Economic and Strategy Viewpoint Schroders Keith Wade

advertisement

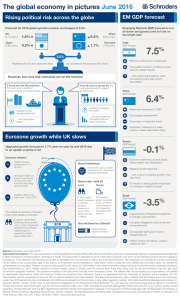

For professional investors only 30 May 2014 Schroders Economic and Strategy Viewpoint Keith Wade Chief Economist and Strategist (44-20)7658 6296 Azad Zangana European Economist (44-20)7658 2671 Craig Botham Emerging Markets Economist (44-20)7658 2882 Forecast update: recovery trimmed, but on track (page 2) Global recovery continues, but our growth forecast has been shaved as a result of downgrades to both the advanced and emerging economies. The latter face the more significant challenge in adjusting to the post financial crisis world, whilst the former should bounce back with the US in the second quarter. Divergent monetary policy remains a key theme with the Fed and Bank of England expected to raise rates in 2015 while the ECB, BoJ and PBoC are likely to remain on an easing tack. The risks to our forecasts are still tilted toward weaker growth and inflation led by a China hard landing, the threat of Eurozone deflation and secular stagnation. However, stagflationary risks have risen as a result of introducing a new scenario, capacity constraints bite, whilst political event risk is present should the Russia-Ukraine crisis deteriorate or a trade war erupt in Asia. Europe: mixed macro & mixed election results (page 6) The European growth figures for the first quarter were very mixed. Some countries such as Germany and Spain are gaining momentum in their recoveries, while others such as Italy and France are failing to impress and are struggling to implement structural and fiscal reforms. The European parliamentary election results were also mixed, with eurosceptic parties making clear gains, but not in all countries. The most worrying results came from France and the UK, where large gains were made by populists, and where they are most likely to influence future results. The wider impact will be to slow EU expansion, which raises the risk of greater Russian influence in the region in the long-term. EM forecast update: crumbling BRICs (page 13) The situation has stagnated or deteriorated for the BRIC countries, with macro disappointments in China, and political concerns in Brazil and Russia. India alone has hinted at a brighter future, but upgrades will have to wait until promises become actions. Views at a glance (page 19) A short summary of our main macro views and where we see the risks to the world economy. Chart: Global growth upswing intact Contributions to World GDP growth (y/y) 6 5 4.9 4.8 4.8 4.9 4 3.6 3.2 2.8 3 Forecast 4.6 4.4 2.6 2.4 2.1 2.8 2.9 14 15 World 2.4 2 1 0 -1 -1.4 -2 -3 00 01 US 02 03 Europe 04 05 Japan 06 07 08 Rest of advanced 09 10 BRICS 11 12 13 Rest of emerging Source: Thomson Datastream, Schroders 28 May 2014 forecast. Previous forecast from February 2014. Please note the forecast warning at the back of the document. Issued in May 2014 by Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority. For professional investors only 30 May 2014 Forecast update: recovery trimmed, but on track Global growth forecasts have been trimmed We continue to expect global growth to strengthen, but have shaved our forecasts for 2014 and 2015 by 0.2% to 2.8% and 2.9% respectively. Downgrades to both the advanced and emerging economies forecasts have been made, although we still see the problems in the latter as more fundamental than in the former. In the short run this is reflected in the continuing divergence between the Purchasing Managers' indices (PMIs) for the developed and emerging economies, as represented by the BRICs. Chart 1: Emerging economies lag developed market pick-up (PMI's) Index 60 55 50 45 40 35 30 2006 2007 2008 2009 2010 Developed 2011 2012 BRICs 2013 2014 Source: Markit, Schroders. 29 May 2014. Emerging economies still waiting for the turn Looking further out, the emerging economies need to adapt to a world of weaker external demand through improvements in competitiveness, cutting debt and eventually re-orientating growth toward domestic demand (see our recent Talking Point, "Emerging markets: roadmap to recovery" for more on the adjustment process and the characteristics of those economies most likely to succeed). Progress is being made in economies like India where the current account deficit has narrowed, and economies such as Korea and Taiwan are well placed to capture an upturn in US demand, where there are signs that imports are picking up. However, we need to become more confident on growth in the other large economies like China and Brazil before the emerging markets can return to a stronger growth path. Our China forecast for 2014 remains at 7.1%, but has been revised down to 6.8% in 2015 (see EM forecast: crumbling BRICs, below). On the advanced economy side the downgrade to growth is in large part a reaction to the weakness of the first quarter in the US where GDP is now reported as having fallen at an annual rate of 1%, the first contraction since 2011. We would attribute much of this to the harsh weather during the period which hit construction and spending on durables as well as exports. Unsurprisingly given the impact of the weather on supply chains, inventory building fell sharply and stripping this factor out, final sales grew and were led by a 3.1% gain in consumption. Monthly data for April are pointing to a sharp rebound in q2 with GDP expected to rise at a 4.5% annual rate. Nonetheless, there are areas where we are more cautious, for example, on the housing market where starts and sales have persistently disappointed. US rebound expected in q2 Again this is partly a weather effect, but the slowdown was in train prior to q1. Higher mortgage rates are one explanation following the bond market’s "taper tantrum" last year, although mortgage borrowing does not seem to have been a driver of the recovery in the first place. Instead there would seem to be a new dynamic at play 2 Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority For professional investors only 30 May 2014 where shifts in investor behaviour drive the market. Such buyers are sensitive to similar factors as those buying homes to live in rather than rent, only more so, and the rise in house prices and bond yields will have made property investment less attractive than a year ago. In a recent study the Federal Reserve bank of San Francisco reported evidence of a marked slowdown in regions where investment buyers had previously been active1. Fed and BoE to tighten, whilst ECB, BoJ and PBoC ease further Despite trimming the US growth forecast we still expect the Fed to end QE by October and raise interest rates from q3 2015 as unemployment continues to fall and wages accelerate. The jobless rate is forecast to fall from its current level of 6.3%, reaching 5.9% by the end of this year and 5.2% by the end of next. Our inflation forecast is marginally higher and Fed funds is now expected to rise to 0.75% by end 2015. These forecasts for unemployment are below the lower end of the range published by the Federal Reserve members and presidents in March. Divergence in monetary policy remains a key theme in the forecast. In the Eurozone we expect another rate cut from the ECB and measures to reduce bank funding costs, but no QE as the economy is expected to escape deflation. For the UK, we have brought forward our first rate hike to August 2015 as a result of stronger activity, but remain later than the consensus. In Japan we have pushed out an acceleration in QQE until September when the Bank of Japan (BoJ) is expected to downgrade growth expectations. We still have doubts about the sustainability of growth and fear that the central bank has become too optimistic on the economy. The People’s Bank of China (PBoC) is expected to trim the RRR, but refrain from easing further as it continues to control excess liquidity. Scenario analysis: deflation remains the greater tail risk We have updated our scenarios and now include two new projections to capture the risks around the baseline outlook. Both are primarily US scenarios, but they could easily apply more widely and especially to the UK. Trade and financial links mean they have global implications. Secular stagnation would add to the deflationary risks The first is "secular stagnation" where economic growth remains weak as a result of slow productivity gains, an outlook recently popularised by Larry Summers. In this scenario, capital spending remains sluggish as despite interest rates being at record lows, the cost of capital remains above the expected rate of return. Household expenditure is constrained by weak real income growth, a consequence of sluggish productivity and deteriorating demographics. Other countries experience similar effects and the net result is a deflationary outcome where growth and inflation are below the baseline projection. Clearly, interest rates and monetary policy would be looser in this scenario with, for example, no increase in rates from the Federal Reserve and increased pressure for the US central bank to restart QE. The "capacity constraints bite" scenario takes us in a more stagflationary direction The second we have labelled "capacity constraints bite" where the amount of spare capacity proves to be considerably less than anticipated by policymakers. Estimating output gaps is a hazardous business as structural shifts can make current capacity obsolete and skills redundant. The forces of secular stagnation can also play a role by slowing productivity and the trend rate of growth. The net result is that central banks overestimate the ability of the economy to grow without pushing inflation higher and keep policy too loose. Once the mistake has been realised they then have to tighten aggressively to bring the economy back to trend. An overestimation of the amount of slack in the economy was one of the factors which led to the great inflation of the 1970s (see chart 2). Today, it could come about through the structural changes brought by the global financial crisis and the subsequent shift from finance and construction – the sectors which experienced the greatest effects of the bubble. 1 3 See “The slowdown in existing home sales”, FRBSF Economic letter, May 19, 2014. Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority For professional investors only 30 May 2014 Chart 2: The hazards of output gap analysis US Outputgap, % of potential GDP 10 5 0 -5 -10 -15 -20 1951 1955 1959 1963 1967 1971 1975 1979 1983 1987 1991 1995 1999 2003 2002 retrospective output-gap estimate Real time estimate Source: Orphanides A., “Historical Monetary Policy Analysis and the Taylor Rule”. Federal Reserve working paper 2003-36. An escalation of the Ukraine crisis cannot be ruled out The other new scenario is "Russian rumble" where, following the annexation of the Crimea, Russia takes military action in East Ukraine. In response the US and EU step up trade sanctions and Russia cuts gas and oil supplies to Europe. So far markets seem very relaxed about such a risk believing that neither side would wish to cause so much damage to their economies, but if this scenario did play out it could have major ramifications. We would expect to see a disruption to the European recovery until alternative energy supplies are found, and for oil prices to rise significantly thus hitting inflation and activity world wide. Amid a deterioration in international relations, market volatility could be expected to increase and we would expect central banks to run looser monetary policy despite the pick up in inflation. Our other scenarios are unchanged from last quarter. On the deflationary side we still have the "China hard landing" where the financial system unravels thus resulting in a collapse in fixed investment and growth. As we have argued before this primarily impacts the emerging market economies, particularly the commodity producers. Growth in the US and Europe is also weaker, but there is some offset from the fall in oil prices and inflation. Alongside, "secular stagnation" our third deflationary projection is "Eurozone deflation" whereby the Eurozone experiences a Japan style slump with prices falling persistently and the region experiencing debt deflation. Again monetary policy would be looser than in the baseline with the ECB embarking on QE and policy elsewhere also likely to be easier including in the US. Of the remaining scenarios we still attach some risk to an escalation of the dispute between China and Japan over the Diaoyu or Senkaku islands which results in the "trade war" scenario. Alternatively this could originate from an escalation of the current dispute between China and Vietnam. Like the "Russian rumble" this is political event risk and would push the world economy in a more stagflationary direction through its impact on trade and commodity prices. The latter typically rise during trade wars as users build up their inventory and hoard commodities for fear of being unable to obtain future supplies. Finally, the "G7 boom" scenario is the sole reflationary outcome whereby we see a return of animal spirits and a much stronger pick up in business spending than in the baseline. 4 Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority For professional investors only 30 May 2014 Chart 3: Scenario risks around the baseline 2015 Inflation vs. baseline forecast +2.0 +1.5 Stagflationary Reflationary Capacity limits bite Trade war +1.0 +0.5 G7 boom Russian rumble +0.0 Baseline -0.5 Secular stagnation Eurozone deflation -1.0 China hard landing -1.5 Productivity boost Deflationary -2.0 -2.0 -1.5 -1.0 -0.5 +0.0 +0.5 +1.0 2015 Growth vs. baseline forecast +1.5 +2.0 Source: Schroders 28 May 2014 forecast. Please note the forecast warning at the back of the document. Balance of risks still tilts toward deflation, but stagflation has risen as a result of new scenario In terms of probabilities there is still a skew toward deflation with a total probability of 15% attached to those scenarios which result in weaker growth and inflation, unchanged from last quarter). However, as a result of introducing the capacity limits bite and Russian rumble scenarios, the probability of a stagflationary outcome has risen sharply to 12% from 3% previously. The probability on the reflationary boost has fallen from 10% to 6% this quarter reflecting less upside risk on capex. The overall balance of probabilities has shifted toward weaker growth and higher inflation compared with 3 months ago. Chart 4: Baseline and scenario probabilities Eurozone deflation, 4% G7 boom, 6% Trade war, 2% Capacity limits bite, 8% Baseline, 65% China hard landing, 6% Other, 2% Russian rumble, 2% Secular stagnation, 5% Source: Schroders 28 May 2014 forecast. Previous forecast from February 2014. Please note the forecast warning at the back of the document. 5 Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority For professional investors only 30 May 2014 Europe: Mixed macro & mixed election results The year so far has been one of consolidation for Europe. Because of the European parliamentary elections, which took place earlier this month, very little has been achieved with regards to the wider EU reforms required to improve stability and resilience to future banking and sovereign debt crises. Like the Union's macroeconomic performance, the results from the European elections have been mixed. European parliamentary election results Mainstream parties took a beating in the European elections… Nobody expected the mainstream parties to have an easy ride in this month's European parliamentary elections. This was a chance for voters to vent their anger and frustrations over not only the dismal macroeconomic performance of their economies over the past five years, but also the social impact that such failings have had. UK Independence Party leader Nigel Farage described the election as a "free hit" for voters against the establishment, but could the results really bring about the "earthquake" that he touted? Chart 5: Rise in populist votes % 70 >90% 60 50 40 30 20 10 0 Gre UK Ita Den Fra Share of votes for populist parties Aus Neth Fin Swe Ger Spa Voter turnout in 2014 election Pol Bel Average turnout* *Average turnout taken for 1999, 2004 and 2009 elections, except for Poland who joined after 1999. Source: European Parliament, Schroders. 28 May 2014. …although, it could have been far worse In our view, the election results were more mixed than has been suggested by the press. Populist parties clearly made gains compared to the previous results, but the uniform swing towards such parties has not occurred. Voter turnout was also mixed, but not significantly different to past elections (chart 5 above). Looking at the results, we find a trend of rising discontent with mainstream parties where domestic economic and social problems have been more severe, but also where those parties have not blamed the EU for their ills, rather than a direct vote against the Europe. Box 1: Summary of European parliamentary election results: 6 In Germany, the federal government coalition won about 63%, increasing their share from the 2009 EU election (59%). The radical-left Die-Linke won 7.4% of the votes, slightly down compared to the previous election, but did manage to win a seat. In our view, a strong result for the proEuropeans, and while Die-Linke made progress, it was less than was expected. In France, the extreme-right wing Front National beat the mainstream parties by winning 25% of the votes, highlighting the discontent in French politics at the moment. The biggest loser was President Hollande's Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority For professional investors only 30 May 2014 Socialist party, which won a pathetic 14% of the votes, finishing in third place. The French result reflects both the anger over what is seen as Brussels imposed austerity, but also the perceived loss in sovereignty, and powers over national borders. Francois Hollande, who had promised a reversal of austerity measures in his election campaign, has been forced to backtrack and face reality. However, his (and previous governments') refusal to be clear with the electorate has allowed the Front National to seize the political agenda. Hollande's approval rating is now below 20%, compared to previous president Sarkozy's rating at the end of his second year of around 35%. The politics of France is horrible at present, and with the main opposition being hit by bribery scandals, the Front National has managed to capitalise on the downturn in the popularity of leading political figures, and has emerged as a genuine political force in France. While Greece and Italy saw big support for eurosceptic parties, it was the UK and France that saw the biggest swings 7 In Italy, the big winner was Matteo Renzi’s, whose party won 40.8% of the votes in the first election since he took power as Prime Minister. Meanwhile, the anti-establishment Beppe Grillo's party (5-star movement) won just 21.1% of the votes, falling from 25.5% won in last year's general election. The increased vote for Renzi's party may just be a result of the honeymoon period new leaders tend to enjoy, however, it does reduce the risk of the coalition breaking up in coming years. In Spain, the governing Popular Party won the election with a slight majority, with votes swinging towards parties that favour a referendum on independence for certain regions. In Portugal, the mainstream opposition Socialists Party won 32% of the votes, while the governing coalition won about 28%. Anti-EU parties made little impact. In Greece, radical leftists Syriza came first with 26.5% of the votes, but the governing coalition jointly won 30.5%. Compared to the 2012 general election (the last contest including all parties) this was a slight fall in the votes for Syriza. However, the extreme-right Golden Dawn party secured 9.4% of the votes - a 2.5% increase compared to the last election, highlighting the ongoing crisis in Greece. In the Netherlands, the anti-EU Party of Freedom (PVV) won 13% of the votes - lower than expected and less than the 2009 election. The proEuropean parties won the largest share of the votes, suggesting low risk from the Netherlands. In the UK, the UK Independence Party won the largest share of the votes (27.5%), with Labour coming in second (25.4%). The Conservative party finished third (23.9%) with the Liberal Democrats finishing a woeful fifth (6.9%). While the natural position of the mainstream parties is to be proEU, the surge in support for UKIP is likely to have a larger impact than expected. Overall, some anti-EU parties made ground in the elections, while others in some countries actually underperformed expectations. Italy saw the biggest favourable swing towards the current government, while Spain, the Netherlands and Portugal did better than expected against the anti-EU parties. The results in France and the UK are the most concerning, with a genuine message being sent to leaders that change is needed. For France, austerity and structural reforms will continue regardless of the result, and with both of the mainstream parties strongly in favour of the European project, we see low risk from the European election results. The next presidential elections are not for another three years, and even then, the first past the post system will keep influence of the Front National low. Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority For professional investors only 30 May 2014 The wider impact will be to future EU policy, in particular on EU expansion, which raises the risk of greater Russian influence in the region In the UK the risks are more severe. The Conservative party harbours a significant number of Euro-sceptics and is where UKIP originated from. The Conservatives have promised a referendum on the UK's membership of the EU in 2017, which may eventually be adopted by Labour as we approach the 2015 election (currently holding on to a loose pro-European stance), especially if UKIP continues to build support. The immediate impact has been for Prime Minister David Cameron to successfully demand a review of EU policy, and for former Luxembourg Prime Minister Jean-Claude Juncker’s nomination for the European Commission presidency to be challenged. Cameron has openly been campaigning to block his candidacy as Juncker is viewed as an old-school EU federalist. The UK's membership of the EU is looking more precarious, which should concern other EU member states that share similar political views. Beyond the UK, the impact on wider EU policy could be to halt one of the Union's most successful achievements - the expansion of the EU, and the reforms introduced in new member states and accession candidates. If progress halts altogether, there is a danger that candidate states in Eastern Europe could lose hope of accession, and start to turn back to the recently resurgent Russia. Eurozone forecast update Like the European elections, the recent macro data has also been mixed. First quarter Eurozone GDP is estimated to have grown by 0.2% (quarter-on-quarter), matching quarterly growth at the end of 2013 but disappointing the City, where consensus expectations were for an acceleration to 0.4% growth. The main drivers of the disappointment came from France, Italy and the Netherlands – all of which continue to struggle with ongoing austerity and structural reforms (see chart 6). Chart 6: European growth slow but steady Like the politics, the growth picture was also mixed in Q1 Q/Q 1.5% 1.0% 0.5% 0.0% -0.5% -1.0% -1.5% Neth Por Fin Ita Fra EZ Aus Q4 Q1 Spa Bel Ger UK Source: Thomson Datastream, Eurostat, Schroders. 29 May 2014. French quarterly GDP was flat in the first quarter compared to 0.2% in the previous three months (revised down from 0.3%) and against expectations of 0.1% growth. The French GDP report highlighted falling domestic demand, likely to be in reaction to the recent increases in already high taxes. The Italian economy also surprised to the downside by contracting by 0.1% (consensus estimates of 0.2% growth). In fact, the level of Italian GDP is now lower than the previous trough in 2013 Q3. Elsewhere in the Union, Germany’s GDP growth was better than expected (0.8% vs. 0.7% consensus), which helped support an acceleration in growth for Poland and Hungary (both up 1.1%). Spain is estimated to have grown by 0.4% on the quarter – its fastest quarterly growth rate for six years - however; both Finland and the Netherlands struggled, with the former falling into a triple-dip recession. 8 Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority For professional investors only 30 May 2014 We have revised up the forecast for Germany and Spain, but downgraded Italy and France In terms of our forecast, the slightly lower than expected outturn for the first quarter coupled with downward revisions to the second half of last year's growth means that our forecast for aggregate Eurozone growth for 2014 has been revised down from 1.1% to 1.0%. However, the aggregate figure hides some differing trends. We have revised up our forecast for Germany for this year and next as the latest GDP figures supported our view that the pick up in domestic demand will continue to surprise economists to the upside (table 1). Spain has also been revised up on the back of continued improvements in activity. We now have a higher growth forecast for Spain than for France or Italy in 2015. Table 1: Updated GDP growth forecasts 2014 Prev. 2015 Prev. Germany 2.2 1.9 2.3 2.2 France 0.6 0.9 0.9 1.1 Italy 0.0 0.3 0.6 0.7 Spain 1.0 0.6 1.3 1.1 Eurozone 1.0 1.1 1.4 1.4 Source: Thomson Datastream, Schroders 28 May 2014 forecast. Previous forecast from February 2014. Please note the forecast warning at the back of the document. We have downgraded both France and Italy on the back of the weaker start to 2014, but also the lack of progress in implementing reforms. The fiscal slippage which is now very likely by the pair should help avoid another round of significant recessions; however the outlook is not particularly rosy for the pair. The profile of our aggregate Eurozone growth profile is therefore largely unchanged (chart 7). The forecast for HICP inflation has however been lowered slightly in the near term, largely on the back of lower than expected energy prices, especially of natural gas (chart 8). Charts 7: Eurozone GDP forecast %, Q/Q +0.6 Charts 8: Eurozone inflation forecast %, Y/Y +3.0 +0.4 +2.5 +0.2 +2.0 +0.0 +1.5 HICP inflation forecast +1.0 -0.2 Real GDP forecast -0.4 +0.5 +0.0 -0.6 i ii iii iv i ii iii iv i ii iii iv i ii iii iv 2012 2013 Current forecast 2014 2015 Previous forecast i ii iii iv i ii iii iv i ii iii iv i ii iii iv 2012 2013 Current forecast 2014 2015 Previous forecast Source: Thomson Datastream, Schroders 28 May 2014 forecast. Previous forecast from February 2014. Please note the forecast warning at the back of the document. Expectations are high for ECB action next month, but can they deliver? 9 With regards to monetary policy, the latest mixed growth numbers highlight the problem the ECB faces in setting monetary policy for a diverging set of economies. Nevertheless, the disappointment in the growth figures is likely to support the doves at the Bank for greater stimulus. We continue to expect the European Central Bank to cut the main refinancing rate at the June meeting (to 0.1%), but no cuts to the deposit rate, nor the introduction of quantitative easing. However, the market is clearly pricing in more than just a cut in the main refinancing rate, and given the recent comments Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority For professional investors only 30 May 2014 from members of the Governing Council, the risk to our forecast is skewed towards greater action. Whether that action can lift growth and inflation is another matter altogether. UK forecast update: stronger growth = earlier rate hike The UK continues to perform strongly, prompting an upgrade to our forecast… The UK economy continues to perform very strongly, in particular, strong growth in household consumption and more recently, business investment. Slight upward revisions to growth in 2013, along with an upside surprise compared to our forecast for the first quarter, has led us to conclude that there is stronger momentum in domestic demand than previously forecast. Households have been reducing their savings rates to expand consumption, despite falling real disposable income. The recent fall in inflation is helping to moderate the squeeze, but ultimately, the household sector seems to be happy to increase its leverage once again. This might be explained by the recent sharp fall in the unemployment rate, which fell to 6.8% over the first quarter, compared to 7.2% in the previous quarter, and 7.8% a year earlier. Indeed, consumer confidence has also been very strong, with the GfK survey recording confidence in May returning to highs not seen since 2005. Overall, it appears that in the absence of serious fiscal consolidation this year and a willingness of households to borrow once again, domestic demand in particular is likely to be stronger than previously forecast. We have therefore raised the 2014 growth forecast from 2.6% to 2.9%, and from 2.1% to 2.4% for 2015 (chart 9). Supporting this is the downgrade to the inflation forecast for the UK, partly due to a change in assumption on GBP (smaller depreciation), but also on the back of lower near-term pressure from food and energy price inflation (chart 10). Charts 9: UK GDP forecast Charts 10: UK CPI inflation forecast %, Q/Q +1.0 %, Y/Y +4.0 +0.8 +3.5 +0.6 +3.0 +0.4 Real GDP forecast +0.2 +0.0 +2.5 +2.0 +1.5 -0.2 -0.4 CPI inflation forecast i ii iii iv i ii iii iv i ii iii iv i ii iii iv 2012 2013 2014 2015 Current forecast Previous forecast +1.0 i ii iii iv i ii iii iv i ii iii iv i ii iii iv 2012 2013 Current forecast 2014 2015 Previous forecast Source: Thomson Datastream, Schroders 28 May 2014 forecast. Previous forecast from February 2014. Please note the forecast warning at the back of the document. …but also prompting bringing forward the first rate rise forecast 10 Stronger growth raises the prospects that the Bank of England (BoE) may raise its policy interest rate sooner than expected. While inflation in the near term remains benign, the Bank is considering the profile of future interest rates. The debate seems to be heading towards the notion that an earlier start to the hiking cycle will allow the BoE to ease the squeeze on the household sector by hiking more slowly. Macroeconomic theory points to the importance of the level of interest rates for longterm economic growth, but in the short-term, the change in interest rates is more important. Therefore, the BoE should take as much time as possible in normalising rates. Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority For professional investors only 30 May 2014 This debate has been highlighted by recent interviews by Martin Weale, an external member of the BoE's monetary policy committee. As the Bank forecasts the outputgap to be closed by around mid-2017, in theory, it should want to 'normalise' interest rates by then. The first question that arises is what the new equilibrium rate actually is. In the past, 4-4.5% seemed to be the preferred neutral rate, but the Bank has strongly signalled that this is now too high post the financial crisis. Not only is trend GDP growth expected to be lower, but there is an argument that prior to the crisis, banks were not charging enough of a premium (spread) over the Bank's risk free rate implying that lending risks were being underestimated. If lenders are now charging more appropriate premiums, then the Bank of England can achieve the same effective interest rate (true average interest rate charged to households and corporates), but now with a lower base rate. In our view, the Bank is likely to remain very cautious and will look to raise interest rates by no more than 25 basis points each quarter. Even Weale - a more hawkish member - agrees with this pace of tightening. He may start to call for rate increases in the near future, but we forecast the BoE to remain on hold until August 2015. This is sooner than previously forecast (start of 2016), but is later than is priced in by money markets (chart 11). The market is pricing in a strong chance of the first rate rise by February 2015, and at least the first rise by May 2015. As the next general election will be taking place at that time, in our view, it would be strange for the BoE to introduce additional market uncertainty by raising interest rates. We think August 2015 is therefore more likely. Charts 11: Schroders UK interest rate forecast vs. market expectations We expect the BoE to remain dovish, and to hike later than the market expects Basis points (vs. current base rate) 200 175 150 125 100 75 50 25 0 Jun '14 Sep '14 Dec Mar Jun Sep Dec Mar Jun Sep '14 '15 '15 '15 '15 '16 '16 '16 Short sterling contract yield minus current 3m LIBOR Schroders forecast Dec '16 Source: Thomson Datastream, Schroders. 29 May 2014. Conclusions Overall, the quarter has highlighted the big picture in the region. The European recovery is slow and uneven, with many countries still trying to fix their unsustainable public finances. The politics is currently stable enough to support the recovery, but delays to reforms and extensions of austerity are eroding the patience of voters. The risk of Eurozone deflation is elevated as highlighted by one of our scenarios. Markets are looking for the ECB to provide additional stimulus in response as deflation would spell disaster for some member states’ fiscal adjustments. Investors seem happy for the moment, but this month's wobble in peripheral equities suggests that some investors are scaling back expectations, and maybe even losing patience with the slow recovery, along with the poor earnings results. Even peripheral bond spreads have widened out over the month. 11 Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority For professional investors only 30 May 2014 The UK seems to be operating in a much higher gear than the rest of Europe, leading us to revise up our forecasts for growth, and bring forward our forecast for the first rise in interest rates. While we see no reason for activity to dramatically ease in the near term, a return to serious fiscal austerity post the 2015 election is likely to hit growth from there on. Meanwhile, the race for the 2015 general election is underway, and as uncomfortable as it may be for the mainstream parties to admit, the UK Independence Party is going to heavily influence the debate over the country's future, and may even cause more surprises at the polls. 12 Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority For professional investors only 30 May 2014 EM forecast update: crumbling BRICs Downwards revisions as macro disappoints and politics weighs on growth We have revised our growth and inflation numbers for the BRIC economies and have either kept them constant or pushed them down on a mixture of macroeconomic and political deterioration. The political situation has improved in India but we are waiting for concrete policy signals before adjusting our growth expectations. With most tightening cycles concluded, our inflation outlook is also relatively unchanged for now. Table 2: Summary of BRIC forecasts % per GDP annum 2013 2014f 2015f 7.7 7.1→ 6.8 ↓ China 2.3 1.7 ↓ 1.9 ↓ Brazil 4.6 5.0→ 5.5 → India 1.3 0.6 ↓ 1.4 ↓ Russia 2013 2.6 6.2 10.9 6.8 Inflation 2014f 2.7→ 6.6 ↑ 7.1→ 6.3→ 2015f 3.1 ↑ 6.3 ↑ 6.1→ 5.8→ Source: Bloomberg, Thomson Datastream, Schroders. 28 May 2014. Previous forecast from February 2014. Please note the forecast warning at the back of the document. China: property looks precarious Chinese growth slowed as expected in Q1 Finance still a concern, but risks seem to be ebbing The data has largely continued to deteriorate in China since our last forecast. First quarter GDP came in at 7.4% year-on-year, down from the 7.7% recorded in the final quarter of 2013. Other, higher frequency data has pointed to continued slowdown since then, though the latest flash PMI showed some stabilisation. All in all though we see little reason at this point to alter our below-consensus GDP call. The government remains reticent on major stimulus, and continues providing minor encouragements rather than driving in the spurs; the urbanisation plan has been accelerated, the railway budget increased, and assorted minor tax breaks implemented. While this will provide support to growth this year, it depletes the ammunition available later on. We originally expected growth to rebound slightly in 2015 as growth positive measures fed through – with these increasingly frontloaded we now think 2015 will weaken compared to this year. Growth of 6.8% is now forecast. The two areas generating the greatest concern at present are the financial and property sectors. Trust product defaults seem to have tailed away for now; bank analysts estimate that most (around 80%) issuers have successfully repaid or rolled over the products. However, risks remain, predominantly in the mining and coal sectors. There has been some liquidity support: interbank rates have fallen, and the reserve ratio requirement was cut for rural banks, but the People’s Bank of China (PBoC) has maintained a hawkish tone in statements and insisted on the need for tighter liquidity. Credit growth, as measured by total social financing, continues to decelerate, taking investment with it. A financial crisis seems unlikely at present, however. As we said in the March Viewpoint, trust companies themselves are unable to create money, and have little to no securitisation and low leverage. A trust company failing, therefore, has limited direct impact on the financial system. The main concern is its impact on confidence, a full default could lead to a panicked rush out of the shadow financing system and a credit crunch. This, though, presupposes that defaults go unchecked. It seems extremely unlikely to us that the authorities will permit a large scale default in the near future. Though the imposition of minor losses in recent trust default cases shows a willingness to move in this direction, we expect a very gradual approach will be adopted to accustom Chinese investors to the concept of moral hazard. There is also a reputational risk; 84% of trust companies are backed by local governments and large financial institutions. Default by such a trust risks nurturing the idea that the government or bank associated with the product is also bankrupt, a loss of confidence of that kind would be devastating. Continued bailouts, with partial losses, seem likely. The property sector, meanwhile, is effectively now in recession, with sales in their fourth month of contraction (chart 12). Price increases have slowed to just 0.1% month on month, their lowest since October 2012, though still rising 6.7% year on year. A 13 Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority For professional investors only 30 May 2014 Property sector in trouble… slowdown in the sector matters because real estate accounted for 12.7% of GDP in 2013 (this compares to roughly 3% of GDP in the US). Further, land sales are a key source of government revenues, and property sector lending accounts for approximately 20% of bank loans. In an atmosphere of tighter credit, we think property investment will slow compared to last year. While government investment in affordable housing will help, it only accounts for 10-15% of real estate investment. Other measures, such as the easing of restrictions on property purchase, will also provide support, but not enough to reverse the slowdown. Chart 12: The Chinese property sector is slowing Residential floor space started and sold (sq. m, % y/y, 3mma) 120 100 80 60 40 20 0 -20 -40 2005 2006 2007 2008 2009 Starts 2010 2011 2012 Sales 2013 Source: Thomson Datastream, Schroders. 29 May 2014 … but a crisis is unlikely However, while we see property acting as a drag on the economy, we do not think a Western style crisis is imminent. Mortgage loans are 14% of bank loans, and household debt is less than 25% of GDP. Reportedly only 10% of urban households have mortgage debt; combined with high deposit requirements (30% for the first house, 60% for the second, and 100% for the third), this looks a lower risk area than in the UK or US. Additionally, on a price to income basis, affordability has not markedly worsened because incomes have also been rising rapidly in China. The wealth effect is also much smaller; with mortgage equity withdrawal impossible in China, the impact of falling prices on consumption will be limited largely to its impact on confidence. Meanwhile, banks have strong buffers and, ultimately, state backing. The broader concern about overall debt in the Chinese economy, estimated at around 230% of GDP, remains. The figure will continue to grow while total social financing growth outstrips nominal GDP growth (7.8% in Q1), which it seems set to do for some time yet. We do not think this will trigger a crisis but it will weigh on growth as increasing resources are dedicated to debt servicing. 14 Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority For professional investors only 30 May 2014 Chart 13: Declining food prices have kept Chinese inflation contained %, y/y 20 15 10 5 0 -5 -10 2009 2010 2011 Headline CPI 2012 2013 CPI Food 2014 PPI Source: Thomson Datastream, Schroders. 29 May 2014 Pork prices should rebound and push up inflation Inflation so far this year has been subdued (chart 13 above), slipping to an 18 month low of 1.8% in April as food inflation slowed dramatically. We do not expect this to persist, however, as it appears to be linked to the pork cycle. Losses at farms have resulted in a large contraction in capacity, which should push prices higher this year. Still, we think inflation will remain well below the 3.5% target, providing plenty of scope for monetary stimulus, should it be deemed necessary. We think a reserve ratio requirement cut is likely this year, potentially around the third quarter, as the PBoC looks to provide some support to banks, particularly in light of its stated desire to see mortgage lending eased. Brazil: politics and drought undermine growth outlook First quarter GDP had not been published at the time of writing, but weaker high frequency data reinforce our negative view of the Brazilian economy. The central bank's GDP proxy, industrial production and to a lesser extent retail sales have been trending down this year (chart 14). Car sales are also nearing five year lows - they fell 16% year on year in March. Consumer credit demand is also slowing, as higher interest rates, lower consumer confidence and high inflation erode consumer demand. Chart 14: Macro indicators point to a slowdown in Brazil %, y/y 20 15 10 5 0 -5 -10 -15 -20 01 02 03 04 05 06 Retail sales (3mma) 07 08 09 IP (3mma) 10 11 12 13 BCB indicator Source: Thomson Datastream, Schroders. 29 May 2014. Political uncertainty has increased since our last forecast, with the incumbent Dilma 15 Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority For professional investors only 30 May 2014 Falling ratings for Dilma have cheered investors Populist fiscal policy is making the central bank's job harder falling in approval polls, increasing the chances of a second round. Markets have been cheering Dilma's fall, on hopes that it implies a more business friendly candidate will triumph in October. However, she remains the clear frontrunner for now, and in any case whoever wins will have substantial challenges; there will be no instant turnaround. The boost to investor sentiment would be helpful but a number of bottlenecks will take legislation and time to resolve. Until then, Dilma seems to be resorting to populism to shore up her vote; her government has increased welfare payments by 10% and provided additional capital injections to the development bank to maintain credit expansion (further undermining the shaky fiscal position). All this implies sharper cuts post-election and motivates our 2015 growth downgrade. Also affecting our growth outlook is the impact of the recent drought, which has continued almost unabated since we mentioned it in February's forecast. Depleted reservoirs have seen increasing use of high cost thermoelectric plants (for which fuel must be imported) rather than hydroelectric. This has resulted in a number of firms in the metals and chemicals industries reducing production and selling excess power on the spot market instead, where the price is at the government-fixed ceiling. Local media reports a number of firms are struggling to operate with electricity costs at this level. We suspect the central bank must be increasingly frustrated by the refusal of government policy to truly co-operate in containing inflation, which remains close to the upper band of the target range despite the 375 bps of rate hikes since the start of 2013 (chart 15). Inflation is, of course, a backward looking indicator, but worryingly inflation expectations remain elevated as well, suggesting the problem is likely to persist. Despite this, the central bank opted to keep rates on hold at 11% at its latest policy meeting. Though the accompanying statement suggested further hikes would be considered, it seems likely that we will have to wait until after the elections now for rates to increase again. Despite this, inflation pressures look set to remain elevated in 2015, in part due to the ongoing need for high cost thermoelectric plants to stay online, and in part due to the inevitable increase in regulated prices, which have been suppressed in the run up to the election. Chart 15: Brazilian inflation persists, despite tight monetary policy % 8 % 20 18 7 16 14 6 12 5 10 8 4 6 4 3 2 2005 2 0 2006 2007 CPI (y/y), lhs 2008 2009 2010 Inflation expectations, lhs Source: Thomson Datastream, Schroders. 29 May 2014 16 Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority 2011 2012 2013 2014 Selic target rate (rhs) For professional investors only 30 May 2014 India: election positive, but wait and see Modi's mandate is positive for reform hopes India's electorate returned Modi's BJP with 282 seats, granting them a majority and a stronger mandate than many had expected. There had been a risk that results would disappoint and that the optimism of recent months would sour. Instead, the count surprised to the upside, giving investors a fresh injection of hope. The inbox for the new government is a busy one. There is an investment bottleneck to clear, fiscal consolidation will be important, and central bank governor Rajan is keen to move to inflation targeting. Longer term, inefficiencies in the land and labour markets must be addressed, and the tricky issue of foreign investment resolved. A majority for the BJP greatly reduces the need for compromise, and could mean we see reforms pushed through. However, the BJP-led government will still have to negotiate with state governments and the upper house of parliament. State governments could prove particularly obstructive. In all though, this election result is a positive one for the Indian economy. Still, we will have to wait until July's budget for our first real taste of where policy will go. Consequently we feel it is too soon to revise our growth outlook for India on the back of the election results. Higher frequency data in the first quarter was weak, with industrial production and exports contracting, not helped by a strengthening rupee. The tighter monetary policy used to stabilise the rupee is likely hindering growth, especially when India's banks are seeing rising bad debt and so becoming more reluctant to lend. On the monetary policy front, governor Rajan's crusade against inflation continues, with policy remaining tight despite deteriorating growth indicators. Inflation has bounced back slightly after initial successes (chart 16) This acceleration was driven mainly by food price inflation; core CPI was unchanged at 7.8%. There are increased upside risks to our inflation forecast as a result, particularly with the possibility of an El Nino weather system this year. Policy will have to remain tight. Chart 16: Indian inflation down but not out % 9.5 %, y/y 12 9.0 11 8.5 10 8.0 9 7.5 8 7.0 6.5 Jan 12 7 Jul 12 Jan 13 Bank rate Jul 13 CPI (rhs) Jan 14 Source: Thomson Datastream, Schroders. 29 May 2014. Russia: Ukraine unsettles the bear Uncertainty and sanctions generating headwinds for Russian growth 17 Our growth forecast for Russia has seen a significant downgrade following events in Ukraine, which were yet to transpire at the time of our last forecast update. Though sanctions have not been broad based as yet, there is already evidence of an economic impact; Russian GDP grew by 0.9% year on year in the first quarter. This marked a sharp fall from the 2.0% growth recorded in the fourth quarter of 2013. Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority For professional investors only 30 May 2014 Higher frequency data suggests the slowdown has been driven by lower investment spending. Consumer spending has slowed too, but has held up reasonably well in comparison. Meanwhile, PMI data points to ongoing contraction in manufacturing and services. It is not much of a stretch to argue that uncertainty arising from escalating tensions in Ukraine contributed to reluctance to invest. If the situation in Ukraine is not resolved, we would expect Russia’s GDP numbers to continue to worsen throughout the year. Further sanctions are being discussed and the economic damage from extant sanctions and general uncertainty will build over time. As it stands the second quarter already looks likely to disappoint, and will probably put Russia into recession. Russia is vulnerable to financial sanctions Although it is not our base case, particularly as tensions seem to be easing, we should also consider the possibility of Iranian style sanctions. The scope for economic damage then becomes far greater. Chart 17 shows foreign bank claims on Russia in absolute terms and as a share of Russian GDP. The withdrawal of finance equivalent to 12.5% of GDP would be difficult to brush off. Chart 17: Foreign bank claims on Russia $ bn 300 12.5 250 200 9.2 150 100 2.5 1.7 50 1.4 1.1 0.9 0.9 Ge Ned UK Austria 0.8 0.8 0.7 0.4 Jp Swe Sw 0 Total Europe Fr US It Source: BIS, IMF, Schroders. 29 May 2014. Figures above columns denote bank claims as a share of Russian GDP The slowdown will worsen policymaker headaches – presumably already throbbing from sanctions and political pressure – as inflation remains high. Rates have already been hiked in response to this and currency weakness, but there will be increasing policy conflict if the political situation does not improve. The easing of tensions though has seen the ruble strengthen, for now, so the inflation spike could prove temporary. 18 Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority For professional investors only 30 May 2014 Schroder Economics Group: Views at a glance Macro summary – May 2014 Key points Baseline World economy on track for modest recovery as monetary stimulus feeds through and fiscal headwinds fade in 2014. Inflation to remain well contained. US to rebound in q2 after weather related dip in q1. Economy beginning to normalise as banks return to health and private sector re-leverages. Unemployment to fall faster than Fed expects and central bank to complete tapering of asset purchases by October 2014. First rate rise expected in q3 2015. UK recovery to be sustained by robust housing and consumer demand whilst economic slack should limit the pick up in inflation. Growth likely to moderate next year with general election and resumption of austerity. Interest rates to rise in August 2015. Eurozone recovery becomes more established as fiscal austerity and credit conditions ease in 2014. Low inflation likely to prompt ECB to cut rates and take measures to reduce the cost of credit, otherwise on hold through 2015. Deflation to be avoided, but possibility of QE in response to deflation fears. "Abenomics" achieving good results so far, but Japan faces significant challenges to eliminate deflation and repair its fiscal position. Bank of Japan to step up asset purchases as growth and inflation fall back in 2014 and 2015. US leading Japan and Europe (excluding UK). De-synchronised cycle implies divergence in monetary policy with the Fed eventually tightening ahead of others and a stronger USD. Tighter US monetary policy weighs on emerging economies. Region to benefit from advanced country cyclical upswing, but China growth downshifting as past tailwinds (strong external demand, weak USD and falling global rates) go into reverse and the authorities seek to deleverage the economy. Deflationary for world economy, especially commodity producers (e.g. Latin America). Risks Risks are still skewed towards deflation, but are more balanced than in the past. Principal downside risk is a China financial crisis triggered by defaults in the shadow banking system. Some danger of inflation if capacity proves tighter than expected whilst upside risk is a return of animal spirits and a G7 boom (see page 17 for details). Chart: World GDP forecast Contributions to World GDP growth (y/y) 6 5 4.9 4.8 4.8 4.9 4 3.6 3.2 2.8 3 Forecast 4.6 4.4 2.6 2.4 2.1 2.4 2.8 2.9 14 15 World 2 1 0 -1 -1.4 -2 -3 00 01 US 02 03 Europe 04 05 Japan 06 07 08 Rest of advanced 09 10 BRICS 11 12 13 Rest of emerging Source: Thomson Datastream, Schroders 28 May 2014 forecast. Previous forecast from November 2013. Please note the forecast warning at the back of the document. 19 Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority For professional investors only 30 May 2014 Schroders Baseline Forecast Real GDP y/y% World Advanced* US Eurozone Germany UK Japan Total Emerging** BRICs China Prev. (3.0) (2.1) (3.0) (1.1) (1.9) (2.6) (1.4) (4.4) (5.3) (7.1) Prev. Consensus 2015 2.8 2.9 (3.1) 1.9 2.1 (2.2) 2.5 2.9 (3.0) (1.4) 1.1 1.4 1.9 2.3 (2.2) 2.9 2.4 (2.1) 1.3 1.0 (1.3) 4.3 4.3 (4.6) 5.2 5.1 (5.6) 7.3 6.8 (7.3) Consensus 3.2 2.3 3.1 1.4 2.0 2.5 1.3 4.8 5.4 7.2 Prev. (2.8) (1.4) (1.5) (0.8) (1.3) (2.3) (1.9) (5.4) (4.3) (2.7) Prev. Consensus 2015 3.0 3.1 (2.8) 1.6 1.6 (1.5) 1.8 1.9 (1.4) (1.2) 0.8 1.2 1.3 2.0 (1.7) 1.9 2.2 (2.7) 2.6 1.6 (1.5) 5.6 5.6 (5.3) 4.3 4.4 (4.1) 2.5 3.1 (2.9) Consensus 3.0 1.7 1.9 1.3 1.9 2.0 1.8 5.3 4.3 3.0 Wt (%) 100 64.4 24.7 18.6 5.2 3.8 9.1 35.6 21.8 12.5 2013 2.4 1.2 1.9 -0.4 0.5 1.7 1.6 4.6 5.5 7.7 2014 2.8 1.9 2.6 1.0 2.2 2.9 1.2 4.2 5.1 7.1 Wt (%) 100 64.4 24.7 18.6 5.2 3.8 9.1 35.6 21.8 12.5 2013 2.6 1.3 1.5 1.3 1.6 2.6 0.1 4.9 4.7 2.6 2014 3.0 1.5 1.8 0.9 1.3 1.9 2.0 5.7 4.4 2.7 Current 0.25 0.50 0.25 0.10 6.00 2013 0.25 0.50 0.25 0.10 6.00 2014 0.25 0.50 0.10 0.10 6.00 Prev. (0.25) (0.50) (0.10) (0.10) (6.00) Current 4227 375 241 20.00 2013 4033 375 224 20.00 2014 4443 375 295 19.50 Prev. (4443) (375) 20.00 Current 1.68 1.37 101.5 0.81 6.23 2013 1.61 1.34 100.0 0.83 6.10 2014 1.68 1.35 105.0 0.80 6.18 Prev. (1.63) (1.34) (110) (0.82) (6.00) 111.1 109.0 108.3 (108) Inflation CPI y/y% World Advanced* US Eurozone Germany UK Japan Total Emerging** BRICs China Interest rates % (Month of Dec) US UK Eurozone Japan China Market 0.26 0.72 0.21 0.19 - Prev. 2015 0.75 (0.50) 1.00 (0.50) (0.10) 0.10 (0.10) 0.10 (6.00) 6.00 Market 0.92 1.58 0.30 0.19 - Other monetary policy (Over year or by Dec) US QE ($Bn) UK QE (£Bn) JP QE (¥ Tn) China RRR (%) 2015 4443 375 383 19.50 Prev. (4443) (375) 20.00 2015 1.63 1.30 110.0 0.80 6.10 Prev. (1.55) (1.27) (120) (0.82) (5.95) Key variables FX USD/GBP USD/EUR JPY/USD GBP/EUR RMB/USD Commodities Brent Crude Y/Y(%) 4.3 0.7 5.0 -3.5 1.3 -0.7 103.7 (103) Y/Y(%) -3.0 -3.7 4.8 -0.7 -1.3 -4.3 Source: Schroders, Thomson Datastream, Consensus Economics, May 2014 Consensus inflation numbers for Emerging Markets is for end of period, and is not directly comparable. Please note the forecast w arning at the back of the document. Market data as at 16/05/2014 Previous forecast refers to November 2013 * Advanced m arkets: Australia, Canada, Denmark, Euro area, Israel, Japan, New Zealand, Singapore, Sw eden, Sw itzerland, Sw eden, Sw itzerland, United Kingdom, United States. ** Em erging m arkets: Argentina, Brazil, Chile, Colombia, Mexico, Peru, Venezuela, China, India, Indonesia, Malaysia, Philippines, South Korea, Taiw an, Thailand, South Africa, Russia, Czech Rep., Hungary, Poland, Romania, Turkey, Ukraine, Bulgaria, Croatia, Latvia, Lithuania. 20 Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority For professional investors only 30 May 2014 Schroders Forecast Scenarios Global vs. 2015 baseline Scenario Summary Macro impact Baseline We continue to expect global growth to strengthen, but have trimmed our forecasts for 2014 and 2015 by 0.2% to 2.8% and 2.9% respectively. The US should benefit from a weaker fiscal headwind in 2014 and be able to build momentum, although the economy is not expected to regain all the output lost in the first quarter and the housing market is no longer forecast to strengthen as rapidly as before. Europe is also improving, although growth remains skewed toward Germany with only modest signs of improvement in the periphery. Helped by the housing market, UK growth has been revised up to 2.9% (previously 2.6%). Stronger US demand should help global trade and the emerging markets, however several EM economies face inflation and rebalancing pressures such that growth remains sub trend. China forecast for 2014 remains at 7.1%, but has been revised down to 6.8% in 2015. Despite trimming the US growth forecast we still expect the Fed to end QE by October and raise interest rates from q3 2015 as unemployment continues to fall and wages accelerate. Our inflation forecast is marginally higher and Fed funds is now expected to rise to 0.75% by end 2015. In the Eurozone we expect another rate cut from the ECB and measures to reduce bank funding costs, but no QE as the economy is expected to escape deflation. For the UK, we have brought forward our first rate hike to August 2015 as a result of stronger activity, but remain later than the consensus. In Japan we have pushed out an acceleration in QQE until September when the BoJ is expected to downgrade growth expectations. China is expected to trim the RRR, but refrain from easing further as it continues to control excess liquidity. Weak economic activity weighs on Eurozone prices with the region slipping into deflation. Households and companies lower their inflation expectations and start to delay spending with the expectation that prices will fall further. The rise in savings rates deepens the downturn in demand and prices, thus reinforcing the fall in inflation expectations. Falling nominal GDP makes debt reduction more difficult, further depressing activity. Deflationary: weaker growth and lower inflation, persists throughout the scenario As a significant part of the world economy, Eurozone weakness drags on activity elsewhere, while some of the deflationary impact is imported by trade partners. ECB reacts by undertaking QE, but the policy response is too small and too slow to avert the outcome. DM growth picks up more rapidly than in the base as the corporate sector increases capex and consumers spend more rapidly in response to the recovery in house prices. Banks increase lending, reducing their excess reserves and asset prices boom. The Fed begins to withdraw stimulus: rapidly tapering bond purchases in 2014. Interest rates rise and the Fed begins to contract its balance sheet in 2015. However, the withdrawal of stimulus is not sufficient to prevent a more rapid tightening of the labour market and a pick-up in inflation. Reflationary: stronger growth and inflation vs. baseline. Stronger US demand supports activity around the world. Commodity prices and US Treasury yields rise and USD strengthens as inflation picks up and Fed unwinds QE and raises rates. The dispute between China and Japan over the Diaoyu/ Senkaku islands escalates to a trade war which then spreads as nations take sides and cut their trade with each other. Stagflationary: global growth weakens as supply chains are disrupted and a large part of world trade shuts down. However, inflation is likely to be higher as firms hoard commodities pushing up energy, metals and food prices. Central banks overestimate the amount of spare capacity in the economy believing there is significant slack in the labour market and a substantial output gap. However, weaker trend growth and the permanent loss of some capacity in the post financial crisis environment mean that the world economy is closer to the inflationary threshold than realised. Consequently, as demand increases, inflation starts to accelerate prompting a re-appraisal of monetary policy and higher interest rates. Stagflationary: tighter monetary policy slows growth, but inflation continues to rise until the economy has returned to trend. Primarily driven by the US and to a lesser extent the UK - who in turn impact global trade and activity. An implosion in the wealth management products area results in a major cut in Total Social Financing depriving Chinese industry of funds. The resulting downturn in capex spending and the adverse impact on consumer confidence results in a sharp slowdown in Chinese growth. 1. Eurozone deflation 2. G7 boom 3. Trade war 4. Capacity limits bite 5. China hard landing 6. Russian rumble Russia invades East Ukraine. The west retaliates by significantly increasing sanctions and Russia cuts gas and oil supplies to Europe. 7. Secular stagnation Capital expenditure fails to revive as businesses remain cautious on the outlook believing real returns are below the cost of capital, whilst income becomes increasingly concentrated in the hands of the rich with low propensity to consume. 8. Other *Scenario probabilities are based on mutually exclusive scenarios. Please note the forecast warning at the back of the document. 21 Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority Probability* Growth Inflation 65% - - 4% -0.8% -1.0% 6% +1.2% +1.1% 2% -0.9% +0.8% 8% -0.4% +0.7% Global growth slows as China demand weakens with commodity producers hit hardest. However, the fall in commodity prices will push down inflation to the benefit of consumers. Monetary policy is likely to ease/ stay on hold while the deflationary shock works through the world economy. 6% -1.1% -0.9% Stagflationary. Europe is hit by the disruption to energy supply resulting in a fall in output as alternative sources are put in place. Higher oil prices hit global inflation and the breakdown of relations between Russia and the west creates significant volatility in financial markets. 2% -0.6% +0.3% Deflationary: weaker growth and lower inflation as demand remains sluggish. Softer commodity prices also weigh on inflation. Fed still expected to end QE as scheduled but does not raise rates during the forecast period. The opposite of the G7 boom scenario. 5% -0.4% -0.3% 2% - - For professional investors only 30 May 2014 I. Updated forecast charts - Consensus Economics For the EM, EM Asia and Pacific ex Japan, growth and inflation forecasts are GDP weighted and calculated using Consensus Economics forecasts of individual countries. Chart A: GDP consensus forecasts 2014 2015 % % 8 8 7 7 EM Asia EM Asia 6 6 EM 5 EM 5 4 4 Pac ex JP Pac ex JP 3 3 US US 2 UK Japan 1 Eurozone 0 2 UK 1 Japan Eurozone 0 Jan Mar May Month of forecast Jul Sep Nov Jan Mar May Jan Feb Month of forecast Chart B: Inflation consensus forecasts 2014 Mar Apr May 2015 % % 6 6 EM EM 5 5 EM Asia 4 Pac ex JP 3 EM Asia 4 3 UK Pac ex JP Japan 2 UK US 2 Japan US 1 Eurozone 1 0 Jan Mar May Jul Sep Nov Jan Eurozone Mar Month of forecast May 0 Jan Feb Mar Apr May Month of forecast Source: Consensus Economics (May 2014), Schroders Pacific ex. Japan: Australia, Hong Kong, New Zealand, Singapore Emerging Asia: China, India, Indonesia, Malaysia, Philippines, South Korea, Taiwan, Thailand Emerging markets: China, India, Indonesia, Malaysia, Philippines, South Korea, Taiwan, Thailand, Argentina, Brazil, Colombia, Chile, Mexico, Peru, Venezuela, South Africa, Czech Republic, Hungary, Poland, Romania, Russia, Turkey, Ukraine, Bulgaria, Croatia, Estonia, Latvia, Lithuania This document contains forward looking forecasts which by their nature are inherently predictive, and involve risk and uncertainty. While due care has been used in the preparation of forecast information, actual results may vary considerably. Accordingly readers are cautioned not to place undue reliance on these forecasts. The views and opinions contained herein are those of Schroder Investments Management's Economics team, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This document does not constitute an offer to sell or any solicitation of any offer to buy securities or any other instrument described in this document. The information and opinions contained in this document have been obtained from sources we consider to be reliable. No responsibility can be accepted for errors of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions. For your security, communications may be taped or monitored. 22 Issued in May 2014 Schroder Investment Management Limited. 31 Gresham Street, London EC2V 7QA. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority