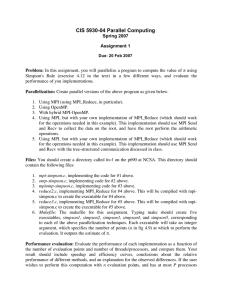

JUNE: SHORTER THAN EVER

advertisement

In partnership with JUNE: SHORTER THAN EVER The challenge of short lead times stabilized earlier this year, but ongoing economic uncertainty and the related need for greater risk management manifest themselves in June with even shorter lead times than before (including several reports of lead times less than 30 days). Both planners and suppliers report difficulty getting their contracts signed and obtaining final budget signoff. CURRENT BUSINESS Conditions CONDITIONS Current Business Favorable (better than last year) Flat (no change from last year) Negative (worse than last year) 100% Survey Respondents 80% 68% 64% 72% 66% 60% 63% 65% 63% 21% 18% 21% 15% 14% 17% 16% Dec 11 Feb 12 40% 23% 20% 0% 20% 15% 16% Feb 11 13% 13% Apr 11 June 11 Aug 11 Oct 11 TODAY’S TRENDS The events that led up to the GSA meeting scandal in the U.S. are causing insecurity among professionals about U.S. government policies and meetings (which have declined significantly). A notable jump in meeting professionals cite an increase in their use of virtual and hybrid technologies. TODAY’S PREDICTIONS Concerns over global economic uncertainty dominate the horizon. Demand for social media use will continue to increase. Expect more (but not always welcome) forms of technology. Meetings and events will become more interactive as new technologies allow attendees to take more active roles. In the U.S., the U.S. government will take a larger role in controlling or influencing the meeting and event industry. 60% 25% 23% 17% 16% Apr12 June 2012 EXECUTIVE SUMMARY Short lead times (sometimes less than 30 days) dominate global headlines. European economic uncertainty remains, which spells increasing anxiety for meeting professionals awaiting resolution. 58% STORY The number of U.S. and European meeting professionals reporting uncertainty about the economy hasn’t changed since April 2012, but anxiety is increasing. Meeting professionals have been hoping for improved conditions for the past six months, and the ongoing economic uncertainty challenges their abilities to execute, plan and strategize. These are reducing cost efficiencies and, in some cases, quality. Ongoing concerns over the European debt crisis, the November U.S. presidential elections and anticipated rising fuel costs represent significant challenges for meeting professionals. Regional challenges do vary, but many of the solutions are the same—become more flexible and smarter with technology, broaden customer and supplier bases, build strong relationships and expose waste. At the same time, meeting professionals are challenged to provide extraordinary experiences, using engaging and novel concepts. Even so, the future of meetings holds many known qualities— increased demands for social media, more technological solutions, younger attendee populations, relatively high fuel prices and governments that struggle for solutions to sovereign issues—all giving meeting professionals a framework within which to devise their long-term strategies. 1 CURRENT CONDITIONS in government policy and decisionmaking. Several indicate their intention to focus less on the U.S. government market sector, citing its volatility. Virtual and hybrid technologies are once again gaining popularity among meeting professionals as a way to expand the impact of events, expose more people to content with less budget, increase attendance and be Media coverage surrounding the decisions that led to the General Services Administration (GSA) meeting scandal has left many meeting professionals dismayed about U.S. government policy surrounding meeting budgets. The sharp decline in government meetings that followed the scandal has further shaken meeting professional confidence U.S. government policies (U.S. only) Full-Time 100% Favorable (better than last year) Flat (no change from last year) Negative (worse than last year) Part-Time 100% 80% 80% 71% 63% 61% 60% 25% 29% 58% 39% 31% 28% 57% 10% 7% 0% 37% 5% 9% 5% 0% Oct 11 Dec 11 Feb 12 Apr 12 June 2012 7% 9% 2% 9% 6% Oct 11 Dec 11 Feb 12 Apr 12 June 2012 0% 6% 7% 4% Favorable (better than last year) Flat (no change from last year) Negative (worse than last year) 100% 60% 49% 20% 0% 2012: 9% 3% April June 2012: 6% More Virtual/ Hybrid Use 2012: 2% 4% April June 2012: 6% “There are more hybrid meetings to increase the reach of events. This means new revenue streams for organizers.” Changing Revenue/ Business Models 2012: 2% 4% April June 2012: 6% “The financial model for running large conventions is broken; no one wants to pay for anything.” 80% 40% 5% Oct 11 Dec 11 Feb 12 Apr 12 June 2012 ATTENDANCE TRENDS Survey Respondents 30% 20% 21% Increasing Travel Costs 40% 28% 29% 20% 13% 40% 40% 20% 20% 58% 60% 62% 40% 40% “With a presidential campaign and the European financial crisis looming, American businesses are nervous about sudden changes in the economy.” “Due to restrictions in government travel, we will see a huge decrease in this particular market segment in our area.” 54% 22% 2012: 1% 6% April June 2012: 7% 70% 67% 65% 60% 31% April 2012: 7% June 2012: 7% Contractor 80% 70% 60% -- “Government meetings have really been impacted by the bad behavior of the GSA.” EMPLOYMENT TRENDS 68% “Short lead times on bookings continue. And when looking at the forecast, tentatives do not yet exist. It makes it hard to determine if budget can be achieved. It’s a Catch 22.”” “International business is moving away from Europe and into Asia due to unstable economy in Europe. Asia is an emerging market for many corporations.” 6% 65% 2012: 10% 6% April June 2012: 16% Short Lead Times EU Economy Concerns about the U.S. government’s policies in regards to meetings and events have increased by 100% CURRENT TRENDING TOPICS 30% 43% 28% 55% 24% 21% 21% 54% 27% 19% 49% 44% 32% 46% 31% 59% 47% 48% 31% 33% 35% 53% 30% 36% 19% 20% 23% 20% 17% 17% Apr 12 June 2012 “Flexibility is still on the minds of event marketers, meeting professionals and trade show organizers. If you are not flexible then you do not win business.” 10% Oct 10 Dec 10 Feb 11 Apr 11 June 11 Aug 11 Oct 11 Dec 11 Feb 12 2 Concerns about the global economy have risen by 7% environmentally responsible. Meeting professionals are more at ease with the virtual and hybrid technologies, as they have seen successful implementation over time. Some consider virtual and hybrid technology to be integral to modern events. U.S. meeting professionals disagree greatly on how the upcoming election will impact events. They disagree on which candidate will have the most positive and negative impacts on the industry, but more consistently agree that changes are in store. In general, industry health has gradually improved for the last 18 months. Budgets are increasing, as are attendance and employment. Meeting professionals frequently refer to changes they are making to adapt to a rapidly shifting marketplace, including the needs to remain flexible, embrace new technology, make smarter hiring MORE CURRENT TRENDS Ongoing global political and social challenges will keep oil prices, and therefore airline costs, high into the distant future. Meeting professionals anticipate the move to more regional, local and virtual/hybrid meetings to continue and accelerate in the future as companies attempt to implement long-term controls on costs and potentially demonstrate greater environmental responsibility. The U.S. presidential election will have a significant effect on meetings and events, but it’s unclear what that effect will be. decisions and provide better training. Meeting professionals are looking for new employees with technology and social media know-how. The increased demand for social media exposure and advances in technology are changing rapidly and require the expertise that comes from employees who have been dedicated to the field for some time. Meeting professionals are also looking at new marketing strategies and approaching new client bases in order to stabilize and expand their businesses. This means learning new vocabulary, new strategies and new ways of working. Meeting professionals are building new relationships and alliances that make it easier for them to adapt to changing market demands. This trend emerged almost a year ago and continues to become more prominent. FUTURE FORECAST The increasing demand for social media represents a significant challenge for many meeting professionals, as they haven’t come to fully understand the benefits or implementations of the different options. They want to understand what various stakeholders need and expect, and how to harness that. Most meeting professionals who face this challenge say they have or will employ the services of a specialist, either on staff or as a consultant. To compound these challenges, meeting professionals are aware of the many companies creating and pro- FUTURE TRENDING TOPICS Global Economic Uncertainty 7% Feb 2012: 7% June 2012: 14% “Again, the economy remains a huge question and will influence how corporations and associations do business.” “A double dip recession would have a dramatically negative affect on convention attendance and corporate travel.” More Virtual/ Hybrid Events 2% Feb 2012: 7% June 2012: 9% “We will continue to see the need to boost attendance at meetings by offering options of hybrid components, community outreach and customization.” More Use of Social Media 6% Feb 2012: 3% June 2012: 9% U.S. Presidential Election 5% Feb 2012: 3% June 2012: 8% More Local/ Regional Meetings 4% Feb 2012: 2% June 2012: 6% More Focus on Measuring Value 2% Feb 2012: 3% June 2012: 5% “We will need to focus on the value of meetings and the use of professionals, like myself, to accomplish strategic initiatives.” “I see complete accountability in terms of having to provide solid value for attendees.” Concern Over a “GSA Effect” -- Feb 2012: 3% June 2012: 3% “We will see continued turmoil with government meetings due to the GSA scandal and knee-jerk reaction for oversight.” 3 moting new (but untried) technology solutions. With increasing numbers of proven existing technologies, many meeting professionals say they are slow to adopt newer options until they are proven and intuitive. Cost is another barrier to adoptions. Meeting professionals also expect to see more tools that help attendees better interact, including smart phone apps, web-based systems and social media resources. Meeting professionals anticipate interactivity will be key to future engagement, especially as average attendee age goes down. Aligned with this expectation is the concern that facilities will not be capable of handling bandwidth. In the U.S., meeting professionals anticipate that the U.S. government will take a greater role in limiting and controlling how its events are conducted and will possibly try to take a greater role in limiting and controlling private sector meetings and events. These professionals cite recent experi- ences with TARP fund recipients and government entities. Oil prices in the U.S. have stabilized since April, but meeting professionals generally expect that these will remain high as instability in the Middle East, domestic dependence on foreign oil and political factors take their toll on the market. This will drive more local, regional and virtual events. Some meeting professionals also see a forced reduction in carbon footprint. CURRENT NUMBERS Current Business Conditions Compared to Last Year Favorable No Change Negative 60.22% 23.66% 16.13% More than 10% better 6 to 10% better 1 to 5% better Flat (no overall change) 1 to 5% worse 6 to 10% worse More than 10% worse 12.90% 21.51% 25.81% 23.66% 8.60% 4.30% 3.23% Current Employment Trends Full-Time Increasing 28.09%, Flat 67.42%, Decreasing 4.49% Part-Time Increasing 27.50%, Flat 66.25%, Decreasing 6.25% Contract Increasing 36.71%, Flat 58.23%, Decreasing 5.06% Change in Attendance Since Last Year Change in Budget/Spend Since Last Year Favorable No Change Negative 53.19% 29.79% 17.02% Favorable No Change Negative 26.97% 51.69% 21.35% Greater than 10% increase 6 to 10% increase 1 to 5% increase Flat (no overall change) 1 to 5% decrease 6 to 10% decrease Greater than 10% decrease 5.32 % 7.45 % 40.43 % 29.79 % 11.70 % 4.26 % 1.06 % More than 10% increase 6 to 10% increase 1 to 5% increase Flat (no overall change) 1 to 5% decrease 6 to 10% decrease More than 10% decrease 3.37% 5.62% 17.98% 51.69% 11.24% 6.74% 3.37% Client Segment with Greatest INCREASE in Activity Client Segment with Greatest DECREASE in Activity Domestic Association International Association Domestic Corporate International Corporate Government Other Domestic Association International Association Domestic Corporate International Corporate Government Other 18.99 % 8.86% 55.70 % 10.13 % 6.33 % 0.00 % 12.90 % 4.84 % 14.52 % 17.74 % 46.77 % 3.23 % FUTURE NUMBERS Predicted Business Conditions for 2012 Predicted Attendance in 2012 Favorable No Change Negative 73.40% 18.09% 8.51% Favorable No Change Negative 65.96% 23.40% 10.64% Favorable No Change Negative 43.82% 39.33% 16.85% More than 10% better 6 to 10% better 1 to 5% better Flat (no overall change) 1 to 5% worse 6 to 10% worse More than 10% worse 7.45% 25.53% 40.43% 18.09% 3.19% 3.19% 2.13% More than 10% increase 6 to 10% increase 1 to 5% increase Flat (no overall change) 1 to 5% decrease 6 to 10% decrease More than 10% decrease 3.19% 11.70% 51.06% 23.40% 7.45% 2.13% 1.06% More than 10% increase 6 to 10% increase 1 to 5% increase Flat (no overall change) 1 to 5% decrease 6 to 10% decrease More than 10% decrease 3.37% 5.62% 17.98% 51.69% 11.24% 6.74% 3.37% Change in Budget for 2012 4 The MPI Business Barometer About MPI The MPI Foundation launched the Business Barometer in April 2008 to monitor the meeting industry’s most immediate needs in relation to economic concerns and opportunities. Meeting professionals must understand how perceptions and realities of the economy affect decision-makers. Beginning in February 2012, the Business Barometer began reporting on predicted conditions, previously relegated to a single annual report. The Business Barometer became a function of a live web experience featuring articles, blogs, research, on-topic discussions, polls and interactive features. Meeting Professionals International (MPI), the meeting and event industry’s largest and most vibrant global community, helps it’s members thrive by providing human connections to knowledge and ideas, relationships and marketplaces. MPI membership is comprised of more than 22,000 members belonging to 71 chapters and clubs worldwide. Survey Approach 3030 LBJ Freeway, Suite 1700 Dallas, TX 75234-2759 tel +1-972-702-3000 fax +1-972-702-3089 Every two months, research firm Association Insights surveys its Business Research Panel, a select group of senior-level meeting professionals from MPI’s 23,000 international members, and asks a short series of quantitative questions related to the economy and a qualitative question regarding each individual’s professional outlook. The survey provides a bi-monthly tracking of current business conditions and outlooks compared with actual business conditions and outlooks a year ago. MPI developed the survey questions with guidance from the Chairman’s Advisory Council, the MPI International Board of Directors, the MPI management team and Association Insights. The Business Barometer allows MPI to better gauge immediate business and economic conditions, enhancing its ability to enrich and focus its offerings to members and affects the organization’s various research initiatives and its resource prioritization. For additional information, visit www.mpiweb.org. Meeting Professionals International Headquarters Europe/Africa 28, Rue Henri VII L-1725 Luxembourg Grand Duchy of Luxembourg tel +352-2610-3610 fax +352-2687-6343 Middle East PC5 Offices, Education City, Doha, Qatar tel +974-454-8000 fax +974-454-8047 Canada 6519-B Mississauga Road Mississauga, Ontario L5N 1A6 Canada tel +905-286-4807 fax +905-567-7191 About the MPI Foundation The MPI Foundation launched FutureWatch in November 2002 as a forecasting vehicle for the meeting industry. This groundbreaking study has changed with time, measuring different aspects of the industry and experimenting with new ways to create an accurate forward-looking picture for the event sector. In order to address the increasing speed of industry progress and communications, MPI changed this annual study in December 2011 into an ongoing program of industry monitoring, with bi-monthly reporting and an annual benchmark study. About Association Insights Association Insights provides research and consulting services to nonprofit organizations and helps them find solutions and make better decisions. Association Insights Olde Vinings Park 2719 Vinings Oak Dr. Smyrna, Georgia 30080-8076 1 (866) 733-6460 +1-404-355-3414 www.associationinsights.com Editorial Support Bill Voegeli, president, Association Insights Jessie States, editor, meeting industry, MPI Design Support Jeff Daigle, creative director, MPI MPI Staff Marj Atkinson, research manager, MPI © 2012, Meeting Professionals International. All Rights Reserved 5