Promoting Innovation Prof. Merritt Fox and Prof. Joseph A. McCahery

advertisement

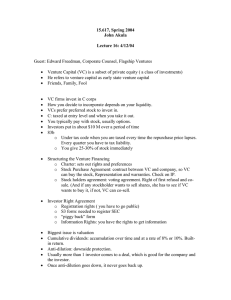

Prof. Merritt Fox and Prof. Joseph A. McCahery Promoting Innovation Importance of IPO for Venture Capitalist Exit Black and Gilson thesis: The optimal contract between the entrepreneur and the venture capitalist is structured around the availability of the venture capitalist’s exit through an IPO. Double-sided Moral Hazard Problem Venture Capitalist Uncertainty Shirking Value-added Services ¥/$/€ Information asymmetry Renegotiation Entrepreneur Agency Costs Venture Capital Architecture Selection Phase Entrepreneur Entrepreneur Operation Phase Exit Phase Investor Investor Staged Staged Financing Financing Entrepreneur Entrepreneur Convertible Convertible Preferred Preferred Stock Stock Investor Investor 2 Regain Regain Control Control IPO 1 Exit Exit Investor IPO Availability Explains National Differences z IPO availability explains why innovation based spin-offs occur in much greater numbers in the United States than in Germany or Japan. z Theory: more “vibrant” public equity market in the United States makes this optimal form of venture capital contract more available in the United States than elsewhere. Further Required Steps toward Better Finance for Innovation z Flexible Business Forms z Corporate Governance and Disclosure z Tax Neutrality z Entrepreneurism Flexible Business Forms To Meet Parties’ Contractual Needs Venture Capitalist Limited Liability Partnership *Agent *Agent Constraints Constraints Rules Rules *Affiliation *Affiliation Terms-Entry Terms-Entry *Appointment *Appointment Rights-Selection Rights-Selection *Decision *Decision Rights-Initiation Rights-Initiation *Trusteeship *Trusteeship Limited Liability Company (Close) Corporation Limited Partnership Entrepreneur *Agent *Agent Constraints Constraints Standards Standards *Affiliation *Affiliation Terms-Exit Terms-Exit *Appointment *Appointment Rights-Removal Rights-Removal *Decision *Decision Rights-Veto Rights-Veto *Reward *Reward Governance and Disclosure z Vibrant Equity Market for IPO Exit Requires: z Non-Control Shareholder Protection z Initial and Ongoing Corporate Disclosure z Market Transparency Tax z Tax Neutrality – US-Check-the-Box z Corporate vs. Partnership Taxation Entrepreneurism z Need for Mobility: z Employees of Established Firms Leaving if Good Ideas are not Implemented z Creating an Entrepreneurial Climate Thank you!

![Chapter 3 – Idea Generation [ENK]](http://s3.studylib.net/store/data/007787902_2-04482caa07789f8c953d1e8806ef5b0b-300x300.png)