Employee Benefits Overview

advertisement

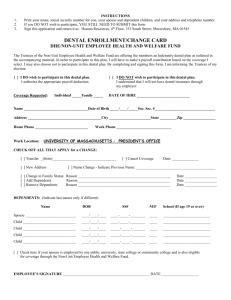

Employee Benefits Overview Benefits of working full time at EPCC • • Vacation – 8 to 13.3 hours per month for Classified Staff based on years of service – 13.33 hours per month for Admin/Professional Staff Sick Leave – • 12 days per year maximum 120 days Personal Leave – 2 days per fiscal year • Holidays - usually 22 • Staff Scholarship Program – 9 credit hours per semester per person _ Employee and eligible dependents Leaves • The Family and Medical Leave Act of 1993 – Employers covered by the law must provide eligible employees up to 12 weeks of leave entitlement per year – Eligibility: 12 months/1250 hours – Qualifying Event • Military Training or Duty • Bereavement Leave • Jury Duty – up to 3 days Your EPCC benefits • • • • • • Health Insurance Dental – DMO or Dental Choice Life Insurance 1, 2, 3, 4 x salary Short Term Disability Long Term Disability Voluntary accidental death & dismemberment (AD&D) • Discount Purchase Program Insurance Benefits • Administered through Employee Retirement System (ERS) for the State of Texas • Web-site: www.ers.state.tx.us. Health Insurance for you and your dependents Full Time: Part Time: State pays • 100% of employees’ premium cost • 50% of their dependents’ premium costs • College contributes to LTD and Dental • Employee pays smoker premium State pays • 50% of employees’ premium cost • 25% of dependents premium costs • College contributes to LTD and Dental • Employee pays smoker premium Coverage changes • Times to make changes in coverage – Summer enrollment – Qualifying life event • marriage • divorce • birth of a child, etc. • complete a change request within 30 days of a life event or go to www.ers.state.tx.us Select a Primary Care Physician • When you enroll, you must select a (PCP) primary care physician for you and your dependents • Each family member may select their own PCP • Change your PCP at any time • Be sure to tell United Health Care when a family member moves out of state Coverage options • PCP directed health care (network) • $25 co-pay PCP office visit • $40 co-pay Specialist (need referrals to most specialists) • 20% co-insurance up to 2,000 out of pocket • No calendar year deductible • $150 co-pay for ER plus 20% • $150/day co-pay plus 20% for hospital stay (max. $750 per stay on co-pay) • Self directed health care (non-network) • $500 deductible • 40% coinsurance up to $7000 out of pocket • You may pay balance above the allowable amount • 40% Emergency Room • $150/day co-pay + 40% for hospital stay (max. $750) Prescription Drug Program $50 plan year deductible to each covered person Retail 30 day supply Retail maintenance 30 day supply Mail order or EDS Pharmacy Network 90 day supply Tier 1 $15 $20 $45 Tier 2 $35 $45 $105 Tier 3 $60 $75 $180 For Your First Mail Order - Rx Begin the mail order process: – Complete mail order form that is available at www.ers.state.tx.us – Send co-payment (check, credit card, TexFlex) – Send prescriptions – Allow 10-14 days for initial order 1ST Dental Option • Dental (HMO) Health Maintenance Organization • Call Humana to select your dentist at (877) 377-0987 2ND Dental Option – Dental Choice Plan • Use any dentist of your choice in the United States and Canada • Benefits increase by using a preferred provider network dentist Optional Term Life, AD&D and Dependent Life • May have life insurance equal to 1, 2, 3, or 4 times your annual salary • Accidental Death and Dismemberment voluntary coverage for you and family • Dependent Term Life $5,000 coverage Short Term & Long Term Disability • Pre-existing conditions DO apply • Can provide income if illness or disability prevents you from working Life Insurance Beneficiary Designation: Go to www.ers.state.tx.us 1-877-275-4377 TexFlex Program • A tax free program • Health Care Reimbursement Account (HCRA) - pays for eligible medical expenses before taxes • Day Care Reimbursement Account (DCRA) - pays for eligible day care expenses before taxes TexFlex HCRA and DCRA • Minimum contribution - $15 per month • Maximum household contribution $416 per month • Eligible expenses may include your dependents by IRS standards. • Select deductions on number of annual paychecks 9 or 12 TexFlex How does it work? • You may enroll in one or both reimbursement accounts • Money is deducted from salary before taxes • Incur eligible expenses and request reimbursement from your Flex account(s) or • Request Flex Convenience Card - $15 annual fee – works like a debit card – valid for three years • Annual administrative fee of $12 for each account • TexFlex is a use it or lose it plan • Full time employees must contribute to a retirement plan • Teacher Retirement System (TRS) or Optional Retirement Program (ORP) • No loan provision • Part time non-benefits eligible employees contribute to either Social Security or FICA Alternative Plan (PERC) * Purchase of Special Service Credit • See TRS (Teacher Retirement System) Benefits Handbook for full details and limitations. • As a new employee, you may purchase up to five years of active duty US military service and establish additional service credit after five years of participation in TRS. • Other than military service, you may purchase service credit for outof-state service and withdrawn service, etc. Refer to TRS Benefits Handbook. * TRS participants only Tax Sheltered Annuity (TSA) • • • • TSA – 403B Plan Before tax contributions You may make a loan against it May withdraw your funds, at age 591/2, even if still employed • See list of authorized vendors under the benefits section at www.epcc.edu Always feel free to contact the Benefits Office if you have any questions about your retirement or benefits 831-6315 or 831-6380 or lalvar89@epcc.edu