DATE: August 10, 2011 TO:

advertisement

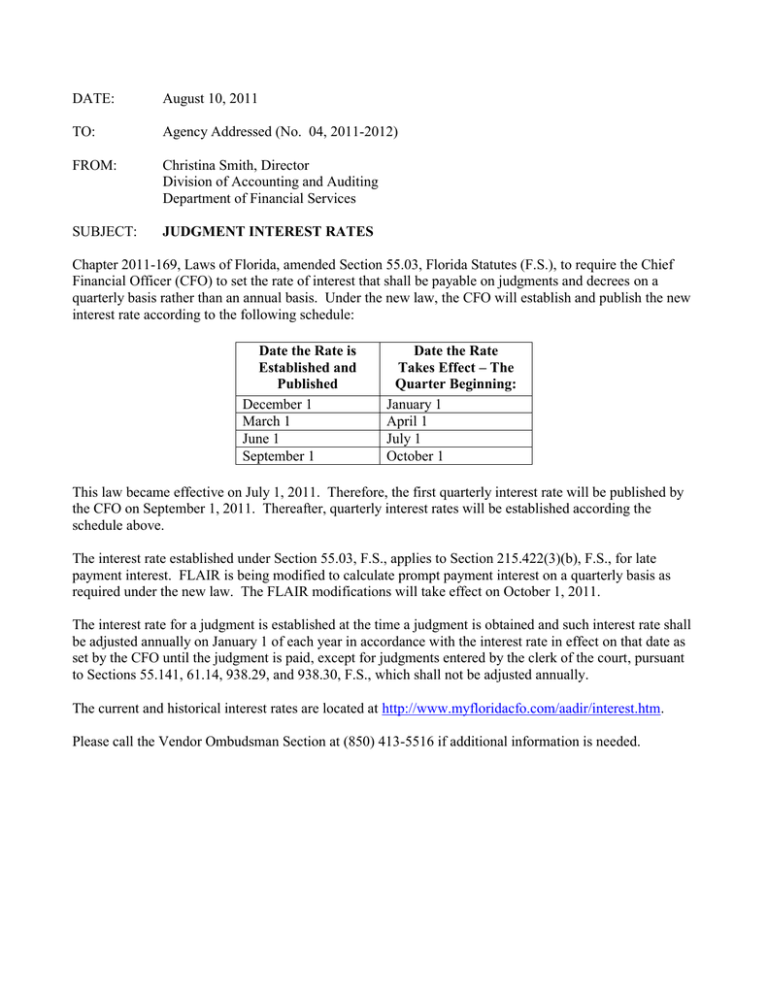

DATE: August 10, 2011 TO: Agency Addressed (No. 04, 2011-2012) FROM: Christina Smith, Director Division of Accounting and Auditing Department of Financial Services SUBJECT: JUDGMENT INTEREST RATES Chapter 2011-169, Laws of Florida, amended Section 55.03, Florida Statutes (F.S.), to require the Chief Financial Officer (CFO) to set the rate of interest that shall be payable on judgments and decrees on a quarterly basis rather than an annual basis. Under the new law, the CFO will establish and publish the new interest rate according to the following schedule: Date the Rate is Established and Published December 1 March 1 June 1 September 1 Date the Rate Takes Effect – The Quarter Beginning: January 1 April 1 July 1 October 1 This law became effective on July 1, 2011. Therefore, the first quarterly interest rate will be published by the CFO on September 1, 2011. Thereafter, quarterly interest rates will be established according the schedule above. The interest rate established under Section 55.03, F.S., applies to Section 215.422(3)(b), F.S., for late payment interest. FLAIR is being modified to calculate prompt payment interest on a quarterly basis as required under the new law. The FLAIR modifications will take effect on October 1, 2011. The interest rate for a judgment is established at the time a judgment is obtained and such interest rate shall be adjusted annually on January 1 of each year in accordance with the interest rate in effect on that date as set by the CFO until the judgment is paid, except for judgments entered by the clerk of the court, pursuant to Sections 55.141, 61.14, 938.29, and 938.30, F.S., which shall not be adjusted annually. The current and historical interest rates are located at http://www.myfloridacfo.com/aadir/interest.htm. Please call the Vendor Ombudsman Section at (850) 413-5516 if additional information is needed.