Financial Services RFP Questions and Responses – updated 3/10/15 The volumes in attachment B – are they monthly? Questions asked prior to the proposal meeting on 3/2/15:

advertisement

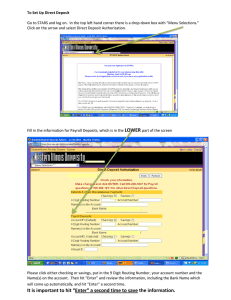

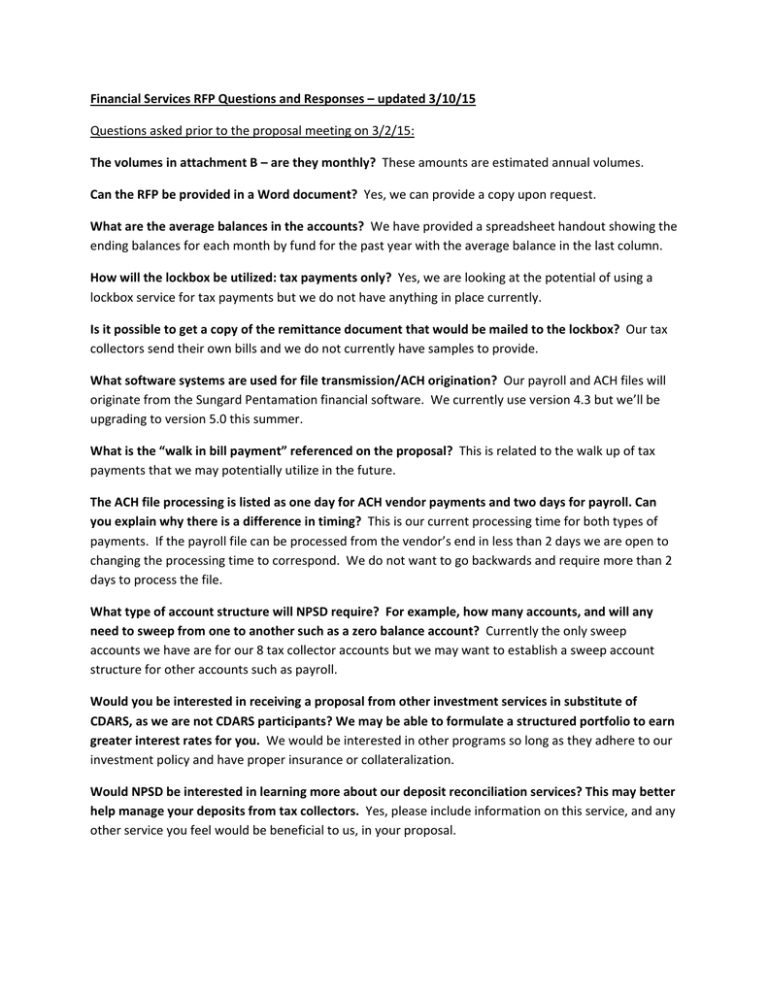

Financial Services RFP Questions and Responses – updated 3/10/15 Questions asked prior to the proposal meeting on 3/2/15: The volumes in attachment B – are they monthly? These amounts are estimated annual volumes. Can the RFP be provided in a Word document? Yes, we can provide a copy upon request. What are the average balances in the accounts? We have provided a spreadsheet handout showing the ending balances for each month by fund for the past year with the average balance in the last column. How will the lockbox be utilized: tax payments only? Yes, we are looking at the potential of using a lockbox service for tax payments but we do not have anything in place currently. Is it possible to get a copy of the remittance document that would be mailed to the lockbox? Our tax collectors send their own bills and we do not currently have samples to provide. What software systems are used for file transmission/ACH origination? Our payroll and ACH files will originate from the Sungard Pentamation financial software. We currently use version 4.3 but we’ll be upgrading to version 5.0 this summer. What is the “walk in bill payment” referenced on the proposal? This is related to the walk up of tax payments that we may potentially utilize in the future. The ACH file processing is listed as one day for ACH vendor payments and two days for payroll. Can you explain why there is a difference in timing? This is our current processing time for both types of payments. If the payroll file can be processed from the vendor’s end in less than 2 days we are open to changing the processing time to correspond. We do not want to go backwards and require more than 2 days to process the file. What type of account structure will NPSD require? For example, how many accounts, and will any need to sweep from one to another such as a zero balance account? Currently the only sweep accounts we have are for our 8 tax collector accounts but we may want to establish a sweep account structure for other accounts such as payroll. Would you be interested in receiving a proposal from other investment services in substitute of CDARS, as we are not CDARS participants? We may be able to formulate a structured portfolio to earn greater interest rates for you. We would be interested in other programs so long as they adhere to our investment policy and have proper insurance or collateralization. Would NPSD be interested in learning more about our deposit reconciliation services? This may better help manage your deposits from tax collectors. Yes, please include information on this service, and any other service you feel would be beneficial to us, in your proposal. Is NPSD able to provide us with Merchant Card statements for 3 months, for a better understanding of the Procurement Card Services requested? We recently began posting our procurement card statements online on our board agenda webpage. The following link for the procurement card statements that were posted starting in December: http://www.npenn.org/Page/19075 Please select the second date for each month on the left to view the Procurement Card statements. Who is you current purchasing card provider? PNC through the Easyprocure program How many cardholders do you currently have? We have approximately 45 cardholders. Do you currently have a revolving‐debt or a non‐revolving debt purchasing card (payment of the full account balance is due before the next billing cycle)? Non‐revolving (paid in full each month) What fees do you currently pay on your existing Purchasing Card? No monthly or annual fees Do you currently set spending controls for cardholders (monthly spend limits, prevent purchases of specific commodities and services)? If no, is this a feature you would like to receive? Each card has a monthly spend limit but no merchant category code restrictions. Do you currently import your purchasing card transactions into your general ledger system? If no, is this a feature you would like to receive? If so, what is the name of your general ledger system? We do not import via a file but if this can expedite our payment process we would be open to it. We use Sungard Pentamation Financeplus version 4.3 but will be upgrading to version 5.0 this summer. Do you currently receive reward points or rebates with your current card program? We do receive a rebate. Our estimated 2014‐15 rebate will be 115 basis points. Are you able to provide a copy of your accounts payable lists to complete a Free Visa Vendor Match? This will help identify vendors who accept visa, your rebate potential and any data that can be captured automatically. We would be able to provide this but we would need to discuss the appropriate time in the process to review this information. Is NPSD only sending domestic wires? Or is there ever a need for international wire services? In the past 3 years we have not sent any international wires. Beyond vendor payments and direct deposit, what other ACH Origination services might NPSD be interested in, if any? These are currently the only two types that we would want to make payments to via ACH. Does NPSD process your own payroll or is there a third‐party that uploads the file for you? We process our own payroll. Is NPSD able to create a NACHA file for payroll or vendor payments? Or possibly CSV (comma‐ separated value) file? The files that we send to our existing bank are .tpe files. Can NPSD provide an executive overview of the features and functionality you are looking for with the lockbox services? Is the school district able to use the lockbox services for tax collection payments? It was noted that there are currently 8 tax collectors, so NPSD may not be lawfully allowed to use lockbox to collect these payments. Can NPSD provide the annual payment volumes that may be received through the lockbox service if implemented? We will discuss the potential of lockbox services in more detail at the walkthrough meeting on 3/2. Questions asked at the proposal meeting on 3/2 What is the safe deposit box used for? The safeguarding of important district documents. Can you provide further detail on the accounts, the number of deposits, checks presented for deposit, and checks paid? A schedule showing these items is available on the district website with the other proposal documents. Can annual reports be provided electronically (on CD or via internet link?) Annual reports can be presented in these electronic formats. Will Positive Pay be for checks only or should ACH transactions be included? ACH transactions should also be included with checks. What is the current number of employees on direct deposit? Approximately 2,500. How many remote deposit scanners will be needed? We are requesting 8 deposit scanners for our tax collectors and 1 for the business office. Please describe the range of courier services requested. Courier services would be for district deposits for the general fund, school nutrition fund, and the student activity funds at two locations (the ESC building and the high school.) Describe the tax collection deposit cycle. The majority of our deposits from tax collectors occur in July and August during our discount payment period. Deposits will continue through mid‐December when most payments are received. Are you looking for one provider or multiple providers? Our preference is to have one provider for all services. Other notes: Please include services and innovative ideas for consideration that you may offer that were not part of the RFP if they will benefit the District. Please include any services or discounts offered to District employees in your proposal. The District’s financial reports from previous years can be found on our website at http://www.npenn.org/domain/11 We will make the best effort to have our tax collectors establish accounts with the winning vendor. Questions asked after the proposal meeting on 3/2 If the Tax Collectors will open accounts with the bank the District selects to provide these services, what Tax ID do you anticipate they will be opened under (the Districts or the Tax Collectors)? The reason for the question is that the Tax ID owner is the legal owner of the account and we may have to take all instructions on the account from the Tax Collector and not the District. The accounts will be opened with the District’s tax ID number. As far as investments are concerned, we understand preservation of principal is of the utmost importance to the District. Does the District actively manage the investment of funds or do you leave investment decisions to a third party or the current banking provider? Steve and I are active in the investment of funds. We will sometimes solicit advice from our banking and investment partners but we make the decisions of where to invest those funds. The RFP mentions “A truly exceptional system will invest cash on hand at market rates with very little or no risk…” can you provide the current rates you are receiving. We publish a monthly report of our cash and investment balances along with the rates we are receiving on the Finance Committee page of our website. The link to that page where each month’s report titled “Investment Reports” can be found is http://www.npenn.org/domain/1266 How does the District currently pay for banking fees (hard dollar or Earnings Credits)? We currently do not incur banking fees with either of our banks. Are you looking for Earnings Credits or interest on balances? We would prefer interest on balances. Questions updated on 3/10/15 Can you provide the amounts deposited as checks and as cash? Unfortunately the detail of deposits broken down by check and cash is not available. Can you explain the deposits made to the payroll account? These items are payroll payments made in error that were then refunded back to the district by the employee. We normally don't make deposits into the payroll account except for items like this. What is the average dollar amount of you entire payroll ACH for a payroll run? The average per pay is about 2.8 million for direct deposit. How many accounts will use positive pay? We currently have 4 accounts that use the positive pay feature.