A Cognitive Hierarchy Theory of One-Shot Games Teck H. Ho

advertisement

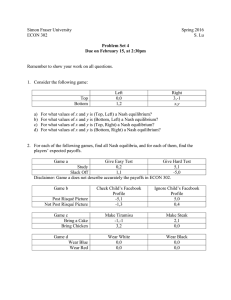

A Cognitive Hierarchy Theory of One-Shot Games Teck H. Ho Haas School of Business University of California, Berkeley Joint work with Colin Camerer, Caltech Juin-Kuan Chong, NUS March – June, 2003 CH Model Teck-Hua Ho 1 Motivation Nash equilibrium and its refinements: Dominant theories in economics for predicting behaviors in games. Subjects in experiments hardly play Nash in the first round but do often converge to it eventually. Multiplicity problem (e.g., coordination games) Modeling heterogeneity really matters in games. March – June, 2003 CH Model Teck-Hua Ho 2 Research Goals How to model bounded rationality (first-period behavior)? Cognitive Hierarchy (CH) model How to model equilibration? EWA learning model (Camerer and Ho, Econometrica, 1999; Ho, Camerer, and Chong, 2003) How to model repeated game behavior? Teaching model (Camerer, Ho, and Chong, Journal of Economic Theory, 2002) March – June, 2003 CH Model Teck-Hua Ho 3 Modeling Principles Principle Nash Thinking Strategic Thinking Best Response Mutual Consistency March – June, 2003 CH Model Teck-Hua Ho 4 Modeling Philosophy General Precise Empirically disciplined (Game Theory) (Game Theory) (Experimental Econ) “the empirical background of economic science is definitely inadequate...it would have been absurd in physics to expect Kepler and Newton without Tycho Brahe” (von Neumann & Morgenstern ‘44) “Without having a broad set of facts on which to theorize, there is a certain danger of spending too much time on models that are mathematically elegant, yet have little connection to actual behavior. At present our empirical knowledge is inadequate...” (Eric Van Damme ‘95) March – June, 2003 CH Model Teck-Hua Ho 5 Example 1: “zero-sum game” ROW T L 0,0 COLUMN C 10,-10 R -5,5 M -15,15 15,-15 25,-25 B 5,-5 -10,10 0,0 Messick(1965), Behavioral Science March – June, 2003 CH Model Teck-Hua Ho 6 Nash Prediction: “zero-sum game” ROW Nash Equilibrium March – June, 2003 Nash Equilibrium T L 0,0 COLUMN C 10,-10 R -5,5 0.40 M -15,15 15,-15 25,-25 0.11 B 5,-5 -10,10 0,0 0.49 0.56 0.20 0.24 CH Model Teck-Hua Ho 7 CH Prediction: “zero-sum game” ROW Nash Equilibrium CH Model (t = 1.55) Nash CH Model Equilibrium (t = 1.55) T L 0,0 COLUMN C 10,-10 R -5,5 0.40 0.07 M -15,15 15,-15 25,-25 0.11 0.40 B 5,-5 -10,10 0,0 0.49 0.53 0.56 0.20 0.24 0.86 0.07 0.07 http://groups.haas.berkeley.edu/simulations/CH/ March – June, 2003 CH Model Teck-Hua Ho 8 Empirical Frequency: “zero-sum game” ROW Nash CH Model Empirical Equilibrium (t = 1.55) Frequency T L 0,0 COLUMN C 10,-10 R -5,5 0.40 0.07 0.13 M -15,15 15,-15 25,-25 0.11 0.40 0.33 B 5,-5 -10,10 0,0 0.49 0.53 0.54 0.56 0.20 0.24 0.86 0.07 0.07 0.88 0.08 0.04 Nash Equilibrium CH Model (t = 1.55) Empirical Frequency March – June, 2003 CH Model Teck-Hua Ho 9 The Cognitive Hierarchy (CH) Model People are different and have different decision rules Modeling heterogeneity (i.e., distribution of types of players) Modeling decision rule of each type Guided by modeling philosophy (general, precise, and empirically disciplined) March – June, 2003 CH Model Teck-Hua Ho 10 Modeling Decision Rule f(0) step 0 choose randomly f(k) k-step thinkers know proportions f(0),...f(k-1) Normalize g (h) f ( h) K 1 f (h ) and best-respond ' h ' 1 March – June, 2003 CH Model Teck-Hua Ho 11 Example 1: “zero-sum game” ROW March – June, 2003 T L 0,0 COLUMN C 10,-10 R -5,5 M -15,15 15,-15 25,-25 B 5,-5 -10,10 0,0 CH Model Teck-Hua Ho 12 Implications Exhibits “increasingly rational expectations” Normalized g(h) approximates f(h) more closely as k ∞ (i.e., highest level types are “sophisticated” (or ”worldly) and earn the most Highest level type actions converge as k ∞ marginal benefit of thinking harder 0 March – June, 2003 CH Model Teck-Hua Ho 13 Alternative Specifications Overconfidence: k-steps think others are all one step lower (k-1) (Stahl, GEB, 1995; Nagel, AER, 1995; Ho, Camerer and Weigelt, AER, 1998) “Increasingly irrational expectations” as K ∞ Has some odd properties (e.g., cycles in entry games) Self-conscious: k-steps think there are other k-step thinkers Similar to Quantal Response Equilibrium/Nash Fits worse March – June, 2003 CH Model Teck-Hua Ho 14 Modeling Heterogeneity, f(k) A1: f (k ) 1 f (k ) t f (k 1) k f (k 1) k sharp drop-off due to increasing working memory constraint A2: f(1) is the mode A3: f(0)=f(2) (partial symmetry) A4a: f(0)+f(1)=f(2)+f(3)+f(4)… A4b: f(2)=f(3)+f(4)+f(5)… March – June, 2003 CH Model Teck-Hua Ho 15 Implications A1 Poisson distribution and variance = t f (k ) e t tk k! with mean A1,A2 Poisson distribution, 1< t < 2 A1,A3 Poisson, t21.414.. (A1,A4a,A4b) Poisson, t1.618..(golden ratio Φ) March – June, 2003 CH Model Teck-Hua Ho 16 Poisson Distribution f(k) with mean step of thinking t: f (k ) e t tk k! frequency Poisson distributions for various t 0.4 0.35 0.3 0.25 0.2 0.15 0.1 0.05 0 t1 t1.5 t2 0 1 2 3 4 5 6 number of steps March – June, 2003 CH Model Teck-Hua Ho 17 Historical Roots “Fictitious play” as an algorithm for computing Nash equilibrium (Brown, 1951; Robinson, 1951) In our terminology, the fictitious play model is equivalent to one in which f(k) = 1/N for N steps of thinking and N ∞ Instead of a single player iterating repeatedly until a fixed point is reached and taking the player’s earlier tentative decisions as pseudo-data, we posit a population of players in which a fraction f(k) stop after k-steps of thinking March – June, 2003 CH Model Teck-Hua Ho 18 Theoretical Properties of CH Model Advantages over Nash equilibrium Can “solve” multiplicity problem (picks one statistical distribution) Solves refinement problems (all moves occur in equilibrium) Sensible interpretation of mixed strategies (de facto purification) Theory: τ∞ converges to Nash equilibrium in (weakly) dominance solvable games Equal splits in Nash demand games March – June, 2003 CH Model Teck-Hua Ho 19 Example 2: Entry games Market entry with many entrants: Industry demand D (as % of # of players) is announced Prefer to enter if expected %(entrants) < D; Stay out if expected %(entrants) > D All choose simultaneously Experimental regularity in the 1st period: Consistent with Nash prediction, %(entrants) increases with D “To a psychologist, it looks like magic”-- D. Kahneman ‘88 March – June, 2003 CH Model Teck-Hua Ho 20 Example 2: Entry games (data) How entry varies with industry demand D, (Sundali, Seale & Rapoport, 2000) 1 0.9 0.8 % entry 0.7 entry=demand experimental data 0.6 0.5 0.4 0.3 0.2 0.1 0 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 Demand (as % of number of players ) March – June, 2003 CH Model Teck-Hua Ho 21 Behaviors of Level 0 and 1 Players (t =1.25) Level 1 Level 0 Demand (as % of # of players) March – June, 2003 CH Model Teck-Hua Ho 22 Behaviors of Level 0 and 1 Players(t =1.25) Level 0 + Level 1 Demand (as % of # of players) March – June, 2003 CH Model Teck-Hua Ho 23 Behaviors of Level 2 Players (t =1.25) Level 2 Level 0 + Level 1 Demand (as % of # of players) March – June, 2003 CH Model Teck-Hua Ho 24 Behaviors of Level 0, 1, and 2 Players(t =1.25) Level 2 Level 0 + Level 1 + Level 2 Level 0 + Level 1 Demand (as % of # of players) March – June, 2003 CH Model Teck-Hua Ho 25 Entry Games (Imposing Monotonicity on CH Model) How entry varies with demand (D), experimental data and thinking model 1 0.9 0.8 % entry 0.7 entry=demand 0.6 experimental data 0.5 t1.25 0.4 0.3 0.2 0.1 0 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 Demand (as % of # of players) March – June, 2003 CH Model Teck-Hua Ho 26 Estimates of Mean Thinking Step t Table 1: Parameter Estimate t for Cognitive Hierarchy Models Data set Game-specific t Game 1 Game 2 Game 3 Game 4 Game 5 Game 6 Game 7 Game 8 Game 9 Game 10 Game 11 Game 12 Game 13 Game 14 Game 15 Game 16 Game 17 Game 18 Game 19 Game 20 Game 21 Game 22 Median t Common t March – June, 2003 Stahl & Wilson (1995) Cooper & Van Huyck Costa-Gomes et al. 2.93 0.00 1.35 2.34 2.01 0.00 5.37 0.00 1.35 11.33 6.48 1.71 16.02 1.04 0.18 1.22 0.50 0.78 0.98 1.42 2.16 2.05 2.29 1.31 1.71 1.52 0.85 1.99 1.91 2.30 1.23 0.98 2.40 1.86 1.01 1.54 0.80 CH Model Mixed Entry 0.69 0.83 0.73 0.69 1.91 0.98 1.71 0.86 3.85 1.08 1.13 3.29 1.84 1.06 2.26 0.87 2.06 1.88 9.07 3.49 2.07 1.14 1.14 1.55 1.95 1.68 3.06 1.77 1.69 1.48 0.73 0.71 Teck-Hua Ho 27 CH Model: CI of Parameter Estimates Table A1: 95% Confidence Interval for the Parameter Estimate t of Cognitive Hierarchy Models Data set Game-specific t Game 1 Game 2 Game 3 Game 4 Game 5 Game 6 Game 7 Game 8 Game 9 Game 10 Game 11 Game 12 Game 13 Game 14 Game 15 Game 16 Game 17 Game 18 Game 19 Game 20 Game 21 Game 22 Common t March – June, 2003 Stahl & Wilson (1995) Lower Upper Cooper & Van Huyck Lower Upper 2.40 0.00 0.75 2.34 1.61 0.00 5.20 0.00 1.06 11.29 5.81 1.49 3.65 0.00 1.73 2.45 2.45 0.00 5.62 0.00 1.69 11.37 7.56 2.02 15.40 0.83 0.11 1.01 0.36 0.64 0.75 1.16 16.71 1.27 0.30 1.48 0.67 0.94 1.23 1.72 1.58 1.44 1.66 0.91 1.22 0.89 0.40 1.48 1.28 1.67 0.75 0.55 1.75 3.04 2.80 3.18 1.84 2.30 2.26 1.41 2.67 2.68 3.06 1.85 1.46 3.16 0.67 0.98 0.57 2.65 0.70 0.87 2.45 1.21 0.62 1.34 0.64 1.40 1.64 6.61 2.46 1.45 0.82 0.78 1.00 1.28 0.95 1.70 1.22 2.37 1.37 4.26 1.62 1.77 3.85 2.09 1.64 3.58 1.23 2.35 2.15 10.84 5.25 2.64 1.52 1.60 2.15 2.59 2.21 3.63 0.21 0.73 0.56 0.26 1.43 0.88 1.09 1.58 1.39 1.67 0.74 0.87 1.53 2.13 1.30 1.78 0.42 1.07 CH Model Costa-Gomes et al. Lower Upper Mixed Lower Upper Entry Lower Upper Teck-Hua Ho 28 Nash versus CH Model: LL and MSD Table 2: Model Fit (Log Likelihood LL and Mean-squared Deviation MSD) Stahl & Wilson (1995) Data set Cooper & Van Huyck Costa-Gomes et al. Within-dataset Forecasting Cognitive Hierarchy (Game-specific t ) 1 LL -721 -1690 -540 MSD 0.0074 0.0079 0.0034 Cognitive Hierarchy (Common t ) LL -918 -1743 -560 MSD 0.0327 0.0136 0.0100 Cross-dataset Forecasting Cognitive Hierarchy (Common t ) LL -941 -1929 -599 MSD 0.0425 0.0328 0.0257 Nash Equilibrium LL MSD Mixed Entry -824 0.0097 -150 0.0004 -872 0.0179 -150 0.0005 -884 0.0216 -153 0.0034 -1641 0.0521 -154 0.0049 2 -3657 0.0882 -10921 0.2040 -3684 0.1367 Note 1: The scale sensitivity parameter l for the Cognitive Hierarchy models is set to infinity. The results reported in Camerer, Ho & Chong(2001) presented at the Nobel Symposium 2001 are for models where l is estimated. Note 2: The Nash Equilibrium result is derived by allowing a non-zero mass of 0.0001 on non-equilibrium strategies. March – June, 2003 CH Model Teck-Hua Ho 29 CH Model: Theory vs. Data (Mixed Games) Figure 2a: Predicted Frequencies of Cognitive Hierarchy Models for Matrix Games (common t ) 1 0.9 y = 0.868x + 0.0499 R2 = 0.8203 Predicted Frequency 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 Empirical Frequency March – June, 2003 CH Model Teck-Hua Ho 30 Nash: Theory vs. Data (Mixed Games) Figure 3a: Predicted Frequencies of Nash Equilibrium for Matrix Games 1 0.9 y = 0.8273x + 0.0652 Predicted Frequency 0.8 2 R = 0.3187 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 Empirical Frequency March – June, 2003 CH Model Teck-Hua Ho 31 CH Model: Theory vs. Data (Entry and Mixed Games) Figure 2b: Predicted Frequencies of Cognitive Hierarchy Models for Entry and Mixed Games (common t ) 1 0.9 y = 0.8785x + 0.0419 R2 = 0.8027 Predicted Frequency 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 Empirical Frequency March – June, 2003 CH Model Teck-Hua Ho 32 Nash: Theory vs. Data (Entry and Mixed Games) Figure 3b: Predicted Frequencies of Nash Equilibrium for Entry and Mixed Games 1 0.9 y = 0.707x + 0.1011 0.8 2 Predicted Frequency R = 0.4873 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 Empirical Frequency March – June, 2003 CH Model Teck-Hua Ho 33 Economic Value Evaluate models based on their value-added rather than statistical fit (Camerer and Ho, 2000) Treat models like consultants If players were to hire Mr. Nash and Ms. CH as consultants and listen to their advice, would they have made a higher payoff? March – June, 2003 CH Model Teck-Hua Ho 34 Nash versus CH Model: Economic Value Table 3: Economic Value for Cognitive Hierarchy and Nash Equilibrium Data set Total Payoff (% Improvement) Actual Subject Choices Ex-post Maximum Within-dataset Estimation Cognitive Hierarchy (Game-specific t ) Cognitive Hierarchy (Common t ) Cross-dataset Estimation Cognitive Hierarchy (Common t ) Nash Equilibrium Stahl & Wilson (1995) Cooper & Van Huyck Costa-Gomes et al. Mixed Entry 384 685 79% 1169 1322 13% 530 615 16% 328 708 116% 118 176 49% 401 4% 418 9% 1277 9% 1277 9% 573 8% 573 8% 471 43% 471 43% 128 8% 128 8% 418 9% 398 4% 1277 9% 1230 5% 573 8% 556 5% 460 40% 274 -16% 128 8% 112 -5% Note 1: The economic value is the total value (in USD) of all rounds that a "hypothetical" subject will earn using the respective model to predict other's behavior and best responds with the strategy that yields the highest expected payoff in each round. March – June, 2003 CH Model Teck-Hua Ho 35 Example 3: P-Beauty Contest n players Every player simultaneously chooses a number from 0 to 100 Compute the group average Define Target Number to be 0.7 times the group average The winner is the player whose number is the closet to the Target Number The prize to the winner is US$20 March – June, 2003 CH Model Teck-Hua Ho 36 A Sample of Caltech Board of Trustees David Baltimore President California Institute of Technology Donald L. Bren Chairman of the Board The Irvine Company • Eli Broad Chairman SunAmerica Inc. • Lounette M. Dyer Chairman Silk Route Technology March – June, 2003 • David D. Ho Director The Aaron Diamond AIDS Research Center • Gordon E. Moore Chairman Emeritus Intel Corporation • Stephen A. Ross Co-Chairman, Roll and Ross Asset Mgt Corp • Sally K. Ride President Imaginary Lines, Inc., and Hibben Professor of Physics CH Model Teck-Hua Ho 37 Results from Caltech Board of Trustees Caltech Board of Trustees ALL CEOs only Mean Target Standard Deviation Sample Size March – June, 2003 42.6 29.8 23.4 70 CH Model 37.8 26.5 18.9 20 Teck-Hua Ho 38 Results from Two Other Smart Subject Pools Mean Target Standard Deviation Sample Size March – June, 2003 Portfolio Managers Economics PhDs 24.3 17.0 16.2 26 27.4 19.2 18.7 16 CH Model Teck-Hua Ho 39 Results from College Students Mean Target Standard Deviation Sample Size March – June, 2003 Caltech UCLA Wharton Germany Singapore 21.9 42.3 37.9 15.3 29.6 26.5 10.4 18.0 18.8 27 28 35 36.7 25.7 20.2 67 46.1 32.2 28.0 98 CH Model Teck-Hua Ho 40 CH Model: Parameter Estimates Table 1: Data and estimates of t in pbc games (equilibrium = 0) Mean Steps of subjects/game Data CH Model Thinking game theorists 19.1 19.1 3.7 Caltech 23.0 23.0 3.0 newspaper 23.0 23.0 3.0 portfolio mgrs 24.3 24.4 2.8 econ PhD class 27.4 27.5 2.3 Caltech g=3 21.5 21.5 1.8 high school 32.5 32.7 1.6 1/2 mean 26.7 26.5 1.5 70 yr olds 37.0 36.9 1.1 Germany 37.2 36.9 1.1 CEOs 37.9 37.7 1.0 game p=0.7 38.9 38.8 1.0 Caltech g=2 21.7 22.2 0.8 PCC g=3 47.5 47.5 0.1 game p=0.9 49.4 49.5 0.1 PCC g=2 54.2 49.5 0.0 mean 1.56 median 1.30 March – June, 2003 CH Model Teck-Hua Ho 41 Summary CH Model: Discrete thinking steps Frequency Poisson distributed One-shot games Fits better than Nash and adds more economic value Explains “magic” of entry games Sensible interpretation of mixed strategies Can “solve” multiplicity problem Initial conditions for learning March – June, 2003 CH Model Teck-Hua Ho 42