Finance

advertisement

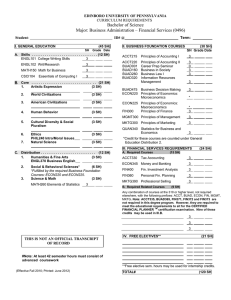

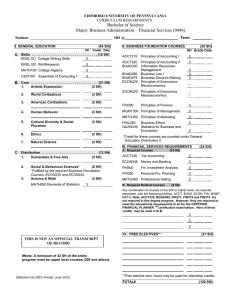

New Program Begins Fall 2014 Apply Now! Finance A major in finance will facilitate learning to ensure that students have a solid understanding of the fundamental concepts and tools of finance used by financial managers to identify financial problems and opportunities, analyze their impact, and design solutions in a variety of situations and organizations. As a result, students will be prepared for fulfilling and successful careers in finance and have the necessary academic foundation for graduate studies. A new state-of-the-art finance trading room will give students the opportunity to use their financial skills in a real-world setting. Students who are interested in careers in the broad categories of investment management, financial analysis, insurance and risk management, real estate management, and corporate and financial institutions management will be well suited to this finance major. This program will provide students with the necessary quantitative skills, the ability to analyze and interpret data, and interpersonal and communication skills to successfully fulfill the responsibilities of many growing financial career titles. Learning Outcomes Students who successfully complete the Finance major will be able to: 1. Demonstrate proficiencies in accounting, economics, finance, management, marketing, and management information systems. 2. Communicate orally and in writing about business topics. 3. Describe the implications of globalization and cultural diversity in business. 4. Apply quantitative decision-making skills in the business. 5. Identify and operate appropriate computer software and data resources for analysis and data presentation. 6. Comprehend and evaluate the critical characteristics of financial securities. 7. Identify and measure risks and rewards of investing in various financial instruments. 8. Interpret and assess the roles of financial institutions and the services they provide. 9. Calculate the costs of capital and solve capital budgeting problems using the cost of capital. 10. Demonstrate the use of the legal, ethical and social responsibility dimensions of business decision-making. 11. Demonstrate the use of specialized training provided by the finance internship and finance electives. 1 Courses Required for the Finance Major* Core Requirements: ACC 2010 ACC 2021 ECO 2010 ECO 2020 MAT 2090 MAT-MGT 3200 MAT 2010 MGT 2010 MGT 2240 MKT 2250 MIS 3010 Credits Principles of Accounting I Principles of Accounting II Principles of Microeconomics Principles of Macroeconomics Statistical Methods Operations Analysis and Modeling Calculus I Business Law I Principles of Management Principles of Marketing Intro to Management Info Systems 3 3 3 3 4 3 4 3 3 3 3 Total credits for Core courses: 35.0 Finance Courses: ECO-FIN 3030 FIN 3010 FIN 3100 FIN 3200 FIN 4100 FIN 4200 FIN 4510 Money and Financial Institutions Corporation Finance Investments I Investments II Portfolio Management Case Problems in Financial Management Internship in Finance 3 3 3 3 3 3 3 or 6 Electives: Choose 6 credit hours from the following courses: (6.0 credits) ECO 3200 International Trade and Finance 3 ECO-FIN 3970 Financial Econometrics 6 Any FIN course at the 3000 or 4000 level 3 Total credits for Finance courses: 27.0 – 30.0 Total credits required to complete the major: 62.0 – 65.0 In addition to the total credit hours required for the major, all students must complete all general education degree requirements. Total of 120 credits required for graduation. *Finance may also be completed as a minor or students can major in Business Administration with a Specialization in Finance. Elmira College accepts a maximum of sixty-eight (68) semester hours of credit from two-year colleges. Students who have received an Associate of Science degree from Corning Community College are accepted as Juniors, if they have at least 54 college transfer credits. 2