Final Rule Sets Out Detailed Requirements for Charitable Hospitals

advertisement

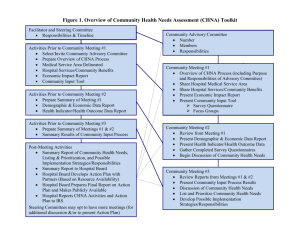

January 28, 2015 Practice Groups: Health Care Final Rule Sets Out Detailed Requirements for Charitable Hospitals By Kelsey U. Jernigan and Mary Beth F. Johnston Tax On December 31, 2014, the Treasury Department and the Internal Revenue Service (“IRS”) published a final rule (the “Final Rule”)1 implementing the requirements in Internal Revenue Code Section 501(r) for tax-exempt hospitals (“Section 501(r)”).2 Based on the Final Rule, these hospitals need to review their financial assistance policies and implementation of such policies, billing and collection policies and practices, and guidelines for conducting community health needs assessments. In 2010, the Affordable Care Act added Section 501(r), which requires tax-exempt hospitals to perform a community health needs assessment (“CHNA”) every three years, establish a financial assistance policy, set limitations on certain charges and restrict debt collection practices.3 The addition of Section 501(r) prohibits certain aggressive debt collection practices and increases transparency of tax-exempt hospitals’ financial assistance programs. Though these statutory requirements became effective shortly after the Affordable Care Act was signed into law, hospitals have been permitted to rely on agency guidance and the proposed rules published in 2012 and 2013 in order to comply with the law until final regulations were promulgated.4 The Final Rule allows hospitals to continue reliance on the proposed rules and agency guidance for at least one year before coming into compliance with the Final Rule, i.e., by the hospital’s first taxable year beginning after December 29, 2015. The Final Rule also provides guidance on definitions of “hospital facility” and “hospital organization” for entities that were unsure whether the regulation applied. The Final Rule details the extensive requirements for hospitals to follow in order to comply with Section 501(r). Financial Assistance Policy The majority of the Final Rule focuses on the mandatory elements of a hospital’s financial assistance policy (“FAP”). Similar to the proposed rule in 2012 (the “2012 Proposed Rule”),5 the Final Rule does not mandate any specific eligibility criteria for financial aid, nor does it require any particular levels of financial assistance that a hospital must offer. Rather, the Final Rule prescribes the detail that must be included in a hospital’s FAP, as well as the specific procedural requirements for notifying patients about the availability of financial aid. Some of the significant changes from the 2012 Proposed Rule to the Final Rule include: 1 Additional Requirements for Charitable Hospitals; Community Health Needs Assessments for Charitable Hospitals; Requirement of a Section 4959 Excise Tax Return and Time for Filing the Return; Final Rule, 79 Fed. Reg. 78954 (Dec. 31, 2014). 2 26 U.S.C. § 501(r). 3 Pub. Law 111-148 (Mar. 23, 2010) at § 9007(a). 4 Reliance on Proposed Regulations for Tax-exempt Hospitals, Notice 2014–2 (2014–3 IRB 407 (January 13, 2014)); see also 77 Fed. Reg. 38148 (June 26, 2012); 78 Fed. Reg. 20523 (April 5, 2013). 5 77 Fed. Reg. 38148 (June 26, 2012). Final Rule Sets Out Detailed Requirements for Charitable Hospitals • List of Specific Providers Covered by the FAP: The FAP must list all providers delivering emergency or other medically necessary care in the hospital facility and further specify whether each provider is covered by the hospital’s FAP.6 The Final Rule also clarifies that if a hospital facility outsources the operation of its emergency room to a third party, and the care provided by the third party is not covered by the hospital’s FAP, then the hospital facility may not be considered to operate an emergency room for purposes of determining nonprofit status.7 The Final Rule further explains that medical care provided by a “substantially related entity” of the hospital must be covered by the hospital’s FAP.8 A substantially related entity, with respect to a hospital facility that is operated by a taxexempt hospital organization, is defined as “an entity treated as a partnership for federal tax purposes in which the hospital organization owns a capital or profits interest, or a disregarded entity of which the hospital organization is the sole member or owner, that provides emergency or other medically necessary care in the hospital facility.”9 • Description of Discounts: The FAP is no longer required to describe all discounts offered by the hospital—the Final Rule requires only that all discounts “available under the FAP” are described.10 This revision allows a hospital to offer discounts outside of the FAP that may not be considered “financial assistance,” such as discounted amounts to individuals who are not FAP-eligible. • Billing Statement Notices: The Final Rule revises the billing statement notice requirements, mandating only that a hospital’s billing statement include a conspicuous notice informing the recipient about the availability of financial aid and how to obtain more information (instead of the 2012 Proposed Rule’s requirement that a full summary of the FAP be included on such statements).11 • Limitation on Charges: The Final Rule clarifies that Section 501(r)(5), which prohibits taxexempt hospitals from using gross charges (i.e., full chargemaster rates), applies only to the amounts charged to individuals who are eligible for financial assistance. Section 501(r)(5) and the Final Rule also limit amounts charged to individuals eligible for financial assistance to no more than the amount generally billed to individuals with insurance covering such care, or “AGB” (a calculation that is defined in detail in the Final Rule).12 • Refund to Patients: Following a determination that an individual is eligible under the FAP, the hospital must refund any amount that the individual has already paid to the hospital exceeding what a FAP-eligible individual would have been charged. The Final Rule includes a $5.00 threshold amount, under which hospitals are not required to issue such refunds due to administrative costs.13 6 26 C.F.R. § 1.501(r)–4(b)(1)(iii)(F). Prior IRS guidance cites the operation of a full-time emergency room as evidence that a hospital is operated to serve the public rather than a private interest, a critical issue for a nonprofit hospital claiming exemption under Section 501(c)(3), see Rev. Rul. 69-545, (1969–2 C.B. 117). 8 26 C.F.R. § 1.501(r)–4(b)(1)(i). 9 26 C.F.R. § 1.501(r)–1(b)(28). 10 26 C.F.R. § 1.501(r)–4(b)(2)(i)(A). 11 26 C.F.R. § 1.501(r)–4(b)(5)(i)(D)(2). 12 26 C.F.R. § 1.501(r)–5(a)(2). 13 26 C.F.R. § 1.501(r)–6(c)(6)(i)(C)(2). 7 2 Final Rule Sets Out Detailed Requirements for Charitable Hospitals • Information from Non-Applicant Sources: The Final Rule requires the FAP to describe any information about FAP applicants that the hospital may obtain from sources other than the individual applicants themselves, which the hospital may consider in a financial assistance determination, including, but not limited to, publicly available information, credit checks, and enrollment in public programs. The FAP must also describe whether, and under what circumstances, the hospital may use prior FAP applications and determinations in order to presumptively determine whether an individual is FAPeligible.14 • Mandatory Translations: The Final Rule lowers the threshold applicable to translations of required documents in order to be consistent with other guidance from the Department of Health and Human Services. Hospitals must now provide written translations of the FAP, FAP application, and plain language summary of the FAP in every language spoken by each limited English proficiency language group that constitutes the lesser of either 1,000 individuals or 5 percent of the community served by the hospital, or the population likely to be encountered by the hospital.15 • Measures to Publicize the FAP: The 2012 Proposed Rule required the FAP to include measures to widely publicize the FAP within the community served by a hospital facility, specifically explaining the measures taken by the hospital facility to notify and inform the community about the FAP. However, the Final Rule provides flexibility by “eliminat[ing] the requirement that the FAP list the measures taken to widely publicize the FAP and instead require[s] only that a hospital facility implement the measures to widely publicize the FAP in the community it serves.”16 Further, the Final Rule fleshes out numerous other requirements, such as detailing the specific “public locations” in which the FAP must be publicized, requiring that a physical office location be included in the contact information that is provided for more information about the FAP and prescribing the specific elements required in each written notice. Billing and Collection Practices Section 501(r) also places limitations on the billing and collection practices of a tax-exempt hospital, prohibiting certain “extraordinary collection actions” (“ECAs”) until the hospital has made reasonable efforts to determine whether an individual is eligible for financial assistance.17 The Final Rule, like the 2012 Proposed Rule, specifies the collection actions that are considered ECAs and details the procedural notice requirements that a hospital must satisfy prior to the initiation of such ECAs. • Actions that are not ECAs: The Final Rule clarifies that a hospital lien to obtain proceeds of settlements, judgments, or compromises arising from a patient’s suit against a thirdparty tortfeasor is not an ECA, nor is the filing of a claim in a bankruptcy proceeding. The Final Rule also provides specific criteria that a hospital may follow in order to exempt 14 26 C.F.R. § 1.501(r)–4(b)(1)(iii)(E). 26 C.F.R. § 1.501(r)–4(b)(5)(ii). 16 79 Fed. Reg. 78974. 17 26 U.S.C. § 501(r)(6). 15 3 Final Rule Sets Out Detailed Requirements for Charitable Hospitals certain sales of debt from being considered an ECA.18 In other words, the hospital may initiate these collection actions without satisfying the “reasonable efforts” requirements of the Final Rule. • Deferring or Denying Medically Necessary Care: The Final Rule also adds a collection activity that is to be considered an ECA—the deferral or denial of, or requiring prepayment prior to, the provision of medically necessary care because of an individual’s nonpayment of bills for previously provided care.19 However, the IRS and Treasury Department acknowledge that the timing of this collection activity depends on when an individual seeks medical care from the hospital, “a contingency over which the hospital facility has no control.”20 Thus, the Final Rule provides alternate procedures for hospitals to satisfy the requirement that the hospital has made “reasonable efforts” to determine whether the individual is FAP-eligible prior to initiating this ECA.21 Specifically, a hospital is not required to generally provide the oral and written notification about the FAP and potential ECAs that would otherwise be required at least 30 days prior to the initiation of an ECA. Instead, the hospital may defer or deny (or require payment before providing) medically necessary care at any time after providing the individual with the FAP application, and notifying the individual in writing about the availability of financial assistance and the deadline for applying for such assistance. Hospitals must also expedite the review process of a FAP application submitted under these circumstances in order to ensure that medically necessary care is not unfairly delayed. Community Health Needs Assessment Section 501(r)(3) requires a tax-exempt hospital to conduct a CHNA and adopt an implementation strategy to meet the community health needs identified through the CHNA at least once every three years. In a 2013 proposed rule (the “2013 Proposed Rule”), the IRS and Treasury Department published guidance on the process of conducting a CHNA and the CHNA report requirements. The Final Rule includes few substantive changes from the 2013 Proposed Rule. • Joint CHNAs: The Final Rule amends the 2013 Proposed Rule in relation to joint CHNA reports. The 2013 Proposed Rule allowed a hospital organization to conduct its CHNA in collaboration with other organizations, permitting collaborating hospital facilities that define their community to be the same and conduct a joint CHNA process to produce a joint CHNA report. The Final Rule clarifies that, when collaborating hospital facilities conduct a joint CHNA process and file a joint CHNA report, the CHNA report must contain all of the same basic information that separate CHNA reports must contain, noting that Section 501(r) applies separately to each hospital organization.22 The Final Rule also expressly requires the joint CHNA report to clearly identify the hospital facilities to which it applies and to require all collaborating hospital facilities and organizations included in the joint CHNA report to define their community to be the same. 18 26 C.F.R. § 1.501(r)–6(b). The Final Rule does not eliminate or reduce a hospital’s Emergency Medical Treatment and Active Labor Act obligations. See also 26 C.F.R. § 1.501(r)–4(c). 20 79 Fed. Reg. 78993. 21 26 C.F.R. § 1.501(r)–6(c)(4)(iii). 22 79 Fed. Reg. 78967. 19 4 Final Rule Sets Out Detailed Requirements for Charitable Hospitals • Added Flexibility: The Final Rule also provides hospitals additional time and flexibility in evaluating the plan’s impact on community health needs, requiring only that the CHNA report evaluate the impact of any actions the hospital has taken to address the health needs identified in the prior CHNA.23 The Final Rule also provides an additional five months for hospitals to adopt the implementation strategy, which must occur by the “15th day of the fifth month after the end of the taxable year in which the hospital facility completes the final step for the CHNA.”24 Penalties and Safe Harbor Failure to meet the requirements of Section 501(r) could result in significant consequences for tax-exempt hospitals, including potential revocation of the hospital’s tax-exempt status and an excise tax. While the 2013 Proposed Rule stated that a hospital may, at the discretion of the IRS, be subject to an excise tax for the failure to meet the CHNA requirements, the final rule definitively states that “there is imposed on the hospital organization a tax equal to $50,000” in such circumstance.25 However, the Final Rule provides protection from such penalties in the form of a safe harbor for certain charges, as well as the exclusion of certain conduct from what is considered “a failure to meet requirements.”26 • In the event that a hospital charges a FAP-eligible individual an amount that exceeds what is permitted under the rule, the Final Rule illuminates the circumstances under which a hospital organization meets the safe harbor.27 Specifically, a hospital will be deemed to meet the requirements of Section 501(r)’s limitation of charges if (i) the charge in excess of AGB was not made or requested as a precondition of providing medically necessary care to the FAP-eligible individual, (ii) as of the time of the charge, the FAP-eligible individual has not submitted a complete FAP application to the hospital, or has not otherwise been determined by the hospital to be FAP-eligible, and (iii) if the individual does submit a complete FAP application, is determined to be FAP-eligible, and has already paid the hospital some amount for the care at issue, then the hospital complies with the Final Rule requirements for refunding the FAP-eligible individual.28 • Section 1.501(r)–2(b) provides that an omission of required information from a policy or report, or an error with respect to implementation, will not be considered a failure to meet the requirements as long as the following conditions are met: (i) the omission was minor and either inadvertent or due to reasonable cause, and (ii) the hospital corrects the error as promptly after discovery as is reasonable, including the establishment of practices or procedures reasonably designed to promote and facilitate compliance.29 Additionally, a hospital’s failure to meet one or more requirements of Section 501(r) “that is neither willful nor egregious” may be excused if the hospital corrects and discloses the failure.30 23 26 C.F.R. § 1.501(r)–3(b)(6)(i)(F). 26 C.F.R. § 1.501(r)–3(a)(2). 25 26 C.F.R. § 53.4959–1(a)(1). 26 26 C.F.R. § 1.501(r)–5(d); 26 C.F.R. §1.501(r)–2(b). 27 26 C.F.R. § 1.501(r)–5(d). 28 Id. 29 26 C.F.R. § 1.501(r)-2(b)(1). 30 26 C.F.R. § 1.501(r)-2(c). The IRS and Treasury Department proposed correction and disclosure procedures in Proposed Procedures for Charitable Hospitals to Correct and Disclose Failures to Meet § 501(r), Notice 2014–3 (January 24 5 Final Rule Sets Out Detailed Requirements for Charitable Hospitals Next Steps Nonprofit hospital organizations should carefully review their financial assistance policies and billing and collection policies and practices to determine whether they are in compliance with the extensive final regulatory requirements. In addition, hospitals face the continued obligation to conduct a CHNA every three years. A robust compliance program will help to ensure that any omissions or errors in the implementation of Section 501(r) will be discovered and corrected promptly, potentially allowing the hospital to avoid heavy penalties and even the loss of its tax-exempt status. Authors: Kelsey U. Jernigan kelsey.jernigan@klgates.com +1. 919.466.1113 Mary Beth F. Johnston marybeth.johnston@klgates.com +1.919.466.1181 Anchorage Austin Beijing Berlin Boston Brisbane Brussels Charleston Charlotte Chicago Dallas Doha Dubai Fort Worth Frankfurt Harrisburg Hong Kong Houston London Los Angeles Melbourne Miami Milan Moscow Newark New York Orange County Palo Alto Paris Perth Pittsburgh Portland Raleigh Research Triangle Park San Francisco São Paulo Seattle Seoul Shanghai Singapore Spokane Sydney Taipei Tokyo Warsaw Washington, D.C. Wilmington K&L Gates comprises more than 2,000 lawyers globally who practice in fully integrated offices located on five continents. The firm represents leading multinational corporations, growth and middle-market companies, capital markets participants and entrepreneurs in every major industry group as well as public sector entities, educational institutions, philanthropic organizations and individuals. For more information about K&L Gates or its locations, practices and registrations, visit www.klgates.com. This publication is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon in regard to any particular facts or circumstances without first consulting a lawyer. © 2015 K&L Gates LLP. All Rights Reserved. 13, 2014). The Final Rule indicates that the IRS intends to release final guidance on this process “in the near future.” 79 Fed. Reg. 78960. 6