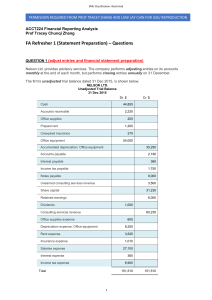

The following transaction pertain to a recently started (in 20X3)... Life Company that performs security services:

advertisement

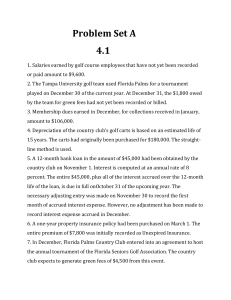

The following transaction pertain to a recently started (in 20X3) Free Life Company that performs security services: 1) Jan. 15 Began operations when the owners contributed $20,000; 2) Jan. 31 Paid $2,400 cash for an insurance policy; the policy contract had a 2year term; 3) Feb. 28 Received $3,600 cash in advance for services to be performed during a year; 4) March 14 Purchased supplies of $3,000 on account; 5) March 25 Received $5,000 cash for services provided; 6) April 16 Incurred $2,500 of utility expense on account; 7) May 31 Invested $4,000 in a certificate of deposit that carried a 1-year term and 7% annual interest; 8) June 17 Billed clients $3,500 for services performed; 9) June 30 Bought a car for $3,000 cash; expected useful life of the car is 2 years with no salvage value; 10) July 28 Collected $3,000 cash from accounts receivable; 11) Aug. 23 Paid $3,500 cash for accounts payable (see Events 4 & 6); 12) Sep. 5 Distributed $1,500 to the owners; Adjusting entries a1) Dec. 31 Recorded the insurance expense for the accounting period (see Event 2); a2) Dec. 31 Adjusted records to recognize revenue on services provided from March to December (see Event 3); a3) Dec. 31 Recorded the supplies expense; at the end of the accounting period $500 of supplies remained on hand (see Event 4); a4) Dec. 31 Recorded the accrual interest on the CD (see Event 7); a5) Dec. 31 Recorded depreciation expense on the car used during the year (see Event 9); a6) Dec. 31 Accrued $1,000 of salaries payable. Required: 1) Record the transaction in the general journal; 2) Post the transaction to the appropriate T-accounts and calculate the accounts’ balances; 3) Prepare the balance sheet, income statement, statement of changes in equity, and the statement of cash flows; 4) Prepare the closing entries at December 31 in the general journal.