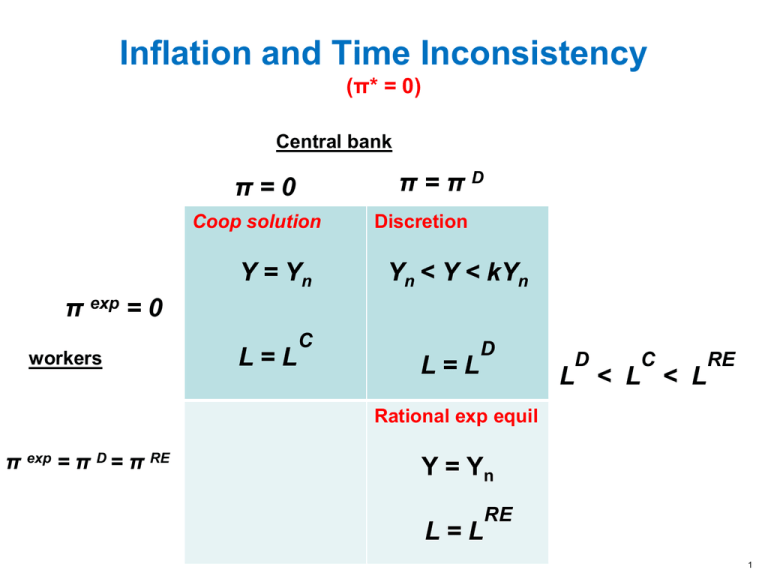

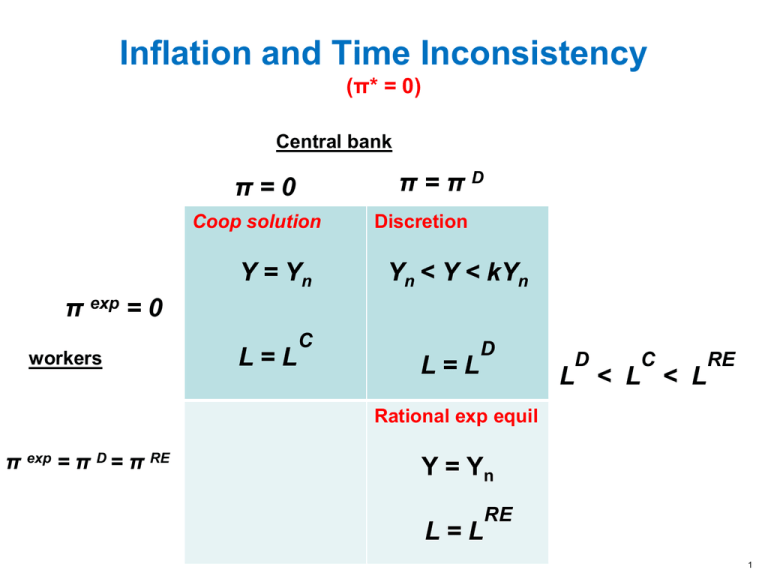

Inflation and Time Inconsistency

(π* = 0)

Central bank

π=πD

π=0

Coop solution

π exp = 0

workers

Y = Yn

L=L

C

Discretion

Yn < Y < kYn

L=L

D

D

C

RE

L < L < L

Rational exp equil

π exp = π D = π RE

Y = Yn

L=L

RE

1

The Crisis: where are we?

“Deleveraging”, “Quantitative Easing” and

“Tapering”

14.02 Spring 2014

2

United States: real house prices since 1880

© S&P Dow Jones Indices. All rights reserved. This content is excluded from our Creative

Commons license. For more information, see http://ocw.mit.edu/help/faq-fair-use/.

Source: S&P, Case-Shiller Index

3

Real house prices (indeces, 2000=100)

© IMF. All rights reserved. This content is excluded from our Creative Commons

license. For more information, see http://ocw.mit.edu/help/faq-fair-use/.

Source: IMF, World Economic Outlook, October 2013

4

House prices and household debt (mortgages)

leverage = 10

house

house

leverage = 9,18

debt and equity

100

equity

10

debt

90

house

house

debt and equity

101

equity

11

debt

90

leverage = 10

• The additional 9$ borrowed are

spent

• Leverage and amplification

• 1$ increase in house price

• 9$ increase in spending

house

debt and equity

house

101

equity

11

cash

9

debt

99

5

Households’ leverage ratios: debt to disposable income

Source: IMF, World Economic Outlook, October 2008

6

House prices and household debt (mortgages)

© IMF. All rights reserved. This content is excluded from our Creative Commons

license. For more information, see http://ocw.mit.edu/help/faq-fair-use/.

Source: IMF, World Economic Outlook, October 2013

7

Deleveraging: US Household saving

(percent of disposable income)

"Data Source: FRED, Federal Reserve Economic Data, Federal Reserve Bank of St. Louis:

Personal Savings; U.S. Department of Commerce: Bureau of Economic Analysis;

http://research.stlouisfed.org; accessed September 8, 2014."

8

Deleveraging: US Household consumption

(constant dollars)

"Data Source: FRED, Federal Reserve Economic Data, Federal Reserve Bank of St. Louis: US

Household Consumption; U.S. Department of Commerce: Bureau of Economic Analysis;

http://research.stlouisfed.org; accessed September 8, 2014."

9

The consequences of Banks’ Deleveraging

10

Asset prices and banks’ leverage

leverage = 10

assets

assets

leverage = 19

liabilities

100

capital

10

liabilities

90

assets

assets

liabilities

95

capital

5

liabilities

90

leverage = 10

assets

After a fall in asset values

banks sell asset:

Demand function slopes the wrong way !

assets

liabilities

50

capital

5

liabilities

45

11

The leverage cycle

12

12

Banks deleveraging: an example

Courtesy of the Federal Reserve Bank of Boston. Used with permission.

13

Banks’ leverage and deleveraging

© Bank of England. All rights reserved. This content is excluded from our Creative

Commons license. For more information, see http://ocw.mit.edu/help/faq-fair-use/.

Source: Bank of England

14

Bank deleveraging and bank lending to firms

© Bank of England. All rights reserved. This content is excluded from our Creative

Commons license. For more information, see http://ocw.mit.edu/help/faq-fair-use/.

Source: Bank of England

15

Bank deleveraging and bank lending to households and firms

© IMF. All rights reserved. This content is excluded from our Creative Commons

license. For more information, see http://ocw.mit.edu/help/faq-fair-use/.

Source: IMF, World Economic Outlook, October 2013

16

How long does a deleveraging cycle last ?

Japan: leverage of non financial corporations (1976 – 2010)

© Wiley. All rights reserved. This content is excluded from our Creative Commons

license. For more information, see http://ocw.mit.edu/help/faq-fair-use/.

Source: Koo, 2008

17

Reducing leverage: Japan 1990 - 2010

© Richard C. Koo. All rights reserved. This content is excluded from our Creative Commons license. For more information, see http://ocw.mit.edu/help/faq-fair-use/

18

Per-capita income after a banking crisis

average of 88 episodes

© IMF. All rights reserved. This content is excluded from our Creative Commons

license. For more information, see http://ocw.mit.edu/help/faq-fair-use/.

Source: IMF, World Economic Outlook, October 2009

19

Macroeconomics

how it responded to the crisis and the

challenges today

20

World Output Growth

© IMF. All rights reserved. This content is excluded from our Creative Commons

license. For more information, see http://ocw.mit.edu/help/faq-fair-use/.

Source: IMF, World Economic Outlook, April 2014

21

How did monetary and fiscal policy respond ?

22

However they responded, it worked !

This crisis and the Great Depression in the 1930s

World Industrial Output

Courtesy of Barry Eichengreen and Kevin Hjortshøj O'Rourke. Used with permission.

Source: Eichengreen and O’Rourke, Vox-EU, March 2010

23

Fiscal policy

© IMF. All rights reserved. This content is excluded from our Creative Commons

license. For more information, see http://ocw.mit.edu/help/faq-fair-use/.

Source: IMF, World Economic Outlook

24

US Federal Government debt

(percent GDP, 1940-2013)

Image is in the public domain courtesy of the Congressional Budget Office.

25

© IMF. All rights reserved. This content is excluded from our Creative Commons

license. For more information, see http://ocw.mit.edu/help/faq-fair-use/.

26

Monetary policy

© IMF. All rights reserved. This content is excluded from our Creative Commons

license. For more information, see http://ocw.mit.edu/help/faq-fair-use/.

27

Zero Lower Bound: the “Liquidity Trap”

• Spending shock shifts IS

to IS ‘

• Monetary policy response

shfts LM to LM ‘

• Zero Lower Bound

• Central bank buys asset,

prints money:

Quantitative Easing

• IS ‘ shifts up to IS ‘’

28

Quantitative Easing and the Holmstrom-Tirole model

•

•

•

ρ = i + x : interest rate at which firms can borrow

Investment = I (Y, ρ)

Crisis reduces banks’ capital (slide 11)

– x = f (capital of banks and own resources of entrepreneurs, A ) ↑

• for given i, Investment ↓

– Quantitative Easing raises banks’ capital x ↓

• For given i, Investment ↑

X down

x up

29

The «asset side» of the Federal Reserve’s balance sheet,before the crsis

Image is in the public domain courtesy of the Federal Reserve of New York.

30

The «asset side» of the Federal Reserve’s balance sheet, today

Image is in the public domain courtesy of the Federal Reserve of New York.

31

Quantitative easing

before

Central Bank

assets

Gvt bills

Commercial Bank

liabilities

100

cash

80

bank

reserves

20

assets

liabilities

Loans

50

Mortgage

backed

securities

30

deposits

90

Reserves at

the CB

20

equity

10

after

assets

liabilities

Gvt bills

100

cash

80

Mortgage

backed

securities

30

bank

reserves

50

assets

liabilities

Loans

50

Mortgage

backed

securities

0

deposits

90

Reserves at

the CB

50

equity

10

32

Quantitative easing and Credit easing

https://www.khanacademy.org/economics-finance-domain/corefinance/money-and-banking/federal-reserve/v/more-on-quantitativeeasing--and-credit-easing

33

Fed «Tapering» and its consequences

© IMF. All rights reserved. This content is excluded from our Creative Commons

license. For more information, see http://ocw.mit.edu/help/faq-fair-use/.

34

MIT OpenCourseWare

http://ocw.mit.edu

14.02 Principles of Macroeconomics

Spring 2014

For information about citing these materials or our Terms of Use, visit: http://ocw.mit.edu/terms.