Document 14343834

advertisement

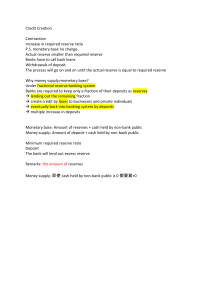

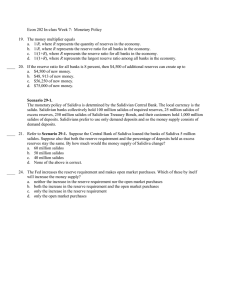

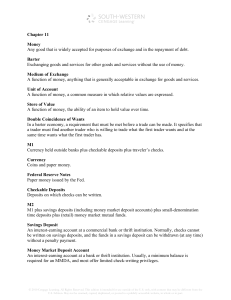

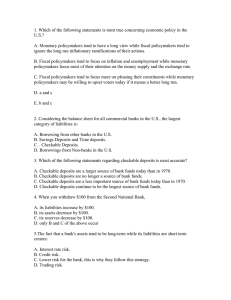

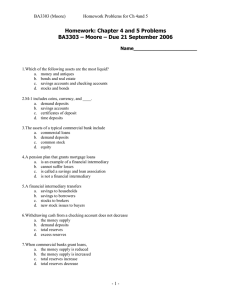

What is Money? • Medium of Exchange • Store of Value • Unit of Measurement Money Supply M1, M2, M3 determine the money supply M1 = cash and checking account deposits M2 = M1 + savings accounts & money market accounts M3 = M2 + large, long-term deposits (time deposits like CDs & institutional money markets). • Which is the broadest measure of money; used by economists to estimate the entire supply of money within an economy? • M3 • Which is the most liquid? • M1 M1, M2, M3 and Liquidity The Fed Fractional Reserve Banking • Required Reserves • Excess Reserves • The Money Multiplier • The FDIC – Protects deposits at banks up to $250,000 – Created by FDR during Great Depression Monetary Policy • Influencing the Economy by changing the money supply. • To fight inflation: Decrease the MS. • To fight unemployment: Increase the MS. Tools of the FOMC • The Reserve Requirement • The Discount Rate • Buying / Selling of Bonds • Keynesians vs. Monetarists Monetary Policy: Recent History Greenspan’s History, 1987-95 February, 1994 Recent Presidents March, 1997 December, 2000 January, 2001 July 2004 September 2006 October 2008 June 24, 2008