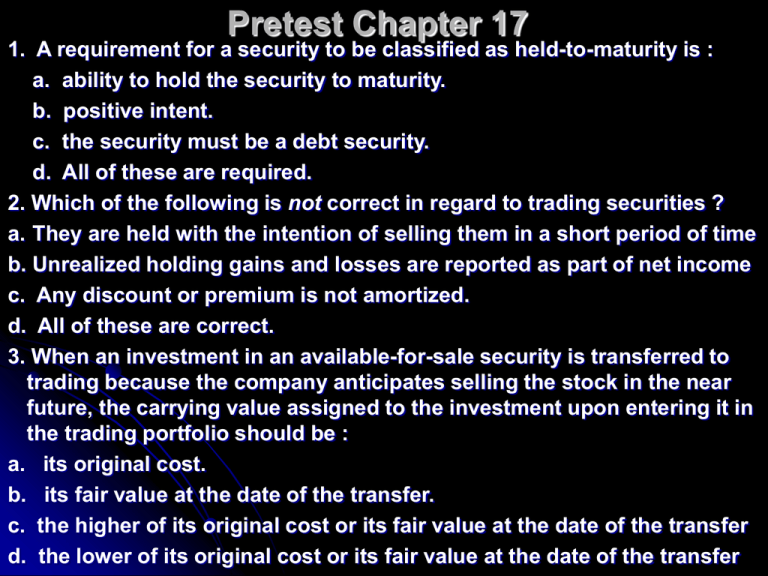

Pretest Chapter 17

advertisement

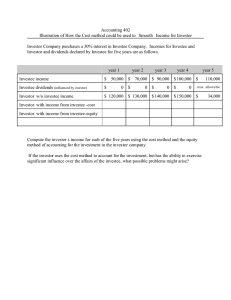

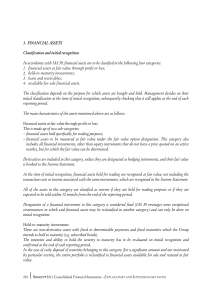

Pretest Chapter 17 1. A requirement for a security to be classified as held-to-maturity is : a. ability to hold the security to maturity. b. positive intent. c. the security must be a debt security. d. All of these are required. 2. Which of the following is not correct in regard to trading securities ? a. They are held with the intention of selling them in a short period of time b. Unrealized holding gains and losses are reported as part of net income c. Any discount or premium is not amortized. d. All of these are correct. 3. When an investment in an available-for-sale security is transferred to trading because the company anticipates selling the stock in the near future, the carrying value assigned to the investment upon entering it in the trading portfolio should be : a. its original cost. b. its fair value at the date of the transfer. c. the higher of its original cost or its fair value at the date of the transfer d. the lower of its original cost or its fair value at the date of the transfer Pretest Chapter 17 4. Under the equity method of accounting for investments, an investor recognizes its share of the earnings in the period in which the a. investor sells the investment. b. investee declares a dividend. c. investee pays a dividend. d. earnings are reported by the investee in its financial statements. 5. On October 1, 2004, Lyman Co. purchased to hold to maturity, 300 shares, $ 1,000, 9 % bonds for $ 312,000. An additional $ 19,000 was paid for accrued interest. Interest is paid semiannually on December 1 and June 1 and the bonds mature on December 1, 2008. Lyman uses straight-line amortization. Ignoring income taxes, the amount reported in Lyman's 2004 income statement from this investment should be a. $ 6,750. b. $ 6,030. c. $ 7,470. d. $ 8,190.