An Emerging Market for Corporate Control? The Mannesmann Takeover

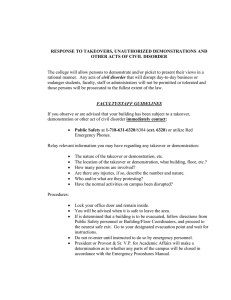

advertisement