HOW TO CHOOSE A MEDICAL PLAN MOTT COMMUNITY COLLEGE Chadd Hodkinson

advertisement

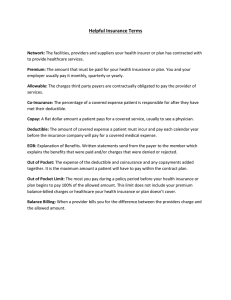

HOW TO CHOOSE A MEDICAL PLAN MOTT COMMUNITY COLLEGE Chadd Hodkinson SET SEG Employee Benefit Services Account Executive The content in this presentation is informational. Each employee should review the benefit summary and network information specific to their plan and discuss specific circumstances and questions with their carrier. Health savings accounts (HSAs) and flexible spending arrangements (FSAs) are IRS-regulated accounts. Nothing in this presentation represents tax advice. Discuss HSA/FSA questions with a tax advisor. TOPICS OF DISCUSSION • Insurance terms • The “Pick Two” concept • Traditional plan vs. high deductible health plan • Flexible spending arrangements • Health savings accounts • Risk tolerance • How to choose a medical plan COVERAGE LEVEL This usually sets what is covered and the amount we have to spend out of pocket for services received • Covered services List of medical procedures and prescription drugs that are covered under the plan • Deductible What employee owes before insurance plan pays • Copayment or “Copay” A fixed amount paid for a particular service • Coinsurance Employee’s share of health care costs after deductible is met • Out of pocket maximum Maximum amount we will spend on deductibles, coinsurance and copays COINSURANCE EXAMPLE 0% Coinsurance After Deductible 100% Coverage After Deductible (except for services subject to a copay) $500 Individual Deductible 20% Coinsurance After Deductible 100% Coverage After Deductible and Coinsurance (except for services subject to a copay) $500 Individual Deductible 20% Cost Share Up to Another $1,500 OUT OF POCKET MAXIMUM EXAMPLE 100% coverage (even for services subject to copay) Deductible, coinsurance and copay expenditures for approved, innetwork services $6,350 per individual, $12,700 total for a couple or family FLEXIBILITY • Degree to which Mott enrollees can choose from a variety of hospitals, out-patient facilities and doctors when accessing care • All three options offered at the college are preferred provider organization (PPO) plans • PPOs provide maximum network flexibility PREMIUM COST SHARE Premium cost share is what your employer deducts from your check each pay period for you to stay enrolled in the plan. PA 152 Public Act 152 of 2011 limits the amount that public employers can pay toward employees’ health insurance (medical coverage). For Mott, starting July 1, 2015, the annual hard cap limits are: • Single Coverage: $5,992.30 • Two Person Coverage: $12,531.75 • Family Coverage: $16,342.66 The difference between the plan cost and the hard cap amount the employer can contribute is the premium cost share for the employee. THE PICK TWO CONCEPT • Coverage Level What benefits and prescriptions are covered; out of pocket costs under the plan (deductible, copays, etc.) • Flexibility The degree of employee discretion when choosing facilities and providers • Premium Cost Share The amount the employee has deducted from their check each pay period to be enrolled in the plan TRADITIONAL PLAN • • • • • • May or may not have deductibles Copays generally apply on day one of plan Deductibles generally only apply to certain services (e.g. inpatient hospital stays, out patient surgical procedures, diagnostic testing, etc. – see benefit summary for details) Copays generally cover standard services (e.g. office visits, urgent care visits, emergency room visits, prescription drugs, etc.) and do not apply to deductible Depending on carrier and plan, may provide high or low level of coverage, high or low level of flexibility and high or low level of cost Compatible with a flexible spending arrangement (FSA) HIGH DEDUCTIBLE HEALTH PLAN (HDHP) • • • • • • Deductible of at least $1,300 for a single person and $2,600 for two-person or family coverage Employee pays 100% (except for preventive care) of medical and prescription drug costs (less any carrier discounts) until deductible is met Copays do not apply until deductible is met Generally lower coverage level and lower cost Depending on carrier and network, may provide high or low level of flexibility Compatible with a flexible spending arrangement (FSA) or a health savings account (HSA) FLEXIBLE SPENDING ARRANGEMENT (FSA) BASICS • Tax sheltered account that can be used to reimburse approved medical expenses on a pre-tax basis • Employee’s FSA is funded with employee-elected, pre-tax, payroll deductions. The employee sets the contribution amount. • Money goes in tax free and comes out tax free (if spent on approved medical expenses) • IRS allows contributions up to $2,550 for 2015 (discuss maximum contribution specifics with college HR department) • Account is use it or lose it • The entire elected amount is available on day 1 of the FSA plan year, even though money will be deducted over the course of the year HEALTH SAVINGS ACCOUNT (HSA) BASICS • The account and its contents belong to you • Money goes in tax free, can grow tax free and comes out tax free (if spent on approved medical expenses) • Rolls over year after year (no use it or lose it) • Fully portable if you leave the high deductible plan or the district • Accessible in retirement HSA LIMITATIONS • • • • Only available with tax qualified high deductible health plan (HDHP) May not contribute (or receive contributions) to an HSA if enrolled in other coverage that is not a tax-qualified HDHP (including Medicare or a medical FSA) May not contribute (or receive contributions) to an HSA if claimed as a dependent on someone else’s tax return or if a beneficiary of someone else’s general purpose FSA Discuss other limitations that apply to HSAs and/or FSAs with a tax advisor RISK TOLERANCE • How much risk related to your health insurance is too much risk for you? No one else can decide that for you. o Example: With your current health and financial circumstances, plan A will cost you less in premium cost share than plan B. However, if you are prescribed a very expensive medication during the year, plan A will require you to pay a large share of the cost of that expensive medication while plan B will only require you to pay a small share of the cost. RISK TOLERANCE • Neither plan is the “right” choice; neither is “wrong” • If you choose plan A, have a plan for covering unexpected expenses • If you choose plan B, be sure you can afford the premium cost share and still have money left to pay any out of pocket expenses under the plan HOW TO CHOOSE A MEDICAL PLAN Which two elements of the “Pick 2” concept are offered? • What does the plan cover and what is the out of pocket exposure? (Coverage Level) • What hospitals, providers and facilities participate with the plan’s network? (Flexibility) • What is the premium cost share for the plan? (Cost) What tax leveraged accounts are available? • FSA? • HSA? Is this plan compatible with my level of risk tolerance? MCC Staff Medical Plan Comparison BCBSM Plans PLAN OPTIONS Effective 7/1/15 - 6/30/16 In Network Plan Features PLAN 1 PLAN 2 PLAN 3 PPO - CONVENTIONAL PPO - HIGH DEDUCTIBLE HSA ELIGIBLE PPO - HIGH DEDUCTIBLE HSA ELIGIBLE $500 $1,300 $1,300 $1000A $2,600 $2,600 20% 0% 20% Deductible A Deductible - Single B Deductible - 2 Person/Family Additional Cost After Deductible C Coinsurance % after Deductible D Co-Insurance Max after Ded - Single $1,500 $0 $950 E Co-Insurance Max after Ded - 2 Person/Family $3,000 $0 $1,900 F Max Out of Pocket - Single $6,350 $2,250 $2,250 G Max Out of Pocket - 2 Person/Family $12,700 $4,500 $4,500 $20B Maximum Out of Pocket Cost Copayments H Office Visit Copay $0 after Ded. 20% After Ded. I Specialist Copay B $40 $0 after Ded. 20% After Ded. J Urgent Care Copay $60B $0 after Ded. 20% After Ded. $0 after Ded. 20% After Ded. K L B ER Copay Chiropractic Benefit $150 B $0 after Ded/12 Visits 20% after Ded/12 Visits B $30/12 Visits M Generic Rx Copay $10 $10 after Ded. $15 After Ded. N Preferred Brand Name Rx Copay $40B $60 after Ded. $50 After Ded. $60 after Ded. 50% - $70 min/$100 max After Ded. O B Non-preferred Brand Name Rx Copay $80 Monthly Rates P One Person Rate per Month $543.14 $502.08 $455.72 Q Two Person Rate per Month $1,302.02 $1,203.45 $1,092.26 R Full Family Rate per Month $1,633.28 $1,508.93 $1,371.07 Employee Bi-Weekly Payroll Deduction Amounts Employer Employee Employer Employee Employer Employee S Cost Share per Pay - One Person $230.47 $20.21 $230.47 $1.26 $230.47 $0.00* T Cost Share per Pay - Two Person $481.99 $118.94 $481.99 $73.45 $481.99 $22.13 U Cost Share per Pay - Full Family $628.56 $125.25 $628.56 $67.87 $628.56 $4.23 Cost Share - Hard Cap A for 2 Person/Family coverage, once a single member meets the "individual" deductible amount of $500, BCBSM will begin paying 80% of the cost of most approved services for that member. See benefit summary for details. B Copay does not apply to deductible or coinsurance. *Because the Single Coverage rate is less than the Hard Cap limitations, this plan will automatically come with an HSA partially funded by MCC. The difference between the hard cap limitation and the premium amount will be placed in an HSA for the employee. The employee can opt to contribute their own dollars as well. DISCLAIMER: This document is a summary of certain plan features. It should not be interpreted as a complete comparison of the products represented. information see the Summary of Benefits on the HR website. For more PLAN OPTIONS - CHANGES • Traditional PPO Plan 1 is changing from Community Blue to Simply Blue • Diagnostic services provided in the office/urgent care setting apply to deductible in addition to copay • ER copay not waived for accidental injury • Physical, speech and occupational therapy limited to 30 visits per member per year • Chiropractic limited to 12 visits per member per year • Out of network services are processed as out of network, even if referred by an in-network provider • Plan copays are different PLAN OPTIONS - CHANGES • Plan 3 changed • Was a $2,000 deductible plan with no coinsurance • Effective July 1, Plan 3 will be a $1,300 deductible plan with 20% coinsurance after deductible • New drug copays after deductible; changed from $15/$30/$60 to $15/$50/50% WHICH PLAN IS RIGHT FOR ME? Example: Plan 1, BCBSM, $500/$1,000, assume family coverage Best Case Worst Case Actual – How much will you spend in each category? Deductible $0 $1,000 ? Coinsurance $0 $3,000 ? Copays $0 $8,700 ? Annual Premium Cost Share $3,260 $3,260 $3,260 Annual Total $3,260 $15,960 ? *Example assumes member accesses approved, in-network services only. Numbers rounded for simplicity. HOW TO CHOOSE A MEDICAL PLAN Plan 1 – BCBSM Traditional PPO $500/$1,000 • Higher coverage level, higher flexibility, higher cost What tax leveraged accounts are available? • FSA compatible Is this plan compatible with my level of risk tolerance? • Fits an individual with a lower risk tolerance WHICH PLAN IS RIGHT FOR ME? Example: Plan 2 HSA, $1,300/$2,600 0% – Assume Family Coverage Best Case Worst Case Actual – How much will you spend in each category? Deductible $0 $2,600 ? Coinsurance $0 $0 $0 Copays $0 $1,900 ? Annual Premium Cost Share $1,770 $1,770 $1,770 Annual Total $1,770 $6,270 ? *Example assumes member accesses approved, in-network services only. Numbers rounded for simplicity. HOW TO CHOOSE A MEDICAL PLAN Plan 2 – BCBSM HSA $1,300/$2,600 0% • Lower coverage level, higher flexibility, lower cost What tax leveraged accounts are available? • HSA or FSA compatible Is this plan compatible with my level of risk tolerance? • Fits an individual with a moderate risk tolerance WHICH PLAN IS RIGHT FOR ME? Example: Plan 3 HSA, $1,300/$2,600 20% – Assume Family Coverage Best Case Worst Case Actual – How much will you spend in each category? Deductible $0 $2,600 ? Coinsurance $0 $1,900 ? Copays $0 $0 ? Annual Premium Cost Share $110 $110 $110 Annual Total $110 $4,610 ? *Example assumes member accesses approved, in-network services only. Example assumes deductible and coinsurance maximum hit in worst case (leaving no copay liability). Numbers rounded for simplicity. HOW TO CHOOSE A MEDICAL PLAN Plan 3 – BCBSM HSA $1,300/$2,300 20% • Lower coverage level, higher flexibility, lower cost What tax leveraged accounts are available? • HSA or FSA compatible Is this plan compatible with my level of risk tolerance? • Fits an individual with a higher risk tolerance SAMPLE FAMILY – “ACTUAL” CASE 1 Tim Smith: Rarely goes to the doctor. Got sick twice during the year, saw his primary care physician both times and was prescribed a generic antibiotic each time. Jan Smith: Visited her primary care physician once. Filled two generic 90-day prescriptions four times during the year. Visited urgent care once and the emergency room once for two separate cases of bronchitis. Filled three additional preferred brand name prescriptions and two additional generic prescriptions. Johnny: Receives his vaccinations and his parents take him to his annual visits. Broke his leg and required a $16,000 surgery, a cast, two specialist visits and five physical therapy visits. Three pediatrician visits per year for illness. Three generic antibiotic prescriptions during the year. SAMPLE FAMILY – “ACTUAL” CASE – PLAN 1 BCBSM TRADITIONAL PPO; $500/$1,000 Tim Jan Johnny SAMPLE FAMILY – “ACTUAL” CASE PLAN 1 Number Annual premium cost share Deductible Primary care physician office visit copay ($30) Specialist copay ($30) Urgent care copay ($30) Emergency room copay ($150) Generic drug copay ($15 for 30 day) Generic drug copay ($30 for 90 day) Preferred brand drug copay ($50) Non-preferred brand drug cost/copay (50%; $70-$100) Annual Total Cost Cost Number Cost Number Cost Total Cost $3,260 SAMPLE FAMILY – “ACTUAL” CASE – PLAN 1 BCBSM TRADITIONAL PPO; $500/$1,000 Tim Jan Johnny SAMPLE FAMILY – “ACTUAL” CASE PLAN 1 Number Cost Number Cost Number Cost Annual premium cost share Deductible/coinsurance 0 $0 0 Primary care physician office visit copay ($20) Specialist copay ($40) Urgent care copay ($60) Emergency room copay ($150) Generic drug copay ($10 for 30 day) Generic drug copay ($20 for 90 day) Preferred brand drug copay ($40) Non-preferred brand drug cost/copay ($80) Annual Total Cost (including premium cost share, deductible and copays): $0 1 Total Cost $3,260 $2,000 $2,000 SAMPLE FAMILY – “ACTUAL” CASE – PLAN 1 BCBSM TRADITIONAL PPO; $500/$1,000 Tim Jan Johnny SAMPLE FAMILY – “ACTUAL” CASE PLAN 1 Number Cost Number Cost Number Total Cost Cost Annual premium cost share $3,260 Deductible/coinsurance 0 $0 0 $0 1 $2,000 $2,000 Primary care physician office visit copay ($20) 2 $40 1 $20 3 $60 $120 Specialist copay ($40) 0 $0 0 $0 2 $80 $80 Urgent care copay ($60) 0 $0 1 $60 0 $0 $60 Emergency room copay ($150) Generic drug copay ($10 for 30 day) Generic drug copay ($20 for 90 day) Preferred brand drug copay ($40) Non-preferred brand drug cost/copay ($80) Annual Total Cost (including premium cost share, deductible and copays): SAMPLE FAMILY – “ACTUAL” CASE – PLAN 1 BCBSM TRADITIONAL PPO; $500/$1,000 Tim Jan Johnny SAMPLE FAMILY – “ACTUAL” CASE PLAN 1 Number Cost Number Cost Number Total Cost Cost Annual premium cost share $3,260 Deductible/coinsurance 0 $0 0 $0 1 $2,000 $2,000 Primary care physician office visit copay ($20) 2 $40 1 $20 3 $60 $120 Specialist copay ($40) 0 $0 0 $0 2 $80 $80 Urgent care copay ($60) 0 $0 1 $60 0 $0 $60 Emergency room copay ($150) 0 $0 1 $150 0 $0 $150 Generic drug copay ($10 for 30 day) Generic drug copay ($20 for 90 day) Preferred brand drug copay ($40) Non-preferred brand drug cost/copay ($80) Annual Total Cost (including premium cost share, deductible and copays): SAMPLE FAMILY – “ACTUAL” CASE – PLAN 1 BCBSM TRADITIONAL PPO; $500/$1,000 Tim Jan Johnny SAMPLE FAMILY – “ACTUAL” CASE PLAN 1 Number Cost Number Cost Number Total Cost Cost Annual premium cost share $3,260 Deductible/coinsurance 0 $0 0 $0 1 $2,000 $2,000 Primary care physician office visit copay ($20) 2 $40 1 $20 3 $60 $120 Specialist copay ($40) 0 $0 0 $0 2 $80 $80 Urgent care copay ($60) 0 $0 1 $60 0 $0 $60 Emergency room copay ($150) 0 $0 1 $150 0 $0 $150 Generic drug copay ($10 for 30 day) 2 $20 2 $20 2 $20 $60 Generic drug copay ($20 for 90 day) 0 $0 8 $160 0 $0 $160 Preferred brand drug copay ($40) Non-preferred brand drug cost/copay ($80) Annual Total Cost (including premium cost share, deductible and copays): SAMPLE FAMILY – “ACTUAL” CASE – PLAN 1 BCBSM TRADITIONAL PPO; $500/$1,000 Tim Jan Johnny SAMPLE FAMILY – “ACTUAL” CASE PLAN 1 Number Cost Number Cost Number Total Cost Cost Annual premium cost share $3,260 Deductible/coinsurance 0 $0 0 $0 1 $2,000 $2,000 Primary care physician office visit copay ($20) 2 $40 1 $20 3 $60 $120 Specialist copay ($40) 0 $0 0 $0 2 $80 $80 Urgent care copay ($60) 0 $0 1 $60 0 $0 $60 Emergency room copay ($150) 0 $0 1 $150 0 $0 $150 Generic drug copay ($10 for 30 day) 2 $20 2 $20 2 $20 $60 Generic drug copay ($20 for 90 day) 0 $0 8 $160 0 $0 $160 Preferred brand drug copay ($40) 0 $0 3 $120 0 $0 $120 Non-preferred brand drug cost/copay ($80) 0 $0 0 $0 0 $0 $0 Annual Total Cost (including premium cost share, deductible and copays): $6,010 SAMPLE FAMILY – “ACTUAL” CASE 1 Tim Smith: Rarely goes to the doctor. Got sick twice during the year, saw his primary care physician both times and was prescribed a generic antibiotic each time. Jan Smith: Visited her primary care physician once. Filled two generic 90-day prescriptions four times during the year. Visited urgent care once and the emergency room once for two separate cases of bronchitis. Filled two additional preferred brand name prescriptions and three additional generic prescriptions. Johnny: Receives his vaccinations and his parents take him to his annual visits. Broke his leg and required surgery, a cast, two specialist visits and five physical therapy visits. Three pediatrician visits per year for illness. Three generic antibiotic prescriptions during the year. SAMPLE FAMILY – “ACTUAL” CASE – PLAN 2 BCBSM HSA; $1,300/$2,600 0% Date Paid (assume all incurred on/after July 1, 2015) Copay SAMPLE FAMILY – “ACTUAL” CASE PLAN 1 Service Received Deductible Cost Annual premium cost share Annual Total Cost (including premium cost share, deductible and copays): Number Cost Total Cost $1,770 Deductible Remaining $2,600 SAMPLE FAMILY – “ACTUAL” CASE – PLAN 2 BCBSM HSA; $1,300/$2,600 0% Date Paid (assume all incurred on/after July 1, 2015) Copay SAMPLE FAMILY – “ACTUAL” CASE PLAN 1 Service Received Deductible Cost Number Total Cost Cost Annual premium cost share Deductible Remaining $1,770 $2,600 7/10/15 Jan’s 90 day generic prescriptions $55 $0 $0 $55 $2,545 7/21/15 Jan’s generic prescription $30 $0 $0 $30 $2,515 7/21/15 Jan’s preferred brand name prescription $240 $0 $0 $240 $2,275 7/23/15 Johnny’s specialist visit $145 $0 $0 $145 $2,130 9/21/15 Jan’s emergency room visit $595 $0 $0 $595 $1,535 9/27/15 Johnny’s surgery ($16,000) $1,535 $0 $0 $1,535 $0 All remaining approved, in-network medical services covered at 100% Annual Total Cost (including premium cost share, deductible and copays): SAMPLE FAMILY – “ACTUAL” CASE – PLAN 2 BCBSM HSA; $1,300/$2,600 0% Date Paid (assume all incurred on/after July 1, 2015) Copay SAMPLE FAMILY – “ACTUAL” CASE PLAN 1 Service Received Deductible Cost Number Total Cost Cost Annual premium cost share Deductible Remaining $1,770 $2,600 7/10/15 Jan’s 90 day generic prescriptions $55 $0 $0 $55 $2,545 7/21/15 Jan’s generic prescription $30 $0 $0 $30 $2,515 7/21/15 Jan’s preferred brand name prescription $240 $0 $0 $240 $2,275 7/23/15 Johnny’s specialist visit $145 $0 $0 $145 $2,130 9/21/15 Jan’s emergency room visit $595 $0 $0 $595 $1,535 9/27/15 Johnny’s surgery ($16,000) $1,535 $0 $0 $1,535 $0 All remaining approved, in-network medical services covered at 100% Thru 6/30/15 Generic drug copay ($10 for 30 day) $0 6 $60 $60 $0 Thru 6/30/15 Generic drug copay ($20 for 90 day) $0 6 $120 $120 $0 Thru 6/30/15 Brand drug copay ($60) $0 2 $120 $120 $0 Annual Total Cost (including premium cost share, deductible and copays): $4,670 SAMPLE FAMILY – “ACTUAL” CASE – PLAN 3 BCBSM HSA; $1,300/$2,600 20% Date Paid (assume all incurred on/after July 1, 2015) Copay SAMPLE FAMILY – “ACTUAL” CASE PLAN 1 Service Received Deductible Cost Annual premium cost share Annual Total Cost (including premium cost share, deductible and copays): Number Cost Total Cost $110 Deductible Remaining $2,600 SAMPLE FAMILY – “ACTUAL” CASE – PLAN 3 BCBSM HSA; $1,300/$2,600 20% Date Paid (assume all incurred on/after July 1, 2015) Copay SAMPLE FAMILY – “ACTUAL” CASE PLAN 1 Service Received Deductible/ Coinsurance Cost Number Total Cost Cost Annual premium cost share Deductible Remaining $110 $2,600 7/10/15 Jan’s 90 day generic prescriptions $55 $0 $0 $55 $2,545 7/21/15 Jan’s generic prescription $30 $0 $0 $30 $2,515 7/21/15 Jan’s preferred brand name prescription $240 $0 $0 $240 $2,275 7/23/15 Johnny’s specialist visit $145 $0 $0 $145 $2,130 9/21/15 Jan’s emergency room visit $595 $0 $0 $595 $1,535 9/27/15 Johnny’s surgery ($16,000) $1,535 $0 $0 $1,535 $0 Annual Total Cost (including premium cost share, deductible and copays): SAMPLE FAMILY – “ACTUAL” CASE – PLAN 3 BCBSM HSA; $1,300/$2,600 20% Date Paid (assume all incurred on/after July 1, 2015) Copay SAMPLE FAMILY – “ACTUAL” CASE PLAN 1 Service Received Deductible/ Coinsurance Cost Number Total Cost Cost Annual premium cost share Deductible Remaining $110 $2,600 7/10/15 Jan’s 90 day generic prescriptions $55 $0 $0 $55 $2,545 7/21/15 Jan’s generic prescription $30 $0 $0 $30 $2,515 7/21/15 Jan’s preferred brand name prescription $240 $0 $0 $240 $2,275 7/23/15 Johnny’s specialist visit $145 $0 $0 $145 $2,130 9/21/15 Jan’s emergency room visit $595 $0 $0 $595 $1,535 9/27/15 Johnny’s surgery ($16,000) $1,535 $0 $0 $1,535 $0 $16,000 - $1,535 = $14,465 remaining on Johnny’s surgery bill; 20% of $14,565 = $2,893; plan limits the Smith family to another $1,900 in coinsurance exposure after deductible 9/27/15 Coinsurance for Johnny’s remaining surgery bill $1,900 Smith family covered at 100% for all approved medical services and prescriptions for the remainder of the plan year Annual Total Cost (including premium cost share, deductible and copays): $4,610 TOTAL COST COMPARISON Assume family coverage Best Case Worst Case “Actual” Example Case Plan 1 – BCBSM Traditional $3,260 $15,960 $6,010 Plan 2 – BCBSM HSA 1300 $1,770 $6,270 $4,670 Plan 3 – BCBSM HSA 2000 $110 $4,610 $4,610 HOW TO CHOOSE A MEDICAL PLAN Some questions to consider during open enrollment: • What is the “actual” situation likely to be for you and your family in the coming year? • What medical and prescription services were accessed in the last year? • Was last year “typical”? • What assumptions are you comfortable making regarding medical and prescription services you are likely to need in the next year? • Which of the “pick two” factors are most important to you? Is there an opportunity to pay for medical expenses on a pre-tax basis using an FSA or HSA? • What is your risk tolerance? • QUESTIONS?