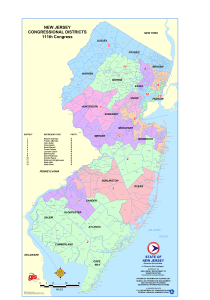

Abstract of Ratables 2010 Atlantic County (609)

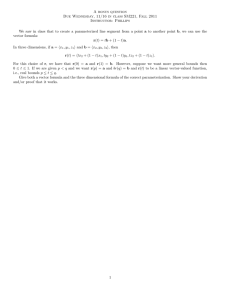

advertisement

Abstract of Ratables Atlantic County 2010 Atlantic County Board of Taxation 5909 Main Street Mays Landing; NJ 08330 (609) 645-5820 Dennis Levinson, County Executive Gerald DelRosso, County Administrator William J. Polistina, President Harry Brown, Commissioner Theresa Prendergast, Commissioner Jeffrey Waldman, Commissioner John W. Collette, Jr., Commissioner Margaret M. Schott, County Tax Administrator 2010 ATLANTICCOUNTYTAX ASSESSORS AND COLLECTORS TAXING DISTRICT ASSESSORS ADDRESSES PHONE#'S COLLECTORS PHONE#'S 1. ABSECON CITY BRIAN CONOVER MUNICIPAL COMPLEX, 500 MILL ROAD, ABSECON, NJ 08201 641-5587x115 AGNES BAMBRICK 641-2762x773 2. ATLANTIC CITY NOVELETTE 1301 BACHARACH BLVD., ROOM#606, ATLANTIC CITY, NJ 08401 347-5380 THERESA ELBERSON 347-5630 3. BRIGANTINE CITY BARBARA SACCOCCIA CITY HALL, 1417 W. BRIGANTINE AVE., BRIGANTINE,NJ 266-7600x240 DANA WINELAND 266-7600X231 4. BUENA BOROUGH DENNIS DEKLERK MUNICIPAL BLDG., 616 CENTRAL AVE.,MINOTOLA,NJ 856-697 -1783 MARYANNCORALUZZO 856-697-1783 5. BUENA VISTA TWP. BERNADETTE E. LEONARDI ROUTE 40, BOX 605, BUENA,NJ 08310 856-697-2100*8x22 TERENCE GRAFF 856-697-2100 6. CORBIN CITY BERNADETTE E. LEONARDI MUNICIPAL BUILDING, 316 ROUTE 50, CORBIN CITY, NJ 08270 628-2673 BEVERLY TOTTEN 628-2673 7. EGG HARBOR CITY WILLIAM M JOHNSON 500 LONDON AVE., EGG HARBOR CITY,NJ 08215 965-4747 BEVERLY TOTTEN 965-0123 8. EGG HARBOR TWP. MARYANNE LAVNER 3515 BARGAINTOWN 926-4083 SHARON MILLER 926-4077 9. ESTELL MANOR CITY JAMES MANCINI CITY HALL, POB 102, ESTELL MANOR,NJ 08319 476-2384 DEBORAH HAMPLE 476-2384 10. FOLSOM BOROUGH JOSEPH D. INGEMI 1700 12TH ST., RT. 54, FOLSOM,NJ 08037 561-3507 BERTHA CAPPUCIO 561-4374 11. GALLOWAYTWP. DAVID T. JACKSON 300 E. JIMMIE LEEDS RD., GALLOWAY TWP, NJ 08205 652-3700x228 ALBERT STANLEY 652-3700X234 12. HAMILTON TWP. GERARD P. MEAD 610113TH 625-1671 RENEE DESALVO 625-2151 13. HAMMONTON TOWN MARY JOAN WYATT TOWN HALL, 100 CENTRAL AVE., HAMMONTON, NJ 08037 567-4325x115 ROSEMARIE F. JACOBS 567-4304x120 14. LINWOOD CITY ARTHUR E AMONETTE CITY HALL, 400 POPLAR AVE., LINWOOD, NJ 08221 926-7973 CARL WENTZELL 926-7975 15. LONGPORT BOROUGH JEFFREY HESLEY BOROUGH HALL, 2305 ATLANTIC AVE., LONGPORT, NJ 08403 823-4015 THOMAS D. HILTNER 823-2731 16. MARGATE CITY ANDREW J. BEDNAREK CITY HALL, 1 S. WASHINGTON 822-1950 THOMAS D. HILTNER 822-2508 17. MULLICA TWP. GERARD P. MEAD TOWN'HALL, 561-7070x19 BERTHA CAPPUCCIO 561-4499 18. NORTHFIELD CITY MARK SYKES CITY HALL, 1600 SHORE ROAD, NORTHFIELD,NJ 641-2832 x128 CINDY RUFFO 641-2832X126 19. PLEASANTVILLE CITY DIANE KELLY CITY HALL 18 N. FIRST ST., PLEASANTVILLE, 484-3634 FLORROMAN 484-3631 20. PORT REPUBLIC CITY BRIAN VIGUE CITY HALL, 143 MAIN ST., PORT REPUBLIC, NJ 08241 652-1501 DONNA L. O'BRIEN 652-9334 21. SOMERS POINT CITY DIANE HESLEY 741 Shore Rd.,SOMERS POINT,NJ 08244 927-9088 x127 LYNN MacEWAN 927-9088x141 22. VENTNOR CITY JUDITH WEINER CITY HALL. 6201 ATLANTIC 823-7911 JULIE HARRON 823-7971 23. WEYMOUTH TWP. BERNADETTE MUNICIPAL BLDG., 45 S. JERSEY AVE., DOROTHY, NJ 08317 476-2633x105 DEBRA D'AMORE 476-2633x103 HOPKINS E. LEONARDI 08203 08341 RD., EGG HARBOR TWP,NJ 08234 ST.,RM#203, MAY LANDING, NJ 08330 AVE., MARGATE, NJ 08402 POB 317, WHITE HORSE PIKE, ELWOOD,NJ 08217 08225 NJ 08232 AVE., VENTNOR,NJ 08406 --. 1 ABSTRACT OF RATABLES --.-.---- 2 ----------------------------------------- 4 3 5 6 7 8 '. 2010 County Equalization Taxable Value Taxable Value Total Taxable (a) (b) TAXING DISTRICT Land Improvements Value of Land & Improvements (Col. 1[a] + [b)) Total Partial Exemptions & Abatements Net Total of Locally Assessed Taxable Value Personal of Land & Property (C. 138 L. 1966) Improvements Net Valuation Taxable (Col. 4 + 5) General Table Average Tax Rate Ratio of Assessed to Apply to True Value of per $100 Valuation (R.S. 54:3-17 to 19) Real Property (Col. 2-3) 1. ABSECON CITY 482,408,845 546,383,100 1,028,791,945 2. ATLANTIC CITY 8,324,419,900 12,163,121,000 20,487,540,900 0 16,504,000 1,648,926 1,030,440,871 1.960 20,471,036,900 9,817,552 20,480,854,452 1.809 1,028,791,9451 3. BRIGANTINE CITY 3,368,495,400 1,293,079,200 4,661,574,600 0 4,661,574,600 1,948,692 4,663,523,292 1.091 4. BUENA BOROUGH 99,480,700 302,711,800 0 302,711,800 1,751,034 304,462,834 2.335 5. BUENA VISTA TWP* 203,231,100 438,078,400 660,128,200 0 660,128,200 1,724,892 661,853,092 1.866 32,726,880 300,464,985 2.716 6. CORBIN CITY 222,049,800 9,904,400 22,743,200 32,647,600 7. EGG HARBOR CITY 101,063,700 199,962,400 301,026,100 741,370,500 1,829,553,100 2,570,923,600 39,708,500 79,288,600 118,997,100 25,638,300 1,408,561,600 80,214,500 105,852,800 8. EGG HARBOR TWP 9. ESTELL MANOR CITY 10. FOLSOM BOROUGH 2,268,168,200 3,676,729,800 966,744,300 1,310,069,200 849,415,400 11. GALLOWAY TWP 12. HAMILTON TWP 13. HAMMONTON TOWN 343,324,900 208,477,400 14. LINWOOD CITY 301,021,400 640,938,000 483,469,900 15. LONGPORT BOROUGH 1,201,251,600 16. MARGATE CITY 2,223,499,900 0 2,741,000 0 0 32,647,600 79,280 298,285,100 2,179,885 2,570,923,600 118,997,100 6,851,792 427,499 105,852,800 3.216 2,577,775,392 3.980 119,424,599 2.892 354,702 106,207,502 2.779 1.969 0 3,676,729,800 10,247,088 3,686,976,888 0 1,310,069,200 4,177,676 3,490,780 1,314,246,876 4.149 846,822,900 850,313,680 3.365 2,592,500 784,491,300 0 784,491,300 653,040 785,144,340 3.652 384,702,100 1,585,953,700 0 1,585,953,700 149,357 1,586,103,057 0.867 1,232,224,100 3,455,724,000 0 3,455,724,000 3,456,806,629 1.278 0 291,861,400 1,082,629 968,437 292,829,837 3.947 0 993,465,100 2,073,817 995,538,917 2.570 1,051,922,200 14,837,550 1,066,759,750 2.783 17. MULLICA TWP 85,702,000 206,159,400 291,861,400 18. NORTHFIELD CITY* 333,447,600 660,017,500 993,465,100 19. PLEASANTVILLE 322,836,900 737,382,100 1,060,219,000 20. PORT REPUBLIC CITY 22,291,100 55,073,100 77,364,200 0 77,364,200 341,654 77,705,854 3.188 21. SOMERS POINT CITY 261,541,800 429,820,600 691,362,400 0 691,362,400 1,786,733 693,149,133 4.155 22. VENTNOR CITY 1,803,680,050 840,333,500 2,644,013,550 0 2,644,013,550 2,511,795 2,646,525,345 1.727 23. WEYMOUTH TWP 29,212,700 68,080,000 97,292,700 0 97,292,700 402,659 97,695,359 3.229 21,959,388,995 25,828,767,400 47,788,156,395 47,758,022,095 69,507,469 47,827,529,564 TOTALS CITY* 8,296,800 30,134,300 105.25% 102.16% 107.36% 98.73% 99.34% 57.75% 96.92% 51.06% 55.66% 51.02% 97.14% 49.60% 57.25% 61.99% 69.72% 84.28% 45.70% 90.82% 84.64% 51.28% 46.80% 95.35% 53.93% Page #3 12 2010 Apportionment Section A Section IV V N.et County Municipal Net County Taxes Taxes Budget III (a) of Taxes ' B Section (b) (c) Local Health County Open Services Taxes Space Preservation (a) Trust Fund Taxes As Required by C TAXING DISTRICT Less County Apportioned State Aid Municipal Budget Library (Col. AI +AII) (RS. 52:270- State Aid Taxes 118.40) (CoI.AIII-IV) (R.S.26:3A2-19) (RS.40:12-16 to 19) III Total Tax Levy Adjusted Open Space, Rate is computed As Required Local Recreation, (Cols. AV+B[a), by Municipal Municipal Farmland & [b),[c) + CI[a), Budget Purpose Historic [b),[c), + CII) " District School Purposes District School Budget (b) (c) Regional Consolidated & Joint School on which Tax Preservation Budgets 1. ABSECON CITY 2,616,178.78 0.00 2,616,178.78 2. ATLANTIC CITY 51,835,993.05 0.00 51,835,993.05 171,685.12 D Local Taxes to be Raised for I Apportioned Section .. 49,034.10 10,194,630.00 7,161,186.59 1,007,158.52 119,676,154.50 197,959,872.00 15,451,298.00 20,192,714.59 •• 370,479,178.07 3. BRIGANTINE CITY 11,512,331.27 0.00 11,512,331.27 1,254,945.06 760,948.45 217,330.56 4. BUENA BOROUGH 831,112.44 0.00 831,112.44 89,633.06 54,349.90 15,522.60 3,666,640.49 B 2,449,703.69 7,106,962.18 5. 6. 7. BUENA VISTA TWP' 1,794,998.51 0.00 1,794,998.51 193,109.33 117,093.80 33,442.55 7,873,235.55 B 2,336,889.35 12,348,769.09 152,405.72 0.00 152,405.72 16,376.79 9,930.23 2,836.12 786,464.00 84,275.43 1,052,288.29 CITY 842,118.09 0.00 842,118.09 90,557.07 54,910.18 15,682.61 2,305,539.50 1,242,956.72 G 3,608,335.00 8,160,099.17 8. EGG HARBOR TWP 13,523,311.01 0.00 13,523,311.01 1,464,805.79 888,199.50 253,674.11 68,257,423.00 17,671,868.00 9. ESTELL MANOR CITY 576,538.23 0.00 576,538.23 62,016.35 37,604.23 10,739.95 2,430,006.00 336,777.54 3,453,682.30 10. FOLSOM BOROUGH 562,709.78 0.00 562,709.78 60,466.10 36,664.23 10,471.48 1,708,638.00 571,684.57 2,950,634.16 11. GALLOWAY 10,157,281.36 0.00 10,157,281.36 1,097,620.68 665,553.25 190,085.23 29,280,026.00 16,120,080.84 G 15,081,766.00 72,592,413.36 12. HAMILTON 7,092,224.07 0.00 7,092,224.07 766,051.62 464,503.04 132,664.32 19,390,321.00 9,505,101.47 G 17,173,971.24 54,524,836.76 13. HAMMONTON 4,004,487.71 0.00 4,004,487.71 431,989.90 261,941.39 74,811.73 17,330,874.00 6,504,047.75 28,608,152.48 14. LINWOOD 3,402,937.30 0.00 3,402,937.30 222,000.83 63,404.49 10,518,382.50 15. LONGPORT 398,441.58 113,796.84 920,717.00 16. MARGATE CITY 718,960.65 205,338.64 10,261,763.50 17. MULLICA 112,322.05 32,079.72 3,829,326.00 2,531,178.97 G 3,148,012.88 11,560,788.85 18. NORTHFIELD 192,701.92 55,036.80 9,448,577.00 5,010,283.24 M 7,955,002.08 25,582,440.87 19. PLEASANTVILLE CITY' 20. PORT REPUBLIC CITY 21. CORBIN CITY EGG HARBOR TWP TWP TOWN CITY BOROUGH TWP 6,113,025.29 0.00 6,113,025.29 11,032,920.05 0.00 11,032,920.05 657,104.02 1,539,204.00 5,756,209.67 M 1,188,209.00 1,500,000.00 20,126,257.26 7,522,437.49 13,743,447.43 0.00 1,722,629.35 2,920,839.83 3,364,200.14 0.00 3,364,200.14 366,034.71 221,948.80 63,389.85 7,877,482.00 17,799,138.00 407,351.64 0.00 407,351.64 43,772.06 26,541.63 7,580.42 1,530,305.00 445,615.00 SOMERS POINT CITY 3,879,102.47 0.00 3,879,102.47 428,363.62 259,742.54 74,183.73 8,648,205.50 22. VENTNOR 7,393,634.57 0.00 7,393,634.57 802,595.75 486,661.94 138,993.01 16,914,449.00 23. WEYMOUTH 485,825.72 0.00 485,825.72 52,361.21 31,749.74 9,067.88 1,975,222.00 146,224,156.38 0.00 146,224,156.38 8,063,043.00 6,194,455.00 2,776,325.26 358,735,803.50 CITY TWP Totals 29,692,193.50 15,541.00 8,673,415.46 M 1,619,175.00 58,542,171.51 28,673,581.28 44,172,286.28 0.00 6,836,484.56 •• 5,846,588.00 102,574,836.41 20,453,303.44 1,722,629.35 185,239.88 515,555.00 5,540,362.70 2,920,839.83 CITY· 50,862,314.60 2,476,706.75 28,799,497.88 18,330,278.00 45,685,787.27 590,831.00 9,770.00 3,154,827.55 381,525,030.47 540,866.00 968,448,439.12 'Revalued "Revaluation "'Prior Abatement Year Adjustment Amount included (B = Buena Regional; G = Greater Egg Harbor Regional; M = Mainland Regional) Page #5 ABSTRACT 13 OF RATABLES Real Property Exempt From Taxation 2010 (a) (b) (c) Public Other School Property School Property (d) Public Property (e) (f) Church & Cemeteries Charitable Property & Graveyards (g) Other Exemptions not included Foregoing TAXING DISTRICT in Classifications Total Amount of Real Property Exempt From Taxation (a+b+c+d+e+f) 1. ABSECON CITY 21,759,000 2. ATLANTIC CITY 154,073,600 3. BRIGANTINE 11,460,500 13,105,900 0 38,075,400 100,776,900 0 2,121,415,600 216,147,000 0 2,124,197,300 4,615,833,500 0 16,376,100 14,135,000 231,767,700 26,282,200 46,096,600 355,700 7,912,100 68,633,500 53,600 2,775,000 6,373,200 8,929,800 188,200 8,944,900 54,913,714 178,475,300 38,886,000 5,595,700 42,099,700 341,905,300 18,118,200 686,500 25,600 1,889,900 23,424,700 0 510,400 5,741,800 CITY 29,658,300 181,384,700 6,589,700 4. BUENA BOROUGH 6,559,700 2,214,800 5,395,300 5,369,800 274,800 20,771,100 18,252,400 17,682,300 3,659,900 2,220,600 1,130,100 193,900 1,633,700 28,930,614 0 0 5. BUENA VISTA TWP" 6. CORBIN CITY 7. EGG HARBOR CITY 6,286,500 8. EGG HARBOR TWP 76,848,600 9. 0 ESTELL MANOR CITY 2,704,500 2,480,400 1,012,900 15,774,200 101,135,720 70,427,300 807,000 232,100,200 802,868,920 72,092,500 321,400 35,231,600 5,385,400 3,547,100 93,091,600 209,669,600 44,878,200 2,924,700 21,585,700 15,067,700 323,800 11,404,800 412,100 6,933,200 13,634,900 204,000 19,767,300 96,184,900 72,427,200 36,701,300 7,045,100 0 699,800 44,446,200 111,210,700 29,406,200 0 6,545,900 172,109,200 14,620,500 2,062,100 222,100 2,501,400 23,364,400 1,738,100 10. FOLSOM BOROUGH 11. GALLOWAY 12. HAMILTON TWP 13. HAMMONTON 14. LINWOOD CITY 31,475,700 15. LONGPORT BOROUGH 16. MARGATE CITY 0 24,166,400 17. MULLICATWP 18. NORTHFIELD 19. PLEASANTVILLE 382,624,500 TWP TOWN 3,958,300 CITY" CITY" 5,000 1,926,400 114,608,370 54,963,000 980,300 29,293,300 25,968,600 10,372,800 211,846,900 1,177,600 9,403,900 TOTALS 0 22,121,400 PORT REPUBLIC CITY VENTNOR CITY 780,000 82,962,400 SOMERS POINT CITY WEYMOUTH TWP 0 1,451,000 21. 23. 0 6,142,170 20. 22. 0 0 3,436,800 3,874,800 760,700 145,400 90,268,900 299,400 15,691,500 7,602,700 71,600 68,347,000 104,553,500 6,257,900 15,808,900 0 27,574,580 10,894,190 0 12,021,080 66,298,750 2,512,900 0 2,325,100 654,200 0 850,100 6,342,300 3,055,613,414 505,611,890 969,603,470 66,778,100 22,192,400 2,806,645,780 7,426,445,054 "Revalued Page #6 ABSTRACT 14 OF RAT ABLES 15 Amount of Miscellaneous Revenues for the Support of the Local Municipal Budgets 2010 TAXING DISTRICT Deductions Allowed (C.73, L 1976) (a) (b) Surplus Revenues Revenues Delinquent Total of Misc. Revenues Appropriated Anticipated Taxes & Liens (a+b+c) Misc. (c) Receipts (d) from (a) (b) Full Estimated Amount of SeDiSu Deductions Veterans Allowed Deductions (C.129, L 1976) 1,623,469.13 725,000.00 2,921,769.13 74 18,500 440 110,000 26,154,511.00 150,000.00 26,304,511.00 254 63,500 5431 135,750 1,345,000.00 3,251,272.22 302,000.00 4,898,272.22 99 24,750 542 135,500 70,000.00 785,385.90 220,000.00 1,075,385.90 89 22,250 156 39,000 BUENA VISTA TWP* 185,000.00 1,862,700.00 75,000.00 2,122,700.00 123 30,750 237 59,250 6. CORBIN CITY 256,587.00 147,979.09 30,000.00 434,566.09 7 1,750 25 6,250 7. EGG HARBOR CITY 131,145 2,922,608 10,000 3,063,753.00 78 19,500 152 38,000 8. 9. EGG HARBOR TWP 648,753.00 15,247,997.00 82,041.00 15,978,791.00 257 64,250 1,099 274,750 ESTELL MANOR CITY 300,000.00 693,195.18 75,000.00 1,068,195.18 32 8,000 78 19,500 10. FOLSOM BOROUGH 258,000.00 487,625.89 95,000.00 840,625.89 22 5,500 79 19,750 11. GALLOWAY 2,535,000.00 4,997,977.75 20,164.91 7,553,142.66 260 65,00Q 1,287 321,750 1. ABSECON CITY 2. ATLANTIC CITY 573,300.00 3. BRIGANTINE CITY 4. BUENA BOROUGH 5. 0.00 TWP 12. HAMIL TON TWP 2,803,000.00 5,704,224.54 600,000.00 9,107,224.54 196 49,000 629 157,250 13. HAMMONTON 2,171,000.00 3,396,973.50 14,823.00 5,582,796.50 270 67,500 529 132,250 14. LINWOOD CITY 475,000.00 3,385,334.00 250,073.00 4,110,407.00 43 10,750 326 81,500 15. LONGPORT BOROUGH 350,000.00 995,262.75 110,000.00 1,455,262.75 18 4,500 90 22,500 16. MARGATE CITY 2,365,000.00 2,725,434.27 525,000.00 5,615,434.27 66 16,500 409 102,250 1,000,000.00 1,363,603.43 386,500.00 2,750,103.43 92 23,000 234 58,500 1,380,000.00 3,058,843.47 200,000.00 4,638,843.47 134 33,500 447 111,750 65,500 17. MULLICATWP 18. NORTHFIELD TOWN CITY* 19. PLEASANTVILLE 20. PORT REPUBLIC CITY 10,277 ,572.00 38,000.00 10,315,572.00 198 49,500 262 214,570.00 431,534.00 70,000.00 716,104.00 13 3,250 56 21. 14,000 SOMERS POINT CITY 1,223,500.00 2,415,624.10 400,000.00 4,039,124.10 121 30,250 416 104,000 22. VENTNOR CITY 1,300,000.00 3,833,762.00 1,088,320.00 6,222,082.00 111 27,750 388 97,000 23. WEYMOUTH TWP 380,000.00 304,371.00 684,371.00 19 4,625 61 15,250 19,964,855.00 96,067,260.22 121,499,037.13 2,576 643,875 8,485 2,121,250 TOTALS CITY* 0.00 0.00 5,466,921.91 *Revalued Page #7 ADDENDUM TO 2010 ABSTRACT OF RATABLES - ASSESSED VALUE OF PARTIAL EXEMPTIONS & ABATEMENTS ABSTRACT OF RATABLES 2010 (1) (2) (3) (4) (5) (6) (7) (8) Air/Water Pollution Control R.S.54:43.56 Automatic Fire Suppression Systems R.S.54:43.130 Fallout Shelter R.S.54:4- Waterl Sewage Facility R.S.54:4- Urban Enterprise Zone R.S.54:43.139 Chapter 104 P.L. 1977 Chapter 233 P.L. 1979 Chapter 12 P.L.1977 (Residential and Industrial) R.S.54:4-3.72 (Multiple Dwelling) R.S.54:4-3.121 (Commercial and Industrial) R.S. 54:4-3.95 3.48 3.59 Only to be used until Only to be used until TAXING DISTRICT 1. ABSECON CITY ATLANTIC CITY 2. BRIGANTINE CITY 3. 4. BUENA BOROUGH 5. BUENA VISTA TWP" 6. CORBIN CITY 7. EGG HARBOR CITY EGG HARBOR TWP 8. 9. ESTELL MANOR CITY 10. FOLSOM BOROUGH 11. GALLOWAY TWP 12. HAMILTON TWP 13. HAMMONTON TOWN 14. LINWOOD CITY 15. LONGPORT BOROUGH 16. MARGATE CITY 17. MULLICA TWP 18. NORTHFIELD CITY" 19. PLEASANTVILLE CITY* 20. PORT REPUBLIC CITY 21.. SOMERS POINT CITY 22. VENTNOR CITY 23. WEYMOUTH TWP TOTALS Only to be used until year 2000 (Repealed) year 2000 (Repealed) year 2000 (Repealed) 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 o o o o o o o o *Revalued Page #8 ADDENDUM TO 2010 ABSTRACT OF RATABLES - ASSESSED VALUE OF PARTIAL EXEMPTIONS & ABATEMENTS ABSTRACT Of RATABLES 2010 (9) (10) (11) (12) (13) (14) (15) (16) Dwelling Abatement Chapter 441 P.L. 1991 R.S. 40A:21-5 Dwelling Exemption Chapter 441 P.L. 1991 R.S. 40A:21-5 New Dwelling New Dwelling 'Conversion Exemptions Chapter 441 P.L. 1991 Multi Dwelling Commercial R:S. 40A:21-5 R.S. 40A:21-6 Multi Dwelling 'Conversion Exemption Chapter 441 P.L. 1991 R.S. 40A:21-6 Total Assessed Value as Reflected In Column 3 of Abstract of Ratables TAXING DISTRICT 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 'Conversion Abatement Chapter 441 P.L. 1991 R.S. 40A:21-5 'Conversion Abatement Chapter 441 P.L. 1991 'Industrial Exemption Chapter 441 P.L. 1991 R.S. 40A:21-7 ABSECON CITY ATLANTIC CITY BRIGANTINE CITY BUENA BOROUGH BUENA VISTA TWP* CORBIN CITY EGG HARBOR CITY EGG HARBOR TWP ESTELL MANOR CITY FOLSOM BOROUGH GALLOWAY TWP HAMILTON TWP HAMMONTON TOWN LINWOOD CITY LONGPORT BOROUGH MARGATE CITY MULLICA TWP NORTHFIELD CITY* PLEASANTVILLE CITY* PORT REPUBLIC CITY SOMERS POINT CITY VENTNOR CITY WEYMOUTH TWP 0 30,000 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 149,200 0 0 0 0 2,741,000 0 0 0 0 0 0 0 0 0 0 0 6,356,200 0 0 0 0 0 2,281,800 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 8,099,200 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 5,943,800 0 0 0 0 0 0 0 0 0 0 2,592,500 0 0 0 0 0 1,940,600 0 0 0 0 0 16,504,000 0 0 0 0 2,741,000 0 0 0 0 0 2,592,500 0 0 0 0 0 8,296,800 0 0 0 0 TOTALS 30,000 9,246,400 2,281,800 8,099,200 o o 10,476,900 30,134,300 *Revalued Page #9 Tax Rate Certific~tion Schedule I -- 2010 County Taxes County Library Rate Rate Local Taxes School Taxes Total Local Local Local Municipal Budget Municipal Purpose Open Space Local Health Services Open Space Preservation Total County District School Regional School Rate Rate Rate Rate Rate Rate Rate 0.017 0.000 0.016 0.018 0.018 0.030 0.018 0.034 0.031 0.035 0.018 0.035 0.031 0.028 0.025 0.021 0.038 0.019 0.021 0.034 0.037 0.019 0.032 0.005 0.005 0.005 0.005 0.005 0.009 0.005 0.010 0.009 0.010 0.005 0.010 0.009 0.008 0.007 0.006 0.011 0.006 0.006 0.010 0.011 0.005 0.009 0.276 0.258 0.295 0.326 0.323 0.555 0.334 0.626 0.575 0.632 0.329 0.644 0.562 0.473 0.460 0.989 0.000 0.000 0.000 1.204 1.190 0.000 0.414 0.000 0.000 0.033 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.152 0.000 0.043 0.000 0.000 0.000 0.000 0.000 0.061 0.000 0.695 0.967 0.432 Effective Total Tax Tax Rate Ratio Rate 1.960 1.809 1.091 2.335 1.866 3.216 2.716 3.980 2.892 2.779 1.969 4.149 3.365 3.652 0.867 1.278 3.947 2.570 2.783 3.188 4.155 1.727 3.229 105.25% 102.16% 107.36% 98.73% 99.34% 57.75% 96.92% 51.08% 55.66% 51.02% 97.14% 49.60% 57.25% 61.99% 69.72% 84.28% 45.70% 90.82% 84.64% 51.28% 46.80% 95.35% 53.93% 2.063 1.848 1.171 2.305 1.854 1.857 2.632 2.033 1.610 1.418 TAXING DISTRICT 1. 2. ABSECON CITY 3. BRIGANTINE 4. BUENA BOROUGH 5. BUENA VISTA TWP* 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. CORBIN CITY ATLANTIC CITY ** CITY EGG HARBOR CITY EGG HARBOR TWP ESTELL MANOR CITY FOLSOM BOROUGH GALLOWAY TWP HAMILTON TWP HAMMONTON TOWN LINWOOD CITY LONGPORT BOROUGH MARGATE CITY MULLICA TWP NORTHFIELD CITY* PLEASANTVILLE CITY* PORT REPUBLIC CITY SOMERS POINT CITY VENTNOR CITY WEYMOUTH TWP 0.254 0.253 0.247 0.273 0.271 0.466 0.280 0.525 0.483 0.530 0.276 0.541 0.471 0.437 0.386 0.319 0.588 0.294 0.315 0.524 0.560 0.280 0.497 0.000 0.000 0.027 0.030 0.029 0.050 0.031 0.057 0.052 0.057 0.030 0.058 0.051 0.000 0.042 0.000 0.063 0.000 0.034 0.057 0.062 0.030 0.054 0.346 0.700 0.319 0.376 0.625 0.670 0.334 0.592 0.584 0.331 0.000 0.000 2.403 0.767 2.648 2.035 1.609 0.794 1.475 2.038 1.340 0.058 0.297 1.308 0.949 0.738 1.969 1.248 0.639 2.022 0.000 0.000 0.000 0.437 0.723 0.000 0.733 0.000 0.000 0.864 0.503 0.000 0.000 0.986 0.000 0.000 0.805 0.353 0.258 1.201 0.686 0.282 0.538 0.409 1.307 0.765 0.954 0.349 0.592 1.075 0.799 1.669 0.574 1.251 0.693 0.605 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.020 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.020 0.000 0.000 0.010 1.913 2.058 1.926 2.264 0.604 1.077 1.804 2.334 2.356 1.635 1.945 1.647 1.741 *Revalued **Revaluation Abatement Amount Page #10 ABSTRACTOFRATABLES 2010 " TOTAL LINE ITEMS AND ASSESSMENTS CLASS1 LINE ITEMS CLASS1 ASSESSED VALUE CLASS 2 CLASS 2 LINE ITEMS ASSESSED VALUE CLASS3A LINE ITEMS CLASS3A ASSESSED VALUE CLASS3B LINE ITEMS CLASS3B ASSESSED VALUE CLASS4A LINE ITEMS FOR ATLANTIC CLASS4A ASSESSED VALUE COUNTY CLASS4B LINE ITEMS CLASS4B ASSESSED VALUE CLASS4C LINE ITEMS CLASS4C ASSESSED VALUE TOTAL LINE ITEMS TOTAL ASSESSED VALUE TAXING DISTRICT 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. ABSECON CITY ATLANTIC CITY BRIGANTINE CITY BUENA BOROUGH BUENA VISTA TWP" CORBIN CITY EGG HARBOR CITY EGG HARBOR TWP ESTELL MANOR CITY FOLSOM BOROUGH GALLOWAYTWP HAMILTON TWP HAMMONTON TOWN LINWOOD CITY LONGPORT BOROUGH MARGATE CITY MULLICA TWP NORTHFIELD CITY* PLEASANTVILLE CITY" PORT REPUBLIC CITY SOMERS POINT CITY VENTNOR CITY WEYMOUTH TWP TOTALS 551 2,286 196 215 2,888 76 1,042 4,315 729 451 3,736 4,949 716 138 64 209 1,662 218 427 105 173 119 314 37,483,145 1,181,823,900 76,346,600 9,751,500 35,300,200 1,684,500 6,988,700 118,169,900 8,897,200 4,236,100 136,666,800 64,734,600 18,359,200 14,155,200 50,730,100 47,714,300 13,922,600 21,365,600 24,659,300 2,192,000 9,673,000 42,014,300 5,299,400 3,255 11,089 8,540 1,265 2,415 25,579 1,932,168,145 817,257,600 2,799,361,800 4,489,202,400 214 1,236 14,165 735 666 13,267 8,562 4,573 2,735 1,590 6,551 2,172 3,118 5,134 457 3,753 6,310 660 230,358,000 524,315,100 27,016,400 234,673,900 1,988,870,600 99,847,900 79,034,300 2,985,184,800 895,118,800 617,744,600 683,099,000 1,531,492,600 3,311,966,600 250,731,000 756,993,900 652,008,700 71,423,800 475,701,700 2,495,328,850 80,424,900 0 0 0 96 117 3 0 22 19 11 122 42 168 2 0 0 57 1 0 6 0 0 1 0 0 0 18,365,000 28,290,700 507,500 0 3,888,200 2,882,000 1,795,500 33,225,500 7,016,300 23,051,900 749,400 102,462 26,097,157,250 667 128,344,100 0 0 6,685,600 595,200 0 1,147,400 0 0 143,900 0 0 0 166 264 11 0 66 50 56 263 151 418 2 0 185 177 1 0 6 0 0 1 1,837 0 0 0 1,688,000 2,470,100 107,500 0 527,000 1,717,400 178,400 1,468,600 1,843,300 5,877,300 34,600 0 89,331,100 2,224,300 3,600 0 56,700 0 0 3,300 107,531,200 195 1,714 115 98 93 16 149 900 6 40 444 242 407 146 8 185 86 223 366 12 277 134 33 174,051,200 16,222,646,800 92,716,600 29,873,600 56,224,900 3,331,700 43,187,700 431,936,100 269,334,500 153,837,600 86,453,100 2,523,200 89,331,100 15,126,200 213,519,700 200,438,000 2,544,300 164,782,600 90,037,600 9,774,600 0 9 0 3 13 0 17 21 5 12 2 11 26 0 0 0 3 0 83 0 0 2 1 5,889 18,786,115,700 208 422,623,800 3,379,300 8,441,500 0 4,848,500 0 3,789,800 13,087,400 0 9,390,400 28,633,700 1,573,300 12,167,000 17,058,000 15,076,200 20,219,400 0 0 0 2,656,300 0 102,129,400 0 0 1,604,100 206,700 232,440,200 0 178 5 10 1 0 10 12 1 0 17 16 12 0 0 10 2 3 23 0 14 29 2 0 262,355,900 3,309,000 8,885,900 439,800 0 6,790,400 8,210,400 345 573,431,600 700,000 0 71,190,000 56,945,500 7,732,900 0 0 6,712,000 515,400 987,100 80,983,600 0 41,205,100 15,028,700 1,439,900 4,001 1,901 8,856 1,853 5,811 320 2,454 19,501 1,545 1,236 17,851 269 6,320 3,023 1,662 6,955 4,159 3,564 6,033 584 4,219 6,594 1,012 1,028,791,945 16,489,851,200 4,661,574,600 302,711,800 660,128,200 32,647,600 301,026,100 2,570,923,600 118,997,100 105,852,800 3,676,729,800 341,356,200 846,822,900 784,491,300 1,585,953,700 3,455,724,000 291,861,400 993,465,100 1,060,219,000 77,364,200 691,362,400 2,644,013,550 97,292,700 109,723 42,819,161,195 "Revalued Page #11 ABSTRACT OF RATABLES - 2010 Special Taxing Districts Tax Rate per $100 Assessed Valuation Total amount of miscellaneous revenues (including Surplus 42,526,223.57 revenues apportioned) for support of the County Budget TAXING DISTRICT Rate per $100 to be applied to Column 11 for apportionment of County Taxes 0.268686831564 0.02887180352 Rate per $100 to be applied to Column 11 for apportionment of County Library Taxes Assessed Tax Total Valuation Rate Levy ATLANTIC CITY I Special Improvement District 10,937,953,500 1 ---'-'0.0:..:..3---=76...L1 4_1--'13_00-'..J0 I Rate per $100 to be applied to Column 11 for apportionment of Local Health 0.017506706014 Services Taxes BUENA BOROUGH Fire District #1 Rate per $100 to be applied to Column 11 for apportionment of Open Space 0.00500000 Preservation Trust Fund Tax Fire District #2 142,938,300 161,254,734 0.080 114,150 0.116 186,655 BUENA VISTA TWP Fire District #1 187,121,400 0.092 171,412 'Adjustments (Net total12A lib +/-) 146,224,156.38 2,968,229.48 Fire District #2 149,695,000 0.167 249,300 Total County Taxes Apportioned (Including Adj~stments - Total 12A1 +/-) 149,192,385.86 Fire District #3 Fire District #4 146,870,000 74,302,700 0.096 0.083 140,300 61,400 Fire District #5 102,139,100 0.175 178,420 Net County Taxes Apportioned (12AIII) 'Net overpayments are added to the net taxes apportioned and net underpayments are deducted ;;ES~ f)llg'a~tt Tax Administrator > ----------'~ * . I L1AMP TINA, President I hereby certify that this is a true copy of the Abstract of Ratables for the year 2010 as filed in my office by the Atlantic HARR~, Commissioner ~~ THERESA PRENDERGAST, --3;;::; u-- C County Board of Taxation mmi§kioner ~ Jane Lugo Treasurer of Atlantic County JEFFREY WALDMAN, Commissioner JO~E~,C;f1~~~L .\ , Page #12