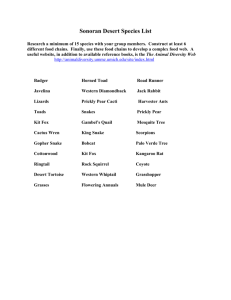

Tugas17 Peter Pepper Company paid $100,000 ...

advertisement

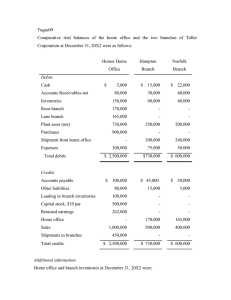

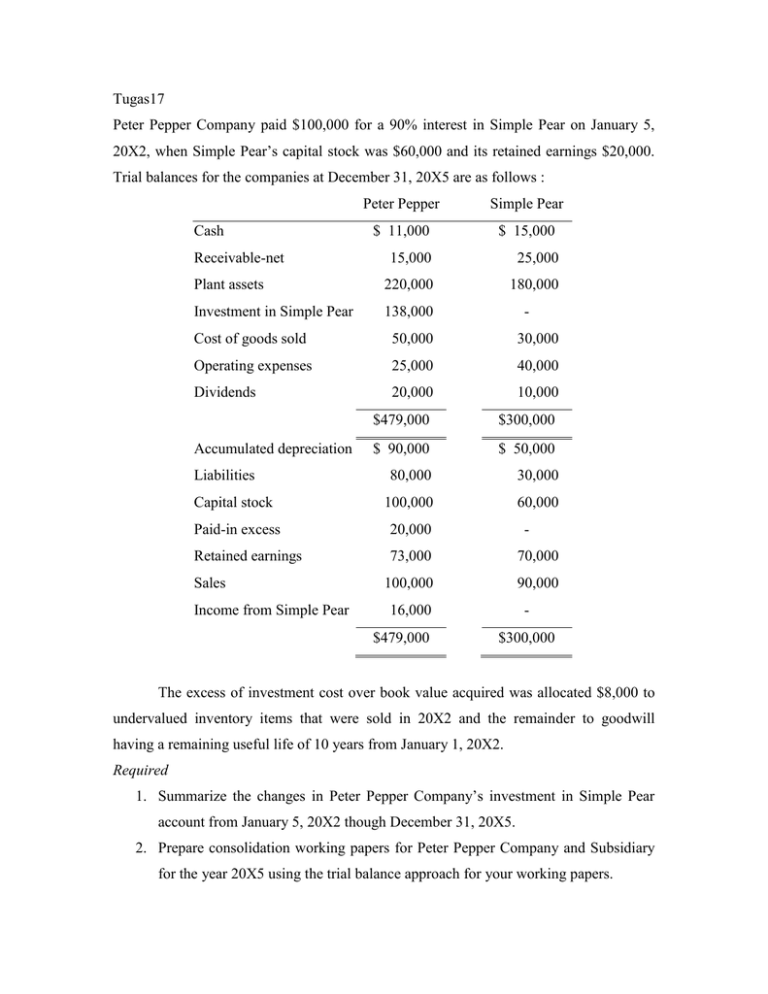

Tugas17 Peter Pepper Company paid $100,000 for a 90% interest in Simple Pear on January 5, 20X2, when Simple Pear’s capital stock was $60,000 and its retained earnings $20,000. Trial balances for the companies at December 31, 20X5 are as follows : Peter Pepper Simple Pear $ 11,000 $ 15,000 15,000 25,000 Plant assets 220,000 180,000 Investment in Simple Pear 138,000 Cash Receivable-net - Cost of goods sold 50,000 30,000 Operating expenses 25,000 40,000 Dividends 20,000 10,000 $479,000 $300,000 $ 90,000 $ 50,000 80,000 30,000 Capital stock 100,000 60,000 Paid-in excess 20,000 Retained earnings 73,000 70,000 100,000 90,000 Accumulated depreciation Liabilities Sales Income from Simple Pear - 16,000 $479,000 $300,000 The excess of investment cost over book value acquired was allocated $8,000 to undervalued inventory items that were sold in 20X2 and the remainder to goodwill having a remaining useful life of 10 years from January 1, 20X2. Required 1. Summarize the changes in Peter Pepper Company’s investment in Simple Pear account from January 5, 20X2 though December 31, 20X5. 2. Prepare consolidation working papers for Peter Pepper Company and Subsidiary for the year 20X5 using the trial balance approach for your working papers.