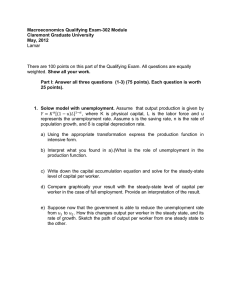

Macroeconomic Qualifying Exam-302 Module Claremont Graduate University September, 2006

advertisement

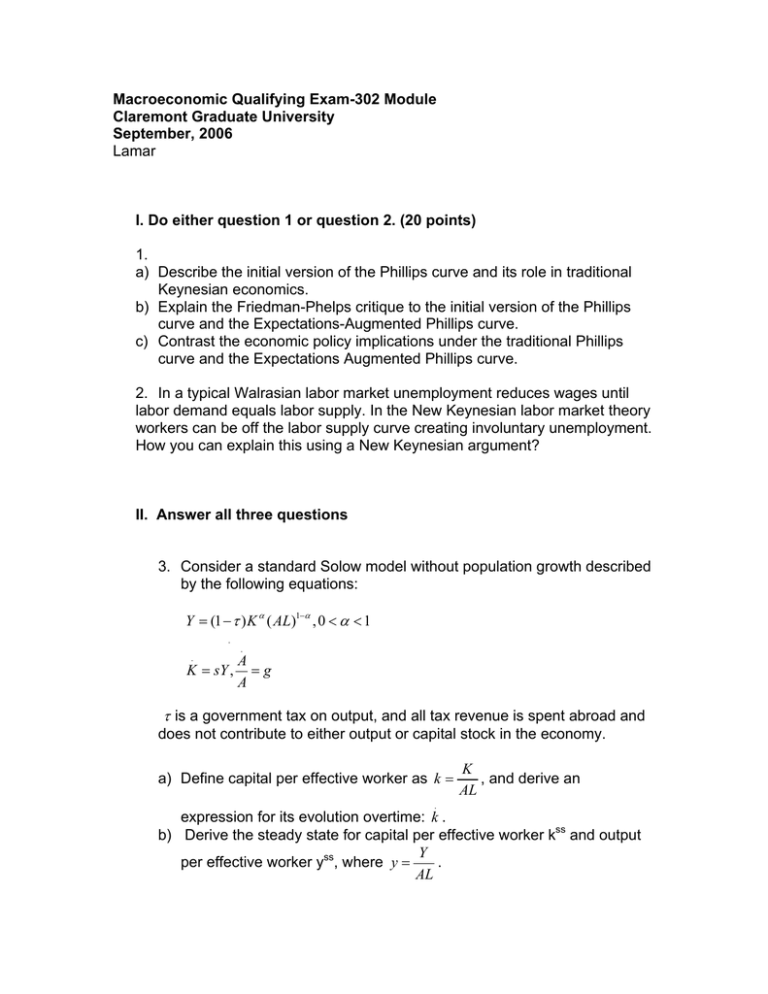

Macroeconomic Qualifying Exam-302 Module Claremont Graduate University September, 2006 Lamar I. Do either question 1 or question 2. (20 points) 1. a) Describe the initial version of the Phillips curve and its role in traditional Keynesian economics. b) Explain the Friedman-Phelps critique to the initial version of the Phillips curve and the Expectations-Augmented Phillips curve. c) Contrast the economic policy implications under the traditional Phillips curve and the Expectations Augmented Phillips curve. 2. In a typical Walrasian labor market unemployment reduces wages until labor demand equals labor supply. In the New Keynesian labor market theory workers can be off the labor supply curve creating involuntary unemployment. How you can explain this using a New Keynesian argument? II. Answer all three questions 3. Consider a standard Solow model without population growth described by the following equations: Y = (1 − τ ) K α ( AL)1−α , 0 < α < 1 . . A K = sY , = g A . τ is a government tax on output, and all tax revenue is spent abroad and does not contribute to either output or capital stock in the economy. a) Define capital per effective worker as k = K , and derive an AL . expression for its evolution overtime: k . b) Derive the steady state for capital per effective worker kss and output Y per effective worker yss, where y = . AL c) What would be the effect of an increase in the tax rate on actual investment in the economy and the steady state of output per effective worker ? d) Now assume that the tax on output also hurts individual’s incentives to invent new technologies. Specifically assume that the growth rate of 1 technology, g, is given by g = b(1 − τ ) α where b>0. What is the new steady state level of output per effective worker? What is the effect of an increase in the tax on yss now? e) Explain in words, or graphically, the result you got in d). (30 points) 4. Consider a simple IS-LM model. a) Graphically derive the Aggregate Demand curve. Now assume that total expenditure is given by E (Y , i − Π e , G, T ) where 0 < EY < 1, Ei −Πe < 0, EG = 1, ET < 0. Also assume real money demand equals L(i, Y ) where Li < 0 LY > 0 . b) Show graphically what is the effect on output of an increase in G. What assumption is important in order to explain this result? What happens to the Aggregate Demand curve? c) Show algebraically the effect on output of an increase in G. d) When the crowding-out effect is insignificant? (30 points) − 5. Consider a labor market with flexible wages but prices fixed at P = P . Assume an upward sloping labor supply curve, and assume firms will meet demand at the prevailing price as long as it does not exceed the level where marginal cost equals price; denote this level of output by YMAX. a) Show the labor market equilibrium of this model in ((W/P),L) space. Be sure to label the curves, equilibrium labor and wages. b) Does this model explain involuntary unemployment? Why? c) How will real wages, employment, and output respond to a negative aggregate demand shock in this model? Please show this graphically. Given your results, describe the effect of a contractionary monetary policy on income, the real wage, and unemployment in this economy. (20 points)