Global Strategic Bond Fund Investor: SGBNX SGBNX SGBNX | Advisor: SGBVX

advertisement

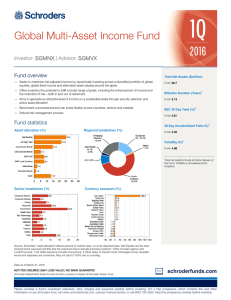

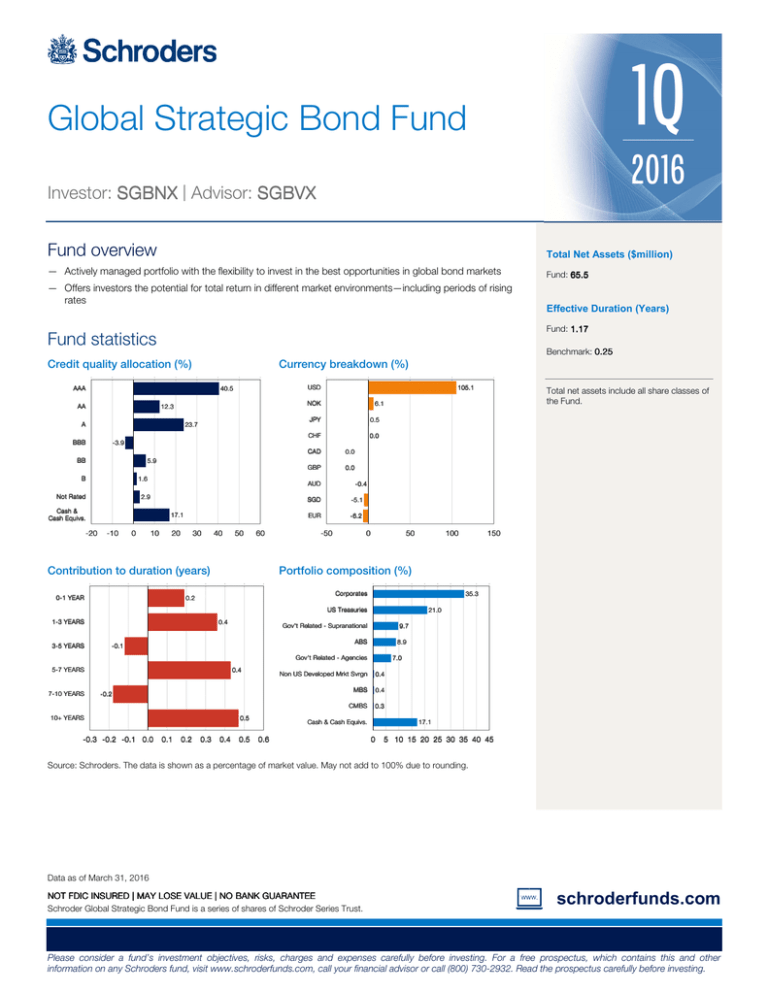

1Q Global Strategic Bond Fund 2016 Investor: SGBNX | Advisor: SGBVX Fund overview Total Net Assets ($million) — Actively managed portfolio with the flexibility to invest in the best opportunities in global bond markets Fund: 65.5 — Offers investors the potential for total return in different market environments—including periods of rising rates Fund: 1.17 Fund statistics Benchmark: 0.25 Credit quality allocation (%) Currency breakdown (%) AAA 12.3 23.7 BBB 105.1 NOK A 5.9 B 1.6 Not Rated JPY 0.5 CHF 0.0 2.9 17.1 -10 0 CAD 0.0 GBP 0.0 AUD Cash & Cash Equivs. 10 20 30 40 50 60 Contribution to duration (years) 0-1 YEAR - 0.4 SGD - 5.1 EUR - 6.2 -50 0 50 Corporates 0.4 21.0 Gov't Related - Supranational 9.7 ABS - 0.1 8.9 Gov't Related - Agencies 5-7 YEARS 0.4 10+ YEARS 0.5 0.1 0.2 0.3 0.4 0.5 7.0 Non US Developed Mrkt Svrgn - 0.2 -0.3 -0.2 -0.1 0.0 150 35.3 US Treasuries 7-10 YEARS 100 Portfolio composition (%) 0.2 1-3 YEARS 3-5 YEARS Total net assets include all share classes of the Fund. 6.1 - 3.9 BB -20 USD 40.5 AA Effective Duration (Years) 0.4 MBS 0.4 CMBS 0.3 Cash & Cash Equivs. 0.6 17.1 0 5 10 15 20 25 30 35 40 45 Source: Schroders. The data is shown as a percentage of market value. May not add to 100% due to rounding. Data as of March 31, 2016 NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE Schroder Global Strategic Bond Fund is a series of shares of Schroder Series Trust. schroderfunds.com Please consider a fund’s investment objectives, risks, charges and expenses carefully before investing. For a free prospectus, which contains this and other information on any Schroders fund, visit www.schroderfunds.com, call your financial advisor or call (800) 730-2932. Read the prospectus carefully before investing. Schroder Global Strategic Bond Fund Performance* (%) As of March 31, 2016 3 2 1 0 -1 -2 -3 -4 -5 -6 Investor Shares Advisor Shares BBA LIBOR USD 3 Months Index 0.41 0.16 - 1.04 0.34 Fees and Expenses (%) as of March 23, 2016 - 1.06 - 2.75 - 4.20 QTD * Please see below for notes accompanying this update. The notes include a description of the index and certain risks associated with investing in the fund. Fund information Inception Date Dividend Frequency Gross 1.25 1.50 Net 0.79 1.04 Since Inception Performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. Principal value and investment returns will fluctuate so that shares, when redeemed, redeemed, may be worth more or less than their original cost. For the most recent monthmonth-end performance, visit www.schroderfunds.com or call (800) 730730-2932. Performance for periods less than one year is not annualized and performance of periods greater than one year ye ar is annualized. CUSIP Advisor Shares - 2.95 - 4.31 1 Year Investor Shares In order to limit the Fund's expenses, the Fund's adviser has contractually agreed through February 28, 2017 to waive its fees, pay Fund operating expenses, and/or reimburse the Fund to the extent that Total Annual Fund Operating Expenses (other than acquired fund fees and expenses, other indirect acquired fund expenses, interest, taxes, and extraordinary expenses), for the Fund's Investor Shares, exceed 0.79% of Investor Shares' average daily net assets and, for the Fund's Advisor Shares, exceed 1.04% of Advisor Shares' average daily net assets. The expense limitation may only be terminated during its term by the Board of Trustees. Management team Investor Shares Advisor Shares 808090583 808090591 6/23/2014 6/23/2014 Monthly Monthly — Managed by Gareth Isaac and Paul Grainger, Senior Portfolio Managers and Bob Jolly, Head of Global Multi-Sector Strategy — The portfolio managers are backed by Schroders' integrated and experienced fixed income team of over 100 fixed income specialists located around the globe Risk: All investments involve risks including the risk of possible loss of principal. The market value of a fund's portfolio may decline as a result of a number of factors, including interest rate risk, credit risk, inflation/deflation risk, mortgage and asset-backed securities risk, US Government securities risk, derivatives risk, counterparty risk and liquidity risk. Frequent trading of the fund's portfolio may result in relatively high transaction costs and may result in taxable capital gains. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets. Investing overseas involves special risks including among others, risk related to political or economic instability, foreign currency (such as exchange, valuation, and fluctuation) risk, market entry or exit restrictions, illiquidity and taxation. These risks exist to a greater extent in emerging markets than in developed markets. Please see the prospectus for a full description of the risks associated with the Fund. Important Information: Source: Schroders, Barclays Capital. Performance: Total return figures are net of fees and expenses, which includes a .25% distribution fee paid under rule 12b-1 for Advisor Shares only, and reflect reinvestment of all dividends and distributions at net asset value. As described in the prospectus, during certain periods shown, the expenses borne by the Fund were limited by the investment adviser; otherwise total return would have been lower. Index: The BBA LIBOR USD 3 Month Index is the average interest rate that lending banks in London charge when lending to other banks. The Libor is an average of the interest rate banks pay to borrow for 3 months. Investors may not invest directly in an Index. Sector/Securities: Securities holdings, sector breakdowns and credit quality indicate characteristics as of a point in time and may not be representative of the Fund's current or future investments. Portfolio sectors/securities and allocations are subject to change at any time and should not be viewed as a recommendation to buy/sell. Credit/Quality: Schroders receives credit quality ratings on underlying securities of the Fund from the three major reporting agencies - S&P, Moody's and Fitch. When calculating the credit quality breakdown, Schroders uses the average rating of the agencies. Securities that are not rated by all three agencies are reflected as such. The ratings exclude cash and cash equivalents. Schroders converts all ratings to the equivalent S&P major rating category for purposes of the category shown. The breakdown does not include forwards, IRS and CDS Float. Schroder Fund Advisors LLC, Member FINRA, SIPC – 875 Third Avenue, New York, NY 10022-6225 (800) 730-2932 FS-STRTGCBD