ADDRESS Si necesita una versión en español de este aviso, visite...

advertisement

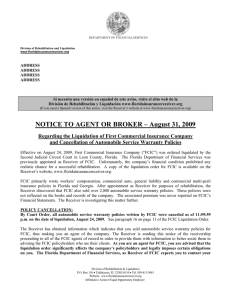

DEPARTMENT OF FINANCIAL SERVICES Division of Rehabilitation and Liquidation www.floridainsurancereceiver.org ADDRESS ADDRESS ADDRESS ADDRESS Si necesita una versión en español de este aviso, visite el sitio web de la División de Rehabilitación y Liquidación www.floridainsurancereceiver.org (If you need a Spanish version of this notice, visit the Receiver’s website at www.floridainsurancereceiver.org) NOTICE TO POLICYHOLDER – September 1, 2009 Regarding the Liquidation of First Commercial Insurance Company and Cancellation of Automobile Service Warranty Policies Dear Policyholder: This letter is being sent to you because records indicate that you are or have recently been a policyholder of First Commercial Insurance Company (“FCIC”). Effective on August 24, 2009, First Commercial Insurance Company (“FCIC”) was ordered liquidated by the Second Judicial Circuit Court in Leon County, Florida. The Florida Department of Financial Services was previously appointed as Receiver of FCIC. Unfortunately, the company’s financial condition prohibited any realistic chance for a successful rehabilitation. A copy of the liquidation order for FCIC is available on the Receiver’s website, www.floridainsurancereceiver.org. After appointment as Receiver for purposes of rehabilitation, the Receiver discovered that FCIC also sold over 2,000 automobile service warranty policies, possibly including your policy. These policies were not reflected on the books and records of the company. The associated premium was never reported on FCIC’s Financial Statements. The Receiver is investigating this matter further. POLICY CANCELLATION: By Court Order, all automobile service warranty policies written by FCIC were canceled as of 11:59:59 p.m. on the date of liquidation, August 24, 2009. If you have additional questions regarding the status of your automobile service warranty policy, please contact your agent or the dealer through which you purchased the policy. Division of Rehabilitation & Liquidation P.O. Box 110 • Tallahassee, FL 32302-0110 • Tel. 850-413-3081 Website: www.floridainsurancereceiver.org Affirmative Action • Equal Opportunity Employer CLAIMS ISSUES (FOR LOSSES INCURRED PRIOR TO 11:59 P.M. ON AUGUST 24, 2009): There is no guaranty association coverage for automobile service warranty policies. If you have a claim for losses incurred prior to the policy cancellation, you will need to file a claim in the FCIC receivership estate. The claims procedure which is the sole method for obtaining claims payment from a receivership estate is set out in Part I of Chapter 631, Florida Statutes. The deadline for filing claims in the FCIC receivership is 11:59 p.m. on August 17, 2010. Proof of Claims forms will be available to potential claimants within the next few months. These forms will explain the procedure for filing claims in the FCIC receivership estate. In the meantime, if your automobile is currently being repaired, you will need to pay directly for any necessary repairs. This will help lessen any expenses you could otherwise incur (e.g., storage fees, etc). Please save receipts and other documentation to support any claim you may later file in the estate. It will not be necessary for you to obtain authorization from the Receiver before incurring repair expenses. Under the Court's supervision of a company in liquidation, the Receiver is charged with gathering the company's assets, converting them into cash and distributing the cash to claimants of the company. Chapter 631, Florida Statutes, establishes a set of priorities for the payment of claims. There are ten classes of claims. All approved claims in a class must be paid in full before any payment is made to the next lower class. Within a class, all approved claims are paid equal pro rata shares if there are not sufficient funds to pay the class in full. All claims payments depend upon the availability of assets. Please be aware that it may be several years before claims payments, if any, are distributed from the FCIC estate. PREMIUM ISSUES: If you use credit cards or other automatic deduction methods for paying premium on your automobile service warranty policy with FCIC, you should discontinue your premium payments due to the policy cancellation. Please contact your agent or the dealer through which you purchased the warranty policy if you need help in notifying any premium finance company, bank, or credit card company that you used regarding these matters. Premium Refunds/Unearned Premium: Since there is no guaranty association, warranty policyholders will need to file a claim for any unearned premium in the FCIC receivership proceeding. Instructions for filing claims in the receivership will be provided with the Proof of Claims Forms, which will be available within the next few months. CONTACTING THE RECEIVER: Please contact the Receiver by using the “Contact Us” form at the Receiver’s website, www.floridainsurancereceiver.org. You may also contact the Florida Department of Financial Services, as Receiver, at (850) 413-3081 or toll free at 1-800-882-3054. Your anticipated cooperation and assistance in these matters is greatly appreciated. Page 2 of 2