Macroeconomics Qualifying Exam Part 2 September, 2009 Claremont Graduate University

advertisement

Macroeconomics Qualifying Exam

Part 2

September, 2009

Claremont Graduate University

Please answer question ONE and EITHER questions two or three

completely. Each part is equally weighted. HINT: “Prove” means to show

mathematically using a formal derivation. “Describe” or “explain” means

to provide the behavioral intuition for a result.

1. Consider an OLG economy with productive capital, K, and a

"Medicare" package in which young people are taxed to pay for

healthcare for older people. Population grows geometrically, Nt+1 =

(1+n)Nt, n > -1, N0=1, and young people pay tax τ >0, while old people get

a transfer σ>0 that subsidizes their consumption. The tax and transfer occur

in the same period. An agent who is born at time t faces the decision

problem

Maxc0, c1

s.t.

(1-β)ln (c0, t) + βln(c1, t+1)

c0,t = wt– st - τ

c1,t+1 = Rt+1st + σ,

where c0, c1, s, w and R have the standard definitions, and the utility

function has the standard properties.

a) Identify the choice and state variables for this model at time t.

b) Write down the aggregate government budget constraint (GBC) at

time t. Identify each term. Now state this in per worker terms.

c) Find the flow (2 period) budget constraint for an agent born at time t.

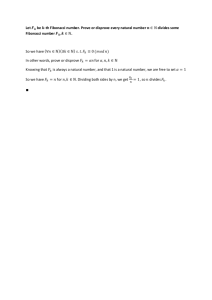

Use the per worker GBC to substitute σ out of the flow budget constraint in

terms of τ. Derive a condition showing that lifetime resources will be higher

with the Medicare package than without it if some condition is met.

Assume the economy is at a steady state.

d) Briefly describe what the condition you derived in (c) means in plain

English. Now agree or disagree and support your answer: Population

growth in the US is approximately 1% per year (let a period in the model

be a year for this calculation); this means the condition you found in (c) is

likely to be met today in the US.?

e) Take the FOC and solve for the savings relation.

f) Prove or disprove that the savings relation is increasing in R. Why might

this be important?

g) Prove or disprove this statement: Savings is higher for the economy

above without Medicare (when τ=σ= 0) than with Medicare (for τ,σ> 0).

h) In plain English, tell me why you obtained the result in (g).

i) Let y=kα where α ∈(0,1). Set up and solve the firm's profit maximization

problem. Find prices rt and wt.

j) Define a competitive equilibrium for this model C3: clearly, completely,

and concisely.

k) Now assume that all tax revenue collected is consumed by an

(unmodeled) government administering Medicaid and none reaches the

oldsters. This means that τ>0 and σ=0. Find all steady states for this

economy.

l) Assuming τ>0 and σ=0, derive the phase portrait for this economy,

showing arrows of motion, steady states and noting their stability

properties.

2. Consider an infinitely-lived representative agent (Cass) economy. In this

model, population is normalized to 1 and leisure is not valued. The

decision problem at time t is described by

Maxct

s.t.

βt U(ct)

ct = f(kt) - it

kt+1 = (1-δ)kt + it,

where c is consumption, k is capital, i is investment, δ∈ [0,1] is

depreciation, β∈ (0,1) is the discount rate, and the utility function and

production function f(k) have the standard properties including the Inada

conditions.

a. Identify the state variable or variables for this model.

disagree: This is a planning problem. Support your claim.

Agree or

b. Find the first order condition(s) for an optimal solution to this problem.

c. Identify the variables the optima solve for in (a) with a star (*) and show

which other variables these depend on from the decision-maker’s

perspective.

d. State the complete set of optimality conditions for this model

e. Let production be quadratic, f(kt) = kt2. Find all steady states for this

model

f. Derive arrows of motion for the dynamics in the phase space using the

production function in (e).

g. Now, construct the phase portrait for this model, and identify the

stability properties of all steady states.

3. Consider a two period life pure exchange OLG economy. In this model,

all agents are identical with N young members. There is no population

growth. Agents have endowments in the first and second periods {e0,

e1}>>0. Let c0 and c1 be young and old consumption, β∈ (0,1) be the

discount rate, and R be the yield on savings, s. Agents in this economy

have quadratic utility and solve

Max

C0, C1

c02/2 + β c12/2

c0 = e0 – s

c1 = e1 + Rs

a. Solve for optimal savings.

b. Derive a condition under which the agent has positive savings.

c. Define a general equilibrium for this model completely and carefully.

d. Solve for the equilibrium yield R*.

e. Using (d), prove that i) R*>0; ii) R* is decreasing in β. Explain the reason

for result (ii) in plain language.

Now let’s add a storage technology so that 1 unit of forgone consumption

in period 0 can be stored and will produce δ∈ [0,1] units in period 1. The

parameter δ captures possible spoilage. Agents now solve

Max

C0, C1

c02/2 + β c12/2

c0 = e0 – s

c1 = e1 + δs

f. Find the optimal savings.

g. Prove or disprove: agents always save for any δ>0. After you have

proved or disproved this, explain what your finding means using plain

English.