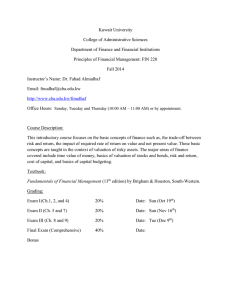

HOFSTRA UNIVERSITY FRANK G. ZARB SCHOOL OF BUSINESS DEPARTMENT OF FINANCE

advertisement

HOFSTRA UNIVERSITY FRANK G. ZARB SCHOOL OF BUSINESS “Educating for Personal and Professional Achievement” DEPARTMENT OF FINANCE FINANCE 402- MANAGERIAL FINANCE (Graduate course) Spring 2014, Section 01, Saturday 3:15 PM to 6 PM, CRN 24527 INSTRUCTORS’ NAMES: LOCATION OFFICE: OFFICE HOURS: PHONE EXTENSION: EMAILS: Dr. Ehsan Nikbakht, CFA 116A Weller TH 9:30-11am, 2:15-3:45 PM 463-5679 FINEZN@HOFSTRA.EDU Dr. Andrew Spieler, CFA 220 Weller On Leave 463-5334 FINACS@HOFSTRA.EDU GENERAL INFORMATION Location of Department Office Telephone number of Department Department Chairperson 221 Weller Hall 463-5698 Dr. K.G. Viswanthan DESCRIPTION OF COURSE Course explores key issues encountered by financial managers and analyzes the decision making that is most consistent with maximizing the value of the firm. Coverage includes, but is not limited to, capital expenditure analysis, mergers and acquisitions, working capital management, financing, cost of capital and capital structure decisions, dividend policy, and risk management. Differences among manufacturing services and financial services firms are analyzed. The financial decision-making process is developed with emphasis on the role of global financial markets, ethics, and considering the various constituencies of modern corporation. Cases and computer applications are employed extensively. PREREQUISITES OF COURSE Prerequisites: Open only to matriculated Zarb School of Business E.M.B.A. students. READING SOURCES TEXTBOOK: Ross, Westerfield, and Jordan, Fundamentals of Corporate Finance (Alternate Edition), McGraw Hill, Latest Edition ISBN 978-0-07-328212-1 CASES: Ginny’s Restaurant; Southport Minerals; Netscape IPO; JetBlue IPO; Ebay IPO FINANCIAL CALCULATOR: Students are required to use a Texas Instrument BA for this course. This calculator is required for the CFA exam as well. 1 PROGRAM-WIDE LEARNING GOALS This course exposes the students to a variety of perspectives in finance including ethics, communication, teamwork, critical thinking, global perspectives, the use of information technology, and understanding the regulatory, political, social, and demographic forces underlying finance decisions. Upon completion of this courses, students will: 1. understand time value of money applications for financial analysis. 2. understand the risk-return relationship in the CAPM. 3. learn to calculate the cost of capital and WACC. 4. be able to analyze capital budgeting decisions. 5. learn to value basic financial securities including stocks and bonds. 6. be able to analyze financial statements and understand their limitations. 7. learn how to identify and value real options. 8. understand and apply risk management techniques. 9. learn how to analyze finance related cases and develop solutions. Students are expected to read the financial pages of a major newspaper and relate this material to the course work. Significant written and oral communication skills (including class participation, presentations, and projects) will be emphasized. INSTRUCTOR’S COURSE-SPECIFIC LEARNING GOALS This course presents the tools to develop the conceptual skills required of managers. It is designed to put in practical use the theories and techniques analyzed in the classroom. Finance 402 is a core course that also serves as a foundation for upper level finance courses and other graduate interdisciplinary courses. Emphasis will be placed on valuation in an environment of risk. Some of the more modern issues concerning the interpretation of firm policy with respect to dividends, financial structure and corporate asset and liability restructuring, plus modern techniques employed in capital budgeting will be discussed. This course also represents a survey of financial principles and is designed to provide students with a sound background in the field of finance. Upon completion of this course, students will understand the mathematics of time value of money, the principles of risk and return, stock and bond valuation, and financial statement analysis. The course will familiarize students with the institutional environment of finance, which includes financial markets and instruments and financial institutions. SCHOOL OF BUSINESS POLICY ON MAKEUP EXAMINATIONS To be eligible for a makeup examination, a student must submit to the instructor written documentation of the reason for missing a scheduled examination due to medical problems or death of an immediate family member. This has to be done before the scheduled exam. The instructor (not the student) determines whether and when a makeup is to be given. If a makeup examination is to be given, the instructor will determine the type of makeup examination. If the student misses (for any reason) the scheduled makeup examination, additional makeups are not permissible. UNIVERSITY POLICY ON INCOMPLETE GRADES When requested by the student, the instructor may grant, at her/his discretion, a grade of Incomplete (‘I’). An ‘I’ grade should be given only when unforeseen circumstances prevent the student from completing 2 course work on time. As part of the normal final-grade process, the instructor must submit an ‘I’ grade online to the Office of Academic Records with a default grade, the grade the student will receive if the missing work is not completed. The default final grade must be a letter grade or a permanent ‘I’; a UW is not an acceptable default grade. In unusual circumstances, the faculty member may submit an ‘I’ grade without prior discussion with the student. The instructor will decide the time frame in which the student will complete the required course work. However, the deadline may not exceed one calendar year from the close of the semester or session in which the course was taken. A student will not be allowed to attend the regular class meetings at the next offering of the course. The instructor will inform the student of the completion requirements and terms. The instructor is required to submit a grade for the student within 30 days after the student has submitted work to fulfill the terms specified. If the instructor cannot oversee the completion of the incomplete work with the student, the instructor will arrange for oversight within the department with the Dean’s permission. If the incomplete work is not completed by the deadline, the ‘I’ grade will convert to the default grade previously submitted by the instructor. UNIVERSITY POLICY ON ACADEMIC HONESTY Academic dishonesty is a serious ethical and professional infraction. “Hofstra University places high value upon educating students about academic honesty. At the same time, the University will not tolerate dishonesty, and it will not offer the privileges of the community to the repeat offender.” Please refer to the Undergraduate Policy at http://www.hofstra.edu/pdf/Faculty/Senate/senate_FPS_11.pdf for details about what constitutes academic dishonesty, including plagiarism, and Hofstra’s procedures for handling violations. DEPARTMENT STATEMENT ON ACADEMIC HONESTY The Department of Finance is dedicated to maintaining the highest level of academic honesty in all of its classes. The University Policy on Academic Honesty states that expulsion from the University is a possible punishment for academic dishonesty. The University Policy also states that students "must avoid not only cheating, but the very appearance of cheating." Activities such as looking at the examination of another student, talking, or passing notes during examinations give the appearance of cheating, and therefore will be regarded as cheating. Submission of assigned work that is identical in any abnormal way to the work of another student is subject to reasonable interpretation as cheating. Students knowingly providing work to others are as guilty of cheating as those who accept their work. (For further information on academic honesty, please refer to the "Policy on Academic Honesty" in the Hofstra University General Bulletin. ) STUDENT WITH DISABILITIES STATEMENT If you believe you need accommodations for a disability, please contact Services for Students with Disabilities(SSD). In accordance with Section 504 of the Rehabilitation Act of 1973 and the Americans with Disabilities Act of 1990, qualified individuals with disabilities will not be discriminated against in any programs, or services available at Hofstra University. Individuals with disabilities are entitled to accommodations designed to facilitate full access to all programs and services. SSD is responsible for coordinating disability-related accommodations and will provide students with documented disabilities accommodation letters, as appropriate. Since accommodations may require early planning and are not retroactive, please contact SSD as soon as possible. All 3 students are responsible for providing accommodation letters to each instructor and for discussing with him or her the specific accommodations needed and how they can be best implemented in each course. For more information on services provided by the university and for submission of documentation, please contact the Services for Students with Disabilities, 212 Memorial Hall, 516-463-7075. METHODS OF EVALUATING STUDENTS Class sessions will be primarily devoted to presentation of assigned materials following the latest edition of the text book. Students will be evaluated based on their learning of the concepts and topics covered in lectures. Class discussion/participation is both expected and encouraged. Students should read the assigned materials in advance of the class sessions, to ensure better understanding of the issues involved, and meaningful class participation. Class attendance is required. Missed classes would call for extra effort on the part of the student to catch up before the following class. Supplemental readings and case studies will also be assigned. GRADING POLICY Mid-Term Final Projects/Participation Total 35% 35% 30% 100% ASSIGNMENTS 1. Odd- numbered problems (ONP) of each chapter on weekly basis. See the weekly assignments on your course calendar as attached. 2. Group project on stock valuation (3 stocks in each portfolio) including: a. b. c. d. e. f. g. Introduction of the firm Fundamental statistics for each stock Technical indicators of for each stock Computation of the risk and return ratio, using historical data , for each stock Valuation of each stock Class presentation Submission of the report on June 1, 2013 4 COURSE CALENDAR Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 S S S S S S S S S S S S S S S S S S S Date 2/2 2/2 2/9 2/16 2/23 3/2 3/9 3/16 3/23 3/30 4/6 4/13 4/20 4/27 5/4 5/11 5/18 5/25 6/1 Topic Classes Begin. An Overview of Finance and Investment Chapter 1, 5 Chapter 6 plus CASES* Chapter 7 Chapter 7 Chapter 8 plus CASES* Chapter 8 Chapter 9 NO CLASS Chapter 13 Chapter 14 Chapter 15 Chapter 22 Chapter 22 Chapter 23 Chapter 23 and CASES* NO CLASS CASES and Final Exam* 5 Assignment Assigning Students into Groups ONP 1-19 ONP 1-19 Ginny’s Restaurant ONP 1-17 ONP 1-17 ONP 1-17 ONP 1-17 ONP 1-17 ONP 1-15 ONP 1-15 ONP 1-15 ONP 1-15 ONP 1-15 ONP 1-15 Final Report is due COURSE OUTLINE Chapter 1 Introduction to Corporate Finance: -Corporate Finance and the Financial Manager -Forms of Business Organization -The Goal of Financial Management -The Agency Problem and Control of the Corporation -Financial Markets and the Corporation Chapter 5 Introduction to Valuation: The Time Value of Money: -Future Value and Compounding -Present Value and Discounting -More about Present and Future Values Chapter 6 Discounted Cash Flow Valuation -Future and Present Values of Multiple Cash Flows -Valuing Level Cash Flows: Annuities and Perpetuities -Comparing Rates: The Effect of Compounding -Loan Types and Loan Amortization Chapter 7 Interests Rates and Bond Valuation -Bonds and Bond Valuation -More about Bond Features -Bond Ratings -Some Different Types of Bonds -Bond Markets -Inflation and Interest Rates -Determinations of Bond Yields Chapter 8 Stock Valuation -Common Stock Valuation -Some Features of Common and Preferred Stocks -The Stock Markets Chapter 9 Net Present Value and Other Investment Criteria -Net Present Value 6 -The Payback Rule -The Discounted Payback -The Average Accounting Return -The Internal Rate of Return -The Profitability Index -The Practice of Capital Budgeting Chapter 13 Return, Risk, and the Security Market Line -Expected Returns and Variances -Portfolios -Announcements, Surprises, and Expected Returns -Risk: Systematic and Unsystematic -Diversification and Portfolio Risk -Systematic Risk and Beta -The Security Market Line Chapter 14 Options and Corporate Finance -Options: The Basics -Fundamentals of Option Valuation -Valuing a Call Option -Employee Stock Options -Equity as a Call Option of the Firm’s Assets -Options and Capital Budgeting -Options and Corporate Securities Chapter 15 Cost of Capital -The Cost of Capital: Some Preliminaries -The Cost of Equity -The Costs of Debt and Preferred Stock -Weighted Average Cost of Capital vs. Required Rate Return -Implications for valuation Chapter 22 International Corporate Finance -Terminology -Foreign Exchange Markets and Exchange Rates -Purchasing Power Parity -Interest Rate Parity, Unbiased Forward Rates, and the International Fisher Effect -International Capital Budgeting 7 -Exchange Rate Risk -Political Risk Chapter 23 Risk Management and Introduction to Financial Engineering Hedging with options Hedging with futures Hedging with swaps Securitization Analysis of Selected Cases: Written Analysis of Cases is required: 1. Ginny’s Restaurant; 2. Netscape IPO; 3. JetBlue IPO; 4. Ebay IPO Note: A volume of detailed slides, readings and assignments will be posted on Blackboard. Check your Blackboard site periodically, please. Additional Readings “An Economist’s Perspective on the Theory of the Firm”, Oliver Hart, Columbia Law Review, Vol. 89, No. 7, Contractual Freedom in Corporate Law (Nov., 1989), pp. 1757-1774 http://business.illinois.edu/josephm/BA549_Fall%202010/Session%204/Hart%20%281989%29.pdf “How CFOs Make Capital Structure and Capital Budgeting Decisions”, Journal of Applied Corporate Finance, 2002 “Corporate Dividend Policies: Lessons from Private Firms” Michaely and Roberts, University of Pennsylvania, Review of Financial Studies, 2012 “Mergers, Acquisitions & Corporate Restructuring”, Malacrida and Watter, Swiss Commercial Law Series, 2005 “Understanding the Risk Management Process”, Internal Auditor, 2007, http://www.theiia.org/intAuditor/itaudit/archives/2007/may/understanding-the-risk-management-process/ “Risk Management for Beginners”, EconoMonitor, 2009, http://www.economonitor.com/blog/2009/01/risk-management-for-beginners/ “Risk Management” New York Times Magazine, http://www.nytimes.com/2009/01/04/magazine/04riskt.html?_r=0 8 “Financial Crisis 101: A Beginner’s Guide to Structured Finance, the Financial Crisis, and Capital Market Regulation” by William Werkmeister, Kennedy School Review, Harvard University, 2010, http://isites.harvard.edu/icb/icb.do?keyword=k74756&pageid=icb.page399909 “Market Risk Premium used in 82 countries in 2012: a survey with 7,192 answers”, Pablo Fernandez, Javier Aguirreamalloa and Luis Corres, IESE Business School, SSRN-id2084213 “Ten Badly Explained Topics in Most Corporate Finance Books”, Pablo Fernández, Working Paper, IESE, SSRN-id2079055 9