Pinnacle Academ y June 2015 Revision Tests

advertisement

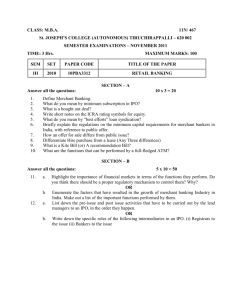

Downloaded from www.ashishlalaji.net Pinnacle Academy June 2015 Revision Tests 201-202, Florence Classic, Besides Unnati Vidhyalay, 10, Ashapuri Society, Jain Derasar Rd., Akota, Vadodara-20. ph: 98258 561 55 Financial Reporting Revision Test Conducted on 20th June 2015 [Solution is at the end with marking for self-assessment] Time Allowed-1.5 hours Q1 (a) (b) Maximum Marks- 80 On 30th June 2011, A Ltd. incurred Rs.2,00,000 net loss from disposal of a business segment. Also, on 30th July 2011, the company paid Rs.60,000 for property taxes assessed for calendar year 2011. How shall these transactions be included in determination of net income of A Ltd. for the six months interim period ended on 30th September 2011? (4 Marks) A Ltd. owns 30% of equity capital of B Ltd. B Ltd. in turn owns 35% of equity capital of C Ltd. and 40% of equity capital of D Ltd. You are required to answer the following questions: (i) Is B Ltd. related party of A Ltd.? (ii) Is C Ltd. related party of A Ltd.? (iii) Are C Ltd. and D Ltd. related parties? (4 Marks) (c) ABC Ltd. has three segments namely A, B and C. The segment assets of the three segments are Rs.200 lakhs, Rs.500 lakhs and Rs.1,300 lakhs respectively. Deferred tax assets included in the assets of each segment are – A: Rs.30 lakhs; B: Rs.50 lakhs and C: Rs.25 lakhs. Applying the test of segment assets of AS 17 decide, which segments are reportable? (4 Marks) (d) Give four examples of activities that do not necessarily amount to Discontinuing Operations, but might do so in combination with other circumstances. (4 Marks) Q2 (a) N Ltd. had announced a VRS for its employees on 1st January 2012. The scheme is scheduled to close on 30th June 2012. The scheme envisaged an initial lump-sum payment of Rs.2 lakhs and monthly payments over the balance period of service of employees coming under the plan. 1 Downloaded from www.ashishlalaji.net 200 employees opted for the scheme as on 31st March 2012. The total lump sum payment for these employees would be Rs.250 lakhs and the aggregate of future payments to them would amount to Rs.1,500 lakhs. However, no payment had been made to the employees under the scheme up to 31st March 2012. The company had not made any provision in its accounts towards any liability under the scheme. Give your view. (4 Marks) (b) During the year 2012 – 13, R Ltd. was sued by competitor for Rs.15 lakhs for infringement of a trademark. Based on the advice of the company’s legal counsel, R Ltd. provided for a sum of Rs.10 lakhs in financial statements for the year ended 31st March 2013. On 18th May 2013, the Court decided in favour of the party alleging infringement of the trademark and ordered R Ltd. to pay the aggrieved party a sum of Rs.14 lakhs. The financial statements were prepared by the company’s management on 30th April 2013 and approved by the board on 30th May 2013. Should R Ltd. adjust its financial statements for the year ended 31st March 2013? What would be the treatment of the above, in case the court decision was held on 1st June 2013? (4 Marks) (c) Goods of Rs.2,00,000 were destroyed due to flood in March 2009. A claim was lodged with insurance company but no entry was passed in the books for insurance claim. In March 2012 the claim was passed and the company received Rs.1,50,000 against the claim. Explain the treatment of this item? (4 Marks) in the statement of profit and loss after determination of current net profit or loss. (d) Garden Ltd. acquired fixed assets viz. Plant and Machinery for Rs.20 lakhs. During the same year it sold its furniture and fixtures for Rs.5 lakhs. Can the company disclose, net cash outflow towards purchase of fixed assets in the cash flow statement as per AS 3? (2 Marks) Q3 Following is the consolidated balance sheet of A Ltd. and its subsidiary S Ltd. and its jointly controlled entity B Ltd. as on 31st March 2014: Liabilities Share Capital of Rs.100 each General Reserve Profit and Loss account 6% Debentures Creditors A Ltd. B Ltd. 6,00,000 2,00,000 80,000 ----75,000 9,55,000 2,00,000 --------1,50,000 67,500 4,17,500 2 Downloaded from www.ashishlalaji.net Assets Fixed Assets Stock Debtors 6% Debentures of B Ltd. acquired at par Shares of B Ltd. (1,500 shares at Rs.80) Cash at bank Profit and loss account A Ltd. B Ltd. 4,50,000 1,40,000 80,000 90,000 1,20,000 75,000 --------9,55,000 1,50,000 60,000 45,000 --------12,500 1,50,000 4,17,500 A Ltd. acquired the shares on 1st August 2013. The profit and loss account of B Ltd. showed a debit balance of Rs.2,25,000 on 1st April 2013. During June 2013, goods costing Rs.9,000 were destroyed against which the insurer paid only Rs.3,000. Creditors of B include Rs.30,000 for goods supplied by A Ltd. on which A Ltd. has made profit of Rs.3,000. Half of these goods were still in stock of B Ltd. as on 31.03.14. Prepare consolidated balance sheet of A Ltd. following the proportionate consolidation method. (16 Marks) Q4 (a) A fixed asset was revalued upwards in the year 2005. It was originally acquired in year 2001 at a cost of Rs.60 lakhs and estimated residual value was Rs.6 lakhs with a useful life of 9 years. The asset was revalued upwards to Rs.45 lakhs at the end of year 2005. At the end of the year 2007, the indications of impairment were observed. The recoverable amount is estimated at Rs.14 lakhs. What should be the accounting treatment for the year 2007, if– i. The company has transferred an amount equal to the incremental depreciation due to upward revaluation to the Profit & Loss account from revaluation reserve. ii. The company has not made any such transfer as mentioned in (i) above. Company follows the method of straight line depreciation. Tax rate applicable to company is 30%. Also, highlight AS 22 impact, if any. (8 Marks) (b) Jet Carriers Ltd. has initiated a lease for four years in respect of a vehicle costing Rs.20,00,000 with expected useful life of 5 years. The asset would revert to the company under the lease agreement. The other information available in respect of lease agreement is: (1) The unguaranteed residual value of the equipment after the expiry of the lease term is estimated at Rs.2,50,000. (2) The implicit rate of interest is 10%. (3) The annual payments have been determined in such a way that the present value of the lease payment plus the residual value is equal to the cost of asset. Ascertain in the hand of Jet Carriers Ltd.: 3 Downloaded from www.ashishlalaji.net i. The annual lease payment. ii. The unearned finance income. iii. The segregation of finance income. Note: PV Residual value for 4 years @ 10% is 0.683. PV Factor for 4 years @ 10% is 3.16987. (10 Marks) Q5 (a) The fair value of plan assets as on 1st April 2009 is Rs.2,00,000. On 30th September 2009, the plan received contributions of Rs.55,000 and paid benefits of Rs.25,000. The fair value of plan assets as on 31st March 2010 is Rs.3,00,000. As on 1st April 2009 the firm expects to receive interest and dividend income (post tax) on investment of plan assets @ 9.25 %. The capital gains yield (post tax) for the year is expected to be 2 % and the administration cost shall be 1%. On net basis 10.25 % return p.a. is expected. Determine actual, expected and unexpected return on plan assets as per AS 15. (6 Marks) (b) Following particulars in respect of stock options granted by a company are available: Grant Date Number of employees covered Vesting Condition: Three years continuous employment Nominal Value per share (Rs.) Exercise Price per share (Rs.) Vesting date Exercise date Fair value of option on grant date (Rs.) April 1, 2008 300 10 40 March 31, 2011 July 31, 2011 20 Number of options to vest per employee shall depend on company’s average annual earnings after tax during vesting period as under: Average Annual PAT Less than Rs.100 crores Rs.100 crores to less than Rs.120 crores Rs.120 crores to less than Rs.150 crores Above Rs.150 crores Solution prepared by No. of options per employee Nil 30 45 60 CA. Ashish Lalaji Be free to send your suggestions / comments to CA. Ashish Lalaji at 9825856155 / ashishlalaji@rediffmail.com 4 Downloaded from www.ashishlalaji.net Position on 31.03.09 (i) Company expects to earn Rs.115 crores (ii) Number of employees expected to be entitled for option 280 Position on 31.03.10 (i) Company expects to earn Rs.130 crores (ii) Number of employees expected to be entitled for option 270 Position on 31.03.11 (i) Company actually earned Rs.128 crores on an average (ii) Number of employees entitled for option 275 Position on 31.07.11 Number of employees exercising the option 265 Compute expense to be recognized in each year and value of options forfeited. (6 Marks) (c) On 1.4.2001 ABC Ltd. received Government grant of Rs.300 lakhs for acquisition of a machinery costing Rs. 1,500 lakhs. The grant was credited to the cost of the asset. The life of the machinery is 5 years. The machinery is depreciated at 20% on WDV basis. The Company had to refund the grant in May 2004 due to non-fulfillment of certain conditions. How you would deal with the refund of grant in the books of ABC Ltd.? (4 Marks) Solution prepared by CA. Ashish Lalaji Be free to send your suggestions / comments to CA. Ashish Lalaji at 9825856155 / ashishlalaji@rediffmail.com 5 Downloaded from www.ashishlalaji.net Solution of FR Revision Test Conducted on 20th June 2015 Q1 (a) According to AS 25 “Interim Financial Reporting” an enterprise should treat an interim period to be a separate accounting period (discrete approach). As on 30th September 2011, A Ltd. will have to report entire Rs.2,00,000 loss on the disposal of business segment since the loss was incurred during the period. Such loss cannot be deferred and taken to another interim period. (2 Marks) However, a cost charged on an annual basis can be allocated to interim periods on accrual basis. Since Rs.60,000 property taxes is for the entire calendar year 2011, Rs.30,000 shall be reported as an expense for six months ended on 30th September 2011; while remaining Rs.30,000 would be reported as prepaid expenses. (2 Marks) (b) (i) Associates and Joint Ventures of the Reporting Enterprise are related parties. B Ltd. is an associate of A Ltd. Hence, A Ltd. and B Ltd. are related parties. (ii) An associate of associate is not a related party. Only in the case of parent, subsidiary of subsidiary become related parties. (iii) C Ltd. and D Ltd. are Fellow-associates. Fellow-subsidiaries become related parties because of common control. In case, common control is missing, parties do not become related. (1 + 1 + 2 = 4 Marks) (c) As per AS 17 “Segment Reporting”, a segment is reportable if segment assets are 10 % or more than the total segment assets. However, segment assets do not include income tax assets. Hence, deferred tax asset (DTA) should be excluded from the segment assets to apply the test of segment assets for identifying reportable segments. (Rs. in lakhs) Segment A B C Current DTA to be Revised Segment Excluded Segment Assets Assets 200 30 500 50 1,300 25 Total Segment Assets 170 450 1,275 1,895 Thus, segments having assets of Rs.189.5 lakhs or more are reportable i.e. segments B and C. (4 Marks) Solution prepared by CA. Ashish Lalaji 6 Downloaded from www.ashishlalaji.net (d) AS 24 “Discontinuing Operations” explains the criteria for determination of discontinuing operations. Examples of activities that do not necessarily amount to discontinuing operations, but might do so in combination with other circumstances: (i) (ii) (iii) (iv) Gradual or evolutionary phasing out of a product line or class of service Discontinuing, even if relatively abruptly, several products within an ongoing line of business Shifting of some production or marketing activities for a particular line of business from one location to another Closing of a facility to achieve productivity improvements or other cost savings An example related to consolidated financial statements is selling a subsidiary whose business activities are similar to those of the parent or other subsidiaries. (4 Marks) Q2 (a) As per AS 29 a provision should be recognized if the following conditions are satisfied: Condition 1 Condition 2 Condition 3 Present obligation is a result Outflow of resources to Reliable estimate of of past event settle the obligation is the obligation can be probable made VRS stated in January 2012 As and when the existed on balance sheet date. employees’ applications are accepted, outflow of As on balance sheet date resources to settle the nearly 200 employees had obligation is probable. opted for the scheme evidencing the existence of a Also, it is probable that the liability on the balance sheet liability will increase, if date. more people opt for VRS. Lump sum payment is Rs.250 lakhs and estimated payment is Rs.1,500 lakhs (given) Since all the conditions for recognition of provision are met, the company should recognize provision for the year ending 31st March 2012. (4 Marks) (b) As per AS 4 “Contingencies and Events Occurring after Balance Sheet Date”, adjustments to assets and liabilities are required for events occurring after the balance sheet date that provide additional information materially affecting the determination of amounts relating to conditions existing at the balance sheet date. In the given case, R Ltd. was sued by competitor for infringement of trademark during the year 2012-13 for which provision was also made by it. The decision of court on 18th May 2013 for payment of the penalty will constitute as an adjusting event occurred before approval of the financial statements. Hence, R Ltd. should adjust the provision upward by Rs.4 lakhs to reflect the award decreed by the court to be paid by them to its competitor. 7 Downloaded from www.ashishlalaji.net Had the judgment of the court been delivered on 1st June 2013 it would be considered to be post reporting period i.e. event occurred after the approval of the financial statements. In that case, no adjustment in the financial statements of 201213 would have been required. (4 Marks) (c) The exact reason for not recording the accounting entry in the year of lodging the claim should be ascertained. One of the possible reasons may be the uncertainty related to realization of the claim, which shall make the claim a possible asset. Such contingent assets are not recognizable in books as per AS 29. In other words, no error or omission was committed in 2008 – 09 and hence the collection of Rs.1,50,000 in 2011 – 12 does not represent a prior period item. However, if the company had a strong and valid case then collection of the claim cannot be deemed to be uncertain. In that case, not recording claim in 2008 – 09 is an omission and hence the collection of Rs.1,50,000 in 2011 – 12 is a prior period item. In both the cases, for better understanding of financial statements this item should be disclosed separately. (4 Marks) (d) As per AS 3, an enterprise should report separately major classes of gross cash receipts and gross cash payments arising from investing and financing activities. Acquisition and disposal of fixed assets represent two separate class of cash flows requiring separate disclosure. (2 Marks) Q3 Holding of A Ltd. in JCE is 75%. However, proportionate consolidation method is to be followed. Hence, JCE is not deemed to be subsidiary of A Ltd. Working Notes: (1) Profits earned by B Ltd. during 2013 – 14: Amount (Rs.) Profit and Loss account as on 31.03.14 (1,50,000) Add: Loss by fire (9,000 – 3,000) 6,000 (1,44,000) Less: Profit and Loss account as on 01.04.13 (2,25,000) 81,000 (1 Mark) Solution prepared by CA. Ashish Lalaji 8 Downloaded from www.ashishlalaji.net (2) Analysis of Profits of B Ltd.: Capital Revenue Profits Profits (Rs.) (Rs.) Profit and Loss account as on 01.04.13 (2,25,000) --------Profit in 2013 – 14 (4:8) 27,000 54,000 (1,98,000) 54,000 Loss by fire in June 2013 (6,000) --------(2,04,000) 54,000 A Ltd. (75%) (1,53,000) 40,500 (3 Marks) (3) Determination of Goodwill / Capital Reserve: Cost of Shares Less: Paid up Value Share in capital profits Goodwill Amount (Rs.) 1,20,000 1,50,000 (1,53,000) 1,23,000 (2 Marks) (4) Consolidated Profit and Loss Account: Profit and Loss account as on 31.03.14 of A Ltd. Add: Share in Revenue Profits Unrealised profit (3,000 X 50% X 75%) Amount (Rs.) 80,000 40,500 (1,125) 1,19,375 (2 Marks) Consolidated Balance Sheet of A Ltd. as on 31st March 2014 I. 1. (a) (b) Equity and Liabilities: Shareholders’ Funds Share Capital Reserves and Surplus 2. Non Current Liabilities Long Term Borrowings (6% Debentures) 3. II. 1. Current Liabilities Trade Payables (1,25,625 – 22,500) Total Assets: Non Current Assets Fixed Assets - Tangible - Intangible (Goodwill) Non Current Investment (Debentures of B Ltd.) Note No. Amount 1 6,00,000 3,19,375 Amount 9,19,375 1,12,500 1,12,500 1,03,125 1,03,125 11,35,000 7,75,500 5,62,500 1,23,000 90,000 9 Downloaded from www.ashishlalaji.net 2. Current Assets Inventories Trade Receivables (1,13,750 – 22,500) Cash and Cash Equivalents Total 3,59,500 2 1,83,875 91,250 84,375 11,35,000 See accompanying notes to Consolidated Balance Sheet. Notes forming part of Consolidated Balance Sheet Note No. 1 2 Amount (Rs.) Reserves and Surplus General Reserve 2,00,000 Consolidated Profit and Loss Account 1,19,375 Inventories As given [1,40,000 + (60,000 X 75%)] Less: Unrealised Profit Amount (Rs.) 3,19,375 1,83,875 1,85,000 1,125 (8 Marks) Solution prepared by Q4 (a) CA. Ashish Lalaji Cost of Machinery at beginning of 2001 Less: Depreciation [60 – 6 / 9] X 5 years Book value at end of year 2005 Add: Revaluation gain Revised book value at end of year 2005 Less: Revised depreciation [45 – 6 / 4] X 2 years Book value at end of year 2007 Less: Recoverable amount Impairment loss 60 lakhs 30 lakhs 30 lakhs 15 lakhs 45 lakhs 19.5 lakhs 25.5 lakhs 14 lakhs 11.5 lakhs (2 Marks) Situation (i): Incremental depreciation is: 9.75 – 6 i.e. 3.75 lakhs p.a. i.e. Rs.7.5 lakhs for 2 years. Thus, balance in revaluation reserve shall be Rs.7.5 lakhs [15 – 7.5]. Thus, impairment loss of Rs.7.5 lakhs shall be debited to revaluation reserve and balance Rs.4 lakhs shall be debited to profit and loss account. (2 Marks) Further, deferred tax asset should be recognised on that part of impairment loss recognized in Profit & Loss account i.e. for Rs.1.2 lakhs [4 X 30%] if the firm is reasonably certain in respect of future taxable income against which such deferred tax asset shall be recognised. (2 Marks) Solution prepared by CA. Ashish Lalaji 10 Downloaded from www.ashishlalaji.net Situation (ii): If no transfer has been taken for additional depreciation then balance in revaluation reserve shall be Rs.15 lakhs. Thus, entire impairment loss of Rs.11.5 lakhs shall be debited to revaluation reserve i.e. no portion of impairment loss shall be debited to profit and loss account. In this case, there shall be no impact of AS 22. (2 Marks) (b) (i) Determination of Lease Rent: Let the lease rent charged at the end of each year be Rs.x Year Lease Receipts PVF (10%) 1–4 X 3.16987 4 2,50,000 0.683 PV 3.16987X 1,70,750 3.16987X + 1,70,750 Lease rent is charged in such a manner that cost of the asset is recovered. 3.16987X + 1,70,750 = 20,00,000 i.e. X = Rs.5,77,074 (4 Marks) (ii) Determination of Unearned Finance Income: Unearned Finance Income = [(5,77,074 X 4) + 2,50,000 ] – 20,00,000 = Rs.5,58,296 (1 Mark) (iii) Statement Showing Segregation of Finance Income: Year Due at the beginning 1 2 3 4 20,00,000 16,22,926 12,08,145 7,51,886 Finance Income @ 10 % Total Dues 2,00,000 22,00,000 1,62,293 17,85,219 1,20,815 13,28,960 75,188 8,27,074 Lease Due at the Receipts end 5,77,074 5,77,074 5,77,074 5,77,074 16,22,926 12,08,145 7,51,886 2,50,000 (5 Marks) Q5 (a) Determination Unexpected Return on Plan Assets: Plan assets on 1st April 2009 Add: Expected Return at 10.25% Add: Contributions on 30th September 2009 Les: Benefits paid on 30th September 2009 Add: Expected return on Rs.30,000 (55 – 25) at 10.25% for 6 months Add: Unexpected return (balancing figure) Plan assets as on 31st March 2010 (given) 2,00,000 20,500 2,20,500 55,000 2,75,500 25,000 2,50,500 1,538 2,52,038 47,962 3,00,000 (5 Marks) 11 Downloaded from www.ashishlalaji.net Determination of Expected and Actual Return on Plan Assets: Expected Return (20,500 + 1,538) Unexpected Return Actual Return 22,038 47,962 70,000 (1 Mark) (b) Computation of Provision to be recognized each year: Date 31.03.09 31.03.10 31.03.11 Fair Value of Options Expected to be Exercised 280 X 30 X 20 i.e. Rs.1,68,000 270 X 45 X 20 i.e. Rs.2,43,000 275 X 45 X 20 i.e. Rs.2,47,500 Provision p.a. based on FV 1,68,000 3 i.e. 56,000 2,43,000 3 i.e. 81,000 Cumulative Provision to be recognized Provision Already Recognised Provision to be Recognised 56,000 --------- 56,000 81,000 X 2 i.e. 1,62,000 56,000 1,06,000 2,47,500 1,62,000 85,500 ----(5 Marks) Value of options forfeited = (275 – 265) i.e. 10 X 45 X 20 = Rs.9,000 (1 Mark) (c) According to AS 12 on “Accounting for Government Grants”, the amount refundable in respect of a grant related to a specific fixed asset should be recorded by increasing the book value of the asset by the amount refundable. If the book value is increased, depreciation on the revised book value should be provided prospectively over the residual useful life of the asset. 1st April, 2001 Cost of machinery (Rs.1,500 – 300) 31st March, 2002 Less: Depreciation @ 20% Book value 31st March, 2003 Less: Depreciation @ 20% Book value 31st March, 2004 Less: Depreciation @ 20% 1st April, 2004 Book value May, 2004 Add: Refund of grant Revised book value 1,200.00 240.00 960.00 192.00 768.00 153.60 614.40 300.00 914.40 Depreciation @ 20% on the revised book value amounting Rs.914.40 lakhs is to be provided prospectively over the residual useful life of the asset i.e. years ended 31st March, 2005 and 31st March, 2006. (4 Marks) Solution prepared by CA. Ashish Lalaji Be free to send your suggestions / comments to CA. Ashish Lalaji at 9825856155 / ashishlalaji@rediffmail.com 12