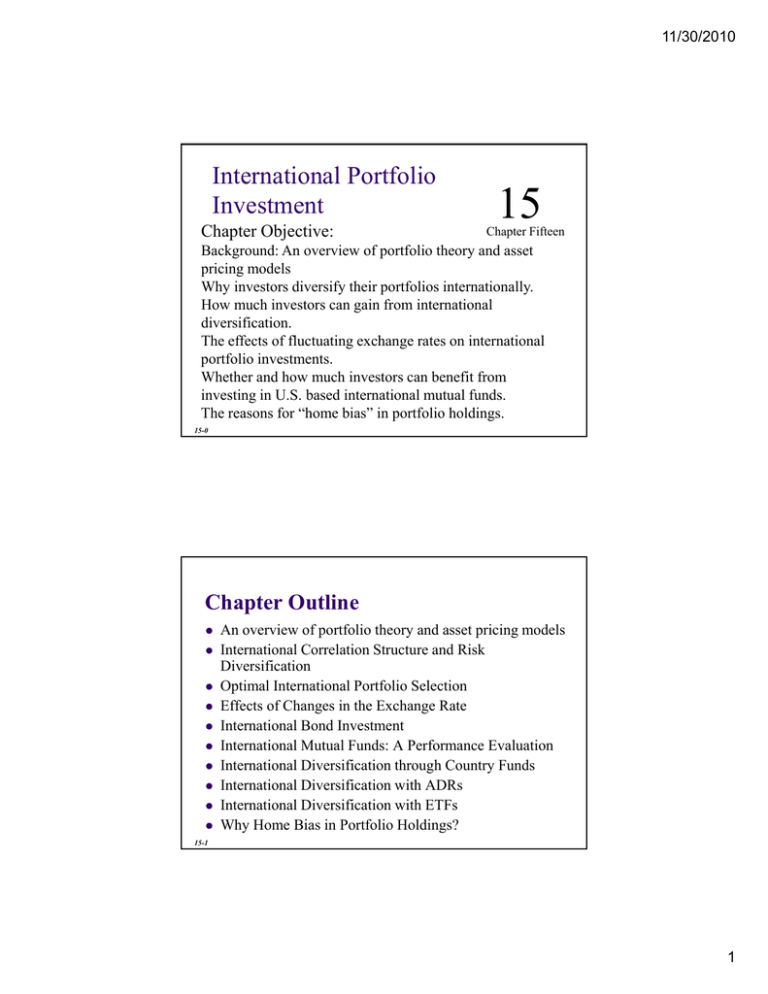

15 International Portfolio Investment Chapter Objective:

advertisement

11/30/2010 International Portfolio Investment Chapter Objective: 15 Chapter Fifteen Background: An overview of portfolio theory and asset pricing models Why investors diversify their portfolios internationally. How much investors can gain from international diversification. The effects of fluctuating exchange rates on international Fifth Edition portfolio investments. / RESNICK Whether and how much investors can benefitEUN from investing in U.S. based international mutual funds. The reasons for “home bias” in portfolio holdings. 15-0 Chapter Outline An overview of portfolio theory and asset pricing models International Correlation Structure and Risk Diversification Optimal International Portfolio Selection Effects of Changes in the Exchange Rate International Bond Investment International Mutual Funds: A Performance Evaluation International Diversification through Country Funds International Diversification with ADRs International Diversification with ETFs Why Home Bias in Portfolio Holdings? 15-1 1 11/30/2010 Overview of portfolio theory and asset pricing models (1) Measuring risk and returns R l for Rules f comparing i risk i k andd returns t Given returns minimize risk Given risk maximize returns Coefficient of variation Return = risk free rate + risk premium Measuring risk and returns of a portfolio Role of correlation Coefficients (+, -, 0) Adding a risk free asset to a risky portfolio Graphing portfolio characteristic in a risk and returns space 15-2 Overview of portfolio theory and asset pricing models (2) Many risky portfolios and risk-free asset S Separation ti Theorem Th Capital Market Line (CML): Pricing a diversified risky portfolio Total Risk = Unsystematic Risk (UR) + Systematic Risk (SR) What determines SR Why is SR important Beta = SR 15-3 2 11/30/2010 Overview of portfolio theory and asset pricing models (3) Capital Asset Pricing Model (CAPM) Whyy is CAPM a ppricingg model? Sharp measure of portfolio performance: [E(Rp) – Rf] / σp E(Rp) = Expected return on portfolio p Rf = Risk free rate σp = standard deviation of the portfolio p’s return 15-4 International Correlation Structure and Risk Diversification Security returns are much less correlated across countries than within a country. This is so because economic, political, institutional, and even psychological factors affecting security returns tend to vary across countries, resulting in low correlations among international securities. Business cycles are often high asynchronous across countries. 15-5 3 11/30/2010 International Correlation Structure Stock Market Australia A U .59 France .29 29 Germany .18 Japan (JP) .15 FR GM JP NL SW UK US Relatively low international correlations .58 58 imply that should be able to Relatively low investors international correlations reduce portfolio risk more if they imply that investors should be able to .31 .65 diversify reduce portfolio riskinternationally more if they rather than domestically. .24 .30 .42 diversify internationally Netherlands .24 .34 .51 .28 rather .62 than domestically. Switzerland .36 .37 .48 .28 .52 .66 United Kingdom United States 15-6 .32 .38 .30 .21 .39 .43 .70 .30 .23 .17 .14 .27 .27 .28 .44 Portfolio Risk (% P %) Domestic vs. International Diversification When fully diversified, an international portfolio can be less than half as risky as a purely U.S. U S portfolio. portfolio A fully diversified international portfolio is only 12 percent as risky as holding a single security. 0.44 Swiss stocks 0 27 0.27 U.S. stocks International stocks 0.12 1 10 20 30 40 50 Number of Stocks 15-7 4 11/30/2010 Optimal International Portfolio Selection The correlation of the U.S. stock market with the returns on the stock markets in other nations varies. The correlation of the U.S. stock market with the Canadian stock market is 72%. The correlation of the U.S. U S stock market with the Japanese stock market is 31%. A U.S. investor would get more diversification from investments in Japan than Canada. 15-8 Summary Statistics for Monthly Returns 1980-2007 ($U.S.) Correlation Coefficient Stock Market CN FR GM JP SD ((%)) 1.07 5.55 Countryy stock market vs. world 1.00 1.20 6.00 1.04 1.19 6.29 1.03 0.92 6.53 1.10 1.19 5.20 0.97 1.11 4.25 0.88 UK Canada (CN) France (FR) 0.49 Germany (GM) 0.46 1.07% monthly return = 12.84% per year 0.73 Japan (JP) 0.34 0.40 0.32 United Kingdom 0.59 0.61 0.56 0.42 United States 0.72 0.55 0.52 0.31 0.61 Mean ((%)) 15-9 5 11/30/2010 Summary Statistics for Monthly Returns 1980-2007 ($U.S.) Correlation Coefficient Stock Market CN Canada (CN) FR GM JP SD ((%)) 1.07 5.55 Countryy stock market vs. world 1.00 1.20 6.00 1.04 1.19 6.29 1.03 0.92 6.53 1.10 1.19 5.20 0.97 1.11 4.25 0.88 UK measures the sensitivity of the market to the world market. France (FR) 0.49 Germany (GM) 0.46 Japan (JP) 0.34 0.40 0.32 United Kingdom 0.59 0.61 0.56 0.42 United States 0.72 0.55 0.52 0.31 Clearly the Japanese market is 0.73more sensitive to the world market than is the U.S. US 0.61 Mean ((%)) 15-10 Selection of the Optimal International Portfolio 2.0% Efficient frontier SD 1.5% OIP Monthly Return NL US 1.0% 0.5% 0.0% 0.0% UK SW CN HK IT GM JP Rf Monthly Standard Deviation 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10% 15-11 6 11/30/2010 Composition of the OIP for a U.S. Investor (Holding Period: 1980—2007 Australia Hong Kong 4.82% 8.76% Italy 6.60% Netherlands 31.11% Sweden 28 01% 28.01% U.S. 20.70% Total 100.00% 15-12 Composition of the OIP, by Countries: 1980—2007 15-13 7 11/30/2010 For a U.S. investor, OIP has more return and more risk. risk The Sharpe measure is 30% higher, suggesting that an equivalent-risk OIP would have more return per unit of risk than a domestic portfolio. OIP ODP Mean Return 1.40% 1.11% Standard Deviation 4.74% 4.25% return Gains from International Diversification OIP 1.40% 1.11% ODP 4.74% 4.25% risk 15-14 Effects of Changes in the Exchange Rate The realized dollar return for a U.S. resident investing in a foreign market will depend not only on the return in the foreign market but also on the change in the exchange rate between the U.S. dollar and the foreign currency. 15-15 8 11/30/2010 Effects of Changes in the Exchange Rate The realized dollar return for a U.S. resident i investing i in i a foreign f i market k is i given i by b Ri$ = (1 + Ri)(1 + ei) – 1 = Ri + ei + Riei Where Ri is the local currency return in the ith market ei is the rate of change in the exchange rate between the local currency and the dollar 15-16 Effects of Changes in the Exchange Rate For example, if a U.S. resident just sold shares in a British firm that had a 15% return (in pounds) during a period when the pound depreciated 5%, his dollar return is 9.25%: Ri$ = (1 + .15)(1 – 0.05) – 1 = 0.925 = .15 + –.05 + .15×(–.05) = 0.925 15-17 9 11/30/2010 Effects of Changes in the Exchange Rate The risk for a U.S. resident investing in a foreign market will depend not only on the risk in the foreign market but also on the risk in the exchange rate between the U.S. dollar and the foreign currency. Var(Ri$) = Var(Ri) + Var(ei) + 2Cov(Ri,eei) + Var The Var term represents the contribution of the cross-product term, Riei, to the risk of foreign investment. 15-18 Effects of Changes in the Exchange Rate Var(Ri$) = Var(Ri) + Var(ei) + 2Cov(Ri,ei) + Var This equation demonstrates that exchange rate fluctuations contribute to the risk of foreign investment through three channels: 1. Its own volatility, Var(ei). 2. Its covariance i with i h the h local l l market k returns Cov(Ri,ei). 3. The contribution of the cross-product term, Var. 15-19 10 11/30/2010 International Portfolio: Risk Decomposition 15-20 International Bond Investment There is substantial exchange rate risk in foreign bond investment. This suggests that investors may be able to increase their gains is they can control this risk, for example with currency forward contracts or swaps. The advent of the euro is likely to alter the risk riskreturn characteristics of the euro-zone bond markets enhancing the importance of non-euro currency bonds. 15-21 11 11/30/2010 International Mutual Funds: A Performance Evaluation 1. 2. 3. A U.S. investor can easily achieve international diversification by investing in a U.S.-based international mutual fund. The advantages include Savings on transaction and information costs. Ci Circumvention i off legal l l andd institutional i i i l barriers b i to direct portfolio investments abroad. Professional management and record keeping. 15-22 International Mutual Funds: A Performance Evaluation As can be seen below, a sample of U.S. based international mutual t l funds f d has h outperformed t f d the th S&P 500 during d i the th period 1977-1986, with a higher standard deviation. US Mean Annual Return 18.96% Standard Deviation US R2 5.78% 0.69 0.39 S&P 500 14.04% 4.25% 1.00 1.00 U.S. MNC Index 16.08% 4.38 .98 .90 U.S. Based International Mutual Funds 15-23 12 11/30/2010 International Mutual Funds: A Performance Evaluation U.S. stock market movements account for less than 40% of the fluctuations of international mutual funds,, but over 90% of the movements in U.S. MNC shares. This means that the shares of U.S. MNCs behave like those of domestic firms, without providing effective international diversification. Mean Annual Return Standard Deviation US R2 U S Based U.S. International Mutual Funds 18.96% 5.78% 0.69 0.39 S&P 500 14.04% 4.25% 1.00 1.00 U.S. MNC Index 16.08% 4.38 .98 .90 15-24 International Diversification through Country Funds Recently, country funds have emerged as one of the h most popular l means off international i i l investment. A country fund invests exclusively in the stocks of a single county. This allows investors to: 1. 2. 3. Speculate in a single foreign market with minimum cost. t Construct their own personal international portfolios. Diversify into emerging markets that are otherwise practically inaccessible. 15-25 13 11/30/2010 International Diversification through Country Funds : Some Evidence RF = α + βUS RUS + βHM RHM + е 15-26 International Diversification through Country Funds : More Evidence 15-27 14 11/30/2010 International Diversification through Country Funds: Is it worth it? 15-28 International Diversification through American Depository Receipts Foreign stocks often trade on U.S. exchanges as ADRs. It is a receipt that represents the number of foreign shares that are deposited at a U.S. bank. The bank serves as a transfer agent for the ADRs 15-29 15 11/30/2010 American Depository Receipts There are many advantages to trading ADRs as opposed to direct investment in the company’s shares: ADRs are denominated in U.S. dollars, trade on U.S. exchanges and can be bought through any broker. Dividends are paid in U.S. dollars. Most underlying stocks are bearer securities, the ADRs are registered. Adding ADRs to domestic portfolios has a substantial risk reduction benefit. 15-30 World Equity Benchmark Shares In April 1996, the American Stock Exchange (AMEX) introduced a class of securities called World Equity Benchmark Shares (WEBS), designed and managed by Barclays Global Investors. In essence, WEBS are exchange-traded funds (ETFs) that are designed to closely track foreign stock market indexes. Currently, there are 23 WEBS tracking the Morgan Stanley Capital International (MSCI) indexes for the following i di id l countries: individual t i Australia, A t li Austria, A t i Belgium, B l i Brazil, B il Canada, Chile, China, France, Germany, Hong Kong, Italy, Japan, Korea, Malaysia, Mexico, the Netherlands, Singapore, South Africa, Spain, Sweden, Switzerland, Taiwan, and the United Kingdom. 15-31 16 11/30/2010 International Diversification with Exchange Traded Funds Using exchange traded funds (ETFs) like WEBS and spiders, id investors i can trade d a whole h l stockk market k index i d as if it were a single stock. Being open-end funds, WEBS trade at prices that are very close to their net asset values. In addition to single country index funds, investors can achieve global diversification instantaneously just by holding shares of the S&P Global 100 Index Fund that is also trading on the AMEX with other WEBS. 15-32 International Diversification with Hedge Funds Hedge funds which represent privately pooled investment funds have experienced phenomenal growth in recent years. This growth has been mainly driven by the desire of institutional investors, such as pension plans, endowments and private foundations, endowments, foundations to achieve positive or absolute returns, regardless of whether markets are rising or falling. 15-33 17 11/30/2010 International Diversification with Hedge Funds Unlike traditional mutual funds that generally depend on “buy buy and hold” hold investment strategies, strategies hedge funds may adopt flexible, dynamic trading strategies, often aggressively using leverages, short positions, and derivative contracts, in order to achieve their investment objectives. These funds may invest in a wide spectrum of securities, such as currencies currencies, domestic and foreign bonds and stocks, stocks commodities, real estate, and so forth. Many hedge funds aim to realize positive returns, regardless of market conditions. 15-34 International Diversification with Hedge Funds Hedge funds tend to have relatively low correlations with various stock market benchmarks and thus offer diversification diversification. In addition, hedge funds allow investors to access foreign markets that are not easily accessible. For example, J.P. Morgan provides access to the Jayhawk China Fund, a hedge fund investing in Chinese stocks not readily available in U.S. markets. Also, hedge funds may allow investors to benefit from certain global macroeconomic events. events In fact, fact many hedge funds are classified as “global/macro” funds. Examples of global/macro funds include such well-known names as George Soros’ Quantum Fund, Julian Robertson’s Jaguar Fund, and Louis Bacon’s Moore Global Fund. 15-35 18 11/30/2010 International Diversification with Hedge Funds Legally, hedge funds are private investment partnerships. As such these funds generally do not register as an investment such, company under the Investment Company Act and are not subject to any reporting or disclosure requirements. As a result, many hedge funds operate under rather opaque environments. While investors may benefit from hedge funds, they need to be aware of the associated risk as well. Hedge H d ffunds d may make k wrong bbets t bbased d on th the incorrect i t prediction of future events and wrong models. The failure of Long Term Capital Management provides an example of the risk associated with hedge fund investing. 15-36 Home Bias in Portfolio Holdings As previously documented, investors can potentially benefit a great deal from international diversification. The actual portfolios that investors hold, however, are quite different from those predicted by the theory of international portfolio investment. investment Home bias refers to the extent to which portfolio investments are concentrated in domestic equities. 15-37 19 11/30/2010 Home Bias in Equity Portfolios Country Share in World Market Vl Value Proportion of Domestic E iti in Equities i Portfolio P tf li France 2.6% 64.4% Germany 3.2% 75.4% Italy 1.9% 91.0% Japan 43.7% 86.7% Spain p 1.1% 94.2% Sweden 0.8% 100.0% United Kingdom 10.3% 78.5% 36.4% 98.0% United States Total 100.0% 15-38 Why Home Bias in Portfolio Holdings? Three explanations come to mind: 1. Domestic equities may provide a superior inflation hedge. 2. Home bias may reflect institutional and legal restrictions on foreign investment. 3. Extra taxes and transactions/information costs for foreign securities may give rise to home bias. 15-39 20 11/30/2010 Why Home Bias in Portfolio Holdings? A recent study of the brokerage records of tens of thousands of U.S. individual investors shows that wealthier, more experienced, and sophisticated investors are more likely to invest in foreign securities. Another study shows that when a country is remote and has an uncommon language, foreign investors tend to stay away. 15-40 21 In Class Exercise # 1: Chapter 15 Use the following information on British Air stocks, bonds and the British pound during the 2009-2010 period: 1/1/2009 1/1/2010 Div /Coupon British Air stock price level (in British pounds) BP 78.75 BP 95.67 BP 1.50 British Air bond price level (in British pounds) BP 950 BP 920 BP 95.00 Dollar price of British pounds $ 1.75 $ 1.60 Standard deviation of the percentage change in the returns (in BP) on British Air stock during the 2009-2010 period: 22.50% Standard deviation of the percentage change in the returns (in BP) on British Air bonds during the 2009-2010 period: 8.25% Standard deviation of the percentage change in the dollar price of British pounds during the 2009-2010 period: 17.00% Correlation coefficient between the returns on the British Air stocks and the British pound 0.31 Correlation coefficient between the returns on the British Air bonds and the British pound 0.52 a) Calculate the percentage return over the 2009-2010 period, in US dollar terms, for: (i) British Air stocks (ii) British Air bonds b) Calculate the standard deviation of returns over the 2009-2010 period, in US dollar terms for: (i) British Air stocks (ii) British Air bonds In Class Exercise # 2: Chapter 15 Suppose you wish to invest in a portfolio which has Use the following information on the stocks of Samsung (a Korean company) and Mexico Air (a Mexican company) during the 2009-2010 period: Returns (in $) on Samsung stock during the 2009-2010 period: 30 % Returns (in $) on Mexico Air stocks during the 2009-2010 period: 10 % Standard deviation of returns (in $) on Samsung stock during the 2009-2010 period: 25 % Standard deviation returns (in $) on Mexico Air stocks during the 2009-2010 period: 12 % Correlation coefficient between the returns on the Samsung and Mexico Air stocks 0.25 Calculate the percentage return and the standard deviation of returns over the 2009-2010 period, in US dollar terms for a portfolio which consisted of 60% Samsung and 40% in Mexico Air stocks: In Class Exercise # 3: Chapter 15 Use the following information on Ericsson and Mexico Air stocks, the Swedish Krona and the Mexican Pesos during the 2009-2010 period: 1/1/09 1/1/10 Div/Shr Ericsson (ER) stock price level (in Swedish Krona) Kr 55.00 Kr 45.00 Kr 2.5 Mexico Air (MA) stock price level (in Mexican Pesos) MP 880 MP 1130 MP 18.0 Dollar price of Swedish Krona $ 0.075 $ 0.1005 Dollar price of Mexican Pesos $ 0.1055 $ 0.1050 Standard deviation of returns (in Kr) on ER stock during the 2009-2010 period: 12.50% Standard deviation of returns (in MP) on MA stocks during the 2009-2010 period: 18.25% Standard deviation of the percentage change in the dollar price of Kr during the 2009-2010 period: 17.00% Standard deviation of the percentage change in the dollar price of MP during the 2009-2010 period: 29.00% Correlation coefficient between the returns on the ER stocks and the Kr 0.28 Correlation coefficient between the returns on the MA stocks and the MP 0.35 Correlation coefficient between the returns on the MA stocks and ER stocks 0.03 R a) Calculate the percentage return and the standard deviation of returns over the 2009-2010 period, in US dollar terms, for: (i) Ericsson (ER) stocks: RER$ = σER$2 = σER$ = (ii) Mexico Air (MA) stocks: RMA$ = σMA$2 = σMA$ = b) Calculate the percentage return and the standard deviation of returns over the 2009-2010 period, in US dollar terms for a portfolio which consisted of 25% ER and 75% in MA stocks: RP$ = σP$2 = σP$ = In Class Exercise # 4: Chapter 15 Use the following information on the stocks of Matusita (a Japanese company) and Mexico Air (a Mexican company), the Japanese Yen and the Mexican Pesos during the 2009-2010 period: 1/1/2009 1/1/2010 Div/Shr Matusita (MT), a Japanese company’s, stock price level (in JY) JY 1575 JY 1740 JY 180 Mexico Air (MA) stock price level (in MP) MP 875 MP 1030 MP 25 Dollar price of Japanese Yen (JY) $ 0.0075 $ 0.0078 Dollar price of Mexican Pesos (MP) $ 0.1000 $ 0.0900 Standard deviation of returns (in JY) on Matusita stock during the 2009-2010 period: 15 % Standard deviation returns (in MP) on Mexico Air stocks during the 2009-2010 period: 20 % Standard deviation of the percentage change in the dollar price of JY during the 2009-2010 period: 5% Standard deviation of the percentage change in the dollar price of MP during the 2009-2010 period: 10 % Correlation coefficient between the returns on the Matusita (MT) stocks and the JY 0.75 Correlation coefficient between the returns on the Mexico Air (MA) stocks and the MP 0.25 Correlation coefficient between the returns on the Matusita (MT) and Mexico Air (MA) stocks 0.10 a) Calculate the percentage return and the standard deviation of returns over the 2009-2010 period, in US dollar terms, for: (i) Matusita (MT) stocks RMT$ = σMT$2 = σMT$ = (ii) Mexico Air stocks RMA$ = σMA$2 = σMA$ = b) Calculate the percentage return and the standard deviation of returns over the 2009-2010 period, in US dollar terms for a portfolio which consisted of 60% Matusita and 40% in Mexico Air stocks: RP$ = σP$2 = σP$ = R Variable Definition P0A,P1A ,DA = Beginning price, ending price, and dividends or interests of foreign security A (stocks or bonds) measured in foreign currency X1 P0B,P1B ,DB = Beginning price, ending price, and dividends or interests of foreign security B (stocks or bonds) measured in foreign currency X2 SR0, SR1= Beginning and ending spot rates for foreign currency of country A or B RSA, RSB = Return on foreign securities A and B (stocks or bonds) measured in foreign currency RXA ,RXB = Return on foreign currency of countries A and B measured in US dollars R$A, R$B = Dollar return on foreign securities A and B (stocks or bonds) SASB = Standard deviation of return on foreign security A and B measured in foreign currency XA XB = Standard deviation of return on foreign currency countries A and B measured in US dollars $A$B = Standard deviation of dollar return on foreign securities A and B SA,XA SA XA = Correlation coefficient of returns on foreign security A measured in foreign currency and the dollar return on foreign currency of country A SB,XB = Correlation coefficient of returns on foreign security B measured in foreign currency and the dollar return on foreign currency of country B A,B = Correlation coefficient of returns on foreign security A and returns on foreign security B R$P = Dollar return on a portfolio containing securities A & B $P = Standard deviation of dollar return on a portfolio containing securities A & B WA, WB = Proportion of funds invested in security A and security B Formulas for Chapter 15 RSA = (P1A - P0A + DA) / P0A : Foreign currency return on security A RSB = (P1B - P0B + DB) / P0B : Foreign currency return on security B RXA,RXB = (SR1 - SR0) / SR0 : Dollar return on foreign currency of countries A or B R$A = (1 + RSA ) * (1 + RXA ) – 1 : Dollar return on security A R$B = (1 + RSB ) * (1 + RXB ) – 1 : Dollar return on security B $A = [SA2 + XA2 + 2*SA*XA*SA,XA ]1/2 : Standard deviation of dollar return on security A $B = [ [ SB2 + XB2 + 2* 2* SB* * XB* * SB,XB ]1/2 : Standard deviation of dollar return on security B R$P = WA* R$A + WB * R$B : Dollar return on the portfolio containing securities A & B $P = [ WA2 * $A2 + WB2 * $B2 + 2 *WA* WB*$A*$B*AB ]1/2: Standard deviation of dollar return on the portfolio containing securities A & B 1