Document 13453931

advertisement

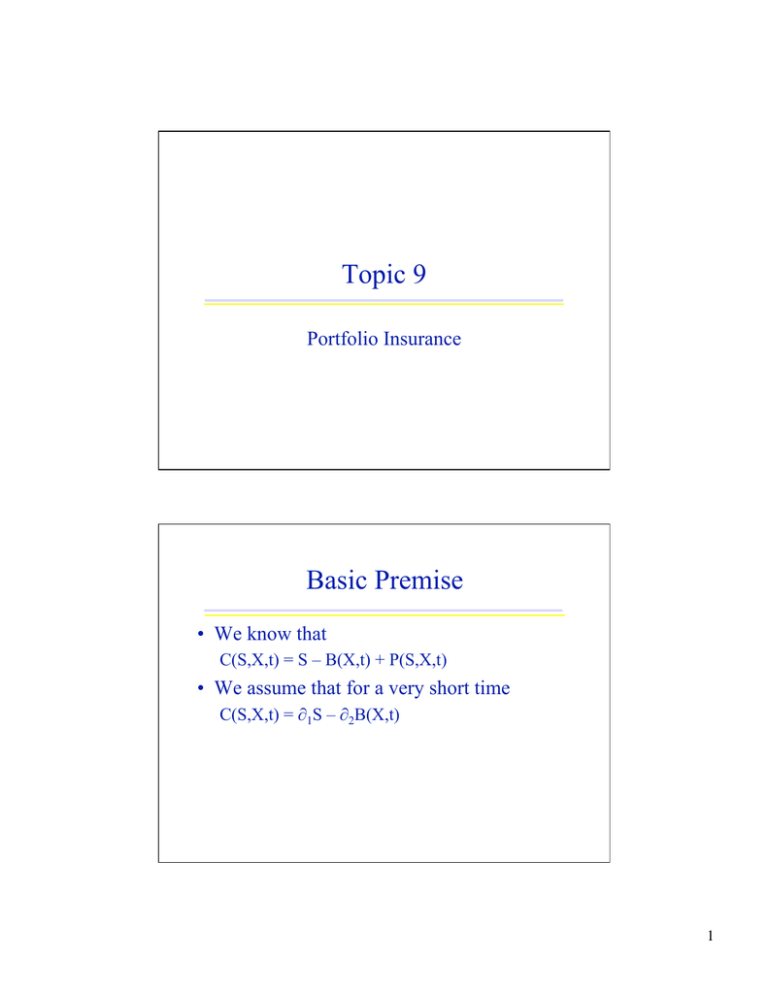

Topic 9 Portfolio Insurance Basic Premise • We know that C(S,X,t) = S – B(X,t) + P(S,X,t) • We assume that for a very short time C(S,X,t) = ∂1S – ∂2B(X,t) 1 Here’s a Picture of ∂1 Call Call ∆C/∆S C2 C1 Stock B B(X,t) (X,t) S1 Stock S2 Here’s a Picture of ∂2 Call Call ∆C/∆X C1 C2 BB(X,t) (X1,t) S B (X2,t) Stock Stock 2 Important Relationships • ∂1 and ∂2 are always less than 1 • ∂2 is always less than ∂1 • Exact values can be estimated using the Black-Scholes OPM • Proportions must be continuously adjusted Example • Suppose ∂1 = 0.7 ∂2 = 0.6 S = $50 B(X,t) = $46 • Then C(S,X,t) = (.7*50) – (.6*46) = $7.40 • Then, sell 100-option contract (receive $740) Sell 60 bonds (receive another $2760, making total $3500) Buy 70 shares stock (pay $3500) Zero net investment • After a moment S = $50.125 B(X,t) = $46.10 C(S,X,t)=7.4275 • Close position, net zero 3 Example • Now, suppose calls selling on CBOE for $7.75 per share Sell 100-share call contract for $775 Create synthetic for $740 Pocket profit of $35 • How will adjustment process work? Basic Premise for Portfolio Insurance • From put-call parity, we know that C(S,X,t) + B(X,t) = S + P(S,X,t) • Then let’s make a simple rearrangement S + P(S,X,t) = C(S,X,t) + B(X,t) • We assume that for a very short time C(S,X,t) = ∂1S – ∂2B(X,t) • Then for a short time S + P(S,X,t) = B(X,t) + ∂C(S,X,t) 1S – ∂2B(X,t) S + P(S,X,t) = ∂1S + (1 – ∂2 ) B(X,t) 4 How does insurance work? Call Call S + P(S,X,t) = ∂1S + (1 – ∂2 ) B(X,t) ∂ close to 1 ∂ declines Less in stock More in bonds B (X,t) B(X,t) Stock S2 Stock S1 How does insurance work? Call Call S + P(S,X,t) = ∂1S + (1 – ∂2 ) B(X,t) ∂ closer to 1 Sell bonds Buy more stock ∂ less than 1 B (X,t) B(X,t) Stock S1 Stock S2 5 How might this process lead to runup? Call Call S + P(S,X,t) = ∂1S + (1 – ∂2 ) B(X,t) ∂ closer to 1 Sell bonds Buy more stock ∂ less than 1 B (X,t) B(X,t) Stock S1 Stock S2 How might this process lead to meltdown? Call Call S + P(S,X,t) = ∂1S + (1 – ∂2 ) B(X,t) ∂ close to 1 ∂ declines Less in stock More in bonds B (X,t) B(X,t) Stock S2 Stock S1 6