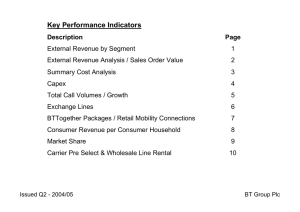

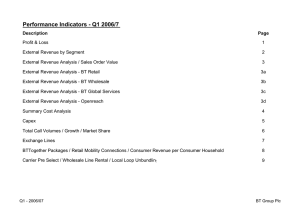

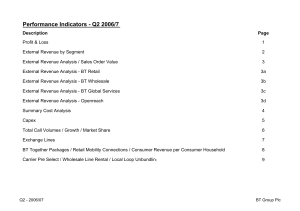

Performance Indicators - Q3 2005/6 - Restatements in red

advertisement

Performance Indicators - Q3 2005/6 - Restatements in red

Q3 - 2005/06

Description

Page

Profit & Loss

1

External Revenue by Segment

2

External Revenue Analysis / Sales Order Value

3

External Revenue Analysis - BT Retail

3a

External Revenue Analysis - BT Wholesale

3b

External Revenue Analysis - BT Global Services

3c

Summary Cost Analysis

4

Capex

5

Total Call Volumes / Growth

6

Exchange Lines

7

BTTogether Packages / Retail Mobility Connections

8

Consumer Revenue per Consumer Household

9

Market Share

10

Carrier Pre Select & Wholesale Line Rental

11

BT Group Plc

BT Group Results - Restated and under IFRS

£m unless stated

Turnover

BT Retail

BT Wholesale

BT Global Services

Other

Eliminations

Group Turnover

Leaver costs

EBITDA Inc. leaver costs

BT Retail

BT Wholesale

BT Global Services

Other

Group EBITDA

2004/05

Q1

Actual

BT Group

2,184

2,273

1,727

7

(1,672)

4,519

102

Better /

(worse) vs

Pr Year

%

(3.7)

1.4

17.8

(14.3)

(2.8)

4.7

-

2005/06

Q1

Actual

BT Group

2004/05

Q2

Actual

BT Group

Better /

(worse) vs

Pr Year

%

2,104

2,304

2,035

6

(1,718)

4,731

2,205

2,263

1,791

6

(1,711)

4,554

6

8

(3.8)

0.7

15.4

(33.3)

0.4

4.7

-

2005/06

Q2

Actual

BT Group

2004/05

Q3

Actual

BT Group

2,122

2,278

2,067

4

(1,704)

4,767

2,160

2,272

1,810

6

(1,712)

4,536

37

12

Better /

(worse) vs

Pr Year

%

(2.6)

1.5

19.4

(50.0)

1.2

7.6

-

2005/06

Q3

Actual

BT Group

2004/05

Q4

Actual

BT Group

2004/05

Full Year

Actual

BT Group

2,103

2,306

2,161

3

(1,691)

4,882

2,149

2,287

2,160

6

(1,782)

4,820

8,698

9,095

7,488

25

(6,877)

18,429

23

44

166

183

931

193

(20)

1,287

(5.5)

6.7

20.7

110.0

5.4

173

993

233

(42)

1,357

191

965

228

26

1,410

7.9

(0.3)

(5.7)

(234.6)

(4.4)

206

962

215

(35)

1,348

183

984

239

(6)

1,400

8.7

(0.8)

1.3

500.0

(1.4)

199

976

242

(36)

1,381

197

984

301

(42)

1,440

754

3,864

961

(42)

5,537

Depreciation & amortisation of intangibles

BT Retail

BT Wholesale

BT Global Services

Other

Group Depreciation

38

479

131

52

700

10.5

4.6

(16.0)

(26.9)

(1.3)

34

457

152

66

709

38

477

138

51

704

(2.6)

3.1

(14.5)

35.3

1.7

39

462

158

33

692

33

473

133

56

695

(9.1)

1.3

(20.3)

16.1

(2.2)

36

467

160

47

710

38

485

148

74

745

147

1,914

550

233

2,844

Op Profit Inc. leaver costs

BT Retail

BT Wholesale

BT Global Services

Other

Underlying Group Op Profit

145

452

62

(72)

587

(4.1)

18.6

(30.6)

(50.0)

10.4

139

536

81

(108)

648

153

488

90

(25)

706

9.2

2.5

36.7

(172.0)

(7.1)

167

500

57

(68)

656

150

511

106

(62)

705

8.7

(0.4)

22.6

(33.9)

(4.8)

163

509

82

(83)

671

159

499

153

(116)

695

607

1,950

411

(275)

2,693

(155)

(7)

425

(14)

411

(113)

4

26.6%

0

302

3.6

3.5

8,557

694

8,422

8.4

171.4

20.2

21.4

(14.2)

23.8

25.0

25.7

(3.2)

3.6

(142)

5

511

(12)

499

(129)

4

25.2%

0

374

4.5

4.4

8,471

716

8,121

(154)

(3)

549

22

571

(143)

1

26.0%

1

430

4.8

5.0

5.30

8,535

803

8,373

35.1

200.0

1.8

(14.4)

2.8

(13.7)

4.2

(12.0)

13.6

2.9

(100)

3

559

(70)

489

(139)

21

24.9%

0

371

5.0

4.4

6.50

8,456

694

8,133

(149)

(10)

546

249

795

(140)

3

25.6%

0

658

4.8

7.7

13.4

130.0

(0.2)

(31.4)

4.3

(37.5)

2.1

(36.4)

1.4

(0.8)

(129)

3

545

0

545

(134)

0

24.6%

0

411

4.9

4.9

(141)

6

560

17

577

(145)

8

25.9%

0

440

4.9

5.2

3.90

8,493

744

7,893

(599)

(14)

2,080

274

2,354

(541)

16

26.0%

1

1,830

18.1

21.5

9.20

8,524

3,011

7,893

Net Finance Costs

Share of post tax profits/losses of associates and joint ventures

Underlying PBT

Specific Items : Net gains (losses)

Reported PBT

Tax - Underlying

Tax on specific items

Tax rate

Minorities

Net Income

EPS before specific items

EPS after specific items

Net Dividend

Average Number of Shares in Issue

Capital Expenditure

Net Debt

Q3 05/06

Page 1

8,512

770

8,046

8,407

759

8,113

BT Group Plc

2004/5

2003/4*

EXTERNAL REVENUE BY

SEGMENT

Consumer

Major Corporate

Business

Wholesale / Global Carrier

Other

Total

Q1

Q2

Q3

Q4

£m

1,495

1,388

646

1,017

6

4,552

£m

1,487

1,383

649

999

4

4,522

£m

1,493

1,377

631

1,021

9

4,531

£m

1,462

1,615

655

993

15

4,740

Total

£m

5,937

5,763

2,581

4,030

34

18,345

2005/6

Q1

Q2

Q3

Q4

£m

1,416

1,391

617

1,088

7

4,519

£m

1,410

1,412

624

1,102

6

4,554

£m

1,400

1,440

600

1,090

6

4,536

£m

1,373

1,693

601

1,147

6

4,820

Total

£m

5,599

5,936

2,442

4,427

25

18,429

Q1

Q2

Q3

£m

1,324

1,597

586

1,218

6

4,731

£m

1,336

1,629

583

1,215

4

4,767

£m

1,324

1,732

568

1,255

3

4,882

Q1

£m

(6.5%)

14.8%

(5.0%)

11.9%

n/m

4.7%

2005/6

Q2

£m

(5.2%)

15.4%

(6.6%)

10.3%

n/m

4.7%

Q3

£m

(5.4%)

20.3%

(5.3%)

15.1%

n/m

7.6%

2005/6

Q2

£m

(4.5%)

5.6%

(4.8%)

11.6%

n/m

2.5%

Q3

£m

(5.4%)

8.9%

(5.3%)

11.6%

n/m

3.2%

* 2003/4 numbers estimated to reflect new Premium Rate Services recognition policy

Headline Year-on-Year Growth

EXTERNAL REVENUE BY

SEGMENT

Consumer

Major Corporate

Business

Wholesale / Global Carrier

Other

Total

Q1

Q2

2004/5

Q3

Q4

(5.3%) (5.2%) (6.2%) (6.1%)

0.2%

2.1%

4.6%

4.8%

(4.5%) (3.9%) (4.9%) (8.2%)

7.0% 10.3%

6.8% 15.5%

n/m

n/m

n/m

n/m

(0.7%)

0.7%

0.1%

1.7%

Total

(5.7%)

3.0%

(5.4%)

9.9%

n/m

0.5%

Underlying Year-on-Year Growth - excluding impact of mobile termination and revenues from Infonet and Albacom

EXTERNAL REVENUE BY

SEGMENT

Consumer

Major Corporate

Business

Wholesale / Global Carrier

Other

Total

Q3 - 2005/06

Q1

Q2

2004/5

Q3

Q4

(4.5%) (4.3%) (4.6%) (4.7%)

0.4%

2.4%

5.2%

0.5%

(3.7%) (2.9%) (2.7%) (6.3%)

10.6% 14.4% 16.0% 21.7%

n/m

n/m

n/m

n/m

0.5%

2.1%

3.2%

2.2%

Page 2

Total

(4.5%)

2.1%

(3.9%)

15.6%

n/m

2.0%

Q1

£m

(4.9%)

4.2%

(2.8%)

16.8%

n/m

3.4%

BT Group Plc

2003/4*

Q3

£m

2004/5

Q3

£m

2005/6

Q2

£m

EXTERNAL REVENUE ANALYSIS

Q1

£m

Q2

£m

Exchange lines/ISDN - connection and rental

Calls

Private Circuits

Transit, conveyance, interconnect circuits and other

wholesale (incl. FRIACO)

Other

949

1,120

352

962

1,091

324

939

1,059

348

929

1,044

324

3,779

4,314

1,348

918

982

326

959

888

325

952

820

325

934

799

316

3,763

3,489

1,292

921

764

314

912

749

302

889

730

322

638

783

632

752

597

750

607

758

2,474

3,043

657

700

650

699

619

685

599

726

2,525

2,810

630

717

634

731

636

698

Total Traditional

3,842

3,761

3693

3662

14,958

3,583

3,521

3,401

3374

13,879

3,346

3,328

3,275

Networked IT Services

Broadband

Mobility

Other

552

92

16

50

584

106

17

54

611

128

26

73

799

165

40

74

2,546

491

99

251

634

186

43

73

699

199

49

86

738

253

55

89

995

292

58

101

3,066

930

205

349

904

314

61

106

918

350

65

106

1,046

374

67

120

Total New Wave

710

761

838

1,078

3,387

936

1,033

1,135

1,446

4,550

1,385

1,439

1,607

4,552

4,522

4,531

4,740

18,345

4,519

4,554

4,536

4,820

18,429

4,731

4,767

4,882

31

31

41

42

39

79

110

79

110

158

199

147

189

164

203

Q1

£m

2,359

8,244

2005/6

Q2

£m

752

8,144

Q3

£m

1,194

8,103

Total Revenue (Incl. Infonet and Albacom)

Q4

£m

Total

£m

Q1

£m

Q2

£m

Memo: Infonet and Albacom included above - Traditional

New Wave

Q4

£m

Total

£m

Q1

£m

Q3

£m

* 2003/4 numbers estimated to reflect new Premium Rate Services recognition policy

SOLUTIONS AND C&SI SALES ORDER VALUE

Total order intake

Rolling 12 months order intake

Q3 - 2005/06

Q1

£m

2,048

5,875

Q2

£m

561

6,020

2003/4

Q3

£m

2,078

6,343

Q4

£m

2,325

7,012

Q1

£m

1,276

6,240

Page 3

Q2

£m

852

6,531

2004/5

Q3

£m

1,235

5,688

Q4

£m

3,798

7,161

BT Group Plc

2003/4*

EXTERNAL REVENUE ANALYSIS Retail

Exchange lines/ISDN - connection and rental

Calls

Private Circuits

Transit, conveyance, interconnect circuits and other

wholesale (incl. FRIACO)

Other

Q1

£m

Q2

£m

775

992

44

Q3

£m

791

967

47

2004/5

Q4

£m

770

944

48

Total

£m

761

927

46

3,097

3,830

185

Q1

£m

Q2

£m

752

875

43

Q3

£m

801

787

47

2005/6

Q4

£m

795

729

48

Total

£m

780

710

35

3,128

3,101

173

Q1

£m

Q2

£m

766

678

41

Q3

£m

754

664

41

741

650

41

296

282

306

260

1,144

266

277

272

254

1,069

262

276

262

2,107

2,087

2,068

1,994

8,256

1,936

1,912

1,844

1,779

7,471

1,747

1,735

1,694

47

63

3

3

48

73

5

9

56

80

6

13

83

99

5

17

234

315

19

42

56

108

17

14

73

110

23

18

72

131

30

19

83

147

32

26

284

496

102

77

75

159

27

17

73

176

30

26

83

185

31

29

116

135

155

204

610

195

224

252

288

959

278

305

328

Total External Revenue

2,223

2,222

2,223

2,198

8,866

2,131

2,136

2,096

2,067

8,430

2,025

2,040

2,022

Memo: Internal Revenue

33

38

45

72

188

53

68

64

83

268

79

82

81

2,256

2,260

2,268

2,270

9,054

2,184

2,204

2,160

2,150

8,698

2,104

2,122

2,103

Total Traditional

Networked IT Services

Broadband

Mobility

Other

Total New Wave

Total Retail Reported Revenue

* 2003/4 numbers estimated to reflect new Premium Rate Services recognition policy

Q3 - 2005/06

Page 3a - Retail

BT Group Plc

2003/4

EXTERNAL REVENUE ANALYSIS Wholesale

Exchange lines/ISDN - connection and renta

Calls

Private Circuits

Transit, conveyance, interconnect circuits and other

wholesale (incl. FRIACO)

Other

Q1

£m

Q2

£m

Q3

£m

2004/5

Q4

£m

Total

£m

Q1

£m

Q2

£m

Q3

£m

2005/6

Q4

£m

Total

£m

Q1

£m

Q2

£m

Q3

£m

176

145

168

149

638

154

155

155

167

631

161

150

169

638

632

597

607

2,474

657

650

619

599

2,525

630

634

636

814

777

765

756

3,112

811

805

774

766

3,156

791

784

805

25

29

40

58

152

71

79

110

132

392

141

160

174

47

45

60

57

209

59

68

70

75

272

89

80

91

72

74

100

115

361

130

147

180

207

664

230

240

265

Total External Revenue

886

851

865

871

3,473

941

952

954

973

3,820

1,021

1,024

1,070

Memo: Internal Revenue

1,392

1,368

1,359

1,369

5,488

1,332

1,311

1,318

1,314

5,275

1,283

1,254

1,236

Total Wholesale Reported Revenue

2,278

2,219

2,224

2,240

8,961

2,273

2,263

2,272

2,287

9,095

2,304

2,278

2,306

Total Traditional

Networked IT Services

Broadband

Mobility

Other

Total New Wave

Q3 - 2005/06

Page 3b - Wholesale

BT Group Plc

2003/4*

EXTERNAL REVENUE ANALYSIS Global Services

2004/5

2005/6

£m

174

128

132

Q2

£m

171

124

132

Q3

£m

169

115

132

Q4

£m

168

117

129

Total

£m

682

484

525

Q1

£m

166

107

129

Q2

£m

158

101

123

Q3

£m

157

91

122

Q4

£m

154

89

114

Total

£m

635

388

488

Q1

£m

155

86

112

Q2

£m

158

85

111

Q3

£m

148

80

112

481

466

435

483

1,865

427

416

407

466

1,716

449

451

433

Total Traditional

915

893

851

897

3,556

829

798

777

823

3,227

802

805

773

Networked IT Services

Broadband

Mobility

Other

505

4

13

-

536

4

12

-

555

8

20

-

716

8

35

2,312

24

80

-

578

7

26

626

10

26

-

666

12

25

-

912

13

26

-

2,782

42

103

-

829

14

34

845

14

35

963

15

36

Total New Wave

522

552

583

759

2,416

611

662

703

951

2,927

877

894

1,014

1,437

1,445

1,434

1,656

5,972

1,440

1,460

1,480

1,774

6,154

1,679

1,699

1,787

309

327

334

329

1,299

287

332

330

385

1,334

356

368

374

1,746

1,772

1,768

1,985

7,271

1,727

1,792

1,810

2,159

7,488

2,035

2,067

2,161

31

31

41

42

39

79

79

158

147

164

110

110

199

189

203

Exchange lines/ISDN - connection and rental

Calls

Private Circuits

Transit, conveyance, interconnect circuits and other

wholesale (incl. FRIACO)

Other

Total Revenue (Incl. Infonet and Albacom)

Q1

Memo: Internal Revenue

Total Global Services Reported Revenue

Memo: Infonet and Albacom included above - Traditional

New Wave

* 2003/4 numbers estimated to reflect new Premium Rate Services recognition policy

Q3 - 2005/06

Page 3c - Global Services

BT Group Plc

2004/5

Summary Cost Analysis

Net staff costs before leaver costs^

Leaver costs

Net staff costs (including leaver costs)

Other operating costs

Sub total

POLO's

Depreciation and amortisation

Amortisation of acquired intangibles

Total costs*

Q1

£m

898

102

1,000

1,285

2,285

988

700

3,973

Q2

£m

859

8

867

1,371

2,238

964

704

3,906

Q3

£m

929

12

941

1,370

2,311

880

695

3,886

2005/6

Q4

£m

980

44

1,024

1,502

2,526

893

745

4,164

Total

£m

3,666

166

3,832

5,528

9,360

3,725

2,844

15,929

Q1

£m

965

6

971

1,436

2,407

1,009

706

3

4,125

Q2

£m

1,002

37

1,039

1,444

2,483

989

690

2

4,164

Q3

£m

980

23

1,003

1,520

2,523

1,032

707

3

4,265

* Under IFRS basis and before specific items

^ Net Staff Costs is total staff costs less own work capitalised

Q3 - 2005/06

Page 4

BT Group Plc

Capex by Line of Business

BT Retail

Q1

Q2

£m

£m

2003/4

Q3

Q4

£m

£m

Total

Q1

Q2

£m

£m

£m

2004/5

Q3

Q4

£m

£m

Total

Q1

2005/6

Q2

£m

£m

£m

Q3

£m

24

19

35

34

112

31

41

44

54

170

35

33

32

215

11

54

89

369

232

22

46

109

409

270

37

49

134

490

249

17

64

216

546

966

87

213

548

1,814

269

30

45

133

477

274

25

50

199

548

269

31

73

141

514

225

14

62

140

441

1,037

100

230

614

1,981

257

10

46

174

487

228

8

52

156

444

238

9

45

199

491

Solutions and C&SI

UK Networks

Other

BT Global Services

36

24

37

97

25

35

42

102

19

33

59

111

41

39

90

170

121

131

228

480

47

37

60

144

61

35

65

161

66

24

51

141

86

25

48

159

260

121

223

604

51

27

64

142

49

32

90

171

55

23

91

169

Others

62

48

63

94

267

42

53

71

90

256

52

46

67

552

578

699

844

2,673

694

803

770

744

3,011

716

694

759

Access

Switch

Transmission

Products/Systems Support

BT Wholesale

(includes Fleet and Property)

Total

2003/4 and 2004/5 numbers restated to reflect trading model changes

Q3 - 2005/06

Page 5

BT Group Plc

Total Fixed Network Calls

Quarterly Minutes (billions)

Jun-02 Sep-02 Dec-02 Mar-03 Jun-03 Sep-03 Dec-03 Mar-04 Jun-04 Sep-04 Dec-04 Mar-05

Jun-05

Sep-05

Dec-05

Internet Related and Other Non Geo

Fixed to Mobile

Total Non Geographic Calls

15.61

2.26

17.88

14.80

2.34

17.13

14.83

2.34

17.18

14.81

2.31

17.12

13.94

2.37

16.31

13.06

2.37

15.43

12.51

2.29

14.79

12.45

2.26

14.70

10.93

2.21

13.13

10.13

2.20

12.33

9.33

2.13

11.46

8.68

2.08

10.76

7.51

2.13

9.64

6.86

2.08

8.94

6.20

2.02

8.22

Local

National

International

Total Geographic

12.96

6.58

0.57

20.11

12.66

6.59

0.57

19.83

13.16

6.65

0.58

20.39

12.81

6.52

0.57

19.91

12.04

6.14

0.56

18.74

11.67

6.09

0.55

18.31

11.89

6.07

0.56

18.51

11.78

6.09

0.55

18.43

10.61

5.53

0.52

16.66

10.34

5.51

0.52

16.37

10.42

5.46

0.52

16.40

10.15

5.33

0.50

15.98

9.53

5.09

0.49

15.11

9.02

4.90

0.48

14.40

9.15

4.87

0.47

14.49

Total Retail

37.98

36.96

37.56

37.03

35.04

33.74

33.30

33.13

29.79

28.70

27.86

26.74

24.75

23.34

22.71

Freephone and FRIACO

18.03

18.80

20.83

22.90

23.20

22.10

22.23

23.64

20.88

18.55

16.71

15.84

12.83

9.90

8.38

BT Group Originating Calls*

56.01

55.76

58.39

59.93

58.24

55.84

55.54

56.77

50.67

47.25

44.57

42.58

37.58

33.24

31.09

Jun-02 Sep-02 Dec-02 Mar-03 Jun-03 Sep-03 Dec-03 Mar-04 Jun-04 Sep-04 Dec-04 Mar-05

Jun-05

Sep-05

Dec-05

* Excluding Payphones and Directories (c0.3bn mins/qtr)

Total Fixed Network Calls

Quarterly Year on Year Minutes Change

Internet Related and Other Non Geo

Fixed to Mobile

Total Non Geographic Calls

(3)%

5%

(2)%

(8)%

7%

(6)%

(8)%

6%

(6)%

(11)%

5%

(9)%

(11)%

5%

(9)%

(12)%

1%

(10)%

(16)%

(2)%

(14)%

(16)%

(2)%

(14)%

(22)%

(7)%

(19)%

(22)%

(7)%

(20)%

(25)%

(7)%

(23)%

(30)%

(8)%

(27)%

(31)%

(4)%

(27)%

(32)%

(6)%

(27)%

(34)%

(5)%

(28)%

Local

National

International

Total Geographic

(4)%

(3)%

(9)%

(4)%

(5)%

(3)%

(11)%

(4)%

(4)%

(2)%

(8)%

(3)%

(6)%

(4)%

(4)%

(5)%

(7)%

(7)%

(3)%

(7)%

(8)%

(8)%

(3)%

(8)%

(10)%

(9)%

(3)%

(9)%

(8)%

(7)%

(4)%

(7)%

(12)%

(10)%

(7)%

(11)%

(11)%

(10)%

(6)%

(11)%

(12)%

(10)%

(7)%

(11)%

(14)%

(12)%

(9)%

(13)%

(10)%

(8)%

(6)%

(9)%

(13)%

(11)%

(7)%

(12)%

(12)%

(11)%

(9)%

(12)%

Total Retail

(3)%

(5)%

(5)%

(7)%

(8)%

(9)%

(11)%

(11)%

(15)%

(15)%

(16)%

(19)%

(17)%

(19)%

(18)%

Freephone and FRIACO

149%

102%

70%

38%

29%

18%

7%

3%

(10)%

(16)%

(25)%

(33)%

(39)%

(47)%

(50)%

BT Group Originating Calls*

21%

16%

13%

6%

4%

0%

(5)%

(5)%

(13)%

(15)%

(20)%

(25)%

(26)%

(30)%

(30)%

Q3 - 2005/06

Page 6

BT Group Plc

Exchange Lines ('000)

Product Group Summary

Jun-02

Sep-02

Dec-02

Mar-03

Jun-03

Sep-03

Dec-03

Mar-04

Jun-04

Sep-04

Dec-04

Mar-05

Jun-05

Sep-05

Dec-05

Retail

Business Voice

Business ISDN

Business Broadband

Major Corporate Broadband *

Total Business

5,702

3,358

59

3

9,122

5,661

3,425

78

5

9,169

5,614

3,468

103

8

9,193

5,570

3,492

136

10

9,208

5,539

3,519

158

20

9,236

5,483

3,528

184

26

9,221

5,395

3,524

218

33

9,170

5,324

3,500

247

40

9,111

5,260

3,476

272

47

9,055

5,148

3,452

297

55

8,952

5,043

3,413

326

65

8,847

4,976

3,382

347

75

8,780

4,895

3,311

371

83

8,660

4,789

3,254

396

90

8,529

4,735

3,207

428

99

8,469

Residential Voice

Residential ISDN

Residential Broadband

Total Residential

19,735

300

110

20,145

19,744

303

150

20,197

19,790

301

205

20,296

19,775

290

293

20,358

19,716

280

378

20,374

19,679

264

455

20,398

19,683

243

578

20,504

19,649

221

680

20,550

19,554

198

783

20,535

19,497

170

931

20,598

19,467

140

1,100

20,707

19,405

115

1,330

20,850

19,086

93

1,486

20,665

18,701

74

1,625

20,400

18,360

61

1,801

20,222

Total Voice

Total ISDN

Total Broadband*

25,437

3,658

172

25,405

3,728

233

25,404

3,769

316

25,345

3,782

439

25,255

3,799

556

25,162

3,792

665

25,078

3,767

829

24,973

3,721

967

24,814

3,674

1,102

24,645

3,622

1,283

24,510

3,553

1,491

24,381

3,497

1,752

23,981

3,404

1,940

23,490

3,328

2,111

23,095

3,268

2,328

Total Retail Lines

29,267

29,366

29,489

29,566

29,610

29,619

29,674

29,661

29,590

29,550

29,554

29,630

29,325

28,929

28,691

277

391

555

800

1,058

1,339

1,753

2,215

2,687

3,294

4,107

4,932

5,598

6,229

6,928

BT Wholesale

BT Wholesale Broadband Connections

* Sold to Major Corporates as Connectivity and not as ISP.

Q3 - 2005/06

Page 7

BT Group Plc

BT Together Packages ('000)

Total

Option 1

Option 2

Option 3

BTT Local

Mar-02

Jun-02

Sep-02 Dec-02 Mar-03

Jun-03

Sep-03 Dec-03 Mar-04

Jun-04 Sep-04

Dec-04

Mar-05

Jun-05

Sep-05

Dec-05

8,590

8,736

8,814

8,883

8,894

8,873

8,934

8,956

8,859

8,991

17,617

17,599

17,560

17,268

16,914

16,609

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

5,100

1,087

82

2,604

5,255

1,173

210

2,296

5,379

1,220

274

2,083

5,419

1,218

324

1,898

5,609

1,250

433

1,699

14,270

1,269

515

1,563

14,314

1,290

556

1,439

14,326

1,317

582

1,335

14,119

1,344

582

1,223

13,836

1,387

575

1,116

13,600

1,409

573

1,027

BT Mobility Connections ('000)

Mar-02

Jun-02

Sep-02 Dec-02 Mar-03

Total

Business

Consumer

Q3 - 2005/06

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

Jun-03

Sep-03 Dec-03 Mar-04

Jun-04 Sep-04

Dec-04

Mar-05

Jun-05

Sep-05

Dec-05

27

57

70

106

145

215

305

341

372

370

350

334

27

N/A

51

6

59

11

82

24

104

41

127

88

144

161

162

179

185

187

196

174

204

146

209

125

Page 8

BT Group Plc

Average Revenue per Consumer Household *

Jun-02

Sep-02

Dec-02

Mar-03

Jun-03

Sep-03

Dec-03

Mar-04

Jun-04

Sep-04

Dec-04

Mar-05

Jun-05

Sep-05

Dec-05

£

£

£

£

£

£

£

£

£

£

£

£

£

£

£

Annual revenue

266

269

270

271

272

270

268

266

265

261

258

254

252

251

250

Contracted**

55%

55%

56%

56%

56%

57%

57%

58%

59%

60%

61%

63%

65%

65%

66%

Non-contracted

45%

45%

44%

44%

44%

43%

43%

42%

41%

40%

39%

37%

35%

35%

34%

* Rolling 12 month consumer revenue, less mobile polos, divided by average number of primary lines

** Includes line rental, broadband, select services and packages.

2003/4 numbers estimated to reflect new Premium Rate Services recognition policy

Q3 - 2005/06

Page 9

BT Group Plc

Fixed to Fixed Voice Market Share *

Jun-02

Sep-02

Dec-02

Mar-03

Jun-03

Sep-03

Dec-03

Mar-04

Jun-04

Sep-04

Dec-04

Mar-05

Jun-05

Sep-05

Dec-05

Residential

73%

73%

74%

73%

72%

70%

69%

68%

66%

65%

63%

62%

61%

59%

58%

Business

47%

47%

47%

46%

45%

44%

43%

43%

43%

42%

42%

41%

41%

41%

41%

* BT estimates: Local, national, international and non-geographic voice minutes

Q3 - 2005/06

Page 10

BT Group Plc

CPS Volumes ('000)

Mar-02

Number of users*

Net adds in quarter

72

Jun-02 Sep-02 Dec-02 Mar-03

Jun-03 Sep-03 Dec-03 Mar-04

Jun-04 Sep-04 Dec-04 Mar-05

Jun-05 Sep-05 Dec-05

214

381

648

1,044

1,622

2,120

2,725

3,299

3,723

4,169

4,571

4,909

5,291

5,554

5,779

142

167

267

396

578

498

605

574

424

446

402

338

382

263

225

* CPS numbers include those customers who have migrated from Indirect Access

WLR and Calls & Access Volumes ('000)

Jun-02 Sep-02 Dec-02 Mar-03

Analogue lines /

ISDN Channels

51

57

72

91

Jun-03 Sep-03 Dec-03 Mar-04

121

180

291

377

Jun-04 Sep-04 Dec-04 Mar-05

491

630

825

1,026

Jun-05 Sep-05 Dec-05

1,450

1,882

2,333

LLU Volumes ('000)

Jun-02 Sep-02 Dec-02 Mar-03

Full and Shared

loops

Q3 - 2005/06

1

1

2

3

Jun-03 Sep-03 Dec-03 Mar-04

6

8

Page 11

8

11

Jun-04 Sep-04 Dec-04 Mar-05

14

20

28

41

Jun-05 Sep-05 Dec-05

72

122

192

BT Group Plc