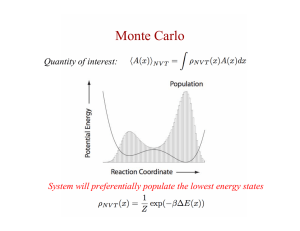

Monte Carlo Simulation

Monte Carlo Simulation

Monte Carlo Simulation

• Monte Carlo Simulation involves the use of pseudo random numbers to model systems where time plays no substantive role

(i.e., static models )

• Generation of artificial data through the use of a random number generator and the cumulative distribution of interest

• Random number generator

– Generates random variables that are uniformly distributed on the interval from 0 to 1 ( U (0, 1)) – Excel’s rand() function is an example

– Not possible to generate truly random numbers with a computer algorithm

• Random numbers, U (0, 1), are then transformed so that they follow the desired probability distribution.

– Uniform ( a , b )

– Normal ( µ , σ )

– Symmetric triangular ( a , b )

9/2/2003 Monte Carlo Simulation 2

Example 1 – Investment Value

• You are planning to invest a total of $15,000 and you have three investment vehicles from which to choose

• The return for each investment vehicle is a random variable ( R

L

R

M

, and R

H

, respectively) and the distribution for each of these random variables is given in the table below

,

• Use Monte Carlo simulation to characterize the distribution of the investment value at the end of one year based on a user-given allocation of the initial investment

9/2/2003

Investment Option

Low risk

Medium Risk

High Risk

Distribution of return (in %)

R

L

~ Normal (3, 1)

R

M

~ Normal (5, 5)

R

H

~ Normal (10, 15)

Monte Carlo Simulation 3

1

Example 1 – Investment Value

• The year-end value of the investment is given by the following expression:

V = S

L

(1 + R

L

) + S

M

(1 + R

M

) + S

H

(1 + R

H

)

9/2/2003 Monte Carlo Simulation 4

Example 2 – Expected Profit

• Based on a model from Anthony Sun (used with permission)

– http://www.geocities.com/WallStreet/9245/vba12.htm

• A firm is considering producing and selling a new product under a pure/perfect competition market and the firm wants to know the probability distribution for the profit associated with this product.

• The total profit is given by the equation:

TP

=

(

×

) ( Q V F )

• Where:

– Q is the quantity sold

– V is the variable cost per unit

– P is the sales price per unit

– F is the fixed cost for producing the product

9/2/2003 Monte Carlo Simulation 5

Example 2 – Expected Profit

• For this product, Q , P , and V are random variables with the following distributions:

– Q : uniform (80,000, 120,000)

– P : normal(22, 5)

– V : normal(12, 8)

• F is estimated to be 300,000

• Want to use Monte Carlo simulation to characterize the distribution of total profit for the proposed product

9/2/2003 Monte Carlo Simulation 6

2

Example 3 – Furniture Promotion

• This problem is from Section 2.2 of Seila et al . (2003)

• A large catalog merchandiser is planning to have a special furniture promotion a year from now. To do this, the company must place its order for furniture now. It plans to sign a contract with the manufacturer for 3000 chairs at a cost of $175 per unit, which the company plans to offer initially for $250 per unit. The promotion will last for 8 weeks, after which all remaining units will be offered for sale at half the original price, or $125 per unit. The company believes that 2000 units will be sold during the first 8 weeks.

• While the number of chairs ordered and the ordering price are set contractually, the number chairs sold during the first 8 weeks and the initial selling price are actually random variables that depend on a number of environmental conditions.

• The company would like to characterize the distribution of the expected profit.

9/2/2003 Monte Carlo Simulation 7

Example 3 – Furniture Promotion

• Assume the following distributions for the two stochastic inputs:

– Demand for chairs – symmetric triangular (500, 3500)

– Initial selling price – uniform (200, 300)

• The profit is given by:

P

=

(

−

)

+

R

2

− −

)

• Use Monte Carlo simulation to characterize the expected profit for the furniture promotion

9/2/2003 Monte Carlo Simulation 8

3