KFC Lamtec

advertisement

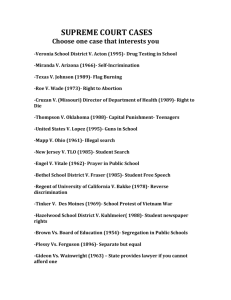

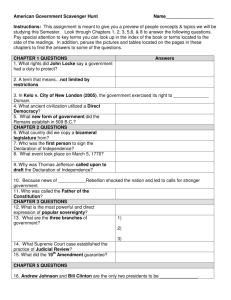

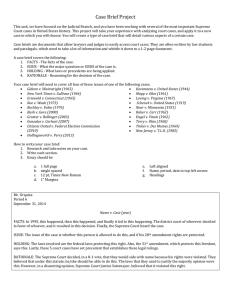

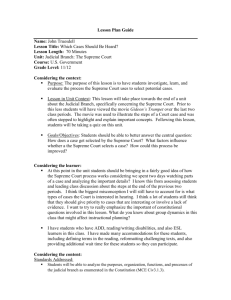

October 10, 2011 Practice Groups: Appellate, Constitutional & Governmental Litigation Public Policy & Law Tax Technology Transactions and Data Protection Supreme Court Denies Cert in KFC and Lamtec Cases By Cynthia M. Ohlenforst, Danny S. Ashby, Eli R. Mattioli, Sam Megally On Monday, October 3, 2011, the U.S. Supreme Court denied certiorari in two cases that would have given the Court the opportunity to clarify whether a business must have a physical presence in a state to be subject to certain tax requirements in the state. In its seminal 1992 decision in Quill Corp. v. North Dakota, 504 U.S. 298 (1992), the Supreme Court ruled that, to be subject to sales and use tax collection and remittance obligations in a state, an out-of-state retailer must have a physical presence in the state. Quill undoubtedly remains the law of the land. Nonetheless, in the face of an increasingly difficult economy, many states are aggressively pushing the boundaries of the Commerce Clause of the U.S. Constitution, including by taking the position that Quill applies only to sales and use taxes and not to income, franchise, business and occupation, or other state taxes. The Supreme Court’s denial of certiorari in Lamtec Corp. v. Dep’t of Revenue of the State of Washington, 246 P.3d 788 (Wash. 2011), cert. denied, 2011 WL 4530146 (U.S. Oct 3, 2011) (No. 10-1289), and KFC Corp. v. Iowa Dep’t of Revenue, 792 N.W.2d 308 (Iowa 2010), cert. denied, 2011 WL 4530160 (U.S. Oct 3, 2011) (No. 10-1340) – cases in which K&L Gates submitted amicus briefs in support of Supreme Court review – keeps open the debate about the extent to which the Court’s decision in Quill applies to taxes other than sales and use taxes. The denial also could potentially embolden states to continue taking increasingly aggressive positions with respect to nexus and other constitutional and statutory standards in an effort to stem growing state budgetary shortfalls. Multistate businesses, online retailers, drop-shippers, and companies with an interest in determining and controlling their exposure to various states’ taxes should remain vigilant in monitoring developments among the states on the nexus front, particularly as more states adopt legislation designed to redefine nexus for tax purposes. Supreme Court Denies Cert in KFC and Lamtec Cases Authors: Cynthia M. Ohlenforst cindy.ohlenforst@klgates.com +1.214.939.5512 Danny S. Ashby danny.ashby@klgates.com +1.214.939.5745 Eli R. Mattioli eli.mattioli@klgates.com +1.212.536.4019 Sam Megally sam.megally@klgates.com +1.214.939.5491 Page 2