Lifecycle Financing from

Cisco Capital

A R C H IT E C T U R

ES

B O R DE R L E S S N E T W O R

KS

Align technology investments with

operational imperatives

S E C UR E

S E R V IC E S

B U S IN E S S A L I G N M E N T

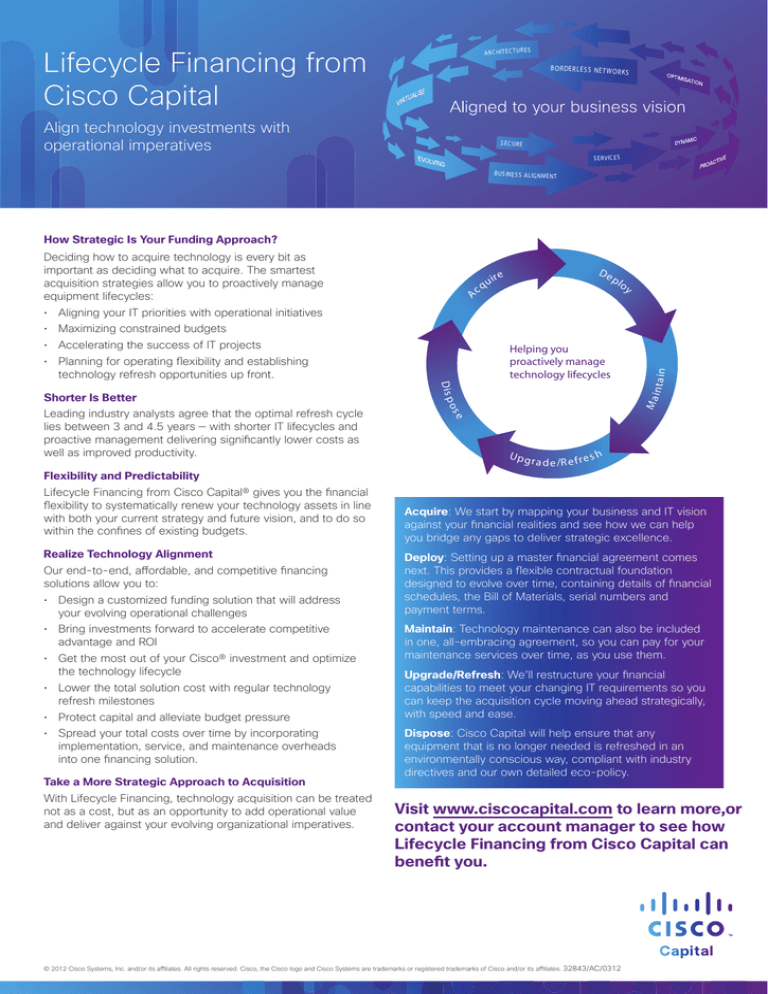

How Strategic Is Your Funding Approach?

A

Deciding how to acquire technology is every bit as

important as deciding what to acquire. The smartest

acquisition strategies allow you to proactively manage

equipment lifecycles:

u

cq

De

ir e

pl

oy

• Aligning your IT priorities with operational initiatives

• Accelerating the success of IT projects

Helping you

proactively manage

technology lifecycles

• Planning for operating flexibility and establishing

technology refresh opportunities up front.

Ma

os

e

Leading industry analysts agree that the optimal refresh cycle

lies between 3 and 4.5 years — with shorter IT lifecycles and

proactive management delivering significantly lower costs as

well as improved productivity.

D is p

Shorter Is Better

in ta in

• Maximizing constrained budgets

Upg

r a d e /R e f r e s

h

Flexibility and Predictability

Lifecycle Financing from Cisco Capital® gives you the financial

flexibility to systematically renew your technology assets in line

with both your current strategy and future vision, and to do so

within the confines of existing budgets.

Realize Technology Alignment

Our end-to-end, affordable, and competitive financing

solutions allow you to:

• Design a customized funding solution that will address

your evolving operational challenges

• Bring investments forward to accelerate competitive

advantage and ROI

• Get the most out of your Cisco® investment and optimize

the technology lifecycle

• Lower the total solution cost with regular technology

refresh milestones

• Protect capital and alleviate budget pressure

• Spread your total costs over time by incorporating

implementation, service, and maintenance overheads

into one financing solution.

Take a More Strategic Approach to Acquisition

With Lifecycle Financing, technology acquisition can be treated

not as a cost, but as an opportunity to add operational value

and deliver against your evolving organizational imperatives.

Acquire: We start by mapping your business and IT vision

against your financial realities and see how we can help

you bridge any gaps to deliver strategic excellence.

Deploy: Setting up a master financial agreement comes

next. This provides a flexible contractual foundation

designed to evolve over time, containing details of financial

schedules, the Bill of Materials, serial numbers and

payment terms.

Maintain: Technology maintenance can also be included

in one, all-embracing agreement, so you can pay for your

maintenance services over time, as you use them.

Upgrade/Refresh: We’ll restructure your financial

capabilities to meet your changing IT requirements so you

can keep the acquisition cycle moving ahead strategically,

with speed and ease.

Dispose: Cisco Capital will help ensure that any

equipment that is no longer needed is refreshed in an

environmentally conscious way, compliant with industry

directives and our own detailed eco-policy.

Visit www.ciscocapital.com to learn more,or

contact your account manager to see how

Lifecycle Financing from Cisco Capital can

benefit you.

© 2012 Cisco Systems, Inc. and/or its affiliates. All rights reserved. Cisco, the Cisco logo and Cisco Systems are trademarks or registered trademarks of Cisco and/or its affiliates. 32843/AC/0312