Enhancing Anti-Money Laundering Procedures Thursday, May 28 11:15 a.m. – 12:15 p.m.

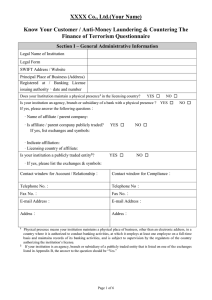

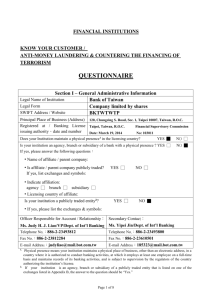

advertisement