Real Estate Finance

Real Estate Finance

• Differences with business finance

• Real estate development process and financing issues

• Real estate financial statements

• Finance instruments & underwriting

• Funding gaps

• City Plaza example

Differences with business finance

• Scale of investment is large

• Financing physical, fixed assets

• Need for long-term financing

• Use of separate construction and permanent financing

• Competition and markets are regional and/or local

• More predictable income & expenses

Three Phases of Development

• Predevelopment

– Planning & design, site control, permitting, preleasing/sales, securing financing

– Large costs, high risk no revenue=>requires equity, grants, deferred loans

• Construction & development

– Site acquisition, final design & contractor selection, construction

– Limited risk => construction loan and equity

• Occupancy and management

– Asset management=> permanent debt take-out

– Retire debt, realize equity returns

Real Estate Financial Statements

Development Budget

• Sources and uses of funds statement

• Analogous to a balance sheet

– Acquisition, hard costs, and soft costs

– Contingencies and reserves

– Per square foot basis useful for comparisons

• Sources of funds

– Debt sources, equity investments, grants

Real Estate Financial Statements

Operating Pro Forms

• Revenue, expenses and net cash flow

• CAM, escalators, and percentage rent

– Lease terms define revenue –key to analyze

• Vacancy rates

• Operating expenses

– IREM, ULI comparable project data to analyze

– Replacement and operating reserves

• Cash flow, debt service and net cash flow

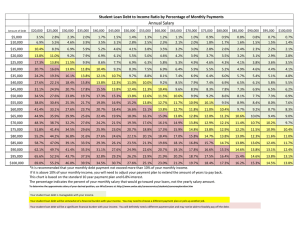

• Supportable debt: PV of [cash flow/DSCR]

• Supportable equity: PV of net cash flow & expected gain on sale

Real Estate Debt Instruments

• Predevelopment loan

• Construction loan

• Real estate mortgage

• Mini-perm loan

• Bridge loan

Underwriting Real estate Loans

• Development Team Capacity

– Experience & ability of development team members

– Management company deserves special attention

• Project cash flow risk

– Initial lease-up risk: will property be occupied at target rent?

– Tenant credit risk: will tenants pay their rent?

– Re-leasing/market risk

– Operating expense risk: are operating costs adequate ?

• Collateral value and appraisals

– Appraisals set the market value & max. Three ways to value a property: cost, comparable sales, discounted cash flow.

– Quality of construction

– Quality of maintenance and replacement funding

Common Funding Gaps

• Supply of pre-development and equity financing

• Weak markets:

– Market rents do not support development costs

– New development needed to change market dynamics

– Lithgow block: income supported 57.5% of development costs; grant/subsidy for 42.5%

City Plaza: Supportable Debt and

Financing Gap

Minimum Annual Cash Flow

Debt Service Coverage Ratio

Cash Flow Available for Debt

Service

Supportable Mortgage Loan

Round to

Annual Debt Service

$144,550

1.25

$115,640

$1,152,105

$1,152,000

$115,629

Total Development Costs $1,490,000

Total Sources (Debt & Grants) $1,302,000

Funding Gap $ 188,00

City Plaza: Options to Fill Gap

• Subordinate Loan from cash flow after senior debt

• Minimum Cash Flow $ 28,921

• Cash flow for debt payments $ 26,292

• Present value, 10 years, 10% $165,794

• Present value, 15 years, 10% $203,887

• Use 13 year term and amortization for loan

• Annual Debt Service: $25,895