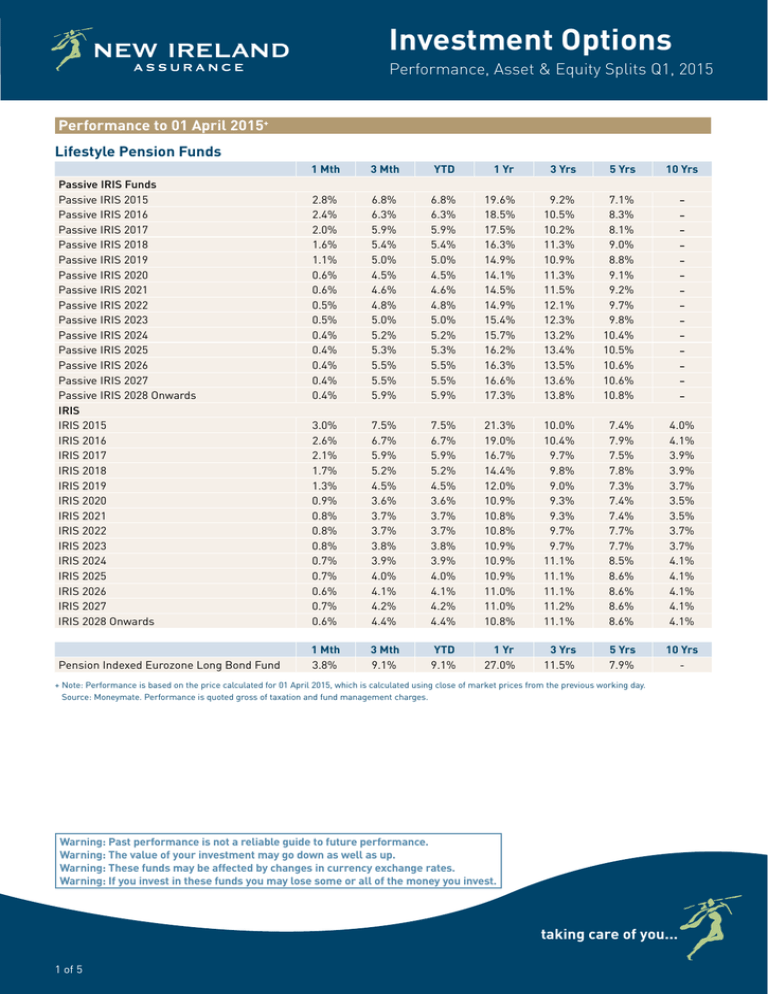

Performance to 01 April 2015 Lifestyle Pension Funds -

advertisement

Investment Options Performance, Asset & Equity Splits Q1, 2015 Performance to 01 April 2015+ Lifestyle Pension Funds Passive IRIS Funds Passive IRIS 2015 Passive IRIS 2016 Passive IRIS 2017 Passive IRIS 2018 Passive IRIS 2019 Passive IRIS 2020 Passive IRIS 2021 Passive IRIS 2022 Passive IRIS 2023 Passive IRIS 2024 Passive IRIS 2025 Passive IRIS 2026 Passive IRIS 2027 Passive IRIS 2028 Onwards IRIS IRIS 2015 IRIS 2016 IRIS 2017 IRIS 2018 IRIS 2019 IRIS 2020 IRIS 2021 IRIS 2022 IRIS 2023 IRIS 2024 IRIS 2025 IRIS 2026 IRIS 2027 IRIS 2028 Onwards Pension Indexed Eurozone Long Bond Fund 1 Mth 3 Mth YTD 1 Yr 3 Yrs 5 Yrs 10 Yrs 2.8% 2.4% 2.0% 1.6% 1.1% 0.6% 0.6% 0.5% 0.5% 0.4% 0.4% 0.4% 0.4% 0.4% 6.8% 6.3% 5.9% 5.4% 5.0% 4.5% 4.6% 4.8% 5.0% 5.2% 5.3% 5.5% 5.5% 5.9% 6.8% 6.3% 5.9% 5.4% 5.0% 4.5% 4.6% 4.8% 5.0% 5.2% 5.3% 5.5% 5.5% 5.9% 19.6% 18.5% 17.5% 16.3% 14.9% 14.1% 14.5% 14.9% 15.4% 15.7% 16.2% 16.3% 16.6% 17.3% 9.2% 10.5% 10.2% 11.3% 10.9% 11.3% 11.5% 12.1% 12.3% 13.2% 13.4% 13.5% 13.6% 13.8% 7.1% 8.3% 8.1% 9.0% 8.8% 9.1% 9.2% 9.7% 9.8% 10.4% 10.5% 10.6% 10.6% 10.8% - 3.0% 2.6% 2.1% 1.7% 1.3% 0.9% 0.8% 0.8% 0.8% 0.7% 0.7% 0.6% 0.7% 0.6% 7.5% 6.7% 5.9% 5.2% 4.5% 3.6% 3.7% 3.7% 3.8% 3.9% 4.0% 4.1% 4.2% 4.4% 7.5% 6.7% 5.9% 5.2% 4.5% 3.6% 3.7% 3.7% 3.8% 3.9% 4.0% 4.1% 4.2% 4.4% 21.3% 19.0% 16.7% 14.4% 12.0% 10.9% 10.8% 10.8% 10.9% 10.9% 10.9% 11.0% 11.0% 10.8% 10.0% 10.4% 9.7% 9.8% 9.0% 9.3% 9.3% 9.7% 9.7% 11.1% 11.1% 11.1% 11.2% 11.1% 7.4% 7.9% 7.5% 7.8% 7.3% 7.4% 7.4% 7.7% 7.7% 8.5% 8.6% 8.6% 8.6% 8.6% 4.0% 4.1% 3.9% 3.9% 3.7% 3.5% 3.5% 3.7% 3.7% 4.1% 4.1% 4.1% 4.1% 4.1% 1 Mth 3.8% 3 Mth 9.1% YTD 9.1% 1 Yr 27.0% 3 Yrs 11.5% 5 Yrs 7.9% 10 Yrs - + Note: Performance is based on the price calculated for 01 April 2015, which is calculated using close of market prices from the previous working day. Source: Moneymate. Performance is quoted gross of taxation and fund management charges. Warning: Past performance is not a reliable guide to future performance. Warning: The value of your investment may go down as well as up. Warning: These funds may be affected by changes in currency exchange rates. Warning: If you invest in these funds you may lose some or all of the money you invest. taking care of you... 1 of 5 Performance to 01 April 2015+ Very Low Risk Pension Funds Pension Cash Fund 1 Mth 0.0% 3 Mth 0.0% YTD 0.0% 1 Yr 0.1% 3 Yrs 0.2% 5 Yrs 0.5% 10 Yrs 1.7% 1 Mth 0.1% 3 Mth 2.0% YTD 2.0% 1 Yr 3.6% 3 Yrs 4.2% 5 Yrs 3.9% 10 Yrs - 1 Mth 0.7% 1.5% 3 Mth 5.4% 6.8% YTD 5.4% 6.8% 1 Yr 9.8% 9.5% 3 Yrs 6.7% 7.5% 5 Yrs 6.5% - 10 Yrs - 1 Mth 2.5% 3.3% 2.1% 3 Mth 12.1% 13.7% 9.6% YTD 12.1% 13.7% 9.6% 1 Yr 22.7% 29.9% 24.1% 3 Yrs 16.0% 17.9% 14.8% 5 Yrs 11.4% 12.8% 10.7% 10 Yrs 5.9% 7.4% 5.3% 1 Mth 3.2% 1.6% 3 Mth 17.4% 11.6% YTD 17.4% 11.6% 1 Yr 29.2% 17.7% 3 Yrs 20.3% 9.1% 5 Yrs 13.4% 6.4% 10 Yrs - Low to Medium Risk Pension Funds Elements (Pension) Medium Risk Pension Funds BNYM Global Real Return Fund (Pension) Protected Assets Fund Medium to High Risk Pension Funds Pension Managed Fund Pension Consensus Fund Pension Evergreen Fund High Risk Pension Funds Pension Indexed All Equity Fund Innovator (Pension) + Note: Performance is based on the price calculated for 01 April 2015, which is calculated using close of market prices from the previous working day. Source: Moneymate. Performance is quoted gross of taxation and fund management charges. Fund Information as at 31 March 2015 Lifestyle Pension Funds Asset Splits Fixed Interest Passive IRIS Funds Passive IRIS 2015 Passive IRIS 2016 Passive IRIS 2017 Passive IRIS 2018 Passive IRIS 2019 Passive IRIS 2020 Passive IRIS 2021 Passive IRIS 2022 Passive IRIS 2023 Passive IRIS 2024 Passive IRIS 2025 Passive IRIS 2026 Passive IRIS 2027 Passive IRIS 2028 Onwards – – – – – – – – – – – – – – Long Bonds Cash 74.4% 63.1% 48.4% 33.5% 18.6% 25.6% 22.3% 17.8% 13.7% 10.4% 7.3% 5.4% 3.9% 2.8% 1.8% 0.7% 0.5% 0.4% 0.4% 3.7% – – – – – – – – Government Bonds Property Equities – – – – 4.5% 10.5% 16.4% 22.6% 28.4% 27.6% 24.7% 21.7% 18.7% 16.5% 15.6% 15.1% 15.0% 3.4% 7.9% 12.0% 15.7% 19.2% 20.1% 20.1% 20.1% 20.1% 19.3% 18.0% 16.5% 10.5% 0.7% 1.4% 2.4% 2.7% 3.3% 3.8% 4.1% 4.1% 4.1% 4.1% 4.1% 4.1% 4.1% 6.0% 14.0% 22.0% 30.0% 38.1% 43.1% 47.2% 51.3% 55.3% 59.4% 61.8% 63.9% 70.0% Fund Information Source: Moneymate. Warning: Past performance is not a reliable guide to future performance. Warning: The value of your investment may go down as well as up. Warning: These funds may be affected by changes in currency exchange rates. Warning: If you invest in these funds you may lose some or all of the money you invest. 2 of 5 Corporate Bonds Lifestyle Pension Funds Asset Splits (continued) IRIS IRIS 2015 IRIS 2016 IRIS 2017 IRIS 2018 IRIS 2019 IRIS 2020 IRIS 2021 IRIS 2022 IRIS 2023 IRIS 2024 IRIS 2025 IRIS 2026 IRIS 2027 IRIS 2028 Onwards Long Bonds Cash Fixed Interest 74.4% 64.3% 49.1% 34.4% 19.5% – – – – – – – – – 25.5% 22.0% 17.0% 11.9% 7.6% 5.0% 3.0% 1.8% 1.2% 1.0% 0.8% 0.7% 0.7% 0.7% – – – – – – – – – – – – – – Target Return Government Strategy Bonds 0.1% 5.6% 13.6% 21.7% 29.6% 37.7% 40.6% 41.8% 42.5% 42.9% 43.2% 42.3% 41.4% 40.2% – 2.8% 6.8% 10.7% 14.8% 18.7% 18.0% 15.3% 13.5% 11.7% 10.3% 9.4% 8.2% 3.1% Corporate Bonds Property Equities – 2.4% 5.9% 9.5% 12.3% 13.4% 13.9% 13.3% 11.3% 9.6% 7.7% 6.3% 5.3% 2.0% – 0.2% 0.7% 1.2% 1.5% 2.0% 2.4% 2.7% 3.3% 3.8% 4.1% 4.1% 4.1% 4.1% – 2.7% 6.9% 10.6% 14.7% 18.7% 22.1% 25.1% 28.2% 31.0% 33.9% 37.2% 40.3% 49.9% Target Return Strategy (TRS) Holdings as at 31 March 2015 IRIS 2015 IRIS 2016 IRIS 2017 IRIS 2018 IRIS 2019 IRIS 2020 IRIS 2021 IRIS 2022 IRIS 2023 IRIS 2024 IRIS 2025 IRIS 2026 IRIS 2027 IRIS 2028 Onwards Overall TRS Holdings 0.1% 5.6% 13.6% 21.7% 29.6% 37.7% 40.6% 41.8% 42.5% 42.9% 43.2% 42.3% 41.4% 40.2% Equities Government Bonds Corporate Bonds Commodities 14.6% 14.6% 14.6% 14.6% 14.6% 14.6% 14.6% 14.6% 14.6% 14.6% 14.6% 14.6% 14.6% 14.6% 6.9% 6.9% 6.9% 6.9% 6.9% 6.9% 6.9% 6.9% 6.9% 6.9% 6.9% 6.9% 6.9% 6.9% 25.3% 25.3% 25.3% 25.3% 25.3% 25.3% 25.3% 25.3% 25.3% 25.3% 25.3% 25.3% 25.3% 25.3% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% Lifestyle Pension Funds Pension Indexed Eurozone Long Bond Geographic Split Germany 40.0% France 39.7% Netherlands 20.3% Fund Information Source: Moneymate. Warning: Past performance is not a reliable guide to future performance. Warning: The value of your investment may go down as well as up. Warning: These funds may be affected by changes in currency exchange rates. Warning: If you invest in these funds you may lose some or all of the money you invest. 3 of 5 Cash Emerging Market Equity High Yield Bonds Property 47.6% 47.6% 47.6% 47.6% 47.6% 47.6% 47.6% 47.6% 47.6% 47.6% 47.6% 47.6% 47.6% 47.6% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 2.4% 2.4% 2.4% 2.4% 2.4% 2.4% 2.4% 2.4% 2.4% 2.4% 2.4% 2.4% 2.4% 2.4% 3.1% 3.1% 3.1% 3.1% 3.1% 3.1% 3.1% 3.1% 3.1% 3.1% 3.1% 3.1% 3.1% 3.1% Fund Information as at 31 March 2015 Low to Medium Risk Pension Funds Elements (Pension) Asset Split n Cash 46.4% n Corporate Bonds 32.3% n Government Bonds 10.2% n Equities 8.6% n High Yield Bonds 1.4% n Property 1% n Target Return Strategy 0.1% Medium Risk Pension Funds BNYM Global Real Return Fund (Pension) Asset Split n Equities 47.1% n Cash 19.3% n Government Bonds 18.8% BNYM Global Real Return Fund (Pension) Equity Split n Other Eurozone Equities 40.1% n North American Equities 29.5% n UK Equities n Alternative Investments6.2% n Commodities 4.5% n Corporate Bonds 2.5% n Infrastructure 1.6% n Japanese Equities 17.8% 7.2% n Other Pacific Basin Equities 3.6% Protected Assets Fund Asset Split n Other Equities 1.7% Protected Assets Fund Equity Split n Other Eurozone Equities 44.3% n Equities n Cash n Protection Asset 70% n North American Equities 33.1% 27.9% 2.1% n Japanese Equities 9.9% n UK Equities 9.4% n Emerging Market Equities 3.3% Medium to High Risk Pension Funds Pension Managed Fund Asset Split n Equities 72.5% n Government Bonds 11.2% n Corporate Bonds 8.2% n Property 4.6% n Cash 3.5% Pension Managed Fund Equity Split n North American Equities 40.0% n Other Eurozone Equities 27.9% n Japanese Equities 9.0% n Other European Equities 8.1% n Other Pacific Basin Equities 7.3% n UK Equities 4.0% n Irish Equities 2.1% n Other Equities 1.7% Fund Information Source: Moneymate. Warning: Past performance is not a reliable guide to future performance. Warning: The value of your investment may go down as well as up. Warning: These funds may be affected by changes in currency exchange rates. Warning: If you invest in these funds you may lose some or all of the money you invest. 4 of 5 Fund Information as at 31 March 2015 Medium to High Risk Pension Funds continued Pension Consensus Fund Asset Split n Equities 75.4% n Government Bonds 13.9% n Cash 8.0% n Property 2.7% Pension Consensus Fund Equity Split Pension Evergreen Fund Asset Split n Equities 50.1% n Property 21.4% n Government Bonds 12.0% n Corporate Bonds 8.7% n Cash 7.8% n North American Equities 44.0% n Other Eurozone Equities 16.4% n UK Equities 9.9% n Japanese Equities 8.9% n Other European Equities 8.1% n Irish Equities 5.8% n Other Pacific Basin Equities5.8% n Emerging Market Equities 0.9% Pension Evergreen Fund Equity Split n North American Equities 39.7% n Other Eurozone Equities 27.9% n Other European Equities 8.0% n Japanese Equities 8.8% n Other Pacific Basin Equities 7.2% n UK Equities 4.0% n Irish Equities 2.8% n Other Equities 1.6% High Risk Pension Funds Pension Indexed All Equity Fund Equity Split Innovator (Pension) Asset Split n Other Eurozone Equities 50.0% n North American Equities 33.5% n Japanese Equities 5.3% n UK Equities 4.3% n Other Pacific Basin Equities 3.7% n Other European Equities 3.1% n Environmental Solutions n Emerging Markets n Water n Agri Business n Alternative Energy n Commodities n Cash 30.6% 23.2% 16.0% 14.0% 8.1% 7.8% 0.1% Fund Information Source: Moneymate. Warning: Past performance is not a reliable guide to future performance. Warning: The value of your investment may go down as well as up. Warning: These funds may be affected by changes in currency exchange rates. Warning: If you invest in these funds you may lose some or all of the money you invest. Terms and conditions apply. The details shown relating to the funds and their composition are as at the dates stated and may change over time. The content of this document is for information purposes only and does not constitute an offer or recommendation to buy or sell any investment or to subscribe to any investment management or advisory service. Mention of individual stocks/assets is not a recommendation to purchase or sell those stocks/assets. While the information has been taken from sources we believe to be reliable, we do not guarantee its accuracy and any such information may be complete or condensed. Not all funds mentioned may be available with all products. Please refer to the relevant product terms and conditions for details of the funds available. New Ireland Assurance Company plc is regulated by the Central Bank of Ireland. A member of Bank of Ireland Group. April 2015 5 of 5 301314 Q1 2015