Program for the 3 Annual Conference of the

advertisement

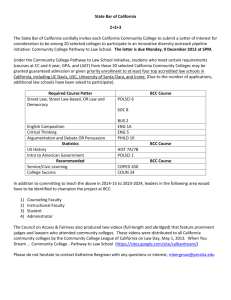

Program for the 3rd Annual Conference of the Bilateral Assistance and Capacity Building for Central Banks (BCC) EXCHANGE RATE POLICY: LIMITS TO FLEXIBILITY, CAPITAL CONTROLS, AND RESERVE MANAGEMENT. GENEVA, OCTOBER 29-30 Hôtel Royal, 41 Rue de Lausanne, Genève The Bilateral Assistance and Capacity Building for Central Banks (BCC) program will hold its third annual conference in Geneva on October 29-30, 2015. The purpose of the conference is to share recent research work and policy experience among the central banks involved in the program, academics and policy makers from other institutions. The conference is structured around two pillars: Research workshop, October 29. The workshop gives researchers from program central banks an opportunity to present their papers. Some papers will be presented in a lunchtime poster session, with posters remaining on display for the entire conference. The afternoon will consist of three panels where six additional papers will be presented in more details, each panel concluding with a synthesis discussion by senior academics and policy makers. The day will conclude with the official conference dinner. Policy conference, October 30. The conference focuses on the design of exchange rate policy and its impact. A keynote academic presentation by Menzie Chinn will be followed by a series of three panels of senior policy makers and academics aimed at drawing lessons from the experience of the countries in the BCC program. To facilitate the organization of the conference, participants are kindly asked to register with Elsa Ferreira at bcc@graduateinstitute.ch 1 Theme of the policy sessions: Exchange rate policy: Limits to flexibility, capital controls, and reserve management. The second day of the conference focuses on the choice of exchange rate regime, and its impact. The “standard” view in international economics has stressed the extent to which flexible exchange rates can help reach necessary adjustments in international prices, against the potential usefulness of a fixed exchange rate for stabilization policies. Establishing the impact of exchange rate flexibility on growth, inflation, and policy incentives is thus a major issue for policy makers. Recent years have seen the emergence of a “new” view that focuses on the global financial cycle and questions the policy autonomy that a flexible exchange rate can deliver. Policy institutions are faced with the challenge of assessing how the financial cycle alters the optimal flexibility of exchange rate and whether it calls for new policy tools. If economic analysis leads one to conclude that exchange rate movements should be tamed, it leaves the practical question of how to achieve this outcome open. Direct interventions on the exchange rate markets are a standard tool for central banks, but their effectiveness remains open to debate. In addition, the conduct of such intervention relies on the availability of sufficient reserves of foreign currencies. The optimal management of this resource is of first order relevance for central banks, given the potential fiscal impact through the central bank’s profits and losses. The issue will be introduced first through a dinner speech by Ayhan Kose on October 29, and then through a keynote lecture by Menzie Chinn in the morning of October 30. These interventions will be followed by three panels of senior BCC countries representative, academics and policy makers. The panels allow for a discussion of the lessons that can be learnt from countries’ experience, as well as to take stock of the challenges lying ahead regarding the design and use of monetary policy frameworks in emerging economies. Participants include: Dr Menzie Chinn, University of Wisconsin at Madison Dr Ayhan Kose, World Bank Dr Thomas Moser, Swiss National Bank Mr Renzo Rossini, Central Reserve Bank of Peru Dr Elman Rustamov, Central Bank of the Republic of Azerbaijan The BCC program The Bilateral Assistance and Capacity Building for Central Banks (BCC) is a program jointly funded by the Swiss State Secretariat for Economic Affairs (SECO) and the Graduate Institute of International and Development Studies, with the purpose of supporting partner central banks in emerging and developing countries in building the analytical and technical expertise required for the efficient conduct of monetary policy. The program builds on longstanding expertise at the Institute in providing technical assistance through missions in the partner countries tailored to their specific needs. http://graduateinstitute.ch/bcc 2 Thursday October 29 11.30 Welcoming remarks, Cédric Tille, BCC and IHEID 11:40-13:00 Standing lunch and poster session (6 papers) 11:40-12:15 Brief presentation of papers by authors 12:15-13:00 Lunch and individual discussion with authors. Loan loss provisions: Evidence from banks in Albania. Dushku, Frashëri, Bank of Albania. A macro-latent factor approach of the yield curve for a small open economy Guarin, Murcia, Central Bank of Colombia. Which dollar debt trigger the balance sheet effect? Evidence for Peruvian firms. Ramirez, Central Reserve Bank of Peru. Exchange rate policy towards a sustainable current account and international reserves management in countries adopt pegged-floating exchange rate regime Case study for Vietnam. Nguyen Duc Trung, State Bank of Vietnam. The consequences of banking limits on the effects of foreign exchange intervention: Disentangling the portfolio balance channel. Cardozo, Gamboa, Pérez-Reyna, Villamizar-Villegas, Central Bank of Colombia. Sovereign risk and the equilibrium exchange rate in Latin-American economies. Ojeda-Joya, Palacios, Sarmiento, Central Bank of Colombia. 3 13:00 – 18:00 Workshop panels In each of the three panels, each presenter will have 30 minutes. The two presentations will be followed by a 15 minutes review by the discussant, and 15 minutes of general discussion. 13:00-14:30 Workshop panel 1: Ex-ante and ex-post indicators and policies Early warning system for currency crisis based on exchange market pressure: The case of Vietnam. Pham Thi Hoang Anh, State Bank of Vietnam. Macroprudential vs. ex-post policies: when domestic taxes are relevant for international lenders. Parra-Polonia, Vargas, Central Bank of Colombia. Discussant: Cédric Tille, BCC and IHEID. 14:30-14:45 Coffee break 14:45-16:15 Workshop panel 2: Impact of exchange rate intervention Assessing the effectiveness of the Bank of Albania’s interventions in the foreign exchange market. Vika, Bank of Albania. FX market statistical regularities in Peru. Gutiérrez, Vega, Central Reserve Bank of Peru. Discussant: Ugo Panizza, IHEID 16:15-16:30 Coffee break 16:30-18:00 Workshop panel 3: FX uncertainty impact and market return Firm exports under exchange rate uncertainty. Ramiz Rahmanov, Central Bank of the Republic of Azerbaijan. An asset allocation framework for excess reserves Vela, Gomez, Garcia, Central Bank of Colombia. Discussant: Yi Huang, IHEID 19:00 Conference dinner (by invitation) Speech by Ayhan Kose, World Bank. 4 Friday October 30 8:45 Welcoming remarks, Monica Rubiolo, SECO 9:00-10:00 Keynote presentation Menzie Chinn, University of Wisconsin at Madison. The paper will be distributed in advance. 10:00-10:20 Coffee break 10:20-17:00 Policy panels Each of the following three policy panels will start with 10 minutes of remarks by each panelist, followed by a discussion between the panelists and the audience. 10:20-12:00 Panel 1: The standard view: real shock absorbers and nominal anchors. Whether the exchange rate should be kept constant of left free to float is a long standing debate in international macroeconomics. Proponents of flexibility argue that exchange rates can help deliver efficient movements in international prices. Opponents counter that the impact on prices is limited and that flexibility can lead to inefficient risk sharing. In addition a stable exchange rate can be a useful nominal anchor in a process of economic stabilization. The panelists will discuss the impact of exchange rate regimes on growth and inflation. Specifically, how large are the gains and costs of flexibility in emerging economies? Does the larger role played by commodity prices in these countries alter the trade-off? Can the exchange rate help anchoring expectations, and should this be a permanent anchor or a temporary one? What is the impact of exchange rate on international trade flows? Speakers Ayhan Kose, World Bank Peter Benczur, European Commission Joint Research Center Bui Quoc Dung, State Bank of Vietnam Elman Rustamov, Central Bank of the Republic of Azerbaijan 12:00-13:30 Lunch (by invitation only) 13:30-14:50 Panel 2: The new view: global financial cycle and policy autonomy. The sharp rise of international financial integration since the 1990’s has led to a growing prominence of financial markets considerations. In particular, movements in the global financial cycle, possibly driven by the economic policy of major core economies, have been transmitted through international capital flows and asset prices, including the exchange rate. While the standard “trilemma” argument in international macroeconomics points that a flexible exchange rate provides a country with more policy autonomy despite its openness to financial flows, the recent “dilemma” arguments calls this benefit into question. The panelists will discuss whether financial integration has significantly changed the terms of the trade-offs regarding the pros and cons of exchange rate flexibility. Specifically, has policy autonomy become elusive? Should policy makers rely on new tools, possibly including capital controls, to regain their autonomy? Should one distinguish between the conduct of policy in normal times and in crisis times? If exchange rate volatility should be limited, should countries stabilize against a single anchor currency or instead opt for a reference basket? 5 Speakers Robert McCauley, Bank for International Settlements Sukudhew Singh, Central Bank Malaysia Renzo Rossini, Central Bank of Peru Francis Blankson, Bank of Ghana 14:50-15:10 Coffee break 15:10-17:10 Panel 3: A practical view: power of policy tools, and reserves management. If limits should be placed on exchange rate volatility, the question is then about the tools that are most efficient in doing so. A standard tool has long been interventions by the central bank on foreign exchange markets. The effectiveness of such interventions remains debated however, especially when they can be seen as not being in line with the broader policy stance. The ability to intervene is also conditional on having sufficient reserves of foreign currencies. Such reserves can compose a large share of central banks’ assets, making their optimal management a central issue. Panelists will discuss the various available tools and the conditions to maximize their effectiveness. They will also review the investment strategies that allow central banks to make the most of their reserves, and thus limit potential losses that are ultimately borne by the taxpayer. Specifically, what are the conditions that make foreign exchange interventions most effective? Should these interventions be coordinated either with other domestic policy institutions, or with foreign central banks? What is the optimal choice between returns and liquidity in the portfolio of foreign assets? How can the fiscal risks be minimized? Speakers Matthieu Bussière, Paris School of Economics Thomas Moser, Alternate Member of the Governing Board of the Swiss National Bank Andrew Filardo, Bank for International Settlements Jorge Toro Cordoba, Central Bank of Colombia Emina-Brodlija Ceman, Central Bank of Bosnia and Herzegovina 17:15 Concluding remarks 19:00 Informal dinner (by invitation only) 6