SIMON FRASER UNIVERSITY Department of Economics Econ 842 Prof. Kasa

advertisement

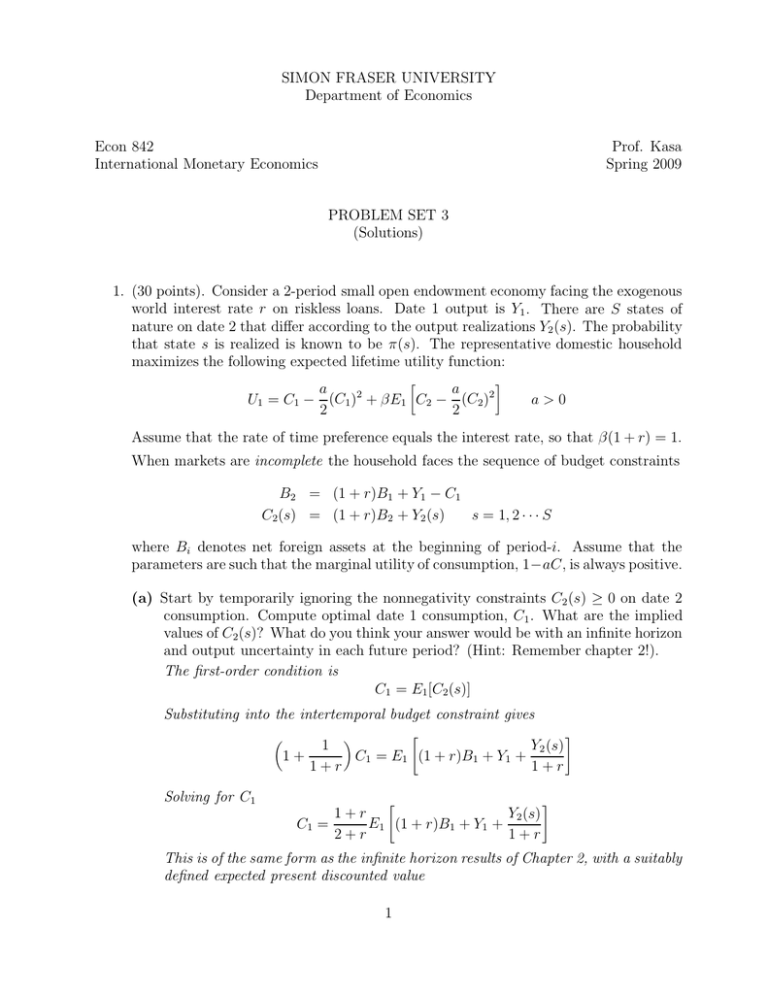

SIMON FRASER UNIVERSITY Department of Economics Econ 842 International Monetary Economics Prof. Kasa Spring 2009 PROBLEM SET 3 (Solutions) 1. (30 points). Consider a 2-period small open endowment economy facing the exogenous world interest rate r on riskless loans. Date 1 output is Y1 . There are S states of nature on date 2 that differ according to the output realizations Y2 (s). The probability that state s is realized is known to be π(s). The representative domestic household maximizes the following expected lifetime utility function: a a U1 = C1 − (C1)2 + βE1 C2 − (C2)2 2 2 a>0 Assume that the rate of time preference equals the interest rate, so that β(1 + r) = 1. When markets are incomplete the household faces the sequence of budget constraints B2 = (1 + r)B1 + Y1 − C1 C2(s) = (1 + r)B2 + Y2 (s) s = 1, 2 · · · S where Bi denotes net foreign assets at the beginning of period-i. Assume that the parameters are such that the marginal utility of consumption, 1−aC, is always positive. (a) Start by temporarily ignoring the nonnegativity constraints C2 (s) ≥ 0 on date 2 consumption. Compute optimal date 1 consumption, C1 . What are the implied values of C2(s)? What do you think your answer would be with an infinite horizon and output uncertainty in each future period? (Hint: Remember chapter 2!). The first-order condition is C1 = E1[C2(s)] Substituting into the intertemporal budget constraint gives " 1 Y2 (s) 1+ C1 = E1 (1 + r)B1 + Y1 + 1+r 1+r Solving for C1 " 1+r Y2 (s) E1 (1 + r)B1 + Y1 + C1 = 2+r 1+r # # This is of the same form as the infinite horizon results of Chapter 2, with a suitably defined expected present discounted value 1 (b) Now let’s worry about the nonnegativity constraint on C2 (s). Without loss of generality, renumber the date 2 states so that Y2 (1) = mins [Y2(s)]. Show that if (1 + r)B1 + Y1 + 2+r Y2 (1) ≥ E1 Y2 1+r then the C1 computed in part (a) (for the 2-period case) is still valid. What is the intuition? Suppose the preceding inequality doesn’t hold. Show that the optimal date 1 consumption is lower (reflecting a precautionary savings effect) and equals C1 = (1 + r)B1 + Y1 + Y2 (1) 1+r (Hint: Apply Kuhn-Tucker). What is the intuition here? Does the usual Euler equation hold in this case? The non-negativity constraint in period 2 won’t bind if (1 + r)B2 + Y2 (1) ≥ 0 where Y2 (1) defines the lowest possible realization of date-2 income, and where B2 = (1 + r)B1 + Y1 − C1 Substituting in the previous expression for C1 rearranging gives (1 + r)B1 + Y1 + 2+r Y2 (1) ≥ E1 Y2 1+r If this doesn’t hold then the nonnegativity constraint binds in at least one state. From the Kuhn-Tucker theorem, it must be the case that C2 (1) = 0. From the budget constraint C2(1) = (1 + r)[(1 + r)B1 + Y1 − C1 ] + Y2 (1) Solving for C1 C1 = (1 + r)B1 + Y1 + Y2 (1) 1+r (c) Now assume the household has access to complete Arrow-Debreu markets, with p(s) being the exogenous state s Arrow-Debreu contingent claims price for state s. Assume these prices are actuarial fair, so that p(s) = π(s). Compute the optimal values of C1 and C2 (s) in this case. Why can we ignore nonnegativity constraints in this complete markets case? The crucial difference with complete markets is that now the Euler equation holds state-by-state. Since we assume π(s) = p(s) the Euler equations are C1 = C2 (s) Substituting into the budget constraint as usual gives C1 = C2(s) = 1+r 2+r 2 " S X π(s)Y2 (s) Y1 + 1+r s=1 # Notice that date 2 consumption is nonrandom. How can this be, given that date 2 output is random? There are two crucial assumptions behind this. First, although the exact realization of the state in period 2 is unknown when deciding date 1 consumption, the endowment which will occur in each state is known. That is, the agent knows in which states he will be poor and in which states he will be rich. Second, we’ve assumed a small open-economy here, meaning that it can trade as much as it wants at constant AD prices. As a result, the agent can use the AD markets to effectively even out his resources in period 2. If he gets unlucky on his endowment, then the AD claim pays off, and makes up for the low endowment. With incomplete markets, the agents period 2 consumption necessarily varies onefor-one with the ex post realized endowment. A really bad draw can then produce a violation of the nonnegativity constraint. 2. (30 points). Consider a two-country, one-good world where agents in each country have preferences ∞ X c1−ρ βt t U= 1−ρ t=0 Country-1’s endowment is y1t = 1 for all t. Country-2’s endowment is y2t = γ t , where γ > 1. (a) Describe the competitive equilibrium with complete markets. (Hint: Consider the Pareto problem). The planner’s FOC is −ρ λ1 c−ρ 1t = λ2 c2t where the λi ’s are the Pareto weights. This implies c1t = c2t λ1 λ2 !1/ρ This then implies that each country’s consumption is a fixed (time invariant) share of the aggregate endowment, which is 1 + γ t . (b) Now suppose agents cannot commit to their Arrow-Debreu contracts, and can go live under autarky at any time. Derive each agent’s participation constraints (for each t). The participation constraints are simply that each agent must receive a prospective future consumption under the risk-sharing arrangement that is a least as good as what he could guarantee himself under autarky. The autarky value for agent 1 is time invariant 1 V1 = 1−β (ignoring the inessential 1 − ρ term). The autarky value of agent 2 increases over time, since his endowment is growing V2t = 3 γt 1 − βγ 1−ρ Notice that for the problem to be well defined it must be the case that βγ 1−ρ < 1, which is only a constraint in the empirically unrealistic case of ρ < 1. (c) Does the complete markets allocation in part (a) satisfy the participation constraints? If not, what is the constrained-optimal allocation? Clearly, no constant sharing rule will respect the participation constraint of agent 2. Therefore the constrained optimal allocation will feature time-varying Pareto weights, with the weight assigned to agent 2 converging to one. How quickly it converges depends on the initial distribution. 3. (40 points). This question is about the trade balance and the terms of trade in openeconomy RBC models. Consider a world consisting of two exchange economies, Country 1 and Country 2. Country 1 receives a stochastic endowment sequence of “apples”, at(st ), and Country 2 receives a stochastic endowment of “bananas”, bt (st ), where the notation st represents the fact that endowments depend on the history of states realized up to period-t. Residents of both countries have the same preferences U (a, b) = ∞ X X t=0 β tπ(st)[at(st )1−ρ + bt (st)1−ρ ]/(1 − ρ) st ∈S t where π(st ) represents the probability of history st (so that this is just expected utility). (a) Compute the Pareto optimal allocation, and describe the supporting prices. Given the form of the preferences, the Pareto optimal sharing rule will feature constant consumption shares. For example, country 1’s share (of both good ‘a’ 1/ρ 1/ρ 1/ρ and good ‘b’) will just be λ1 /(λ1 + λ2 ), where λi is country-i’s Pareto weight. Supporting prices are then just given by plugging the optimal quantities into the common marginal rate of substitution formulas. The important point is that the constant Pareto weights cancel out of the ratios, so that prices are solely a function of aggregate quantities, not the distribution of quantities across countries. For example, letting q denote the relative price of good ‘b’, we have MUb b−ρ q= = −ρ = MUa a ρ a b (b) Let q be a country’s terms of trade, defined as the the relative price of its imports (so that an decrease in q represents a terms of trade improvement). Compute q for country 1. See part (a). (c) Derive an expression for country 1’s trade balance, nx1,t = at − qt bt. Let ωi be the Pareto optimal consumption share of country i, as described in the answer to part (a). Then country 1’s net exports are nx1 = ω2 a − ρ a b ω1 b Assuming a symmetric allocation, so that ωi = 1/2, and simplifying " nx1 = ωa 1 − 4 ρ−1 # a b (d) What is the relationship between nx1/y1 and q, where y1 is country 1’s GDP? What is the relationship between nx1/y1 and y1 ? Are these consistent with the data? Country 1’s GDP is just ‘a’, so we have " ρ−1 # nx1 a =ω 1− y1 b As long as we make the empirically realistic assumption that ρ > 1, it’s clear we have corr(nx/y, y) < 0 corr(nx/y, q) < 0 which is consistent with the data. 5