Name____________________ American Government Date_____________________

advertisement

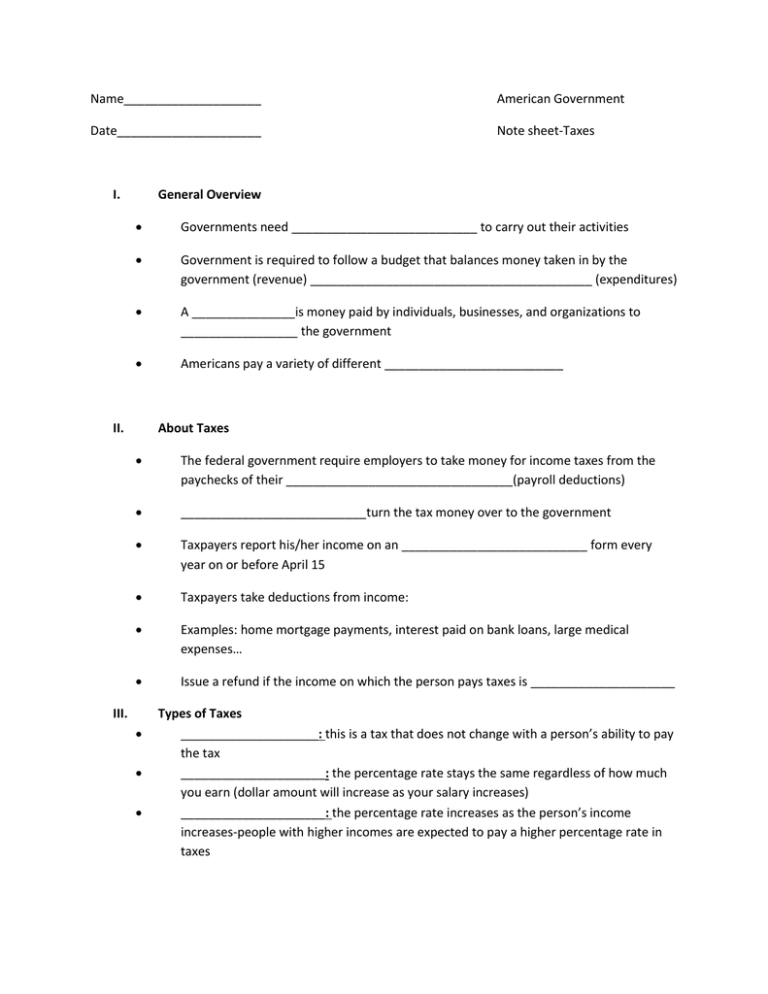

Name____________________ American Government Date_____________________ Note sheet-Taxes I. General Overview Governments need ___________________________ to carry out their activities Government is required to follow a budget that balances money taken in by the government (revenue) _________________________________________ (expenditures) A _______________is money paid by individuals, businesses, and organizations to _________________ the government Americans pay a variety of different __________________________ II. About Taxes The federal government require employers to take money for income taxes from the paychecks of their _________________________________(payroll deductions) ___________________________turn the tax money over to the government Taxpayers report his/her income on an ___________________________ form every year on or before April 15 Taxpayers take deductions from income: Examples: home mortgage payments, interest paid on bank loans, large medical expenses… Issue a refund if the income on which the person pays taxes is _____________________ III. Types of Taxes ____________________: this is a tax that does not change with a person’s ability to pay the tax _____________________: the percentage rate stays the same regardless of how much you earn (dollar amount will increase as your salary increases) _____________________: the percentage rate increases as the person’s income increases-people with higher incomes are expected to pay a higher percentage rate in taxes IV. V. Federal Taxes ________________________: levied on most sources of income and/or corporations ________________________: taxes are places on wages and salaries __________________ is collected from property left behind by those that have died VI. VII. Democrats vs. Republicans _________________-favor a tax system that is significantly progressive _________________- favor a tax system that is proportional or even regressive State and Local Taxes _________________: a tax levied on the yearly earnings of ______________________ _________________: a tax places on the sale of various items it is paid by the purchaser. _________________: a tax levied on the assessed value of a property that you own. (Largest source of income for local governments) __________________: are charges from a specific government agency for things such as court fines, hunting and fishing licenses, car registration…ect. __________________: this is a generally a state tax paid on the specific items that a person inherits. __________________: a selective sales tax levied specifically on activities for entertainment (movie tickets, concert tickets and sporting events). About Taxes: Summarize the slide: