Pacific Coast Opportunities in California, Oregon, Washington and Alaska

advertisement

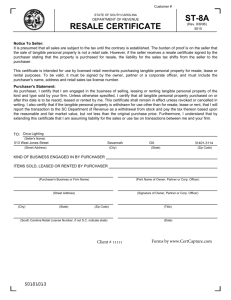

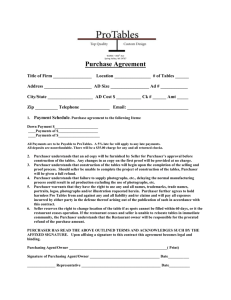

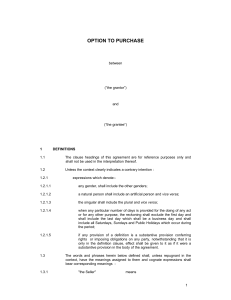

Anchorage Beijing Coeur D’Alene Hong Kong Orange County Portland San Francisco Pacific Coast Opportunities A guide to foreign acquisitions of businesses and real property Seattle Spokane Taipei in California, Oregon, Washington and Alaska Washington DC www.prestongates.com Anchorage Beijing Coeur D’Alene Hong Kong Orange County Portland San Francisco Pacific Coast Opportunities A guide to foreign acquisitions of businesses and real property Seattle Spokane Taipei in California, Oregon, Washington and Alaska Washington DC www.prestongates.com Pacific Coast Opportunities A guide to foreign acquisitions of businesses and real property in California, Oregon, Washington and Alaska This guide is intended to provide general information only and is not intended as legal advice. Prospective investors should seek the assistance of experienced legal and tax advisors at the outset of any transaction. © 1992-2004 by Preston Gates & Ellis LLP Reproduction of this manual in whole or in part without written permission is prohibited. Contents Introduction .........................................................................................1 Due Diligence ........................................................................................3 Structuring the Acquisition .................................................................10 Entity Used in Making and Holding the Acquisition ............................16 Negotiating and Executing Agreements .............................................20 Financing ............................................................................................24 Closing ................................................................................................27 Acquisition of a Public Company ........................................................30 Conclusion ..........................................................................................35 About Preston Gates & Ellis LLP...........................................................36 Introduction The global economy increasingly favors foreign investment into North America and, in particular, the four-state Pacific Coast region of the United States, consisting of California, Oregon, Washington and Alaska. Preston Gates & Ellis LLP, a premier corporate law firm with active commercial practices in each of these states, offers foreign purchasers this guide to some of the principal legal issues surrounding such acquisitions. After identifying the business or real property to be purchased, there are five basic phases of an acquisition: • • • • • Due diligence Structuring the acquisition Negotiating and executing agreements Financing Closing This guide briefly considers matters such as federal and state tax issues, government approvals and reporting procedures, environmental concerns and questions of real property title. Note that this guide confines its discussion to acquisitions of entire businesses and outright purchases of real property. Alternative forms of investment, such as purchases of portions of the stock of existing companies and joint venture partnerships, are not considered. A section at the end of this guide addresses the securities and corporate law issues that surround the acquisition of publicly held corporations. [1] Pacific Coast Opportunities In order to enhance readability and serve a broad spectrum of foreign investors in the four-state region, this guide limits its coverage to a summary of key legal issues. Serious foreign purchasers should seek legal and tax advice at the beginning of any transaction. [2] Due Diligence The due diligence (or investigation) phase of an acquisition is designed to determine whether the business or real property meets the foreign purchaser’s needs and expectations. A particular focus of due diligence is to identify hidden problems, liabilities and costs. Generally, due diligence will involve a four-step process of investigation: • Review of financial statements, tax returns, key leases and contracts, and other documents related to the business. Often, documents are provided by sellers in response to a due diligence document request list provided by the potential purchaser. Alternatively, particularly where an organized auction or other sale process is undertaken with multiple potential purchasers, the seller will organize either a physical or “virtual” due diligence room in which due diligence documents are organized and stored for inspection by potential purchasers. • Inspection of facilities, equipment and other properties. In the case of real property, these should include environmental, structural and other engineering inspections. Appraisals and surveys may also be conducted. • Interviews with management, other employees, and key customers and suppliers. • Review of publicly available records, particularly as they relate to court proceedings, records of mortgages and security interests, and the zoning and land-use status of real property. [3] Pacific Coast Opportunities Ordinarily, before allowing access to sensitive documents, sellers require prospective purchasers to sign confidentiality agreements. Sometimes, such confidentiality agreements will prohibit the potential purchaser from soliciting or even hiring the target’s employees. In some cases, sellers insist that prospective purchasers show their seriousness by signing letters of intent or by paying earnest money (either refundable or non-refundable) before undertaking some phases of due diligence. In many other cases, purchase and sale agreements must be signed prior to giving any access to key customers and employees for due diligence purposes. In investigating businesses, be especially cognizant of some frequently hidden liabilities or costs. These areas deserve special attention in due diligence: • PENSION PLANS. Businesses often maintain their own pension plans or contribute to multi-employer plans. Often, these plans are underfunded or involve large liabilities in the event of termination, becoming a costly burden to a new purchaser. • ENVIRONMENTAL MATTERS. Both past and present environmental practices of businesses need to be carefully reviewed. Businesses are often held liable for significant cleanup costs as a result of their past disposal practices even though, at the time, the practices were lawful. To assess environmental concerns, special environmental consultants are often hired (see discussion below on environmental audits). • LABOR AND EMPLOYMENT ISSUES. Key issues in many business acquisitions include whether union contracts exist and the extent to which the purchaser will be bound by them. Other labor and employment issues often include the existence of unfair labor practices; wrongful termination claims; sex, race, national origin, age, disability or other discrimination claims; health and safety violations; and wage and hour claims. • LEASES AND CONTRACTS. Important leases and contracts must be carefully reviewed to determine the remaining length of the agreement, [4] Due Diligence whether any changes in rent or prices are contemplated, and the extent to which a lease or contract survives a change in ownership. Often, assurances as to the validity and good standing of contracts are sought from the other parties to the contracts. In real property acquisitions, the commonly used tools for such assurances are estoppel certificates. • INDUSTRIAL AND INTELLECTUAL PROPERTY RIGHTS. Ownership of key industrial and intellectual property rights is often a major issue in acquisitions of high technology companies. The issues become particularly complicated with respect to software. Generally, under the U.S. copyright laws, the consultant who writes the software owns it, not the employer. Risks of patent infringement must also be assessed. During the past 10 years, U.S. courts have become far more protective of patents and patent owners. Successfully defending patent infringement actions can cost millions of dollars in attorneys’ fees and other costs and expenses. An additional issue involves software and other intellectual property licenses; often, such licenses cannot be transferred without the consent of the licensor and are subject to termination on change in control. • UCC SEARCH. Most financing liens on the personal property of California, Oregon, Washington and Alaska businesses (such liens are commonly referred to as security interests) are evidenced by filings with a unit of state government located in the capital of each state. To determine the status of such lien filings, what is commonly referred to as a UCC search is performed. In the past five years, the search process under the UCC has become much easier, since a new rule now requires most filings to be done in the state where the entity is formed, rather than where the collateral is located. Real Property and Due Diligence For acquisitions involving real property, several additional due diligence steps are often taken, including the following: • ENVIRONMENTAL AUDIT. If hazardous wastes or other contaminants exist on a piece of real property, the owner can be required to abate or oth[5] Pacific Coast Opportunities erwise clean them up even though the contamination occurred before the owner’s purchase of the property. Contamination problems have been found to exist on many nonindustrial properties. For example, former gasoline stations have been a major source of problems. As a result, today, few investors purchase real property in California, Oregon, Washington and Alaska without having an environmental audit performed by specialized environmental consultants. Typically, an environmental audit is done in two phases. In Phase 1, the property is visually inspected for tell-tale signs, its past use is investigated, and public records are reviewed. A Phase 2 audit is undertaken only if the results of Phase 1 suggest the presence of possible contaminants. In that phase, soil and groundwater samples may be taken and more sophisticated tests performed. Asbestos has been and remains a concern for any purchaser of either real property or a business that in the past handled asbestos. Asbestos on real property may have to be removed through costly procedures if it is friable or if the property in the future is to be remodeled, rebuilt or changed. Businesses that either directly or through predecessors manufactured products that contained asbestos, manufactured products that required asbestos insulation for efficient operation of that product, or handled asbestos, even if many years ago, are increasingly the targets of multiple personal injury lawsuits from workers who claim injury or illness from their contact with asbestos. • TITLE INSURANCE. Title to real property in California, Oregon, Washington and Alaska is not guaranteed by a government registry. Thus, in almost all real estate acquisitions, the purchaser insists on being provided with title insurance in an amount equal to the purchase price. Title insurance, which is issued by private insurance companies, insures that the purchaser has title to the real property, free of all mortgages and other title defects except as specifically identified. Typically, at the outset of a real property acquisition, the purchaser will obtain a preliminary commitment for title insurance. The preliminary commitment will identify all mortgages, easements and other matters that are recorded and that affect the real property. As part of [6] Due Diligence the negotiation and acquisition process, a purchaser might agree to accept the real property with all of the items identified in the preliminary commitment or may insist that the seller remove certain items. In California, Oregon, Washington and Alaska, title insurance for purchasers comes in two alternatives: standard coverage and extended coverage. Extended coverage title insurance insures against items such as encroachments and construction liens. (Construction contractors can enjoy lien rights ahead of a new purchaser, provided they give notice within a specified period of time.) Extended coverage is about 30 to 65 percent more expensive. Although negotiable, it is common for sellers of real property to pay the premium for standard title insurance, with purchasers paying for the additional extended coverage premium. Real property lenders will often require extended coverage title insurance, which is paid for by the purchaser as borrower. • LAND SURVEYS. Land surveys are designed to show the exact legal boundaries of the real estate, then to identify whether buildings and other improvements extend beyond the boundaries of the property; whether they rest on easements that could require their removal; and whether any neighboring buildings or improvements encroach onto the property being purchased. Additionally, land surveys show drainage, access and topography of the property. An adequate and current land survey almost always must be supplied in order to get extended coverage title insurance. Lenders also require surveys. • ZONING AND OTHER LAND-USE REGULATIONS; WATER RIGHTS. Zoning and land-use restrictions must be carefully considered, particularly if new construction is anticipated. Restrictions are particularly sensitive in Washington and Oregon along shorelines and around wetlands. Oregon has a comprehensive statewide system of land-use regulation. Many parcels of land in Oregon are currently in non-conforming uses under conditional use permits, which may restrict even minor changes in use. [7] Pacific Coast Opportunities In California, planning and zoning bodies at all levels of state and local government exercise considerable control over the use of privately held land. In addition, since the early 1970s, the application of the California Environmental Quality Act (CEQA) and the California Coast Act to land-use planning, development and permit processes has made land development and use in California increasingly more complex, expensive and risky. In Alaska, with its high incidence of wetlands, wetland development generally requires a permit from the United States Army Corp of Engineers. Larger communities in Alaska have permitting processes for development, but many smaller communities do not. Assuring access to adequate water rights for the contemplated operations is an essential part of due diligence for uses as varied as silicon wafer production plants to agricultural operations, salmon processing and golf courses. Access to water rights can be an issue even in the rainiest parts of the Pacific Northwest and Alaska. Other Special Due Diligence Considerations Care should be taken by a foreign investor in the United States to ensure review of these special due diligence considerations: • FOREIGN STATUS. Foreign purchasers of real property must consider whether their foreign status will complicate or prohibit, in whole or in part, the proposed acquisition. There are no general prohibitions in California, Oregon, Washington and Alaska on foreign purchases of real property, although certain federally owned lands may not be sold to foreign purchasers. Alaska has certain restrictions on foreign ownership of exploration and mining rights in state-owned lands, and Oregon limits foreign purchases of state-owned lands. Federal laws also limit or prohibit foreign participation in different business areas, including the following: • Fishing boats and other vessels and fishing permits • Radio and television stations, paging companies and other communications activities [8] Due Diligence • Airlines • Certain natural resources and energy facilities • BUSINESSES WITH AN EFFECT ON NATIONAL SECURITY (see discussion below on Exon-Florio) Additionally, foreign purchasers of businesses should consider the effects of the Export Administration Act, the International Traffic in Arms Regulations (ITAR) and other export controls of the United States. Under these laws, giving access to technology or data to foreign nationals is deemed to be an export transaction and may, in some cases, require prior U.S. government approval. While these export control laws do not prohibit or restrict foreign purchases of U.S. businesses, they can complicate later foreign management if foreign personnel cannot be given access to certain technology or data. • SARBANES-OXLEY. A foreign purchaser who presently has stock listed on a U.S. exchange or has stock presently traded on pink sheets or OTB, or expects to list or trade stock in such manner in the future, will want to assure itself that the target has systems and processes in place to meet the certification, financial and disclosure control procedures, as well as other requirements that arise from the requirements of the Sarbanes-Oxley Act and the initial or continued listing requirements of the applicable U.S. securities exchange. [9] Structuring the Acquisition Acquisitions can typically be carried out in a number of different ways, depending on how they are structured. As a general matter, structuring an acquisition will involve two separate questions: • By what method will the purchaser acquire the seller’s business or real property? • Through what type of entity will the purchaser make the acquisition and hold the business or real property? Significant tax and other savings are available to both purchasers and sellers if these questions are properly answered. Method of Acquiring the Business or Real Property Businesses, and to a lesser extent real estate, are usually held by foreign buyers through a corporation. The basic acquisition method issue is usually one of stock versus asset sale: Will the purchaser buy the stock of the corporation or will it buy the assets? INCOME TAX ISSUES The primary motivation for an asset acquisition is the potential U.S. federal, and Oregon and California state, income tax savings to the purchaser. (There is no income tax in Washington. Alaska has a corporate income tax but no individual income tax; thus, in Alaska, the tax analysis is somewhat different.) If stock is purchased, the assets of the acquired corporation will retain the same basis for tax depreciation and other purposes even though a purchase price equal to the fair market value of the assets is paid. On the other hand, if assets [ 10 ] Structuring the Acquisition are purchased, the basis of the asset for tax depreciation and other purposes will be their fair market value. For example, if a purchaser buys, for $1 million, the stock of a corporation whose only assets have been fully depreciated, there would be no further tax deductions available. Conversely, if assets were bought and their fair market value were $1 million or more, the purchaser would be entitled to depreciate the full purchase price over the useful life of the assets. In many cases, however, corporate sellers will resist an asset sale because of the extra tax costs to the seller. Except in the case of certain corporations discussed below, corporate sellers of assets will have two levels of income tax: one at the corporate level on the difference between the corporation’s basis in the assets and the purchase price; and a second at the level of the shareholders on the amount distributed out to them (subject to a partial dividend received deduction in the case of corporate shareholders). The maximum federal corporate income tax rate is 35 percent, and the maximum federal individual income tax rate is also 35 percent (reduced to 15 percent for most dividends and for most capital gains on assets held more than one year); the maximum Oregon corporate and individual income tax rates are 6.6 percent and 9 percent, respectively; and the maximum California corporate franchise and personal income tax rates are 9.3 percent and 11 percent, respectively. Absent some countervailing factors, such as large carried-forward losses or an already high basis in assets, the effect of two levels of income tax on a transaction can be quite costly to the seller. The double level of income tax problem will generally not apply to subsidiaries when owned 80 percent or more by the parent corporation. The problem also will often not apply to corporations which have elected to be treated as an “S-corporation.” To be an S-corporation, a corporation must have 75 or fewer shareholders, each of whom must be an individual (or a qualifying trust) and must meet certain other requirements. Generally, for S-corporations, all items of income and loss flow through to the shareholders, and there is no corporate level of tax. Finally, the problem will not apply in the case of general partnerships, limited partnerships, and limited liability companies, which are often the types of entities used to own real property. Both types of partnerships, for income tax [ 11 ] Pacific Coast Opportunities purposes, are generally ignored, and all items of income and loss flow through to the partners. Similarly, a limited liability company with more than one member is generally taxed as a partnership. Such entities are generally ignored for income tax purposes, and all items of income or loss flow through to members. If parties to a transaction decide to proceed with a stock sale, there are still a number of methods to improve the purchaser’s income tax position. These include payment to selling shareholders for their agreement not to compete with the purchaser in the business being sold. As discussed below, non-compete agreements are very common in business acquisitions. Unlike payments for stock, income tax deductions are available for reasonable non-compete amounts, albeit over a period of 15 years. On the other hand, selling shareholders tend to resist large allocations to non-compete agreements because such amounts are taxed at ordinary income rates (35 percent federally) rather than the lower capital gains rate applicable to payments for stock (generally 15 percent at the federal level). OTHER ISSUES In addition to income tax issues, there is a whole series of other issues involved in choosing between a stock versus asset sale, including the following: • Liabilities. When buying stock, all of the corporation’s liabilities (contractual, tort, product liability, taxes, warranties, environmental and others) follow with the assets. On the other hand, when buying assets, the purchaser has, depending on the agreement reached with the seller, the ability to assume no liabilities or to assume only certain known liabilities. The ability to avoid the seller’s liabilities in an asset sale is subject to a number of exceptions. Mortgages and other liens attach to real property and are thus not avoided through a purchase. A similar principle applies in the case of personal property. As discussed earlier, many environmental liabilities also attach to the land. In Washington, purchasers of a business’s assets can be held responsible for the prior owner’s sales tax, business and occupation tax (B&O), and other state [ 12 ] Structuring the Acquisition tax obligations. Under California, Oregon, Washington and Alaska law, in certain relatively narrow circumstances, purchasers of a business can be responsible for their predecessor’s product liabilities. Under Oregon law, a purchaser of assets may be liable for the unpaid wages of the seller’s employees. California also has a bulk sales act. Under this act, unless trade suppliers for certain types of businesses are given notice of the sale and monies are set aside for them, a purchaser of the business’s assets remains liable to the unpaid trade suppliers. • Transfer taxes. When buying assets in Washington, the purchaser is required to pay a sales tax (at an 8.8 percent rate in the Seattle area) on the equipment (other than exempt manufacturing equipment), vehicles and other tangible personal property not held for resale, and the seller is required to pay a real estate excise tax (at a 1.78 percent rate in the Seattle area) on the real property being sold. These taxes are avoided through a stock sale. However, Washington imposes a real estate excise tax (at 1.78 percent, in the Seattle area, of the value of the real estate) on the sale of 50 percent or more of the stock of a corporation that owns real property located in Washington. There are sales taxes in some of Alaska’s local jurisdictions, but not, for example, in Anchorage. Most of Alaska’s local taxes exempt from their application an isolated transaction or limit taxes to a lower amount on a single large sale. In Oregon, only one county (Washington County) has a tax on the transfer of real property ($1.00 per $1,000 in value). There is no sales tax in Oregon. In California, the application of a sales tax to the transfer of a business’s tangible personal property will depend on whether the seller’s business holds, or is required to hold, a seller’s permit. In the case of the former, sales taxes of up to 8.25 percent will apply. Where the seller’s business is not required to hold a seller’s permit, where the transfer is deemed to be an “occasional sale” or where the transfer of tangible personal property is made by a sale of stock of the [ 13 ] Pacific Coast Opportunities acquired business, sales taxes will not be applied. In addition, California county taxes on the transfer of real property (of varying rates, depending on the county) may also apply to the sale of a business. Finally, a transfer of ownership of the real property may trigger a reassessment of the realty on the basis of its “full cash value,” resulting in increases in annual property taxes. • Union contracts and other employment issues. Where a union contract exists, the union contract will generally continue in force if a stock sale takes place. If an asset sale is used, the purchaser normally will not be bound by the union contract. However, successorship or severance provisions in the union contract might impose substantial obligations on the seller. For example, it is not unusual to find a union contract which mandates that the seller require an asset purchaser, who plans to operate the business, to adopt the contract. While an asset sale may avoid a union contract, the purchaser may not escape the obligation of having to deal with the union. If, after the purchase of assets, more than one-half of all employees doing work done before the closing by union members remain, the purchaser would normally be required to bargain with the union over a new contract. If, in connection with an asset sale involving a business with 100 or more employees, 50 or more full-time employees at a single site can be expected to lose their jobs, the provisions of WARN (a federal plant closure law) may have to be considered. Under WARN, 60 days advance written notice must be given of “plant closings” and “mass layoffs.” States such as California have their own versions of WARN, which may impose more stringent requirements than the federal law. • Key leases and contracts. While key leases and contracts will continue after a stock sale (absent special clauses to the contrary), they may not be assignable to the purchaser in the event of an asset sale. The generally accepted view is that “forward” mergers might be treated as an assignment of contracts by operation of law, triggering the need to get consents from the other party to the contract under anti-assign- [ 14 ] Structuring the Acquisition ment clauses, but that a “reverse” merger, where the target is the survivor, should not have such an effect on contracts. • Government licenses and permits. Many government licenses and permits remain following a stock sale, but are not transferable in connection with an asset sale. On the other hand, for some licenses, reapplication must be made, regardless of the method used in purchasing a business. Such is the case, for example, with respect to California, Oregon, Washington and Alaska liquor and lottery/gaming licenses. In addition to the above issues, foreign purchasers must also consider the effect of a stock versus asset sale on their domestic tax, legal and financial situation. Finally, while the stock versus asset sale issue is usually one of the most important structuring issues, it is by no means the only one. For example, some acquisitions can be tax-free to sellers — and thus cheaper to the purchaser — when the consideration to the seller is purchaser’s stock rather than cash. It is important, therefore, that legal and tax advisors be consulted at the outset of a transaction. [ 15 ] Entity Used in Making and Holding the Acquisition Foreign purchasers can acquire and hold businesses and real property in California, Oregon, Washington and Alaska through a number of different corporate and other entities, either U.S. or foreign-based, depending on tax and other factors. In most cases, foreign purchasers will want to hold their acquisitions through an entity that limits liability from the newly acquired business or real property. Thus, for an asset sale, a new corporation or limited liability company will typically be used. If a stock sale takes place, usually no new corporation will need to be formed. When two or more owners are involved, foreign purchasers should consider the use of a partnership (either a general partnership or a limited partnership) or a limited liability company to carry out asset purchases. As noted above, with partnerships and limited liability companies, the double level of federal, California and Oregon income taxes is generally avoided; all items of income and loss flow through to the partners, and there is no entity-level tax. There are, however, some tax disadvantages to a partnership or limited liability company when foreigners are involved (e.g., special tax withholding obligations apply), and liabilities of the partnership flow through to the general partners. (That problem can, however, generally be solved through the use of a newly created corporation to act as general partner.) When a foreign purchaser decides to use a corporation to make its acquisition, the choice then often becomes whether to use a U.S.-based corporation or a foreign-based corporation operating in the United States. [ 16 ] Entity Used in Making and Holding the Acquisition This choice will be dictated largely by United States and foreign tax considerations, the foreign purchaser’s investment objectives, and the contemplated financing for the acquisition. Some of the U.S. tax consequences affecting this choice include: U.S. Corporations • A foreign-owned U.S.-based corporation will generally be subject to U.S. corporate income taxes on its net income on the same basis as any other U.S. corporation. • If a U.S. corporation is part of a consolidated group (if it is owned 80 percent or more by another U.S. corporation), generally the U.S. corporation’s gains and losses can offset the losses and gains of other U.S. corporations in the consolidated group. • Dividends from U.S. corporations to their foreign shareholders are subject to U.S. tax at a rate of 30 percent, collected by withholding on the dividend distribution. The 30 percent rate, however, has been lowered by tax treaties the United States has in place with member states of the Organization for Economic Cooperation and Development (OECD) and many other countries. • Distributions to foreign shareholders on liquidation of U.S. corporations are generally not subject to tax. Gain on sales of assets before any liquidation would, however, be subject to normal U.S. taxes. • A foreigner’s gain on the sale of stock of a U.S. corporation is generally not subject to U.S. tax. However, a law commonly known as FIRPTA imposes a tax on the sale of stock of U.S. corporations, the assets of which are primarily real property. The tax is collected through a 10 percent withholding on the gross sales price. In California, there is also a 3 percent withholding on the gross sales price on the same basis as FIRPTA. [ 17 ] Pacific Coast Opportunities Foreign Corporations • When a foreign-based corporation is involved in a U.S. trade or business, the net income from that trade or business will be subject to U.S. corporate income tax rates on generally the same basis as U.S. corporations. Many real estate investments in the U.S. by foreign corporations can qualify as a U.S. trade or business, and even if they do not, an election can be made to treat them as such. If a real estate investment does not or is not qualified as a U.S. trade or business, gross rental income from real estate is subject to a U.S. withholding tax at a 30 percent rate. • The gains or losses of a foreign corporation cannot, for U.S. tax purposes, be consolidated with the gains or losses of other corporations. • In addition to the corporate income tax, a foreign corporation with U.S. operations is subject to a branch tax at a rate of 30 percent of the gross amount of the after-tax retained earnings not reinvested in a U.S. trade or business. Under tax treaties with nations such as Japan, however, the branch tax does not apply. In such cases, use of a foreign corporation can offer advantages over a U.S. corporation, since dividends from the U.S. corporation would be subject to a withholding tax, but comparable remittances from the U.S. branch would not be subject to tax. • Net gain realized on the sales of real property is, pursuant to FIRPTA, subject to U.S. income tax on the same basis as applied to U.S. corporations. In addition, FIRPTA imposes a 10 percent withholding on the gross sales amount of any real property sale, although the withheld amount is a credit against the taxes payable on the net gain. In California, there is also a 3 percent withholding on the gross sales price on the same basis as FIRPTA. The above U.S. tax consequences must be considered in tandem with domestic tax consequences to the foreign purchaser. For example, adequate domestic tax credits for U.S. withholdings on dividends might eliminate the advantages discussed above with the use of a foreign corporation rather than a U.S. corporation. In making a choice of entity, [ 18 ] Entity Used in Making and Holding the Acquisition foreign purchasers should also consider U.S. tax issues related to financing (discussed below) and state tax issues. If a foreign purchaser decides to make an acquisition through a U.S. corporation, corporations formed under the laws of California, Oregon, Washington and Alaska would generally be adequate. Corporations in all four states can be formed in a matter of days and without great cost. Foreign purchasers should, however, note that under the Alaska Business Corporation Act, the publicly filed articles of incorporation must disclose the identity of any alien affiliate (foreign person) with an interest in the corporation. [ 19 ] Negotiating and Executing Agreements Typically, most business acquisitions and many real property purchases involve two separate documents: • • an initial letter of intent and a later definitive purchase and sale agreement. Letters of Intent Letters of intent are usually signed after some preliminary due diligence has been completed and an agreement has been reached on the purchase price and other key business terms. Generally, letters of intent are designed to memorialize the agreement on these basic matters and to set forth a schedule for completing the transaction. They are, however, generally not intended to create a legally binding obligation on either of the parties. Often, letters of intent include a statement expressly stating that they do not create legally binding obligations. Letters of intent usually condition the obligations of both parties on completion of a definitive purchase and sale agreement. They also usually condition the purchaser’s obligations on its satisfaction with the results of its due diligence and on securing financing. While generally nonbinding, letters of intent are often used to create the following legally binding obligations: • An agreement by the seller not to sell the business or real property to a third party during an agreed-upon period (often 30, 60 or 90 days). • An agreement by the seller to provide documents and facility access for due diligence purposes. [ 20 ] Negotiating and Executing Agreements • An agreement by the purchaser to keep the results of its due diligence confidential and an agreement by both parties not to issue press releases. A number of other documents and instruments are used as alternatives to letters of intent, including: • TERM SHEETS. Generally, term sheets are simply outlines of key business terms and rarely contain any provisions intended to be binding. • MEMORANDUM OF UNDERSTANDING. While the format is different, a memoranda of understanding generally has the same effect as letters of intent. • OPTION AGREEMENTS. Option agreements are most commonly used in real estate purchases. The purchaser is given a binding option to buy the real property within an agreed period of time — usually in exchange for a payment that is often nonrefundable, but that in some cases can be applied against the purchase price. While letters of intent generally are not intended to be binding, if poorly prepared they can impose unintended legal obligations. Even letters of intent clearly purporting to be nonbinding can, when combined with post-signing behavior suggesting that a deal has been agreed to, result in a finding that a commitment to buy and sell was made. In addition, many of the basic terms of a letter of intent should not be agreed upon until a foreign purchaser has fully considered all of the structuring alternatives. Thus, letters of intent should not be signed before consulting with legal and tax advisors. Purchase and Sale Agreements Both business and real property acquisitions, regardless of whether carried out by a stock or asset sale, are documented through fairly comprehensive purchase and sale agreements. In business acquisitions, such agreements are typically completed after most, if not all, of the due diligence has been completed. A purchase and sale agreement is usually signed before closing. During the period between execution and closing, [ 21 ] Pacific Coast Opportunities specified events and conditions, such as a meeting of shareholders to approve the transaction, obtaining the landlord’s consent, completing of financing, and obtaining government approvals, are provided for. A large portion of purchase and sale agreements for both business and real property acquisitions is taken up by representations and warranties of the seller. These are often heavily negotiated statements made by the seller about the business or real property. If they prove to be incorrect, the purchaser is usually allowed to cancel the acquisition, if not yet closed; if closed, the purchaser is often entitled to seek damages from the seller. To make sure the purchaser has some recourse for false representations and warranties after closing, it is common for purchasers in business acquisitions to insist on a holdback of cash being paid at closing. A portion of the purchase price is typically deposited into an escrow account with a bank or other neutral institution for a period ranging up to three years and is released to the seller only if there have been no breaches of representations and warranties. Holdbacks are less common in cases where a portion of the purchase price is to be paid in installments after closing or in cases where the seller is fully creditworthy. Other Provisions of Purchase and Sale Agreements In addition, other typical provisions of purchase and sale agreements include the following: • NONCOMPETE AGREEMENTS. In business acquisitions, it is common to require individual sellers, particularly if they had been involved in the business, to agree that they will not directly or indirectly compete with the purchaser in the business being sold. Noncompetes for as long as three to five years are not unusual. In some cases, payment is made specifically for the noncompetes, in part to provide the purchaser with advantages under income tax laws. If reasonable in scope, length and territory, noncompete agreements given in connection with a sale of a business are generally enforceable in California, Oregon, Washington and Alaska. [ 22 ] Negotiating and Executing Agreements • MANAGEMENT OF BUSINESS OR REAL PROPERTY PRIOR TO CLOSING. It is common to require sellers to forego capital expenditures, making changes in leases and contracts, and other major actions during the period between execution and closing, as well as to keep the business and real property in good condition. • STOCK SALE PROVISIONS. In stock sales, it is common to stipulate that selling shareholders shall bear their own accounting and attorney fees, along with other transactional expenses. Absent such provisions, these expenses remain as liabilities of the corporation being purchased and are thus, in effect, paid by the purchaser. It is also common to require that all directors and officers provide their written resignations at closing. [ 23 ] Financing Financing for business and real property acquisitions by foreign purchasers typically will come from three different sources: • • • the seller itself, bank and other third-party financing, and the purchaser’s own resources. Seller financing is not uncommon in California, Oregon, Washington and Alaska, particularly in the case of real property acquisitions. When the seller finances the acquisition by deferring the purchase price, the seller will typically insist on a mortgage (usually in the form of a deed of trust in California, Oregon, Washington and Alaska) in the real property being sold and a security interest in the other assets. Obviously, the effects of such seller-retained mortgages and security interests on future financings need to be taken into account. When considering bank financings for business acquisitions, a logical place to start is with the U.S. banks currently providing credit to the business. Often, such banks are familiar and comfortable with the business and its operations and desire to retain a valuable customer. These banks are often the readiest possible source of asset-based acquisition financing (financing which relies solely, in whole or in part, on the assets of the business being acquired rather than on the guarantees of the purchaser). But, when the risk profile of the purchaser differs from that of the seller, many times it is more advantageous to obtain financing from a capital source with an appropriate risk perspective. If foreign sources of financing are used, the purchaser and its lender should consider the effect of the U.S. tax on interest payments, collected [ 24 ] Financing by withholding on the interest payments. The tax rate is 30 percent, but that rate is reduced in most tax treaties and is eliminated in the case of portfolio debt. When the foreign purchaser uses its own resources to finance the acquisition, either through direct cash transfers or through guarantees of loans made by lenders in the United States, a number of U.S. tax issues need to be taken into account, including: • INTEREST WITHHOLDINGS. As noted earlier, interest payments to a foreign lender are subject to U.S. tax withholdings, although there are a number of exceptions. • DEBT-TO-EQUITY RATIO RULES. When excessive debt is used to finance a foreign person’s U.S. subsidiary, U.S. tax authorities have the ability to recharacterize the debt as equity. If debt is recharacterized as equity, interest deductions on the excess debt can be denied. In addition, interest and principal payments from the U.S. subsidiary on debt guaranteed by its foreign parent can be characterized as dividend payments to the foreign parent, in respect of which tax withholdings should have been made. Unfortunately, there are no clear rules on the appropriate debt-to-equity ratio, and numerous factors have to be taken into account in determining safe ratios. However, it can be generally assumed that in cases of debt from a related party, or guaranteed by a related party, ratios of debt-to-equity in excess of 4 to 1 (at the time the debt is created) run serious risks of recharacterization. (In calculating this debt-to-equity ratio, a corporation may use the current fair market value of its assets.) • RECHARACTERIZATION OF NONCOMMERCIAL LOANS GUARANTEED BY A FOREIGN PARENT. When loans guaranteed by a foreign parent are made to its U.S. subsidiary in circumstances which suggest that the loan has no commercial sense independent of the guarantee, U.S. tax authorities have the ability to recharacterize the guaranteed loan to the subsidiary as a loan to the parent, the proceeds of which are in turn used to make a loan to the U.S. subsidiary. As a result of such recharacterization, a withholding tax on all deemed interest payments [ 25 ] Pacific Coast Opportunities made by the subsidiary to its parents would have to be paid. The risks of recharacterization are particularly great when the foreign parent’s guaranty is backed up by a certificate deposit or monetary deposits. • “EARNING-STRIPPING” RULES. Under the U.S. income tax “earning-stripping” rules, certain interest paid or accrued by a corporation to a related, tax-exempt person (including those persons who are partially or wholly tax exempt by virtue of a reduced or eliminated tax treaty rate) is not deductible. These limitations, however, only apply if, at the close of the tax year, the ratio of debt-to-equity of the U.S. corporation exceeds 1.5 to 1. (In calculating this debt-to-equity ratio, the corporation must use its tax basis book value.) Also, the subsidiary’s interest deductions for a taxable year will not be denied if its net interest expenses are no greater than 50 percent of its taxable income (with certain adjustments). Debt guaranteed by a foreign parent or related person is subject to these rules. [ 26 ] Closing Closing is the consummation of an acquisition. At that time, ownership transfers, funds are paid, and the purchaser is placed in control of the business or real property. Typically, closing is conditioned on the occurrence of a number of events set forth in the purchase and sale agreement, ranging from shareholder approval, to financing, to consents from parties to key leases and contracts. For certain types of acquisitions, these conditions should include U.S. governmental screening procedures under Hart-Scott-Rodino and under Exon-Florio. Hart-Scott-Rodino Hart-Scott-Rodino is a pre-acquisition notification process that allows U.S. antitrust authorities to determine whether certain acquisitions create antitrust problems. Generally, Hart-Scott-Rodino will apply to many acquisitions of $50 million or more, where the parties are each of a certain size, although some stock sales with a lower price may be covered if the acquiring person already holds stock of the issuer. Purchases of residential real estate, office buildings and undeveloped land are usually exempt, but other real estate acquisitions may be covered. Under Hart-Scott-Rodino, both the seller and the purchaser must file a notification with the antitrust authorities. Depending on the size of the transaction, the purchaser must pay a filing fee ranging from $45,000 to $280,000; depending on how the transaction is structured, the seller may have to pay a fee as well. After filing, the parties must wait a certain time, usually 30 days, before closing the transaction. This wait[ 27 ] Pacific Coast Opportunities ing period is often shortened by the antitrust authorities, but it can also be extended. If they are concerned about the antitrust implications of the acquisition, the antitrust authorities can try to stop the acquisition through court proceedings. Exon-Florio Exon-Florio permits the president of the United States to prohibit foreign acquisitions which threaten national security. If the acquisition is already closed, the president can order a divestiture. To date, however, although hundreds of transactions have been reviewed, that divestiture power has only been exercised once, when the first President Bush ordered a Chinese purchaser of a Seattle-based manufacturer of airplane parts to divest. “National security” can be interpreted quite broadly, and regulatory authorities responsible for enforcing Exon-Florio have made more vigorous use of the provision since September 11, 2001. Those regulatory authorities have resisted any definition of national security that would exclude any industries from scrutiny by type. Filings notifying the government of the transaction are voluntary; however, notification of transactions involving products, services and technologies important to U.S. defense are considered “appropriate.” Further, since September 11, 2001, the government is more likely than previously to focus on transactions involving telecommunications and technology companies. Potential purchasers should carefully consider whether to make the voluntary filing. If a filing is not made, the acquisition remains perpetually open to government scrutiny and potential divestiture. On the other hand, if a materially complete and correct filing is made, and no government action is taken within 90 days, the acquisition can proceed without any further threat of injunction or divestiture under Exon-Florio. Other Regulations and Procedures For acquisitions of businesses in defense-related industries, foreigners may also have to deal with the U.S. Department of Defense to ensure compliance with the Department’s regulations on foreign control and in- [ 28 ] Closing fluence. In addition, 60-day notice prior to closing may have to be given under the Department of State’s ITAR regulations. Foreign purchasers should also be aware of two post-closing government notification procedures. The International Investment and Trade in Services Survey Act requires that reports be filed with the U.S. Department of Commerce within 45 days of closing whenever a foreign person acquires a 10 percent or greater interest in a U.S. business or real property (subject to certain exceptions for real estate). The Agricultural Foreign Investment Disclosure Act requires that a separate report be filed within 90 days of closing whenever a foreign person acquires or transfers any interest, other than a security interest, in agricultural lands. At closing, a variety of documents and instruments are delivered. Legal opinions from both the seller’s and purchaser’s counsel are commonly delivered in business acquisitions and in larger real property transactions. The legal opinion for the seller will provide assurance to the purchaser that all corporate procedures were properly completed. In a stock sale, delivery of stock certificates, properly endorsed over to the purchaser, is typically the primary closing deliverable from the seller. When assets or real property are purchased, a whole series of transfer instruments are delivered, including deeds for real property, bills of sale for other tangible assets, assignments and assumptions of leases and other contracts, and title documents for vehicles and aircraft. In the case of real property acquisitions, it is common in California, Oregon, Washington and Alaska to close through escrow with a title insurance company. Funds from the purchaser and the deed and other documents from the seller are delivered to the title insurance company with instructions to deliver funds to the seller only when the title insurance company has recorded the deed and is satisfied that it can deliver title insurance showing no mortgages and other title defects, except as otherwise agreed to by the parties. [ 29 ] Acquisition of a Public Company Acquiring a U.S. public company involves a number of highly technical corporate and securities law issues that are largely beyond the scope of this guide. However, here is a summary of some of the key issues encountered in such transactions: Fiduciary Duties In general, directors and management of a U.S. seller have fiduciary obligations to act in good faith, with due care and loyalty, in what they believe to be the best interests of the corporation and its shareholders. In a change of control acquisition, the board is required to maximize share value through the pursuit of the best transaction reasonably available for the corporation’s shareholders. A board of directors, as a general rule, has no fiduciary obligation to negotiate with a hostile bidder or to sell the corporation merely because it received a premium offer for all of the corporation’s shares. Under Delaware law, the seller’s board has a duty to seek the best available transaction, by seeking out the best price and other terms reasonably available under the circumstances, which may not be the ideal transaction. Revlon, Inc. v. MacAndrews & Forbes Holdings, Inc., 506 A.2d 173 (Del. 1996). This duty is imposed if the corporation is sold for cash, for a non-voting security, or to a company controlled by one or more persons (but generally not in a combination for voting securities, except to a controlled company). Deal Protection Deal protection is typically driven by the buyer’s desire for certainty of consummation when negotiating a transaction. The seller may want to [ 30 ] Acquisition of a Public Company preserve the maximum amount of flexibility to consider alternative transactions in order to satisfy the board’s fiduciary duties or to preserve its ability to obtain a more favorable deal. The need for deal protection has resulted in the development of a number of features intended to deter third parties from disrupting a transaction and, in the event of disruption, to compensate the initial buyer. Such measures include: • a no-shop clause, which limits the ability of the seller to solicit competing bids; • a no-talk provision, which restricts the seller’s ability to discuss a bid with, or provide information to, a third party; • break-up fees, which provide that, if a transaction is terminated and the seller enters into an acquisition agreement with a third party, the seller will pay a fee to the initial buyer. The fee is usually in the range of 1 to 4 percent of the equity value of the transaction, depending on the size of the transaction, the circumstances under which the agreement is executed, the nature of the consideration and the terms and conditions of the agreement, including how committed the buyer is; • a requirement that the transaction be presented for seller shareholder approval, regardless of whether the board of the target has changed its recommendation; and • provisions which lock out competitive bidders for a specified period of time. Careful review should be given as to whether the deal protection measures are permissible under applicable state law. Proxy/Registration Statement In a statutory merger, the buyer, if issuing its securities as consideration in the transaction, would file a registration statement on Form F-4 (for foreign private issuers, comparable to the Form S-4) covering the shares to be issued in the merger. In a structured disclosure situation, such as a registration statement, the required disclosure is dependent upon the [ 31 ] Pacific Coast Opportunities requirements of the specific registration form utilized. In most instances disclosure of material facts will be required. The disclosure process under U.S. federal securities laws provides for making prospective purchasers of securities aware of the risks of the enterprise and insisting on the use of factual information. The shareholders of the seller will have to approve a merger by the vote required by the applicable state statute and the seller’s charter. The merger is likely to be structured so that under the applicable statute, shareholder approval of the buyer would not be required. If, however, stock of the buyer is listed on a United States securities exchange, the rules of the exchange may require approval of its shareholders as well. For example, Nasdaq rules require shareholder approval for the issuance of shares equal to 20 percent or more of a company’s outstanding shares. A meeting of shareholders will be required. Solicitation of proxies will be subject to the proxy rules of U.S. federal securities laws. The typical statutory merger involves both the sale of securities registered under the Securities Act of 1933 and a solicitation of proxies subject to the Exchange Act of 1934 proxy rules. The process is facilitated by allowing one document to serve both as the proxy statement of the seller (and the buyer if approval of its shareholders is required) and the prospectus of the buyer. Preparation of the F-4 could take up to 20 days or longer. An additional 30-60 days may be required to complete the Securities and Exchange Commission (SEC) review process and to mail the proxy to the shareholders of the seller. For certain types of transactions (for example, going private acquisitions or acquisitions involving complicated accounting issues), the SEC review could be lengthened by months. Once SEC clearance is received, the seller can set a record date and have proxies printed and sent out to its shareholders. Typically, the seller will require 10-15 days for printing and mailing the proxies. The seller’s shareholder meeting is typically 20-30 days from the date the proxies are mailed, depending on the state law requirements. Anti-takeover Provisions Shareholder rights plans, more commonly known as “poison pills,” have traditionally been adopted by public company boards to prevent certain [ 32 ] Acquisition of a Public Company types of hostile takeovers and to encourage potential buyers to negotiate with a corporation’s board prior to acquiring any sizable amount of its stock. Poison pills are also relevant in friendly transactions. If either the buyer or the seller has a shareholder rights plan, the treatment of the proposed transaction under the plan or plans must be analyzed, and the plans may have to be amended so that a proposed transaction does not trigger the consequences originally intended to apply to hostile takeovers. Such amendments may require early board action. Rights plans provide for the distribution to a company’s common shareholders of “rights,” which are essentially warrants. The distribution is effected as a stock dividend declared by the company’s board and does not require shareholder approval. Upon the occurrence of a triggering event, the rights become exercisable for a number of shares of common stock with a below market exercise price. By purchasing more shares cheaply, the shareholders, other than the potential buyer, are able to dilute the shares held by the potential buyer, which results in making the target unattractive to the potential buyer. A number of states have enacted statutes that protect corporations incorporated (or doing business) in those states from unsolicited takeover bids. State anti-takeover statutes are generally based on a “business combination,” a “fair price” or a “control share” model. Business combination statutes generally prevent acquirors who do not reach agreement with a target corporation’s board from consummating certain transactions, primarily involving some type of self-dealing that may arise in the course of hostile acquisitions. Fair price statutes generally preclude an acquirer who crosses a specified ownership threshold from significant business transactions with the target corporation unless certain “fair price” criteria are met. Control share statutes prohibit an acquirer from voting its shares or electing the board of directors. Another anti-takeover device used by public companies is the staggered board. The staggered board provides anti-takeover protection both by: (i) forcing any hostile bidder, no matter when it emerges, to wait at least one year to gain control of the board; and [ 33 ] Pacific Coast Opportunities (ii) requiring such a bidder to win two elections far apart in time rather than a one-time referendum on its offer. Tender Offers The tender offer is a means of buying a substantial portion of the outstanding stock of a company by making an offer to: (i) (ii) (iii) (iv) purchase all outstanding shares; up to a specified number; tendered by shareholders within a specified period; and at a fixed price (usually at a premium above the market price). Section 14(d)(1) of the Securities Exchange Act of 1934 requires that a tender offer for a class of registered equity securities be made pursuant to filing with the SEC information regarding the bidder’s ownership interest in the target company and material terms of the proposed transaction, as well as specified information regarding the target company, the prior acquisition of the target company’s securities by the bidder, and past dealings between the bidder and the target company. The tender offer can be withdrawn any time during the period an offer request or invitation remains open. Pursuant to Section 14(d)(7) of the Exchange Act and Rule 14d-10, a bidder must pay the same consideration to all shareholders of the target who tender their securities during a tender offer. The remedy for a violation under Section 14(d)(7) is that whenever the bidder increases consideration offered to shareholders at any time, the bidder must pay that increased consideration to all tendering shareholders. Some recent cases have found that Rule 14d-10 applies to employment agreements between the bidder and the target company executives (e.g., non-compete, severance, compensation packages, options and retention bonuses) on the theory that the agreements represent disguised compensation for the executives’ tender and thereby constitute additional consideration paid to those insiders in violation of the “all holders, best price” rule. Absent SEC clarification on the scope of the “all holders, best price” rule, tender offers should be avoided in favor of other acquisition structures, unless the bidder is willing to accept litigation risk. [ 34 ] Conclusion California, Oregon, Washington and Alaska afford exciting opportunities to foreign purchasers of businesses and real property. Those opportunities can be even more gratifying if the acquisitions are properly structured and documented, and if due diligence is fully completed. This booklet has provided a brief guide to foreign investment in the four-state region; it cannot, however, substitute for the active involvement of experienced legal and tax accounting advisors in a transaction. Foreign purchasers are advised to seek the assistance of experienced advisors at the outset of their transaction. [ 35 ] About Preston Gates & Ellis LLP Preston Gates & Ellis LLP has been providing private and public sector clients with counsel, litigation, legislative advocacy and transactional services for more than 120 years. As a full-service law firm, we offer more than 425 attorneys and 630 professional staff members in eleven cities throughout the West Coast, in Washington, DC and in Asia. Our firm is a service organization. Our goal is to offer clients reliable, timely and cost-effective counsel while maintaining the highest standards of legal excellence and personal integrity. We aim to develop with each of our clients a long-term, mutually satisfying relationship. We know these kinds of relationships do not happen overnight. They are based on the trust that develops over time when a law firm understands its clients and their businesses, anticipates their needs, and provides prompt, high-quality and consistently valuable service. Preston Gates lawyers and professionals believe in working as a team with our clients and each other. We make extensive use of sophisticated communications, document production and research technology, and stand ready to meet all of our clients’ legal needs, from drafting simple documents to managing major multi-party transactions throughout the United States and the world. [ 36 ] For more information please contact these Preston Gates offices ANCHORAGE SAN FRANCISCO 420 L Street, Suite 400 Anchorage, AK 99501-1937 Tel: (907) 276-1969 Fax: (907) 276-1365 55 Second Street, Suite 1700 San Francisco, CA 94105-3493 Tel: (415) 882-8200 Fax: (415) 882-8220 BEIJING SEATTLE Suite 1003, Tower E3 Oriental Plaza No 1 East Chang An Avenue Beijing 100738 China Tel: 86 (10) 8518-8528 Fax: 86 (10) 8518-9299 925 Fourth Avenue, Suite 2900 Seattle, WA 98104-1158 Tel: (206) 623-7580 Fax: (206) 623-7022 COEUR D’ALENE 1200 Ironwood Drive, Suite 315 Coeur D’Alene, ID 83814 Tel: (208) 667-1839 Fax: (208) 765-2494 HONG KONG 35th Floor Two International Finance Centre 8 Finance Street Central, Hong Kong SAR Tel: 011 (852) 2511-5100 Fax: 011 (852) 2511-9515 ORANGE COUNTY 1900 Main Street, Suite 600 Irvine, CA 92614-7319 Tel: (949) 253-0900 Fax: (949) 253-0902 SPOKANE 601 West Riverside Avenue, Suite 1400 Spokane, WA 99201-0628 Tel: (509) 624-2100 Fax: (509) 456-0146 TAIPEI 12/F-1 No., 99 Tun Hwa South Road Sec. 2 Taipei 106 Taiwan Tel: 886 (2) 6638-9887 Fax: 886 (2) 6638-9879 WASHINGTON DC Preston Gates Ellis & Rouvelas Meeds LLP 1735 New York Avenue NW, Suite 500 Washington, DC 20006-5209 Tel: (202) 628-1700 Fax: (202) 331-1024 PORTLAND 222 SW Columbia Street, Suite 1400 Portland, OR 97201-6632 Tel: (503) 228-3200 Fax: (503) 248-9085 ONLINE www.prestongates.com www.prestongates.com For more information please contact these Preston Gates offices ANCHORAGE SAN FRANCISCO 420 L Street, Suite 400 Anchorage, AK 99501-1937 Tel: (907) 276-1969 Fax: (907) 276-1365 55 Second Street, Suite 1700 San Francisco, CA 94105-3493 Tel: (415) 882-8200 Fax: (415) 882-8220 BEIJING SEATTLE Suite 1003, Tower E3 Oriental Plaza No 1 East Chang An Avenue Beijing 100738 China Tel: 86 (10) 8518-8528 Fax: 86 (10) 8518-9299 925 Fourth Avenue, Suite 2900 Seattle, WA 98104-1158 Tel: (206) 623-7580 Fax: (206) 623-7022 COEUR D’ALENE 1200 Ironwood Drive, Suite 315 Coeur D’Alene, ID 83814 Tel: (208) 667-1839 Fax: (208) 765-2494 HONG KONG 35th Floor Two International Finance Centre 8 Finance Street Central, Hong Kong SAR Tel: 011 (852) 2511-5100 Fax: 011 (852) 2511-9515 ORANGE COUNTY 1900 Main Street, Suite 600 Irvine, CA 92614-7319 Tel: (949) 253-0900 Fax: (949) 253-0902 SPOKANE 601 West Riverside Avenue, Suite 1400 Spokane, WA 99201-0628 Tel: (509) 624-2100 Fax: (509) 456-0146 TAIPEI 12/F-1 No., 99 Tun Hwa South Road Sec. 2 Taipei 106 Taiwan Tel: 886 (2) 6638-9887 Fax: 886 (2) 6638-9879 WASHINGTON DC Preston Gates Ellis & Rouvelas Meeds LLP 1735 New York Avenue NW, Suite 500 Washington, DC 20006-5209 Tel: (202) 628-1700 Fax: (202) 331-1024 PORTLAND 222 SW Columbia Street, Suite 1400 Portland, OR 97201-6632 Tel: (503) 228-3200 Fax: (503) 248-9085 ONLINE www.prestongates.com www.prestongates.com