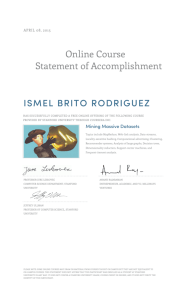

SPRING 2012 S T A

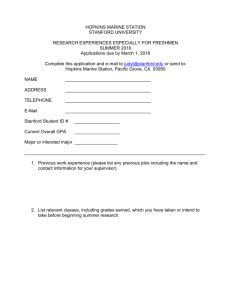

advertisement