total Net Funds Distributed (thousands) [1] State Administered Highways [2] Local Roads and Streets Mass Transit Purposes General and Non-Highway Purposes 611,560 30,759 702,554 463,677 4,084,946 554,936 683,103 129,798 23,199 2,215,452 934,590 87,885 213,886 1,422,935 855,848 434,727 423,635 607,420 602,199 244,402 833,792 670,940 973,549 664,393 418,632 710,351 193,775 307,729 294,138 151,516 551,757 313,265 1,658,881 1,629,909 144,355 1,836,825 393,719 398,347 2,091,957 139,296 538,914 128,972 834,777 3,057,581 362,938 86,866 926,935 1,253,946 359,473 2,322,160 60,669 32.95% 96.52% 1.70% 64.97% 31.53% 75.73% 46.54% 73.68% 0.04% 54.55% 75.45% 78.23% 47.14% 68.33% 70.23% 25.29% 37.77% 69.88% 99.09% 90.49% 18.96% 4.24% 28.39% 17.97% 54.86% 59.18% 48.24% 6.73% 99.10% 77.95% 48.99% 39.50% 25.75% 77.59% 42.84% 53.99% 89.05% 66.39% 55.85% 40.61% 91.42% 51.93% 49.27% 41.99% 55.98% 45.16% 52.71% 37.24% 99.21% 15.15% 62.71% 62.77% 1.47% 70.82% 23.17% 46.18% 19.48% 3.44% -93.57% 17.42% 9.25% 10.99% 44.71% 28.71% 22.53% 72.40% 54.62% 20.69% 0.24% 9.23% 28.10% 50.14% 56.51% 57.16% 39.14% 40.65% 4.93% 89.83% -11.60% 1.38% 9.55% 36.21% 6.72% 47.20% 43.96% 9.26% 18.26% 8.68% 2.83% 5.29% 36.54% 37.93% 5.80% 41.10% 26.18% 21.70% 56.98% -16.44% -- 0.04% 0.06% 1.48% 3.58% 20.36% 4.08% 49.12% 4.50% 6.38% 12.67% 0.57% 1.68% 0.60% 0.11% 5.94% 1.61% -5.40% 0.68% 0.00% 36.80% 44.44% 13.44% 24.72% 2.22% -2.52% -0.57% 1.09% 26.11% 29.09% 28.98% 3.12% 2.22% 0.14% 1.43% 1.09% 34.81% 19.52% 3.28% 9.55% 4.46% 1.50% -2.99% 20.62% 0.98% -3.52% 34.03% 4.24% 1.95% 26.00% 8.28% 1.93% 0.71% 0.91% 21.82% -15.36% 14.73% 9.10% 7.55% 2.86% 1.30% 0.70% 7.61% 4.02% -0.28% 16.14% 1.17% 1.65% 0.15% 3.78% 0.18% 44.30% 3.43% 0.32% 9.35% 23.53% 21.85% 9.06% 12.57% 7.74% 1.91% 0.25% 14.26% 0.66% 37.03% -1.98% 8.34% 50.71% 2.92% 25.67% 4.97% 4.80% 0.79% 64.90% 3.26% 39,637,868 47.35% 28.05% 11.32% 13.28% [1] The distributions shown include both specific dedications and the prorated share of motor-fuel tax distributions from common funds with multiple revenue sources. [2] Includes expenditures for county roads under State control. [3] In these States, most highway-user revenues are placed in the State general fund. For a discussion of general fund States' financing, see "Highway Finance" text under "Funds Attributable to Highway Users." Source: "Disposition of State Motor-Fuel Tax Receipts - 2008", Highway Statistics 2008. Federal Highway Administration, Department of Transportation. http://www.fhwa.dot.gov/policyinformation/statistics/2008/mf3.cfm 3-Mar-11 Disposition of State Motor-Fuel Tax Receipts, 2007 State Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming Total Net Funds Distributed (thousands) For Highway Purposes 680,013 31,638 728,385 462,190 3,418,725 567,680 676,813 117,218 26,776 2,233,129 934,173 85,561 237,411 1,338,373 879,793 444,086 439,590 563,168 639,748 238,796 758,834 669,357 1,027,933 674,682 431,432 704,183 193,453 332,467 520,736 151,965 589,571 289,747 2,197,646 1,656,334 124,839 1,894,435 410,639 412,950 2,106,731 146,104 535,261 130,076 849,662 3,086,196 372,747 94,961 932,996 1,119,386 1,107,615 1,006,012 105,251 -39,377,467 97.29% 100.00% 97.45% 94.30% 99.34% 95.88% 62.25% 100.00% 84.13% 98.21% 86.82% 91.37% 95.93% 97.65% 99.94% 97.35% 97.14% 100.00% 99.71% 100.00% 63.67% 6.95% 92.07% 99.68% 93.70% 100.00% 99.14% 99.40% 96.58% 100.00% 61.14% 53.81% 71.86% 88.08% 96.26% 98.51% 73.67% 96.01% 98.27% 54.75% 98.35% 97.97% 89.07% 62.30% 99.09% 61.47% 95.34% 96.36% 99.72% 88.52% 98.80% -88.35% Mass Transit Purposes ----3.47% 36.79% -15.87% -0.67% 1.91% 0.65% 0.07% 0.06% 2.37% --0.29% -32.34% 93.05% 5.63% 0.21% 0.28% -0.86% ---30.96% 21.06% 28.14% 3.78% 2.12% -0.15% 3.99% 1.07% 30.29% 1.17% 0.00% 0.00% 0.96% --2.08% 2.25% -8.11% --6.10% General and Non-Highway Purposes 2.71% -2.55% 5.70% 0.66% 0.65% 0.96% --1.79% 12.51% 6.72% 3.42% 2.28% -0.28% 2.86% ---3.99% -2.30% 0.11% 6.02% --0.60% 3.42% -7.90% 25.13% -8.14% 1.62% 1.49% 26.19% -0.65% 14.96% 0.48% 2.03% 10.93% 36.74% 0.91% 38.53% 2.58% 1.39% 0.28% 3.37% 1.20% 5.56% Source: "Disposition of receipts from State and highway-user imposts, including tolls - 2007", Highway Statistics 2007. Federal Highway Administration, Department of Transportation. http://www.fhwa.dot.gov/policyinformation/statistics/2007/sdf.cfm 17-Sep-08 Disposition of State Motor-Fuel Tax Receipts, 2006 State Alabama Alaska [3] Arizona Arkansas California Colorado Connecticut Delaware District of Columbia [3] Florida Georgia Hawaii Idaho Illinois Indiana [4] Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey [3] New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island [3] South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming Total Net Funds Distributed (thousands) [1] State Administered Highways [2] Local Roads and Streets Mass Transit Purposes General and Non-Highway Purposes 641,990 29,246 698,447 423,592 3,235,557 600,563 576,671 118,471 24,960 2,140,474 447,083 82,853 215,711 1,280,966 879,521 428,833 429,358 527,283 607,360 226,655 732,905 663,876 1,029,661 657,738 423,412 705,246 194,562 308,329 480,079 149,109 579,392 274,468 1,589,128 1,504,846 129,582 1,835,135 435,399 401,987 2,065,227 142,907 521,640 128,633 830,167 2,939,406 339,045 86,628 863,322 997,084 294,355 942,830 95,277 54.83% 100.00% 47.87% 68.35% 59.36% 88.85% 64.08% 100.00% -90.12% 62.85% 78.04% 51.30% 44.10% 31.62% 28.15% 46.42% 79.40% 98.79% 91.04% 27.08% 25.91% 38.89% 53.80% 55.71% 73.48% 48.47% 35.43% 61.31% 85.60% 54.41% 36.15% 52.29% 76.64% 44.77% 62.04% 70.37% 83.75% 91.14% 53.16% 81.56% 95.37% 65.65% 65.22% 79.74% 36.58% 75.20% 47.37% 99.59% 40.72% 70.79% 45.13% -49.87% 30.13% 40.64% 7.42% 3.95% -87.28% 9.28% 11.90% 14.32% 46.85% 55.83% 68.32% 69.70% 50.86% 20.60% 0.96% 8.96% 28.33% 0.25% 55.21% 45.99% 40.18% 26.52% 50.71% 64.57% 35.65% 14.40% 7.05% 18.52% 9.19% 6.42% 52.00% 37.36% 5.64% 13.06% 7.87% 3.32% 12.50% 0.80% 24.41% 0.25% 20.09% 21.60% 21.10% 49.31% -46.72% 29.21% -----3.73% 31.67% -12.72% -0.99% 1.54% 0.41% 0.07% 0.05% 2.16% --0.25% -41.93% 73.83% 5.04% 0.21% 0.33% -0.82% ---30.86% 22.30% 38.53% 4.49% 2.78% -0.10% 3.19% 0.99% 30.17% 1.17% 0.00% 0.00% 0.98% --2.01% 2.75% -9.34% -- 0.03% -2.26% 1.52% --0.29% --0.60% 24.26% 6.10% 1.44% ---2.72% ---2.67% -0.87% -3.78% ---3.04% -7.67% 23.04% -12.45% 0.45% 0.60% 23.89% --13.34% 4.77% 3.82% 9.94% 33.55% 0.17% 41.82% 1.69% 0.57% 0.41% 3.22% -- 35,956,969 62.85% 25.77% 6.25% 5.12% [1] The distributions shown include both specific dedications and the prorated share of motor-fuel tax distributions from common funds with multiple revenue sources. [2] Includes expenditures for county roads under State control. [3] In these States, most highway-user revenues are placed in the State general fund. For a discussion of general fund States' financing, see "Highway Finance" text under "Funds Attributable to Highway Users." [4] This State did not report 2006 data; the table displays 2005 data. Source: "Disposition of State Motor-Fuel Tax Receipts - 2006", Highway Statistics 2006. Federal Highway Administration, Department of Transportation. http://www.fhwa.dot.gov/policy/ohim/hs06/htm/mf3.htm 8-Aug-07 Disposition of State Motor-Fuel Tax Receipts, 2005 State Alabama [3] Alaska [4] Arizona Arkansas California Colorado [3] Connecticut Delaware District of Columbia [4] Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana [3] Maine [4] Maryland Massachusetts Michigan [3] Minnesota [3] Mississippi Missouri Montana Nebraska Nevada New Hampshire [5] New Jersey [4] New Mexico New York North Carolina North Dakota [3] Ohio Oklahoma Oregon Pennsylvania Rhode Island [3,4] South Carolina South Dakota [3] Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming [3] Total Net Funds Distributed (thousands) [1] State Administered Highways [2] Local Roads and Streets Mass Transit Purposes General and Non-Highway Purposes 485,379 31,496 672,214 447,408 3,276,239 516,575 469,107 116,785 25,912 2,005,613 497,248 80,509 210,484 1,275,003 879,521 423,173 428,885 533,393 581,897 217,042 742,289 679,907 1,043,540 661,761 396,428 707,666 185,652 301,469 365,657 152,735 558,860 269,494 1,568,701 1,414,131 115,874 1,727,824 435,755 389,954 1,873,750 147,811 499,896 125,091 879,378 2,885,700 332,605 85,047 874,676 905,907 289,092 936,180 67,811 58.81% 99.93% 66.97% 68.72% 41.54% 76.38% 60.27% 100.00% -70.02% 74.30% 68.96% 60.03% 35.13% 31.62% 50.99% 46.62% 61.14% 99.18% 87.50% 27.03% 84.03% 38.36% 41.74% 60.10% 61.81% 18.71% 47.46% 76.20% 81.46% 28.44% 70.31% 64.62% 80.50% 46.15% 45.80% 40.20% 27.96% 91.95% 40.63% 85.28% 79.80% 52.33% 54.33% 72.97% 33.03% 82.62% 63.50% 100.00% 50.98% 59.58% 39.58% -25.98% 27.60% 56.31% 20.53% 3.18% -100.00% 20.11% 10.71% 19.37% 36.74% 59.53% 68.32% 47.87% 47.88% 30.53% -8.41% 37.27% 14.73% 49.43% 56.79% 35.35% 38.19% 46.67% 52.54% 20.37% 14.41% 16.92% 20.01% 21.06% 6.98% 51.73% 52.40% 23.22% 69.18% 8.05% 4.22% 9.54% 17.68% 27.99% 8.02% 26.94% 14.99% 15.90% 35.13% -41.07% 2.30% 0.61% 0.07% ---3.09% 36.54% --8.84% 1.53% 1.91% 0.13% 5.20% 0.05% -0.61% -0.82% -23.73% -11.48% 1.47% 0.28% 0.00% 0.35% --0.00% 54.63% 0.52% 12.72% 3.74% 0.52% -0.44% 2.14% --1.57% 2.52% 3.25% 1.70% -0.89% -0.66% -7.52% 25.44% 1.00% -7.06% 3.68% 2.14% ----1.03% 13.46% 9.75% 3.10% 0.14% -1.14% 4.89% 8.33% -4.10% 11.97% 1.24% 0.73% -4.26% -34.27% -3.42% 4.13% -9.16% 1.60% 8.78% 1.60% 1.80% 36.15% 0.71% -55.15% 3.60% -16.44% 35.95% 0.09% 51.10% 1.48% 0.71% -0.44% 12.68% 34,794,524 58.82% 30.36% 4.35% 6.47% [1] The distributions shown include both specific dedications and the prorated share of motor-fuel tax distributions from common funds with multiple revenue sources. [2] Includes expenditures for county roads under State control. [3] Preliminary data was used. [4] In these States, most highway-user revenues are placed in the State general fund. For a discussion of general fund States' financing, see "Highway Finance" text under "Funds Attributable to Highway Users." [5] 2004 data was used. Source: "Disposition of State Motor-Fuel Tax Receipts - 2005", Highway Statistics 2005. Federal Highway Administration, Department of Transportation. http://www.fhwa.dot.gov/policy/ohim/hs05/htm/mf3.htm Disposition of State Motor-Fuel Tax Receipts, 2004 State Alabama Alaska [3] Arizona Arkansas California Colorado Connecticut Delaware District of Columbia [3] Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey [3] New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island [3] South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming Total Net Funds Distributed (thousands) [1] State Administered Highways [2] Local Roads and Streets Mass Transit Purposes General and Non-Highway Purposes 548,147 28,889 637,285 433,819 3,505,378 551,036 460,708 115,945 26,898 1,868,160 497,056 77,851 208,359 1,242,493 714,884 417,065 421,854 461,285 558,278 210,567 735,125 677,048 1,047,120 670,384 408,243 697,143 186,856 308,151 448,816 152,735 611,633 246,427 1,587,050 1,289,161 99,244 1,610,870 407,749 395,131 1,784,442 147,289 473,550 126,108 800,164 2,882,165 325,457 87,735 868,810 883,020 306,677 898,307 99,448 59.83% 96.67% 61.01% 68.41% 61.02% 71.12% 70.88% 100.00% -77.00% 10.45% 59.29% 42.52% 47.15% 47.15% 36.05% 36.10% 73.98% 95.99% 91.80% 20.17% 64.09% 23.97% 39.62% 48.65% 64.93% 79.97% 45.60% 69.12% 81.46% 22.97% 58.09% 45.43% 82.97% 28.50% 56.45% 9.45% 82.99% 64.06% 47.70% 60.65% 55.67% 43.87% 63.18% 60.73% 49.56% 72.32% 61.22% 98.79% 39.80% 72.42% 38.47% 3.30% 37.57% 29.55% 37.19% 24.72% 3.07% -100.00% 11.15% 5.13% 34.37% 48.67% 45.18% 52.85% 63.95% 57.63% 20.52% 3.92% 8.20% 37.49% 20.59% 66.96% 55.96% 46.53% 34.37% 9.11% 50.30% 27.94% 14.41% 15.35% 24.94% 17.07% 7.16% 63.36% 41.80% 18.02% 14.56% 8.55% 6.87% 10.47% 33.96% 37.82% 9.21% 39.09% 25.60% 16.20% 36.17% -45.14% 20.15% -0.03% -0.76% 1.70% 4.15% 26.05% --9.86% 0.00% 1.16% 0.25% ---0.83% 3.27% --25.76% 13.19% 9.07% 1.33% 0.05% 0.70% 0.40% 0.27% 0.26% 0.00% 11.84% 0.03% 35.54% 2.62% 2.58% 1.18% 0.03% 2.22% 26.97% 16.55% 0.55% 1.14% -0.48% -1.79% 7.27% 1.97% 0.58% 8.15% 4.71% 1.70% -1.41% 1.28% 0.09% ----1.99% 84.42% 5.18% 8.56% 7.67% 0.00% -5.44% 2.23% 0.09% -16.58% 2.13% -3.09% 4.77% -10.51% 3.83% 2.67% 4.13% 49.84% 16.95% 1.96% 7.25% 5.56% 0.57% 72.50% 0.23% 0.42% 28.87% 28.34% 9.23% 18.32% 27.14% 0.18% 23.06% 4.21% 0.63% 0.63% 6.91% 2.73% 34,248,015 57.45% 27.71% 6.38% 8.46% [1] The distributions shown include both specific dedications and the prorated share of motor-fuel tax distributions from common funds with multiple revenue sources. [2] Includes expenditures for county roads under State control. [3] In these States, most highway-user revenues are placed in the State general fund. For a discussion of general fund States' financing, see "Highway Finance" text under "Funds Attributable to Highway Users." Source: "Disposition of State Motor-Fuel Tax Receipts - 2004", Highway Statistics 2004. Federal Highway Administration, Department of Transportation. http://www.fhwa.dot.gov/policy/ohim/hs04/htm/mf3.htm Disposition of State Motor-Fuel Tax Receipts, 2003 State Alabama Alaska [3] Arizona Arkansas California Colorado Connecticut Delaware District of Columbia [3] Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey [3] New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island [3] South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming Total Net Funds Distributed (thousands) [1] State Administered Highways [2] Local Roads and Streets Mass Transit Purposes General and Non-Highway Purposes 544,311 27,309 610,021 431,221 3,151,308 541,579 443,381 108,699 26,749 1,829,482 463,660 73,427 204,792 1,255,512 1,073,885 408,092 416,159 498,960 572,962 211,931 705,114 662,316 1,064,628 623,927 385,661 676,399 179,259 300,570 413,348 154,776 548,821 238,693 1,502,520 1,165,154 105,304 1,384,878 399,613 392,644 1,687,793 143,289 454,022 122,478 789,114 2,760,032 318,990 86,415 831,152 732,863 286,712 884,619 86,343 89.39% 96.02% 60.07% 70.49% 21.50% 77.15% 62.60% 100.00% -77.02% 68.00% 95.96% 50.52% 34.92% 41.25% 20.62% 44.49% 60.18% 96.07% 80.05% 15.75% 76.70% 46.96% 40.17% 49.61% 66.27% 89.45% 42.28% 70.38% 77.42% 44.84% 66.73% 47.09% 76.21% 39.86% 51.55% 24.82% 82.33% 63.63% 53.24% 57.01% 72.03% 53.28% 73.56% 65.75% 68.07% 58.78% 56.20% 99.63% 41.81% 78.37% 8.27% 3.87% 38.44% 27.31% 50.99% 19.98% 4.47% -100.00% 11.02% 12.56% -47.09% 53.33% 58.74% 76.15% 47.72% 30.64% 3.84% 13.99% 39.64% 23.30% 41.79% 58.02% 45.38% 32.11% 9.69% 53.84% 27.02% 14.95% 16.57% 23.81% 16.07% 8.08% 58.79% 46.69% 46.93% 15.64% 8.55% 1.21% 15.05% 14.66% 37.00% 0.34% 34.22% 25.28% 14.63% 39.21% -45.65% 20.54% 0.01% 0.11% 1.17% 0.37% 6.22% 2.87% 29.96% --10.02% 0.63% -0.54% 9.99% -2.21% 0.59% --0.96% 27.80% -11.25% 1.80% 0.24% 1.43% 0.86% 0.02% -1.43% 17.45% 0.46% 34.20% 2.07% 0.17% -0.54% 1.28% 27.82% 22.78% 1.08% 1.55% ---4.84% 8.46% 2.25% -6.59% 1.08% 2.33% -0.32% 1.84% 21.29% -2.97% --1.95% 18.82% 4.04% 1.85% 1.75% 0.00% 1.01% 7.19% 9.18% 0.09% 5.00% 16.81% ---4.78% 0.19% -3.86% 2.60% 6.20% 21.13% 9.00% 2.63% 13.65% 1.19% 1.76% 27.72% 0.76% -22.77% 26.86% 11.77% 9.73% 26.10% 0.03% 1.82% 18.14% 2.34% 0.37% 5.95% -- 32,980,887 55.97% 28.54% 7.04% 8.44% [1] The distributions shown include both specific dedications and the prorated share of motor-fuel tax distributions from common funds with multiple revenue sources. [2] Includes expenditures for county roads under State control. [3] In these States, most highway-user revenues are placed in the State general fund. For a discussion of general fund States' financing, see "Highway Finance" text under "Funds Attributable to Highway Users." Source: "Disposition of State Motor-Fuel Tax Receipts - 2003", Highway Statistics 2003. Federal Highway Administration, Department of Transportation. http://www.fhwa.dot.gov/policy/ohim/hs03/htm/mf3.htm