Study on Limited Partnership Based on an Analysis of Incentive

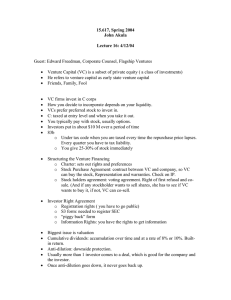

advertisement

Study on Limited Partnership Based on an Analysis of Incentive Mechanism Model of Venture Capitalist Tian-jia Wang, Ya-na Chen Economy & Management School, Wuhan University, Wuhan, China, 430072 (lujunshangjiang@163.com, chenyana613@gmail.com) Abstract - In the system of venture investment, there exists a kind of principal-agent relationship between the venture investor and venture capitalist , which will bring about a series of problems such as moral hazard. The organizational form of limited partnership is inclined to establish an incentive mechanism which can maximize the utility of both the venture investor and the venture capitalist with the coexistence of incentive and constraint. The paper establishes an incentive mechanism model in the organizational form of limited partnership and systematically discusses the effectiveness of the incentive pattern of limited partnership. Keywords - Principal-agent Relationship, Venture Investor, Venture Capitalist, Incentive Mechanism Model, Limited Partnership I. INTRODUCTION In the system of venture investment, there is a kind of principal-agent relationship between the venture investor and venture capitalist. The principal’s adverse selection of the agent and the problem of moral hazard caused by information asymmetry often exist. A limited partnership is a form of partnership in which investor and manager of venture capital form a limited partnership enterprise, and the investor provides capital and assumes the limited liability for the loss and debt of the enterprise to the extent of its capital contribution, while the manager takes charge of the management and operation of the investment and assumes the unlimited liability for the loss and debt of the enterprise[1]. In the limited partnership, the venture investor invests equity capital which accounts for 1% of the gross assets. But the equity capital is rarely in the form of cash, out of the consideration of management commitment and tax benefits. The venture capitalist can use 2.5% of the gross assets as their management fee. They can generally get the 20% of total investment revenue in the distribution of the investment income, but the premise is that the lowest rate of return on investment has been reached ( at least principal guarantying ) .Applying the limited partnership into the venture investment, the organizational form of limited partnership has an significant incentiveand-constraint effect on the venture capitalist. On one hand, besides the fixed management fee as reward, the venture capitalist can receive investment revenue according to a relatively high proportion, which can generate a long-term incentive. On the other hand, as the general partner, the venture capitalist is obligated to assume unlimited liability for the loss and debt of the venture investment, which, in turn, urges him to work hard. From the above, it can be seen that the organizational form of limited partnership is inclined to establish a set of covenant which can achieve the maximum utility for venture investor on the condition that participation constraints and incentive compatibility are satisfied simultaneously. Scholars have undertaken a series of discussions and researches on these problems. Sahlma studies how the venture investor monitors and motivates the venture capitalist to work hard by designing the covenant on the basic of unilateral principal-agent relationship[2]. Jiang Junfeng,et al. study the divisible covenant model of the venture investment revenue by comparing the indirect pricing theory with transaction efficiency and combining the principal-agent relationship[3]. Bergmann and Hege find that if a long-term contract is established between the venture investor and venture capitalist, the venture investor actually receives an incentive to not put off the successful accomplishment of a project[4]. This paper establishes an incentive mechanism model to make a systematic analysis of the effectiveness of the incentive mechanism of a limited partnership. II. THE MODEL AND ANALYSES A. The basic analytical framework of the model Hypothesis1: The degree of effort of the venture capitalist is a . To simplify the analysis, assume that the set consisting of all the degrees of effort has only two elements, a a , a,and a a 0 Hypothesis2: The working cost of the venture capitalist is C (a ) , which is solely related to the degree of effort. C 0, C a o a Hypothesis3: Within each venture investment cycle, the total reward of the venture capitalist paid by the venture investor is I which is related to the degree of effort of the venture capitalist. The total revenue w is measured by the degree of effort a in each venture investment cycle, and w 0 . The total reward paid by the venture capitalist is a I w and the set consist of all the I has two elements, namely, I I , I Hypothesis4: Stochastic variable w w, w, and w w 0 . w is influenced by the degree of effort of the venture capitalist a ,which can be shown as Pw a p1 P w a p0 ,in conditional probability. optimization of the incentive model for the venture capitalist can be transformed into the following problem: Hypothesis5: The total utility function of the venture capitalist is U c U I U a and U I I , I 0 , 2 I 0 . According to assumption 3: I I , I , there are only two modes of payment that the venture investor can choose from. The venture capitalist can choose either mode of payment to simultaneously satisfy both the participation constraint and incentive compatibility. To solve the problem above, we have a The revenue of the venture capitalist investment revenue is V (w) and. V 0 , w a 2 w from the venture 2V . 0 w According to the hypotheses above, the expected utility function of the venture capitalist is MaxE(U R ) s.t. p I (1 p ) I C (a) 0 3 p1 I (1 p1 ) I C (a) p 0 I (1 p 0 ) I C (a) 4 1 1 p0 * I C (a) 5 p1 p 0 p0 * I C (a) 6 p1 p 0 E(U C ) p1 I (1 p1 ) I C(a)1 The expected utility function of the venture investor is E (U R ) p1 (V I ) (1 p1 )(V I ) 2 1 The expected utility function of the venture investor increases with the level of project benefits, therefore the venture investor prefers the venture capitalist to take up high degree of effort a .The expected utility function of the venture capitalist increases with,the total reward paid by the venture investor, thus the venture capitalist has to take up high degree of effort a in order to obtain high expected utility. net is U B. The optimal incentive model for the venture capitalist based on principal-agent relationship In the process of entering into a reward contract, information asymmetry often leads to the fact that the degree of effort and the ability of the venture capitalist cannot be observed[5][6]. To motivate the venture capitalist to work hard, the venture investor need to design a new incentive mechanism. The new incentive mechanism can reach a equilibrium point where the revenue of both the venture investor and the venture capitalist can be maximized while the venture capitalist is also made to pay high degree of effort. The new incentive mechanism can be divided into three stages. In the first stage, the venture investor offers a kind of reward mechanism. In the second stage, the venture capitalist decides whether to accept the incentive mechanism provided by the venture investor. If the incentive mechanism is accepted, then they will enter into the third stage. In the third stage, the venture capitalist will choose his action subject to the constraint of the accepted incentive mechanism[7]. The incentive mechanism provided by the venture investor need to satisfy two categories of constraint conditions. The first category is participation constraint, which means that the expected utility gained by the venture capitalist when they pay high degree of effort is no less than the utility when they accept this incentive mechanism. The second category is incentive compatibility, which means the utility gained by the venture capitalist when they pay high degree of effort is no less than that when they pay low degree of effort. Therefore, the C. c When the revenue of venture investment is high, the utility of the venture capitalist * * 1 p1 , then the venture capitalist I C (a) C (a) 0 p1 p0 obtains award. When the revenue of venture investment is low, the net utility of the venture capitalist is U * I * C a p1 C a 0 and then the venture p1 p0 c capitalist suffers loss. Further discussion on the basic analytical framework In the last section, there are only two elements in the set consisting of three variables: the degree of effort, the total reward and the revenue of the venture capitalist. Each element in the set is studied in two extreme cases. The expression of the total reward of the venture capital is relatively simple. This section is a supplement to the basic analytical framework in order to make the analysis more generalized[8-10]. Hypothesis1: Within a venture investment cycle, the degree of effort of the venture capitalist is a ,and a 0 . The working cost of the venture capitalist is 2 C a and. C a ha , C 0 2 a Hypothesis2: Within a venture investment cycle, the total reward of the venture capitalist paid by the venture investor is I , which includes the fixed reward f , the variable reward n and the capital unvested by the venture capitalist q . The fixed reward f depends on , the rate of management fee on investment funds agreed by both venture investor and venture capitalist in advance. The variable reward depends on the rate of management fee ,the total revenue n of venture investment w and the profit sharing rate z agreed by both venture investor and venture capitalist in advance. Hypothesis3: Within a venture investment cycle, the original capital of the venture investment is T , the capital unvested by the venture capitalist S ,and the corresponding shareholding proportion of the venture capitalist is M . M S ,because the venture entrepreneur might get equity in T exchange of technology or other elements. Hypothesis4: Within a venture investment cycle, the total revenue of venture investment w is affected by the degree of effort of the venture capitalist a and the random factor .Assume that w a .The probability of sucessfully realizing the renvenue of venture investment is p , shown as p w a p in conditional probability, and the probability of failing to realize the renvenue of venture investment is( 1 p ). Hypothesis5: Within a venture investment cycle, the total utility function of the venture capitalist is 2I U c U I U a and U I I , I 0 0 .The a a 2 revenue of the venture capitalist from the venture 2 investment revenue is V w and. V 0, V 0 . w w2 According to the hypotheses above, within a venture investment cycle, the fixed reward gained bu the venture capitalist is f T 7 The variable reward gained by the venture capitalist is n w pzw8 The capital unvested by the venture capitalist is q p1 z Mw 1 pS 9 So the total reward gained by the venture capitalist in this investment cycle is I f n q T w pzw p1 z Mw 1 pS 10 That is I T a pza p1 z M a 1 pS 11 The total utility function of the venture capitalist is U c I C a That is U c T a pz a p1 z M a 1 p S Take the derivative of (13) with respect to M ,we can get a 1 M 0 . Thus, improving the profit sharing rate of z the venture capitalist as z proves to be able to improve his degree of effort. Take the first derivative of a with respect to M , we can get a 1 z 0 . Thus, improving the shareholding M proportion of the venture capitalist as M proves to be able to improve his degree of effort. After the venture capitalist invest a certain amount of capital, the low degree of effort will lead to the failure of investment project. The failure ofinvestment project will result in the loss of the revenue of the capital unvested by the venture capitalist. Therefore, this payment model has have incentive-and-constraint dual effect on the venture capitalist , which supports the conclusion of the basic analytical framework. We use E U c to represent the expected utility of the venture capitalist: E U c EI Ca14 We use EU r to represent the expected utility of the venture investor: EU r Ew I 15 The venture investor designs a kind of covenant which can maximize the utility of both the venture capitalist and the venture investor. The premise of designing this contract is to satisfy two covenant conditions. The first one is participation constraints, which has been presented in previous paper. The second one is incentive compatibility, which means that the maximization of utility of the venture investor has to be achieved by the maximization of utility of the venture capitalist. We can put forward the following questions from the above: MaxEU r MaxEw I 16 s.t. EI C a U (17) 2 ha 12 2 If we want to maximize the total utility function of the venture capitalist, we can apply the definition of derivative to (12) and set it equal to 0. U c pz p1 z M ha 0 We have p1 z M z a 13 h This is the optimal degree of effort of the venture capitalist. The greater the probability of success in investment project, the greater the corresponding degree of effort. MaxI C a (18) Put Expression (13) into the target function(16), we have Maxw Ca U 19 Take the derivative of (14) with respect to z and set it equal to 0: w a C a 0 20 a z a z 2 Put w a , C a ha , a p1 z M z into 2 h Equation (19), we have p1 z M z 121 When the rate of management fee , the shareholding proportion of the venture capitalist M and the probability of success in investment project p are given[11-12]. We can get the optimal profit sharing proportion p for the venture capitalist z* z* 1 pM 22 p1 M Likewise, When the rate of management fee , the profit sharing rate of the venture capitalist as z and the probability of success in investment project are given, take the derivative of (19) with respect to M and set it equals to 0,we can get the optimal shareholding * proportion of the venture capitalist : M M* III. 1 pz 23 p1 z THE VENTURE CAPITALIST CONTRACT ARRANGEMENT AND THE OPTIMAL INCENTIVE MODEL IN A LIMITED PARTNERSHIP A. Assume that the total revenue of the venture capitalist is I , the rate of management fee is ,generally from 1% to 2%.The profit sharing rate is , generally from 10% to 30%. The initial amount of venture investment is T , and the rate of return on venture capital operation is r . The total reveue of the venture capitalist is I T T r Max T r,024 When the venture capitalist pays high degree of effort, the income of the capitalist is I T T r T r 25 I T T T 26 r The equity capital of 1% to 2% which the venture capitalist is required to invest in the initial phase can earn 20% of profits when the venture investment makes a profit. The venture capitalist has a relatively major residual claim for the venture investment. If the venture capitalist pays low degree of effort, the total revenue of the venture capitalist is I T T r 27 I T 28 r When the venture capitalist pays low degree of effort, he can earn no profit. but can only gain the basic fee for the management of original venture capital. In reality ,if the venture investment organization goes bankrupt, the venture capitalist is obligated to assume unlimited liability for the loss and debt of the venture investment organization. B. From another perspective , the venture investor’s expected payoff for the venture capitalist is p1 I * 1 p1 I * C a , exactly equal to the cost of the venture capitalist when he pays high degree of effort. Therefore, when U ( I ) I , the venture investor can carry out the optimal incentive covenant through the covenant arrangement of incentive compatibility. The optimal incentive covenant not only avoids the extra cost of the venture investor, but also guarantees the degree of effort paid by the venture capitalist. IV. CONCLUSIONS According to the theory on mechanism design, the optimal incentive model, which is deduced under the framework of principle-agent theory, features the coexistence of incentive and constraint. The optimal incentive model enables the venture capitalist to gain high level of reward if he pays high degree of effort. And he is held responsible for the loss of venture investment if he pays low degree of effort. In the limited partnership, contract arrangement for the venture capitalist has the advantages of the above optimal incentive model. The venture investor plays dual role as both the manager and investor of venture funds. As the manager of venture funds, the venture capitalist possesses a relatively major residual claim and he can gain high level of reward if he pays high degree of effort. If he pays low degree of effort, the venture capitalist, as the investor of venture funds, would not only lose the revenue of the original capital he has invested, but also have to assume unlimited reliability for the venture investment organization. V. REFERENCES [1] S.Cheng.Propelling venture capital of China actively and reliably[J].Management World,1999(1):2-7(in Chinese) [2] W.Sahlman.The structure and governance of venture capital organization[J].Journal of Financial Economics,1990,27:473521. [3] J.Jiang , X.Wang.Interest division model for venture investment : an analysis based on the entrepreneur's viewpoint[J] . Journal of Industrial Engineering / Engineering Management,2009,23(4):85-90.(in Chinese) [4] D.Bergemann,U.Hege.Venture capital financing,moral hazard and learning[J].Journal of Banking and Finance,1998,22:703735. [5] W. Zhang.Game theory and information economics[M]. Shanghai People's Publishing House Press,1996.401-413. ( in Chinese) [6]J.Trester.Venture capital contracting under asymmetric information[J].Joumal of Banking and Finance , 1998,22 , pp680-695. [7] P.Compers.Optimal investment ,monitoring and the staging of venture capital[J].Journal of Finance, 1995,50:1470-1482. [8] W.Sahlman.Insights from the Venture CapitaI ModeI of Project Governance[J].Business Economics,1999(29)35-42. [9] J.Mirrlees.The optimal structure of authority and incentives within an organization[J].Bell Journal of Economics,1979, 10:74-91. [10] B.Holmstrom,P.Milgrom,Aggregation and linearity in the provision of intertemporal incentives[J].Econometrica1987, 55:309—322. [11] T.Hellmann . The allocation of control right in venture capital contracts[J].RAND Journal of Economics 1998,29(1): 58-70. [12] U.Sweeting.UK venture capital funds and the funding of new technology-based businesses : process and relationships [J] Management Studies,1991,28(6):601—622.